International Journal of Pure and Applied Mathematics

Volume 117 No. 21 2017, 721-733

ISSN: 1311-8080 (printed version); ISSN: 1314-3395 (on-line version)

url: http://www.ijpam.eu

Special Issue

Impact of Corporate Retailing on Consumers and

Small Traders in Salem and Namakkal District

1

1

J. Arul and 2A. Dharmaraj

Department of Management,

Karpagam Academy of Higher Education,

Coimbatore, Tamil Nadu, India.

2

Department of Management,

Karpagam Academy of Higher Education,

Coimbatore, Tamil Nadu, India.

Abstract

Liberalization of economy in the nineties and entry of large players in

the retail business have brought the Indian retail industry into spotlight.

The organized retail sector has been witnessing winds of changes in the last

couple of years. Malls and large-size department stores have become a

fixture in the urban landscape across the country.1 With some 15 million

retail outlets, India has the highest retail density in the world. Thus, India is

popularly referred to as nation of shopkeepers . However, only 4 per cent

of these outlets are more than 500 square feet in size. In the name of

retailing, the unorganized retailing has dominated the Indian landscape so

far. Traditionally it was a family's livelihood, with their shop in the front

and house at the back, while they run the retail business. With rapid

urbanization, and changing patterns of consumer tastes and preferences, it

is unlikely that the traditional outlets will survive the test of time. Despite

the large size of this market, very few large and modern retailers have

established specialized stores for products.

Key Words:Retailing, corporate retailing and corporate retail outlets.

721

ijpam.eu

�International Journal of Pure and Applied Mathematics

1.

Special Issue

Introduction

The Indian retail sector is now among top five fastest growing markets globally

and is witnessing a huge revamping exercise as traditional markets make way for

next formats such as departmental stores, hypermarkets, supermarkets and

specialty stores. India’s vast middle class and its almost untapped retail industry

are key attractions for corporate giants wanting to enter into this newer market.

As Indian retailing is witnessing rapid transformation in different areas of

business by using ascendable and gainful retail models across different categories,

consumers started accepting the modern retail irresistibly. Large retailers feel

bigger outlets are good for the country and stakeholders like farmers, vendors,

small retailers or consumers. But all stakeholders except the consumer feel

otherwise. Big retailers are very keen that the government allows foreign retailers

to invest or buy majority stake in their companies, something that has sparked

widespread protests from local traders. The study conducted by the Indian

Council for Research on International Economic Relations concluded the growth

of organized retail headed by large corporations does not significantly impact

small mom and pop retailers.

2.

Statement of the Problem

The emergence of new trends in retailing is a significant event in the Indian

marketing scenario. Besides, the Indian retail scene has witnessed too many

players in too short a time, crowding several categories without looking at their

core competencies or having a well thought out branding strategy. The most

important debate concerning the implications for the expansion of the organized

retailing in India revolves around whether it is going to have positive impacts

on the economy as a whole as compared to the traditional unorganized form of

retailing. However, India still predominantly houses the traditional formats of

retailing. Traditional retailing has been deep rooted for the past few centuries

and enjoys the benefits of low cost structure, mostly owner-operated, therein

resulting in less labour costs and little or no taxes to pay.

The growth of corporate retailing is having a direct bearing on marketing

environment and changes in the marketing system. The corporate retailers

started attracting in the name of promotion, not only high class people but also

middle class and lower middle class with some entertainments and fun to have

along with shopping and also showing some attractive offers and benefits. So

people started flowing towards the corporate retail shops. The most appealing

argument in favor of the entry of the corporate in the retail market is that the

“consumer will benefit”. The changed shopping outlets are seeing success due

to fair pricing, large assortments, supported by large moving spaces, selfservices, free packing, and the idea of getting everything under one roof has

conquered customers. Today’s price sensitive, time-starved customers are

looking not only for the best deal but also a convenient and user friendly

shopping experience at corporate retail outlets.

722

�International Journal of Pure and Applied Mathematics

3.

Special Issue

Objectives of the Study

The study has the following objectives

To examine the impact of corporate retailing on consumers in Salem

and Namakkal district.

To study the growth and progress of retailing in India.

To review the retail operations of the select corporate retail outlets in

Salem and Namakkal district.

To assess the impact of corporate retail outlets on the consumers in

Salem and Namakkal district.

To offer suitable suggestions for the effective functioning of

corporate retail outlets in Salem and Namakkal district based on the

findings of the present study.

4.

Testing of Hypotheses

The following null hypotheses were formulated and tested.

H01: There is no significant association in the satisfaction levels of the

consumers belonging to different socio-economic profiles towards working of

corporate retail outlets in Salem and Namakkal district.

H02: There is no significant difference between the average amount spent per

purchase by the consumers at the unorganized retail outlets and corporate retail

outlets.

H03: There is no significant relationship among the acceptance levels of the

consumers belonging to different demographic profiles towards impact of

corporate retail outlets in Salem and Namakkal district.

H05: There is no significant relationship in the perceived impact of small traders

belonging to different socio-economic and business profiles towards corporate

retail outlets in Salem and Namakkal district.

5.

Scope of the Study

The present study attempts to examine the impact of corporate retailing on

consumers and small traders in Salem and Namakkal district. This study is

confined to five major retail segments namely, food and grocery, fashion and

accessories, footwear, pharmaceuticals and electronics. These five retail

segments cover nearly 70 per cent of retail business in recent years. The present

study is restricted to five corporate retailers, namely Reliance Fresh, Pantaloon,

Khadim’s, Apollo Pharmacy and Viveks. In the present work, the most common

aspects namely, consumers’ motivating factors to prefer corporate retail outlets,

their satisfaction level with the working of corporate retail outlets, and the

perceived impact of the consumers and small traders towards corporate retail

outlets are mainly emphasized.

Sampling Design

For consumers, multi-stage sampling technique is adopted. At the first stage 5

corporate retailers i.e. Reliance Fresh (Food and Grocery), Pantaloon (Fashion

and Accessories), Khadim’s (Footwear), Apollo Pharmacy (Pharmaceuticals)

723

�International Journal of Pure and Applied Mathematics

Special Issue

and Viveks (Electronics) were selected. In the second stage, from each retail

category one retail outlet were selected. In the final stage, from each of the

selected retail outlet by adopting quota sampling, 100 consumers were selected.

Thus, the sample consists of 500 consumers from 5 retail outlets of 5 corporate

retailers. The following table shows the sampling distribution of the consumers.

Table 1: Sampling Distribution

S. No.

1.

2.

3.

4.

5.

Name of the

Corporate Retailer

Reliance Fresh

Pantaloon

Khadim’s

Apollo Pharmacy

Viveks

Total

Samples

No. of

Retail Outlets

1

1

1

1

1

5

No. of Consumers

100

100

100

100

100

500

For small traders, by using non-probability sampling, 150 respondents i.e. 30

small traders from above mentioned each retail category was taken, with the

criterion that these outlets must be operating within a five kilometre radius of

select corporate retail outlets.

Tools for Data Collection

The present study is empirical in character, based on survey method. The firsthand information for this study was collected from the select corporate retail

outlets. As an essential part of the study, the primary data were collected from

500 consumers with the help of exit interview. Taking into consideration the

objectives of the study, two types of interview schedules i.e. one for consumers

and another for small traders were constructed based on Likert scaling

technique.

Period of Study

As an essential part of the study, the primary data were collected for a period of

5 months from April 2017 to September 2017.

Demographic Profile of the Respondents

The demographic profile of the respondents such as gender, age, education and

years of experience is given in Table 2.

Table 2: Demographic Profile of the Small Traders

Demographic Profile

Male

Gender

Female

Upto 30

31-40

Age

(in years)

41-50

Above 50

Upto S.S.L.C

H.Sc

Education

Diploma/ITI

Degree

Postgraduation and above

Less than 5

6-10

Experience (in years)

11-15

Above 15

Source: Primary Data

724

No. of Respondents

132

18

21

42

53

34

50

20

29

33

18

69

23

23

35

PERCENTAGE

88.00

12.00

14.00

28.00

35.33

22.67

33.33

13.33

19.33

22.00

12.00

46.00

15.33

15.33

23.33

�International Journal of Pure and Applied Mathematics

Special Issue

Out of 150 respondents, 88 per cent are male and 12 per cent are female. A

good majority of the respondents (35.33 per cent) are dispersed in the age group

41-50 years. 14%, 28% and 22.67% of the respondents are dispersed in the age

group up to 30 years, 31-40 years and above 50 years respectively. The

predominant literacy group (33.33 per cent) of the respondents has S.S.L.C

qualification. 13.33 per cent of the respondents have H.Sc qualification. 19.33

per cent of the respondents have studied Diploma/ITI. 22 per cent and 12 per

cent of the respondents have degree, and post graduation and above

qualifications respectively. Besides, 46 per cent of the respondents have up to 5

years of experience in retail business.15.33 per cent and 15.33 per cent of the

respondents have 6-10 years and 11-15 years of experience respectively. 23.33

per cent of the respondents have above 15 years of business experience.

Respondents’ Level of Acceptance towards Attributes of

Corporate Retail Outlets

Statement

Neither agree nor

disagree

Disagree

Strongly disagree

Mean Score

Agree

Total

Strongly agree

LEVEL

OF

ACCEPT

ANCE

Corporate retailers offer

products in more varieties

Corporate retailers have

cheaper priced products

Corporate retailers’ customers

are different from other outlets

Corporate retailers bring

more customers

Presence of corporate

retailers makes small traders

work harder

Corporate retailers are the

main competitors to the

unorganized retail outlets

Small retail outlets have

problems because of entry of

too many corporate retailers

Corporate retail is promoting

local economy

Corporate entry makes the

supply chain more efficient

Corporation led shops sell

cheap, thus consumers save

money by shopping there

Corporate retail throw away

middlemen

38

(25.33)

28

(18.67)

51

(34.00)

41

(27.33)

28

(18.67)

21

(14.00)

4

(2.67)

25

(16.67)

17

(11.33)

31

(20.67)

8

(5.33)

14

(9.33)

59

(39.33)

47

(31.33)

65

(43.33)

55

(36.67)

8

(5.33)

23

(15.33)

22

(14.67)

15

(10.00)

150

(100.00)

150

(100.00)

150

(100.00)

150

(100.00)

22

(14.67)

32

(21.33)

31

(20.67)

59

(39.33)

6

(4.00)

150

(100.00)

3.03

42

(28.00)

15

(10.00)

20

(13.33)

59

(39.33)

14

(9.33)

150

(100.00)

3.08

17

(11.33)

29

(19.33)

41

(27.33)

46

(30.67)

17

(11.33)

150

(100.00)

2.89

15

(10.00)

21

(14.00)

29

(19.33)

22

(14.67)

38

(25.33)

50

(33.33)

58

(38.67)

45

(30.00)

10

(6.67)

12

(8.00)

150

(100.00)

150

(100.00)

8

(5.33)

31

(20.67)

58

(38.67)

51

(34.00)

2

(1.33)

150

(100.00)

5

(3.33)

26

(17.33)

29

(19.33)

24

(16.00)

61

(40.67)

34

(22.67)

38

(25.33)

53

(35.33)

17

(11.33)

13

(8.67)

150

(100.00)

150

(100.00)

Overall

3.19

2.89

2.98

3.15

2.87

2.97

2.95

2.78

2.98

Source: Primary Data

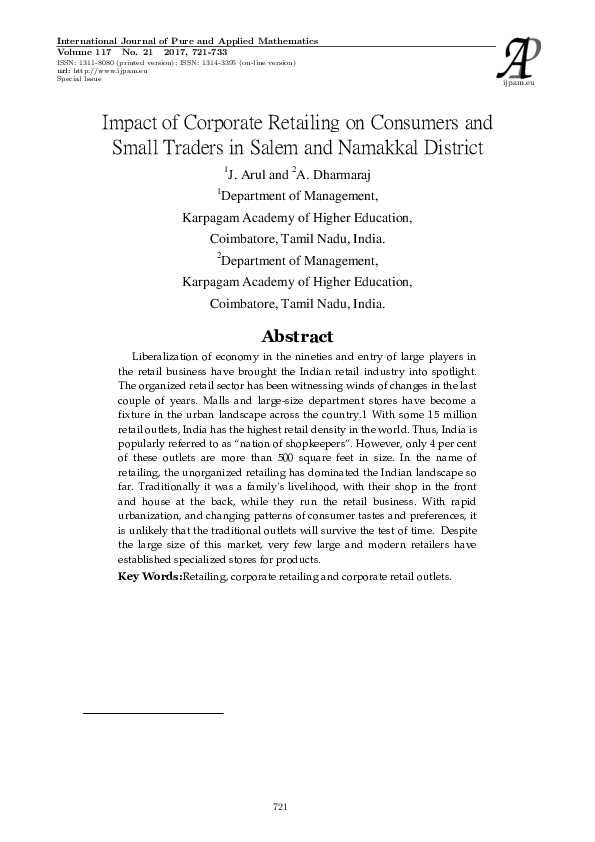

It is inferred from the above table that majority of the respondents indicate that

they disagree (35.33%) with the attributes of corporate retail outlets, followed

closely by neither agree nor disagree (22.67%) and strongly agree (17.33%).

16% and 8.67% of the respondents agree and strongly disagree respectively

with the attributes of corporate retail outlets. The average acceptance score

725

�International Journal of Pure and Applied Mathematics

Special Issue

reveals that the respondents have higher acceptance level towards product

offerings in more varieties by the corporate retail outlets (3.19), followed by

bringing more customers (3.15). On the other hand, the respondents have lower

acceptance score (2.78) towards throw way of middlemen by the corporate retail

outlets.

40

35

Acceptance (%)

30

25

20

35.33

15

22.67

10

17.33

16

8.67

5

0

Strongly Agree

Agree

Neither Agree

Disagree

nor Disagree

Level of Acceptance

Strongly

Disagree

Figure 1: Respondents’ Level of Acceptance towards Attributes of

Corporate Retail Outlets

6.

Findings

The findings of the study are given under two heads, namely perception of the

consumers and perception of the small traders.

Perception of the Consumers

1.

Out of 500 respondents, 54.60 per cent are male and 45.40 per cent

are female. The predominant age group of the respondents is (32.80

per cent) upto 25 years. A good majority of the remaining

respondents (22.20 per cent) are dispersed in the age group 26-35

years. 11.40%, 18.40% and 15.20% of the respondents are dispersed

in the age group 36-45 years, 46-55 years and above 55 years

respectively.

2.

The predominant literacy group (26.60 per cent) of the respondents

has H.Sc qualification. 13.60%, 6.40%, and 9% of the respondents

are uneducated, have primary education and S.S.L.C qualification

respectively. 22.80 per cent of the respondents are graduates and

21.60 per cent have postgraduation and above qualifications.

3.

33.20 per cent of the respondents are businessmen, 17.20 per cent

are employed, 24 per cent are professionals, 17.20 per cent are

726

�International Journal of Pure and Applied Mathematics

Special Issue

agriculturists, and 8.40 per cent of the respondents are students and

housewives.

4.

Out of 500 respondents, 34%, 24.40%, 10.40%, 16.60% and 14.60%

of the respondents are dispersed in the monthly household income

range upto Rs.15000, Rs.15001-25000, Rs.25001-35000, Rs.3500145000 and above Rs.45000 respectively.

5.

29.20 per cent of the respondents have family members 1 and 2,

19.40 per cent have 3 and 4 family members, 32.20 per cent have 5

and

6 family members and 19.20 per cent of the respondents have above

7 family members.

6.

55.40 per cent of the respondents belong to nuclear family pattern

and 44.60 per cent of the respondents belong to joint family pattern.

Out of 500 respondents, 57.80 per cent are married and 42.20 per

cent of the respondents are unmarried. 53.60%, 25.80% and 20.60%

of the respondents belong to Hindu, Muslim and Christian religions

respectively.

7.

100 consumers each from Apollo, Khadim’s, Pantaloons, Reliance

Fresh and Viveks corporate retail outlets located in Salem and

Namakkal district were selected for this study.

8.

Price, quality of products, more variants and one stop shopping are

the factors influencing the respondents to prefer corporate retail

outlets at 40.20%, 42.80%, 46.40% and 53.60% respectively.

59.60%, 60.20%, 65.40% and 66.20% of the respondents prefer

corporate retail outlets because of availability of more brands,

service quality, freedom in choosing brands and customer

relationship respectively.

9.

Respondents ranging from 20.40 per cent to 33 per cent are aware of

corporate retail outlets through newspapers and magazines; notices,

pamphlets and leaflets; posters, banners and hoardings; and

advertisements in radio. 38.60%, 41.60% and 44.20% of the

respondents are aware of corporate retail outlets with the help of

advertisements in television; internet; and friends, neighbours and

relatives respectively.

10.

Out of 500 respondents, 44.44 per cent of the respondents belong to

less than 3 km distance from the corporate retail outlets. 27.80 per

cent and 14.80 per cent of the respondents belong to 3 km to 6 km

distance and 6 km to 9 km distance respectively from the corporate

retail outlets. 13 per cent of the respondents belong to above 9 km

distance from the corporate retail outlets.

Perception of the Small Traders

1.

Out of 150 respondents, 88 per cent are male and 12 per cent are

female. A good majority of the respondents are dispersed in the age

group 41-50 years. 14%, 28% and 22.67% of the respondents are

dispersed in the age group upto 30 years, 31-40 years and above 50

years respectively.

727

�International Journal of Pure and Applied Mathematics

2.

3.

4.

5.

6.

7.

8.

9.

Special Issue

The predominant literacy group (33.33 per cent) of the respondents

has S.S.L.C qualification. 13.33 per cent of the respondents have

H.Sc qualification. 19.33 per cent of the respondents have studied

Diploma/ITI. 22 per cent and 12 per cent of the respondents have

degree, and postgraduation and above qualifications respectively.

46 per cent of the respondents have upto 5 years of experience in

retail business.15.33 per cent and 15.33 per cent of the respondents

have 6-10 years and 11-15 years of experience respectively. 23.33

per cent of the respondents have above 15 years of business

experience. Besides, 75.33 per cent of the retail outlets were started

by the sample small traders, 12 per cent were instituted by their

parents and 12.67 per cent of the retail formats were established by

their forefathers.

Out of 150 respondents, 20%, 20%, 20%, 20% and 20% of the

respondents deals in pharmaceutical, footwear, fashion and

accessories, food and grocery, and electronics products respectively.

29.33 per cent of the respondents positioned their shops at large

shopping complexes, 8.67 per cent of the shops are situated at

popular big shopping malls, and 22.67 per cent are located at local

neighborhood. 11.33 per cent and 15.33 per cent of the retail shops

are so called market popular special product and stand alone

respectively. Besides, 12.67 per cent are roadside shops/street

hawkers.

Out of 150 respondents, 82.67 per cent of the respondents are

engaged in the retail business and 17.33 per cent of the respondents

are engaged in retail cum wholesale business. About 40 per cent of

the retail shops are positioned at a space below 200 sq. ft, 14.67 per

cent of the shops are sited at 201-300 sq. ft. and 28.67 per cent of the

shops are placed at a space of 301-400 sq. ft. 16.66 per cent of the

retail shops are found at a space of more than 400 sq. ft.

In regards to investment, 18 per cent of the traders have invested less

than Rs.2 lakh in their business, 21.33 per cent have invested Rs.2

lakh-4 lakh and 37.33 per cent of the respondents have invested Rs.4

lakh-6 lakh. 23.33 per cent of the respondents have made an

investment of Rs.4 lakh-6 lakh in their business.

Out of 150 respondents, majority of the respondents are dissatisfied

(32%) with their present business, followed closely by neither

satisfied nor dissatisfied (24%) and highly dissatisfied (22%).

15.33% and 6.67 per cent of the respondents are highly satisfied and

satisfied respectively with their present business in Salem and

Namakkal district.

Majority of the respondents indicate that they disagree (35.33%)

with the attributes of corporate retail outlets, followed closely by

neither agree nor disagree (22.67%) and strongly agree (17.33%).

16% and 8.67% of the respondents agree and strongly disagree

respectively with the attributes of corporate retail outlets. The

728

�International Journal of Pure and Applied Mathematics

Special Issue

average acceptance score reveals that the respondents have higher

acceptance level towards product offerings in more varieties by the

corporate retail outlets (3.19), followed by bringing more customers

(3.15). On the other hand, the respondents have lower acceptance

score (2.78) towards throw way of middlemen by the corporate retail

outlets.

7.

Suggestions

Though the growth rate of corporate retailing is very high, it is facing stiff

competition from unorganized retail formats. Besides, rising prices of real

estate, high cost of trained and skilled manpower, and complicated tax structure

make things tough for corporate retailing. Despite all pros and cons, there is an

ample opportunity for corporate retailing. Based on the perception of the

consumers and small traders, the following suggestions are given for effective

functioning of corporate retail outlets.

1.

Corporate retailers benefit only when consumers perceive their

stores brands to have consistent and comparable quality and

available in relation to the branded products. Private labels play an

important role here, in bridging the gaps like special and desired

price points, exclusivity and regional tastes. A private label can add

significant value when it is well recognized and has built positive

association in the minds of the consumers. Therefore, the select

corporate retailers have to provide more assortments for private label

brands to compete with suppliers’ brand.

2.

Corporate retailers can reduce the perception of waiting, without

necessarily reducing the actual wait. They can make outlets by

displaying merchandise to change customers’ perceptions of waiting.

Besides, they can enhance the store atmospherics through visual

communications, lighting, colours and odors. Therefore, the select

corporate retailers have to give more emphasis on display visual

merchandising, lighting, signages and specialized props. The

merchandise presentation ought to be very creative and displays are

often on non-standard fixtures and forms to generate interest and add

on attitude to the merchandise.

3.

The message conveyed to the target consumers must be effective

enough in differentiating the retailers offering from that of their

competitors. The main purpose is to inform the target consumers

about the offering of the retailers, persuade them to visit the retail

outlets and remind them about the retailers. Therefore the corporate

retailers can create awareness about the offering among the target

consumers in a number of ways such as advertising, buzz market,

celebrity endorsement, and use of print media, press releases, and

viral marketing. Once the message is conveyed, the corporate

retailers must add a personal touch to their message by carrying out

door-to-door campaign in order to reinforce the message.

729

�International Journal of Pure and Applied Mathematics

4.

5.

6.

7.

8.

9.

10.

Special Issue

The select corporate retailers should train their employees to be

cooperative with the consumers as this is found to be the major

problem faced by the consumers in the select corporate retail outlets.

As people expect, good quality products at reasonable price, the

corporate retailers shall offer products at reasonable price with good

quality. New products, aggressive retail mix as well as everyday low

pricing strategy can be the strategy to get edge over suppliers’ brand.

The select corporate retailers must ensure that sales personnel have

sufficient knowledge of the products offered, and also must be

capable of handling complaints. They must also exhibit willingness

to handle returns, and should be available for advice or clarification.

Overall, corporate retailers must ensure courteous behaviour of sales

personnel. Well mannered and helpful staff can always lead to store

patronage decisions.

In an age of quick services, technology is a necessary ingredient for

success of any retail outlet. Consumers would prefer to visit such

outlets that would provide prompt and error-free billing services.

Retailers may adopt different technologies to manage faster billing.

Therefore, the select corporate retailers should work on having

multiple payment options like cash, credit cards, debit cards, and so

on to facilitate customers.

The select corporate retailers shall provide sufficient parking facility

to meet out the requirements of the consumers in the light of

securing more business prospects and retaining the valuable

consumers forever.

In order to appeal to all classes of society, corporate retailers would

have to identify with different lifestyles and socio-economic strata of

the consumers and respond to their respective requirements and

shopping patterns. So as to satisfy the consumer needs, the corporate

retailers must have a thorough understanding of how consumers

make store choice and purchase decision. Perceptual mapping of the

consumers provides some valuable insights into the process and

therefore is useful for the store management decision making. For

this purpose, the select corporate retailers shall update database at

least for high-valued consumers.

The modern retail is essentially looking out for more space for

expansion. The availability of the main space would definitely enable

the select corporate retailers to deliver better quality services to the

consumers, resulting in increase in operational efficiencies and

reduction in supply chain costs. It will overcome the problem of

inconvenient location of stores.

730

�International Journal of Pure and Applied Mathematics

8.

Special Issue

Conclusion

The attitudinal shift of the Indian consumers and the emergence of organized

retail formats have transformed the face of retailing in India. With the sign of

reemergence of economic growth in India, consumer buying in retail sector is

being projected as a key opportunity area. As a consequence, Indian corporate

houses are refocusing its strategic perspective on retail marketing with the idea

to use resources optimally in order to create core competence and gain

competitive advantage. The emergence of corporate retailing in the retail market

scene is very significant in the recent past. In the present study the focus has

been given completely on this segment and its impact on consumers and small

traders. The results of the study reveal that absence of private label brand,

inadequate visual merchandising, poor reply on enquiry, inadequate

advertisement, poor co-operation of the staff, higher price, incompetent sales

personnel, undue delay in billing, inadequate parking facility, absence of

customer database and inadequate sales promotion are the problems of the

consumers with the corporate retail outlets. Besides, majority small traders are

dissatisfied with their present business due to stiff competition from the

organized retailing. Based on the results of the surveys, the study has made a

number of specific policy recommendations for effective functioning of the

corporate retailers and for strengthening the competitive response of the small

traders. If this study provokes the people concerned to take some positive

measures in order to improve it, the researcher will feel amply rewarded.

References

[1]

Archer J.S., Taylor D., Up Against the Wal-Marts, New York:

American Management Association (1994).

[2]

Beaumont C.E., How Superstore Sprawl Can Harm

Communities and What Citizens Can Do About It, Washington:

National Trust for Historic Preservation (1994).

[3]

Berman B., Evans J.R., Retail Management, New Jersey:

Prentice Hall (2001).

[4]

Praveenkumar S., Mahalakshmi

Chennai: Rudhra Books (2008).

[5]

Venugopal P., Marketing Channel Management: A Customer

Centric Approach, New Delhi: Response Books (2001).

[6]

Abishek Parekh, Enter the Hypermarket, Business India (2002).

[7]

Spiller A., Customer Satisfaction and Loyalty as Success Factors

in Organic Food Retailing, 16th Annual World Forum and

Symposium on Agribusiness, Food, Health and Nutrition (2006).

731

V.,

Retail

Management,

�International Journal of Pure and Applied Mathematics

Special Issue

[8]

Paninchukunnath A., Organized Supermarkets of South India:

An Exploratory Study of the Margin Free Markets of

Kerala, Indian Journal of Marketing 38(5) (2008).

[9]

Baseer A., Prabha G.L., Prospects and Problems of Indian

Retailing, Indian Journal of Marketing 37(10) (2007).

[10]

Wong A., Sohal A., Assessing Customer-Salesperson Interaction

in a Retail Chain: Differences between City and Country Retail

Districts, Marketing Intelligence & Planning 21(5) (2003).

[11]

Martin Jayaraj A., Dharmaraj A., Competitive Advantage

Strategies adopted by Rural Retailers in Coimbatore District,

Researchers World (2016), 102-107.

[12]

Martin Jayaraj A., Dharmaraj A., A Study on Customers,

Perception towards Marketing Mix Strategies adopted by Rural

Retailers in Coimbatore District, International Journal of

Research in Computer Application & Management 6(8) (2016),

16–19.

[13]

Dharmaraj A., A Study On Customer Satisfaction towards

selective

LG

Products

With

special

reference

to

Gobichettipalayam, Sai Om Journal of Commerce &

Management-A Peer Reviewed National Journal 1(9) (2014), 510.

[14]

Karthikeyan R., Dharmaraj A., Impact of Marketing Strategies On

Pump Industry With Reference To Coimbatore District,

International Journal of Research in Social Sciences 5(2) (2015),

219-224.

[15]

Mathai S.T., Dharmaraj A., Factors Affecting the Impulse Buying

Behaviour of Consumers of Cochin City, Journal of Advanced

Research in Dynamical and Control Systems (2017), 54-60.

[16]

Mathai S.T., Dharmaraj A., A Study on the Parent’s Perspective

Regarding the Impulse Buying behaviour of Children in Retail

Outlets of Cochin City with Special Reference to Snacks,

International Journal of Research in Arts and Science 3 (Special

Issue) (2017).

732

�733

�734

�

Dharmaraj Arumugam

Dharmaraj Arumugam Dr. Dharmaraj

Dr. Dharmaraj