Six Converging Tech Trends

Six Converging Tech Trends

Uploaded by

ibnu.asad984Copyright:

Available Formats

Six Converging Tech Trends

Six Converging Tech Trends

Uploaded by

ibnu.asad984Original Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Copyright:

Available Formats

Six Converging Tech Trends

Six Converging Tech Trends

Uploaded by

ibnu.asad984Copyright:

Available Formats

Six converging

technology

trends

Driving a tectonic

shift in the

Business-Consumer

ecosystem

kpmg.com/in

Table of

Contents

Foreword

01

02

Executive summary

Rise of the digital consumer

06

10

Six trends that will shape the future

Impact on industries

14

54

Impact on decision making process

Impact on IT vendors

58

62

Roadmap

Conclusion and recommendations

70

72

About KPMG in India

Acknowledgement

73

2013 KPMG, an Indian Registered Partnership and a member firm of the KPMG network of independent member firms affiliated with KPMG International Cooperative (KPMG International), a Swiss entity. All rights reserved.

Six converging technology trends | 1

Foreword

The market dynamics are changing; there is a decisive shift in the economic, demographic and

psychographic indicators. While the economic turbulence in the form of financial crisis is very

much evident, the drastic changes in demographic and psychographic indicators of consumers

are not apparent to a larger audience. However, marketers are increasingly getting cognizant of

how these factors which are reshaping the business landscape.

Todays consumer is a changed consumer; he/she will no longer walk down the street and stand

in queues to get a product/service. It is the era of an empowered consumer who has choices and

will come with a number of expectations. Since basic products and services are increasingly getting

commoditized, in order to sustain, marketers can only differentiate in terms of quality of service,

convenience, responsiveness and speed to market. Push strategy adopted by erstwhile marketers,

where products used to be simply pushed to consumers no longer works, there is a need to have pull

strategy which creates a pull in the minds of consumers by giving them superior quality of service in

least possible time at best possible prices.

Technology, which has witnessed a paradigm shift in business arena, has become a critical enabler to

achieve this. Role of technology will have to be looked at from a totally different context as a demand driver

and synthesizer . To cater to todays tech-savvy digital consumers, enterprises will have to redesign their IT

delivery mechanism and leverage various disruptive technologies. Different technologies would be required to

address different needs of todays consumers:

Mobility as preferred medium of purchase; social media as preferred communication channel; embedded

systems for convenience and self-help services; cloud to be agile, scalable, cost effective, and for faster delivery;

big data to understand customer needs better and stay relevant in the marketplace and augmented reality to

enhance customer experience.

These technologies are taking the centre stage in some of the leading enterprises of today and are likely to have

the maximum impact on the way traditional markets were behaving. Transcending the times when customer used

to come to the marketer, the current business scenario requires enterprises be in constant virtual touch with their

customers. Therefore, understanding these technologies and the way these are being used by some of the leading

enterprises worldwide becomes imperative.

This paper explores the potential opportunity from aforementioned disruptive technologies in various focus sectors

comprehensively and suggests ways in which the IT providers and the user community can better capitalize on this

opportunity. We hope you find this interesting and useful; we welcome your comments and feedback on this report.

Pradeep Udhas

Som Mittal

N Chandrasekaran

Partner and Head

Markets

KPMG in India

President

NASSCOM

Chairman NASSCOM and

CEO & MD,

Tata Consultancy Services

2013 KPMG, an Indian Registered Partnership and a member firm of the KPMG network of independent member firms affiliated with KPMG International Cooperative (KPMG International), a Swiss entity. All rights reserved.

2 | Six converging technology trends

Executive summary

Disruptive technological innovations are transforming the world around

us in unpredictable ways. A new era of Digital Consumerism is

radically changing the way customers shop for products and services

which is impacting the business-consumer ecosystem. Technology

players have been fairly swift in responding to these changing

market dynamics but in most cases they have treated these trends

in silos.

A digital consumer does not differentiate between these trends.

For a consumer, these trends are just an extension of his

experience with the world around him, be it interacting with

a retailer, or a bank or a hospital. KPMG in India believes that

when the consumer doesnt differentiate between trends,

then it logically follows that both the industry verticals as

well as the IT-BPO vendors must also look at them in an

integrated manner.

All these trends need to work together to deliver an

outstanding customer experience; just focusing on

one technology in isolation of the other will not work.

Businesses need to focus at creating a holistic

platform which encompasses all these trends.

Technology players in turn must come up with

integrated solutions that will enable businesses to

address the dynamically changing demands of the

new-age consumer effectively.

2013 KPMG, an Indian Registered Partnership and a member firm of the KPMG network of independent member firms affiliated with KPMG International Cooperative (KPMG International), a Swiss entity. All rights reserved.

Six converging technology trends | 3

We have identified six trends viz. big data, cloud, social media, mobility, embedded

systems and augmented reality which will have a logical maturity that inevitably

brings them together.

Big data

Every year, companies and individuals generate billions of gigabytes of data.

Data, which properly analyzed and used in time, can emerge as an unbeatable

competitive advantage. Enterprises need to recognize the prospect big data

represents and should adapt their IT strategy to capture such opportunities. Big

data can help retailers predict buying decisions of shoppers; it can help banks

weed out fraudulent transactions; while governments can use big data to provide

services directly to their citizens.

Cloud computing

The undeniable power of cloud computing to foster innovations and improve

productivity is now accepted by both IT vendors and their customers. While the

financial services and government sectors are mostly moving to a private cloud

model due to information security concerns, other industries like healthcare and

retail have adopted public cloud. Moreover, their existing infrastructure has helped

telecom players to emerge as providers of cloud computing, leading to erosion in

boundaries between IT and telecom vendors.

Social media

A social media strategy has become a must for all enterprises, be it banks, retailers

or the government. With over one billion individuals logged on to various social

networks, people are now using social media for advice on what products to buy,

where to shop and even regarding what firms they want to work with. While most

enterprises use social media for their customer service function only, many firms

have now started using social media in tandem with their sales and marketing

functions. This in turn enables firms to use data generated by the customers

effectively to service their larger pools of customers.

Mobility

Mobile devices have changed the way people access digital content. Smartphones

and tablets have brought rich, digital content to the fingertips of consumers. Mobile

banking has emerged as one of the most innovative products in the financial services

industry. Shoppers are increasingly using their mobile devices for everything from

browsing to comparing to buying products. Governments are also reaching out to their

citizens, using mobile devices as an efficient channel. Enterprises must also jump on to

the mobility bandwagon, and ensure that their applications are mobile ready.

Embedded systems

The decreasing cost of embedded systems has made their presence ubiquitous

across the business landscape. Embedded systems like RFID chips have

revolutionized supply chains for retailers. Embedded systems are also having an

impact in the healthcare industry, where hospitals attach smart chips to patients

to keep track of their entire medical regime.

Augmented reality

Over the past 24-36 months, augmented reality has moved from the world of

science fiction, to our everyday lives. The spread of smartphones and tablets

gave rise to the spread of location-based augmented reality applications, and

now everyone from retailers to healthcare providers have embraced augmented

reality. Augmented reality enhances the customer experience, and enables

enterprises to add a fourth dimension to their products.

2013 KPMG, an Indian Registered Partnership and a member firm of the KPMG network of independent member firms affiliated with KPMG International Cooperative (KPMG International), a Swiss entity. All rights reserved.

4 | Six converging technology trends

The Digital consumer and Disruptive technologies

Source: KPMG in India analysis

Digital consumerism is also impacting the way companies

use technology. Increasingly, the core business platform is no

longer the only source of information and insights. Additional

solutions based on disruptive technologies are being

integrated on to the core platform. This has led to a significant

increase in the level of insights firms have about their

customers. We are already witnessing micro-segmentation

of customer, and products and services being tailored at an

individuals level. The coming decade will only see a rapid

increase in this transformation.

IT vendors will need to change the way they are structured

to deal with these trends. They need to be nimble, and think

on their feet. Rather than being bureaucratic organizations,

IT vendors will need to create internal startups that will

work on adopting these trends. They will also need to look

at an inorganic strategy to add to their capabilities in some

of these areas. This will also have the added advantage of

brining in talent that will act as a force of disruption in these

organizations.

Going forward, IT vendors should seek to work closely with

their customers to stay abreast of the latest technological

developments, and come up with solutions that can take

advantage of the convergence of these technologies. They

should seek to use customer input more diligently while

innovating / developing solutions and products. The emphasis

should be on tapping inputs from various channels, mediums

and devices and using these as critical inputs for new

solutions and incremental innovations. Industry bodies can

also play a vital role in this, and increase awareness about

these technological trends.

We are in an era of technology-led

transformation. Technology will become

central and critical to everything we do. Every

industry, every process, every business

paradigm is being re-imagined, re-defined

and re-engineered. Mobile, cloud computing,

big data, anticipatory computing, Internet of

things (IoT), augmented reality, unfettered

bandwidth, social computing will make

a huge impact and not limited to just the

enterprise; they will impact our personal and

social lives as well as the communities and

societies we live in.

N Chandrasekaran

Chairman NASSCOM and

CEO & MD, Tata Consultancy Services

2013 KPMG, an Indian Registered Partnership and a member firm of the KPMG network of independent member firms affiliated with KPMG International Cooperative (KPMG International), a Swiss entity. All rights reserved.

Six converging technology trends | 5

The digital shift

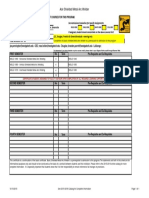

Influence of digital channels across all stages of purchasing

Disruptive technologies

Cloud

Identification

of Need

Seek

Information

Evaluation

Purchase

Consumption

Feedback

In USD billion

206.6

109

2012

2016

Big data

In USD billion

Drivers of convergence

13%

1.5

37%

Of web traffic comes

via mobile more than

double last year

Growth in the number of

global 3G subscribers in

the past year

billion

Smartphones and tablets

will be installed globally

by mid 2013 overtaking

laptops and PCs

48

5.4

2012

Social

2016

No. of accounts in millions

3132

2012

30%

Of global population

which is online

450

35

billion

zettabytes

Estimated number of

business transactions

on the internet, B2C and

B2B, per day by 2020

Amount of data in

the world by 2020

Embedded Systems

1.2

2012

4870

2016

In USD Trillion

2.4

2016

Mobile handset shipment

Increasing influence of digital channels

71%

businesses plan

to increase their

digital marketing

budgets in 2013

The social commerce market is forecast to reach USD 30 billion

by 2015

Leading global retailers are spending between 20-25 percent of

their advertising budget on social media channels

Mobile technologies can be used to cut the cost of a financial

transaction by up to 80 percent

1482

2012

Tablet shipment

Nearly 90 percent of top global banks use social networking to

achieve customer engagement

85

2012

Augmented reality

354.1

2012

in Millions

1858

2016

in Millions

304

2016

in USD Millions

5155.9

2016

2013 KPMG, an Indian Registered Partnership and a member firm of the KPMG network of independent member firms affiliated with KPMG International Cooperative (KPMG International), a Swiss entity. All rights reserved.

6 | Six converging technology trends

Rise of the digital consumer

The advent of technology has empowered the consumer like

never before. The rising presence and reach of the internet,

coupled with the prolific growth of smartphones, tablets

and related technologies, has provided consumers with

unmatched access to information on the go, thereby

helping them make informed purchasing decisions.

The adoption of digital media is redefining consumer

mindsets, patterns of purchase and decision making.

This, in turn, is transforming consumer behavior. The

rapid pace at which digital media is being adopted

is also expected to propel growth in the use of

consumer technology.

2013 KPMG, an Indian Registered Partnership and a member firm of the KPMG network of independent member firms affiliated with KPMG International Cooperative (KPMG International), a Swiss entity. All rights reserved.

Six converging technology trends | 7

Effects of digital channels on purchase decisions

A convergence of various factors a growing social media user base, the rising presence and reach of

smartphones, and the intensifying consumer demand to connect is increasingly changing the buying

behavior.

Typical consumer buying

Identification

of Need

Seek

Information

Evaluation

Purchase

Consumption

Feedback

Source: KPMG in India analysis

Today, digital channels play a pivotal role at each

of these stages. A simple expression of interest

on a social channel or the analysis of consumption

patterns can help businesses understand what

a consumer may purchase and when in the near

future. Based on such information, targeted

marketing programs can be developed and be

made available via different digital channels that

could help influence consumers purchasing

decisions.

A simple comparison engine has made the

evaluation of alternatives more cut-throat.

Customers can evaluate a product on the basis

of any feature or metric. Moreover, with the

advent of technologies such as augmented reality

and artificial intelligence, consumers have the

opportunity to virtually experience a product

before actually purchasing it.

Channels through which products can be

purchased have evolved too. Online transactions,

purchases through mobile-optimized websites and

smartphone applications (apps) are on the incline.

Consumer feedback on products through

comments on forums, social media and review

sites has created the need for heightened

monitoring; positive feedback can generate

immense goodwill, but negative feedback can

spiral into a full-blown PR crisis.

Consumer buying cycle in the digital age

Source: KPMG in India analysis

2013 KPMG, an Indian Registered Partnership and a member firm of the KPMG network of independent member firms affiliated with KPMG International Cooperative (KPMG International), a Swiss entity. All rights reserved.

8 | Six converging technology trends

The next big opportunity

In a short span of time, digital channels have come a long

way, from just providing information (websites) to interacting

with consumers (blogs, forums, social media) and providing

an actual purchase experience (Augmented Reality (AR)).

There is no doubt that technology is rapidly reforming the

way businesses interact with customers. The rise of digital

consumers who shop online, seek recommendations and

interact with brands presents a tremendous opportunity for

companies.

Thus, an in-depth understanding of customer behavior online

and their purchasing preferences has become essential.

Customers live in an integrated online-offline world, so

companies need to aim for suitable presence on digital

channels. New information and communication technologies

are constantly emerging, altering purchasing patterns. While

it may currently be difficult to predict when and which of

these new platforms/technologies will become mainstream,

it is essential to analyze their potential impact on consumer

behavior.

Several companies are already creating digital strategies for

their brands; however, many fail to produce the expected

business outcomes and value through such initiatives, as

these channels and technologies are being perceived in silos.

A holistic and integrated strategy encompassing consumers,

the enterprise ecosystem and channels is the need of the

hour to cater to evolving demands and behavior. The effective

use of such channels can help increase sales by monetizing

demand, improve the effectiveness of marketing campaigns,

enhance product development, drive multi-channel

commerce and, above all, strengthen consumer engagement.

A Digital Consumer expects a seamless, consistent experience

regardless of hardware or software. They also want relatable, intuitive

and intelligent technologies enabled on their devices. Going forward,

we will see a multitude of devices that will continue to get smarter,

more power-efficient and more intuitive. Very soon devices will

respond to voice, gestures and moods, and will interact with each

other to provide more value and intelligence to the digital consumer.

Kumud Srinivasan

President-Intel India

Vinay Bhatia

(Customer Care Associate & Senior Vice President, Marketing & Loyalty, Shoppers Stop Ltd)

Digital Media in no longer just a mere spoke in the wheel; but the

very axle that can drive the wheels of a marketing campaign. We, as

a company, are very clear that Digital Media is here to stay in a huge

huge way! Which is why we have complete cross-functional teams

support to further the digital momentum of the company.

At Shoppers Stop, we dont retrofit digital into our existing

campaigns. Rather, we create specific content for digital media;

and sometimes even use offline mediums to supplement

these campaigns. Whether it is developing Augmented Reality

campaigns, the most Fashionable Facebook Profile picture contest,

#SSTweetStore, exclusive mobile apps, and much more; each such

element receives its due digital diligence.

2013 KPMG, an Indian Registered Partnership and a member firm of the KPMG network of independent member firms affiliated with KPMG International Cooperative (KPMG International), a Swiss entity. All rights reserved.

Six converging technology trends | 9

Disruptive

converging

technologies

Growth and Maturity

Feeder Cycle

Digital

consumerism

Source: KPMG in India analysis

The diagram above shows the interplay between digital consumerism and disruptive technologies.

The increasing adoption and usage of technologies by consumers is fueling the growth and maturity

of technologies and vice versa. This phenomenon is the key driver for convergence of new age

technologies. In the following section, we discuss six technologies that KPMG in India thinks will bring

about a tectonic shift in the business-consumer ecosystem.

2013 KPMG, an Indian Registered Partnership and a member firm of the KPMG network of independent member firms affiliated with KPMG International Cooperative (KPMG International), a Swiss entity. All rights reserved.

10 | Six converging technology trends

Six trends that could shape the future

While technologies such as big data and cloud have been

dominating the imagination of enterprises for the past

couple of years, new disruptive trends like augmented

reality and social media have only now started having a

tangible presence. As per their studies, leading analyst

firms have estimated that the maturity curve of these

technologies is to increase at a rapid pace over the

next decade, with big data and cloud estimated to

reach a market potential of tens of billions of dollars.

2013 KPMG, an Indian Registered Partnership and a member firm of the KPMG network of independent member firms affiliated with KPMG International Cooperative (KPMG International), a Swiss entity. All rights reserved.

Six converging technology trends | 11

Big data

Digitization has made significant strides in recent years

racks of documents and piles of files have been replaced with

zettabytes of data stored in the servers of data warehouses.

Trends such as the growing use of mobile devices and social

media networks are generating considerable amounts of data

both structured and unstructured.

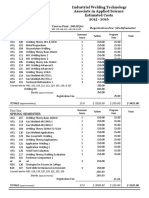

Big data global market size, in USD billion

Underpinned by both technology and economic disruptions,

the cloud will fundamentally change the way technology

providers engage with business customers and individual

users as it is a key driver for mobility and big data.

Rise of social media

Regarded merely as a hub for high school and college

students just a few years ago, social media now exerts

tremendous influence over the way people around the world

of all ages get and share information. The implications for

business are immense.

Social media accounts & users

Source: Wikibon Big Data Market Size and Vendor Revenues report,

http://wikibon.org/wiki/v/Big_Data_Market_Size_and_Vendor_Revenues,

Jan 2013

As per a 2011 analysis, every day, the world creates 2.5

quintillion bytes of data so much that 90 percent of the

data in the world today has been created in the last two years

alone1, and even this volume would have been surpassed by

now.

Analyzing this, big data is likely to become a key basis of

competition, underpinning new waves of productivity growth,

innovation, and consumer surplus by 2020.

Social media usage

Evolution of the cloud computing model

No trend has had as much impact on the world of information

technology over the past decade as Cloud computing.

Looking past the current industry hype surrounding it, cloud

computing is a sustainable, long-term paradigm and the

successor to previous mainframe, client/server, and network

computing eras.

Global cloud computing market, in USD billion

Source: Social Media Market, 2012-16, Radicati Group, June 2012,

Morgan Stanley, Internet Trends 2011, December 2011

Source: Forecast Overview: Public Cloud Services, Worldwide, 20112016, 2Q12 Update", Gartner, September 2012

1 Big data: The next frontier for innovation, competition, and

productivity, May 2011, McKinsey

2013 KPMG, an Indian Registered Partnership and a member firm of the KPMG network of independent member firms affiliated with KPMG International Cooperative (KPMG International), a Swiss entity. All rights reserved.

12 | Six converging technology trends

Dominance of mobility

The surging popularity of smartphones and tablet computers has created

ripples across the computing industry. As industry players continue to shift

their focus from traditional to mobile computing, a significant change is on

the horizon.

Mobile device shipments and mobile penetration

Source: Morgan Stanley, Internet Trends, February 2011, "Portio Research Free Mobile

Factbook 2012", January 2012

The global market for smart connected devices a combination of PCs,

smartphones, and tablets reached 267.3 million units shipped in the

second quarter of 2012 (2Q12), a 27.4 percent increase y-o-y and a 2.8

percent q-o-q improvement.

Both consumers and business buyers around the world continue to

harbor an aggressive appetite for such devices, adding to the already

large collection of devices that are still in active use. Rising focus on the

mobile web platform is affecting a number of business aspects, including

ecommerce spending and online advertising.

Beyond pure-play hardware & software: towards

embedded systems

Embedded systems range from portable devices such as digital watches

and MP3 players, to large stationary installations like traffic lights. Medical

equipment is continuing to advance with more embedded systems for

vital signs monitoring, electronic stethoscopes for amplifying sounds etc.

With technology erasing the boundaries between hardware and software,

embedded systems are expected to bring the new wave of change.

Embedded systems market size

Connectivity, content and

communication are drivers

enabling business change

today. Social media, mobile,

cloud, and big data are major

themes that are forcing

organizations to change the

way they service changing

customer demands and

behavior patterns. We

have seen that data-driven

companies are able to

monitor customer behavior

and market conditions

with greater certainty,

and react with speed and

effectiveness to differentiate

from competition.

Also, the adoption of cloud

is increasingly taking a

truly strategic role in an

organization. The cloud has

rapidly established a new

benchmark in terms of how

easy, quick and flexible

solutions should be available

to the business and it puts

the alignment between

business and IT from a

whole new perspective.

Aruna Jayanthi

CEO Capgemini, India

Source: IDC, "Intelligent Systems: The next big opportunity", September

2011, http://www.cio.com/article/689563/IDC_Embedded_Systems_

Market_to_Double_By_2015

2013 KPMG, an Indian Registered Partnership and a member firm of the KPMG network of independent member firms affiliated with KPMG International Cooperative (KPMG International), a Swiss entity. All rights reserved.

Six converging technology trends | 13

Augmented reality

Augmented Reality (AR) offers a live view of a physical,

real-world environment whose elements are enhanced by

computer-generated sensory input such as sound, video,

graphics or GPS data. The spread of smart mobile devices

has led to rapid growth in AR. Against the backdrop of

steadily increasing processing power the future holds

significant potential for AR, with applications in a wide range

of segments, from agriculture and architecture to education

and medicine. Several technology firms have also jumped on

to the AR bandwagon. For instance, Google has introduced

Google GlassesTM to tap the potential of this technology.2

Augmented reality applications market

Source: Research and Markets, Global Augmented Reality Market

Forecast by Product 2011-16, November 2011

Cloud, Mobility, Social and Big Data will

impact all industries, bringing in new

products and business models, similar to

what Internet did over the last 20 years.

Companies are looking at taking advantage of

these trends to drive growth and accelerate

their innovation agenda to provide superior

customer experience, reduce time to market

or drive efficiencies.

Kris Gopalakrishnan

Executive Co-Chairman, Infosys

The level of technology adoption in India has

grown immensely. A lot of that has got to

do with Indias economic development as a

powerhouse of talent, creators of some of

the worlds successful business empires,

hotbed for new technologies and start-ups,

entrepreneurship, heightened growth in

social and mobile among enterprises and

consumers alike, and a tech-savvy, anxious

young population which will enter the

workforce. Technology is empowering a

whole new wave of innovation and growth

that is aiding businesses to gain and sustain

a competitive edge. We see this change

taking root in industries as diverse as banking,

telecom, e-governance, retail, e-commerce,

professional services among others. The endfocus of course is on delivering greater value

to the customer. Technological advancements

around big data and social media analytics

are allowing businesses to create and deliver

products that are uniquely designed to meet

the needs of an individual customer.

Sandeep Mathur

MD, Oracle India

2 http://www.nbcnews.com/technology/gadgetbox/google-shows-prototype-augmented-reality-glasses-653835

2013 KPMG, an Indian Registered Partnership and a member firm of the KPMG network of independent member firms affiliated with KPMG International Cooperative (KPMG International), a Swiss entity. All rights reserved.

14 | Six converging technology trends

Impact on industries

The growing presence and reach of technologies that span

the web, mobility and social media platforms has led to

the emergence of digital consumers. Todays enterprises

are marketing to digitally active consumers prepared

to adopt new technologies with ease. Gadgets such

as laptops, mobile phones, handhelds and personal

digital assistants (PDAs) have become common and

preferred media for transactions. Consumers tend to

stay connected with the internet regularly and seek

information online before making any purchases.

2013 KPMG, an Indian Registered Partnership and a member firm of the KPMG network of independent member firms affiliated with KPMG International Cooperative (KPMG International), a Swiss entity. All rights reserved.

Six converging technology trends | 15

Possible impact on select sectors

As per KPMG in India analysis, the

following are common traits that the

new-age digital consumer:

Stays ubiquitously connected (thus,

the role of cloud, social media,

mobility and the internet)

KPMG in India has identified a number of select key sectors

that account for a significant portion of it vendors revenues

and are also among the most promising sectors in terms

of growth. These include retail, healthcare, telecom,

government and financial services.

Global market size and growth rate of select verticals

Seeks personalization and

convenience (thus, the role of cloud,

AR, mobility and the internet)

Needs innovative experiences and

entertainment (thus, the role of AR

and social media)

Is influenced by peer reviews and

feedback (thus, the role of social

media and big data)

Needs secure and easy purchase

procedure (thus, the role of

embedded systems, cloud and

mobility)

Needs transparency, accountability

and convenient post-purchase

services (thus, the role of mobility,

big data and embedded systems).

These traits reflect a significant

evolution from the traditional consumer

profile the way in which a new-age

consumer communicates, transacts

and makes purchase decisions has

witnessed a paradigm shift. This change

induces the need for enterprises

to change the way in which they

operate and connect with customers.

To address this need and tap latent

opportunities, industries need to

leverage disruptive technologies and

place digital consumer at the core of

business strategy.

Enterprises need to leverage the

opportunities that disruptive technology

trends present. However, the extent

to which these opportunities are

implemented within an organization

would depend on their relevance of

each disruptive force on the industry to

which the organization belongs.

Source: Ovums Global IT Services Market Forecast Model, July 2011, Ovum

Global IT services market Split by verticals

Source: Ovums Global IT Services Market Forecast Model, July 2011, Ovum

The identified verticals collectively account for close to 70

percent of the market. Further, the impact of disruptive

technologies - cloud, big data, social media, mobility, AR,

and embedded systems on these verticals will likely be the

highest. This report is aimed at gauging this possible impact

through the analysis of various qualitative and quantitative

aspects of these technologies.

2013 KPMG, an Indian Registered Partnership and a member firm of the KPMG network of independent member firms affiliated with KPMG International Cooperative (KPMG International), a Swiss entity. All rights reserved.

16 | Six converging technology trends

In terms of disruptive technologies Big data, Cloud and Mobility are all very

significant. They will disrupt the industry in different and significant ways. So,

it would not be wrong to say that among these, cloud can be considered the

biggest disruption of our times.

Mobility is expected to be a game changer. New business opportunities and

challengers are being brought about by the flood of new mobile technologies

and the speed with which this landscape is changing. Customers now expect to

have access to products and services from anywhere, via both the web and apps,

using the device of their choice to interact and transact. Mobile workers are also

looking at mobile solutions to help them be more productive and efficient.

Big data, backed with predictive analysis can help businesses generate

actionable business insights. In addition to the aspects of complexity and

variability of big data, is the rate of growth or velocity, largely due to the

ubiquitous nature of modern on-line, real-time data capture devices, systems,

and networks. It is due to this that the rate of growth of big data tools will

continue to increase in the foreseeable future.

We believe that in-memory computing is a breakthrough which will not only

enable applications and analytics to run up to thousand times faster, it will enable

businesses to be faster and nimble. SAP HANA in-memory technology platform

is a completely re-imagined modern platform for real-time businesses. SAP

HANA Cloud paves the way for developers to build applications in the cloud with

embedded analytics and the massive speed of the technology itself.

Together Mobility, Cloud and In-memory computing will transform the

businesses to run faster and nimbler than ever before. So, SAP is actively

working around all these three technology areas and is using both organic and

inorganic growth models to strengthen its presence in these segments.

Avaneesh Dubey

Senior Vice President, Business Suite Test Engineering, SAP Labs India

2013 KPMG, an Indian Registered Partnership and a member firm of the KPMG network of independent member firms affiliated with KPMG International Cooperative (KPMG International), a Swiss entity. All rights reserved.

Six converging technology trends | 17

2013 KPMG, an Indian Registered Partnership and a member firm of the KPMG network of independent member firms affiliated with KPMG International Cooperative (KPMG International), a Swiss entity. All rights reserved.

18 | Six converging technology trends

Retail

Following the global economic downturn and a subsequent

dip in employment and consumer confidence, the global retail

industry has recovered since 2010. Stimulus packages provided

by governments, reinforced by strong domestic demand in

some developing countries, boosted the global retail industrys

size to an estimated USD 17 trillion in 20121. North American

and European retailers with players such as Wal-Mart Stores

Inc, Carrefour SA, Metro Ag, and UK-based Tesco continue to

dominate the retail industry2.

Global retail industry, annual sales, in USD trillion

Key drivers of growth

in the retail industry

An expanding population base and a largely

urbanized consumer class provide a thriving

market for retailers

Source: Economist Intelligence Unit, accessed January 2013

With the rise of the digital shopper, shopping has increasingly

moved online and to the mobile platform, especially in the

US, Western Europe and East Asia. In the US, the online retail

outlook for 2012 was encouraging fueled by the results

of the 2011 holiday season. Online sales during the holiday

season in the US increased to US$43 billion, reflecting a 17

percent increase over 20113. The value of mobile shopping

was predicted at more than US$163 billion in sales, or 12

percent of all e-commerce sales, in 20104.

Entry of large, organized retailer into developing

nations like India will also be a big boost

Shift in demographics and purchasing power to the

younger section of the population is also driving

demand

The rise of omni-channel retailers is also bringing

the shop closer to the consumer, and is leading to

increased spending.

1 www.alpencapital.com/downloads/GCC%20Retail%20Industry%20Report%202011_1%20November%202011.pdf ; GCC retail industry report,

Alpen Capital

2 www.stores.org/2012/Top-100-Retailers, January 2012

3 www.comscore.com/Insights/Press_Releases/2012/11/comScore_Forecasts_17_Percent_Growth_for_2012_U.S._Holiday_E-Commerce_Spending

4 www.verizonbusiness.com/resources/whitepapers/wp_near-future-of-retail_en_xg.pdf

2013 KPMG, an Indian Registered Partnership and a member firm of the KPMG network of independent member firms affiliated with KPMG International Cooperative (KPMG International), a Swiss entity. All rights reserved.

Six converging technology trends | 19

Change in footprint over the decade

Across the world, the retail industry is at the centre of a

major shift in the way consumers shop and interact with

their retailers. After almost a century of customers going

to the store, the store is now coming to the customer.

Customers now demand that retailers be wherever they

are. E-commerce has also led to a global marketplace and

has given rise to new, online retailers who take advantage of

this low-cost channel, creating a perfect storm for traditional,

brick-and-mortar retailers.

The growing might of online and now mobile shopping

has led to terms such as omnichannel, which attempt to

portray how customers use stores and websites in tandem5.

Retailers find that the more channels their customers use,

the more they spend.

Shopping preferences of digital consumers

http://www.marksandspencer.com/

According to Marks & Spencers, people who shop on

its website, as well in its stores, spend four times as

much as people who shop just in stores. People who

additionally use the mobile channel end up spending

eight times as much.

Source: http://www.guardian.co.uk/business/2012/sep/02/marks-andspencer-multichannel-shopping

Source: Meet the connected consumer, ZMags6

5 http://www.guardian.co.uk/technology/2012/nov/11/mobiletechnology-leap-forward

6 Meet the Connected Consumer, Jan 2012, Zmags.com

2013 KPMG, an Indian Registered Partnership and a member firm of the KPMG network of independent member firms affiliated with KPMG International Cooperative (KPMG International), a Swiss entity. All rights reserved.

20 | Six converging technology trends

Key components of retail industry

Customer

touch points

Product Placement

Promotions

Point of Sale

Delivery System

After sales services

Past

Present

Past

Present

Past

Present

Past

Present

Past

Present

Store

Traditional media

Peer group

Home

Telephone

Web

Mobile

Call centre

Social media

0

Source: KPMG in India analysis

Source: KPMG in India analysis

4 Very high

5 High

6 Medium

7 Low

0 Absent

Thus, with the advent of the internet, and now mobile and social media, the retail

landscape has undergone a seismic shift. Channels including the web, mobile

and social media have increased their presence in the retail value chain. In the

next decade, these new channels are likely to emerge as critical touch points for

retailers, and providing an outstanding experience at these touch points can be the

difference between winners and laggards.

2013 KPMG, an Indian Registered Partnership and a member firm of the KPMG network of independent member firms affiliated with KPMG International Cooperative (KPMG International), a Swiss entity. All rights reserved.

Six converging technology trends | 21

Enabling technology transformations

Retailers understand that the key to the future of consumer

engagement is to meet shoppers where they are.

Sophisticated mobile devices, big data and cloud computing

currently work in tandem to provide ready access to

information, products and services from virtually anywhere

at any time. The further integration of the cloud and mobility

with social networking creates a powerful, new platform that

allows retailers to engage throughout the purchasing cycle.

To take advantage of such trends, retailers need to invest in

technology resources that can help them stay a step ahead of

the competition.

Big data applications across different functions of the

retail sector

Supply chain

Optimal stocking decisions; Distribution and

logistics optimization; Management supplier

negotiations

Merchandising

Assortment optimization; Placement and

price optimization; Store layout planning

Sales and

Marketing

Online and in-store: Cross-selling; location

based marketing; Customer microsegmentation

Online: Real-time personalization; Facilitate

accurate delivery schedules

Big data

With large amounts of data being generated from the pointof-sale at stores, online transactions and social media, Big

data offers numerous opportunities to retailers to improve

marketing, merchandising, operations, supply chain and aftersales service.

Retailers use big data to help them manage inventory levels,

and make better decisions about new orders7. The US-based

book retailer, Barnes & Noble used a big data analytics

solution to enable suppliers to monitor its inventory and

take real-time replenishment decisions8. Demographic and

purchasing data patterns can be analyzed using big data to

help in merchandising related decisions.

Big data can also be used to better understand the target

market, gauge consumer behavior, understand their

shopping preference and hence do a better positioning of the

product.

Tesco Harnessing big data

Tesco collects vast amounts of data on its

customers' shopping habits that allow it to send

precisely targeted coupons. When a household

starts buying nappies, signaling the arrival

of a new baby, Tesco usually sends discount

vouchers for beer, knowing that the new father

will have less opportunity to go to the pub.

Source: Link

7 Big Data for Retail is Flying Off the Shelves, Nov 2012, Forbes

8 Big Data The Next Big Thing, Sep 2012, NASSCOM

9 The Guardian, www.guardian.co.uk/cloud-computing/high-streetstores-turn-to-hosted-services, June 2010

10 Netsuite, www.netsuiteblogs.com/blog/2012/09/cloud-computingopen-doors-for-multichannel-retailing-in-australia.html , September

2012

11 IDC Retail Insights, www.idc-ri.com/getdoc.

jsp?containerId=prUK23533512, June 2012

In-store: Customer behavior analysis;

Improve multi-channel experience

Customer service

Customer behavior analysis

Source: KPMG in India analysis

Cloud

Retailers progressively need to process large amounts

of data pertaining to customers and products in real time

to provide personalized solutions. The spread of cloud

computing has helped retailers to not only have large

computing resources at their disposal; it has also allowed

them to match their demand with their sales season.

Moreover, retailers are looking to move all their platformbased solutions to the cloud.

UK-based fashion retailer Anthropologie's patterns are

rigorously managed in-house. It was integrated with a core

e-commerce system provided by on-demand e-commerce

provider Venda. The system included a payment mechanism,

a product database and a site design accessible on the web

and mobile platforms9.

Cloud computing also facilitates the implementation of

an omni-channel strategy. It allows for the low-cost and

significantly low-risk rollout of software that is needed to

support multichannel retailing. This is particularly attractive

for small businesses that lack requisite resources. Retailers

can gain real-time visibility into their retail operations from

anywhere at any time, as well as provide a single view of

a customer across channels. Retailers can also keep their

information up to date10.

Further, cloud computing helps retailers manage multiple

channels and locations, integrate their websites with

business, support their Point-of-Sale (PoS) systems, provide

a unified real-time view of business, perform automated

merchandising and marketing, and gain a 360-degree view

of each customer. Recent surveys also reveal that while

current cloud adoption rates in western European retail are

low, adoption is expected to increase 300 percent by 201411.

Additionally, 61 percent of western European retailers plan

to invest in cloud computing in 2012, with a slight preference

for increased investment from large retail companies (500+

employees), and the budget for cloud being typically less than

5 percent of the overall IT spend23.

2013 KPMG, an Indian Registered Partnership and a member firm of the KPMG network of independent member firms affiliated with KPMG International Cooperative (KPMG International), a Swiss entity. All rights reserved.

22 | Six converging technology trends

Social media

Over the past two decades, the internet has evolved into a

large, social community. The social media has given people

a voice. The social commerce market is forecast to reach

US$30 billion by 2015, from an estimated US$9 billion in

201212.

Worldwide social commerce market, annual revenues, in

USD billion

Further, social networks offer retailers the opportunity to

connect with millions of customers and reach out to them

individually. Retail brands need to devise a social media

strategy, one that goes beyond just having a presence on

Facebook and Twitter. Strategy should involve connecting

with audiences over these social networks and leveraging

their urge to talk about and share similar passions13.

It also must be considered that even if a retailer decides

not to have a presence on the social media, it could still feel

its impact. Thousands of consumers write reviews, share

feedback on their shopping experiences on social media

platforms. Therefore, even if a retailer is not present on a

social media platform, it may still be talked about. Therefore, a

retailer must have a social media strategy that encompasses

not only social media platforms but also listening and

monitoring tools.

According to a recent survey by The Partnering Group,

customer use social media primarily for coupons and product

information, as well as to read comments from other users.

Facebook has emerged as the leading social media platform

for such discussions, with an estimated 55 percent of

customers using it14.

Source: Booz and Co

Sephora

leveraging social

media

Cosmetics retailer Sephora has created an

interactive shopping social space launching

its online Beauty talk community. It brought

its customers together and encouraged them

to discuss their enthusiasm for beauty products.

Sephora found that by creating a community

and by opening itself to its customers it was

flooded with people dying to talk to each

other. Moreover, a Beauty talk community

user spends two-and-a-half times

more than the average Sephora

customer.

Leading uses of social media by shoppers

Source: The Partnering Group

Source: EConsultancy

12 www.booz.com/media/uploads/BaC-Turning_Like_to_Buy.pdf

13 www.guardian.co.uk/media-network/media-network-blog/2012/

jul/25/social-retailing

14 www.shop.org/c/journal_articles/view_article_content?groupId=1and

articleId=1541andversion=1.0

2013 KPMG, an Indian Registered Partnership and a member firm of the KPMG network of independent member firms affiliated with KPMG International Cooperative (KPMG International), a Swiss entity. All rights reserved.

Six converging technology trends | 23

Mobility

The spread of mobile devices has changed the way in which

customers interact with retailers. They have emerged as

an integral part of the sales process. Many of the mobile

applications available today benefit the traditional brick-andmortar stores by improving the in-store experience or driving

traffic to stores with discounts.

Product identification can take place at any touch point,

whenever or wherever a customer sees a product. The

interaction may be through an outdoor advertisement, in a

magazine or newspaper, via a retailer's smartphone app, a

mobile website, on a social network or even in-store, where

an out-of-stock size is required15.

A mobile offers the advantage of instant checkout. If the

customers preferred payment and delivery details are

stored securely on their mobile device, they can purchase

anything from anywhere, anytime, simply at the touch of

a few buttons. More than 60 percent of pre-purchase web

searches are initiated on a mobile device. In addition, the

majority of people 67 percent researches products on

smartphones and then purchases them at a physical store16.

The UK-based retailer Sainsbury's launched

a new initiative called Mobile Scan & Go

that lets customers scan items as they

shop using their iPhone or Android

mobile device and pay at the till without

unloading their trolley or bags. This

makes the shopping experience even

more convenient for customers by

letting them track how much they're

spending, view savings instantly,

and then pay at the till without

unloading their trolley, basket or

bag.

Source: http://j-sainsbury.co.uk/media/lateststories/2012/20121014-sainsburys-trials-mobile-scan-go/

Embedded systems

Embedded systems are changing every point in a retailers

business, from sourcing of goods to their distribution to

display in stores and finally, checkout. Embedded systems

are enabling a connected ecosystem of devices that allow

a retailer to have a real-time view of every step in its value

chain17. Retail firms such as eBay, Amazon and Flipkart,

whose business models are built around the long-tail, need

to keep track of millions of items18. They spend considerable

resources on analytics of data, resulting from tracking of

these items. As analytics of the long-tail grows in importance,

embedded systems become a focal point for retailers that

earlier saw only little need for them.

RedBox, a US based retailer of rental DVDs and video games,

offers its customers a touch screen kiosk with information on

movies and the entire process is automated. All a customer

has to do is touch the item they want, use their credit card,

and get the desired video19.

Wal-Mart is one of the pioneers in implementing

self-checkout stations that use embedded systems

to read the bar code on each item, compute the

total of the sale, and process the payment.

Source: How Embedded Systems Are Changing the Way We

Shop, August 2012, bizcloud

Carrefour City, the convenience store

arm of French retail giant Carrefour,

launched 'Mon Panier', a mobile app

that lets customers order and pay

for their grocery shopping with their

mobile phone and then identify

themselves via an NFC and QR-code enabled kiosk

when they arrive at the store to collect their order.

The service is live at Carrefour City outlet at St

Lazare, Paris.

Source: Carrefour uses NFC and QR codes to speed up grocery

shopping, May 2012, NFC World

15

16

17

18

19

www.guardian.co.uk/media-network/media-network-blog/2012/jun/26/mobile-retail-technology-consumer, June 26, 2012

www.cisco.com/web/about/ac79/docs/retail/Retail-Mobility-PoV_011312FINAL.pdf

Retailers Add Gadgets for Shoppers at Ease With Technology, Mar 2012, The New York Times

Does the Long Tail create bigger hits or smaller ones?, Nov 2008, LongTail.com

Communication and Interaction Redesign for Redbox, 2010, Ideo.com

2013 KPMG, an Indian Registered Partnership and a member firm of the KPMG network of independent member firms affiliated with KPMG International Cooperative (KPMG International), a Swiss entity. All rights reserved.

24 | Six converging technology trends

Augmented reality

Another common application of embedded system, used

extensively in retail is Radio Frequency Identification (RFID).

RFID devices are transforming the retail landscape with

their ubiquitous presence in the supply chain. RFIDs enable

retailers to keep track of each and every product in their

system, integrated into a common repository to have unified

and centralized view of information. RFID systems may range

from source tagging, barcode labeling systems, hand-held

labeling systems and retail merchandising systems and can

enable applications such as automatic identification, retail

security and pricing and promotional labels20.

Embedded systems are also enabling a new global standard

for retail payments designed to help exchange data between

payment terminals and POS terminals and support new

payment technologies. Use of Near Field Communications

(NFC) and mobile payments are common applications in this

area. This has the potential to improve customer experience,

as well as sales.

It is no longer enough for retailers to stock their outlets

with the latest products; the popularity of smartphones has

given genesis to a new mobile shopping culture altogether.

Apps such as Blippar, which links smartphone users to

extra video and product content on retailers websites,

have revolutionized the interface between shoppers and

products21. Google has launched an augmented reality-based

head-mounted display (HMD) called Google GlassesTM 22.

This consists of wearable glasses that display information in

smartphone-type format, are hands-free, and interact with

the internet via natural language voice commands. These

glasses seamlessly project information on to the scene in

front of the wearer; a customer can access reviews and price

comparisons of any product in a store; restaurant menus

and reviews can be shared; at a bookstore, a customer can

access book reviews and author information.

AR is also used to explore synergies in print and video

marketing. Marketing flyers can be designed with trigger

images that, when scanned by an AR-enabled device using

image recognition, activate a video version of the promotional

material.

AR technology has made it possible for phones to become

barcode scanners that offer extra information and online

prices. It is estimated that AR-based apps will generate close

to USD 300 million in revenues globally in 2013 as brands and

retailers increasingly show appetite for such features23.

20 RFID Technology In Retail, Apr 2008, Retail Technology Review

21 www.guardian.co.uk/technology/2012/nov/11/mobile-technologyleap-forward

22 www.pbs.org/newshour/extra/features/science/jan-june12/

Google_04-09.pdf

23 www.juniperresearch.com/viewpressrelease.php?pr=348

2013 KPMG, an Indian Registered Partnership and a member firm of the KPMG network of independent member firms affiliated with KPMG International Cooperative (KPMG International), a Swiss entity. All rights reserved.

Six converging technology trends | 25

Current state and way forward

Retail industry is one of the early adopters of disruptive

technologies be it cloud, mobility, social media, big data,

augmented reality or embedded systems owing to its

B2C nature. Till now, mobility, social media and embedded

systems (mostly in the form of RFID) have witnessed

greatest adoption in the retail sector. With web-enabled

smartphones, online shopping is being done using cell

phones and customers are using social media to get product

reviews and give feedback.

A number of companies have also started experimenting

with big data tools such as Hadoop and MapReduce to

unleash the power of big data analytics. Given the quantum

of customer information that retailers have, if utilized in a

correct manner, it can help in identifying and targeting the

right customer segment and better positioning of the product.

However, it will take some time for marketers to develop a

business case which can justify the investments made on

such tools.

Augmented reality is expected to be the game changer

for the retail industry. Increasingly marketers are using

augmented reality to enhance virtual shopping experience

and therefore, the industry would see significant investments

in augmented reality applications in the near future,

especially in the western world.

In terms of convergence, retail is a sector which can

encompass most disruptive technologies. It is not hard

to think of a cloud-based platform providing integrated

social media and augmented reality applications on mobile

devices. The data generated through such applications can

be analyzed using big data tools. There can be several other

such applications which can encapsulate multiple disruptive

technologies within them. The near future will see many

more such applications.

Cloud has been there for quite some time but it is being used

as additional layer for niche applications, for example, to host/

support a social media platform. The core retail platform is still

on-premise software as concerns loom large over replacing

the core platform with a cloud-based solution.

Consumers in modern times expect products and services to cater to their every need,

from world over, at times that they dictate and are willing to share information on their

experiences across social media. The availability of information for customers has

compelled retailers to constantly strive to serve customers above their expectations.

Social media, data analytics, advanced CRM etc. have created the ability of one to one

relationship between customers and retailers. No longer can retailers operate in the

markets by mere segmentation of customers; they have to serve customers based on

individual customer needs.

Service providers to retail like IT companies also have to realize that retailers as

clients expect the provider to give solutions to their business needs rather than mere

pieces of technology. Various functions of retailers including marketing, Human

Resource Development, Finance, operations etc. need technologies that definitely

help the functional team. However these technologies need to form part of the total

solution offered. Retailers also expect to get a clear understanding of the return

on investment which the IT services company is expected to calculate based on

functional understanding of the business. This also means that IT companies need to

understand the core business of their customers and create cross functional value

propositions. For example a technology for social media can also cater to loyalty as well

as marketing requirements of retailers. This also means that IT providers need to be able

to communicate not only with the CTO of companies but also with head of marketing,

head of buying and merchandising, the CEO. As convergence increases, and the need

for mobility increases, IT companies are well expected to provide state of art solutions

and not just technologies and these with best quantifiable benefits.

Kumar Rajagopalan

CEO, Retailers Association of India

2013 KPMG, an Indian Registered Partnership and a member firm of the KPMG network of independent member firms affiliated with KPMG International Cooperative (KPMG International), a Swiss entity. All rights reserved.

26 | Six converging technology trends

Healthcare

Healthcare services, as defined, refer to provisioning of

consultation, diagnostic, patient care and medication services to

a patient suffering from injury, illness, disease, etc.1

The global healthcare market is well poised for growth with

per capita healthcare expenditure growing in most countries

due to changing lifestyle, ageing population, and availability of

better healthcare infrastructure. These countries were either

significantly underserved and are now witnessing capacity

expansion or are actively upgrading their healthcare systems.

Global healthcare spend in USD billion

Key drivers of growth in

the healthcare industry

Changing lifestyle, ageing population and better

availability of healthcare facilities is driving the

healthcare market.

Rising penetration of health insurance is leading to

increased spending on healthcare services.

Source: Economist Intelligence Unit, accessed January 2013

Although the global healthcare market is witnessing growth,

the uptake of healthcare services in both developed and

developing economies remains skewed. Developing

economies such as India, China, Malaysia and Vietnam

continue to lag behind developed countries such as the US,

the UK, Japan, Germany and Korea, which have relatively

mature healthcare markets2. For example, developed

economies such as the US and the UK have over 3 hospital

beds per 1,000 population2; meanwhile, countries such as

India, Indonesia, Vietnam and China have less than 3 hospital

beds per 1,000 population. Therefore, in less developed

countries, the role of the government is paramount.

Increased availability of doctors, medical services,

and health portal is leading to an increased

adoption, especially in the developing economies.

Increasing awareness of health related issues

is also leading to extensive usage of healthcare

services.

1 Independent Market Research on the Global Healthcare Services

(HCS) Industry, June 2012, Frost & Sullivan

2 IMF, The Economics of Public Health Care Reform in Advanced and

Emerging Economies, June 2012, www.imf.org/external/pubs/ft/

books/2012/health/healthcare.pdf

2013 KPMG, an Indian Registered Partnership and a member firm of the KPMG network of independent member firms affiliated with KPMG International Cooperative (KPMG International), a Swiss entity. All rights reserved.

Six converging technology trends | 27

Change in footprint over the decade

The healthcare sector stands at the inflection point

and is witnessing a transformation due to government

regulations and initiatives to bring down the healthcare

costs. Regulations such as Health Insurance Portability

and Accountability Act (HIPAA) and the Health Information

Technology for Economic and Clinical Health Act (HITECH

Act) are emphasizing on the increasing role of IT in healthcare

sector.3 It is because of this that the dynamics of the entire

healthcare industry are increasingly becoming IT driven.

The IT market in healthcare is estimated to be nearly USD 54

billion by 2014, witnessing a CAGR of 16.1 percent between

2009 and 2014.4 IT is getting interwoven in the industry in the

form of electronic medical records, electronic health records,

clinical trial management systems, clinical decision support

systems, data mining systems, hospital information systems,

e-prescribing systems, ambulatory care management

systems, patient management system, computerized

physician order entry system, and non clinical systems to

name a few.

Consumers are increasingly using web, connected devices

and innovative health information technologies for selfmonitoring, facilitate interactions and information exchange

with doctors, and support treatment adherence.

3 US Department of Health and Human Services, http://www.hhs.gov

4 Global Healthcare Information Technology (2009 - 2014), October

2009, Markets and Markets, Research and Markets

2013 KPMG, an Indian Registered Partnership and a member firm of the KPMG network of independent member firms affiliated with KPMG International Cooperative (KPMG International), a Swiss entity. All rights reserved.

28 | Six converging technology trends

Key components of healthcare industry

Customer

touch points

Patient on-boarding

Treatment & Care

Billing

Insurance

Post-Discharge

Service

Past

Present

Past

Present

Past

Present

Past

Present

Past

Present

Physical location

Traditional media

Peer group

Home

Telephone

Web

Mobile

Call centre

Social media

Source: KPMG in India analysis

4 Very high

5 High

6 Medium

7 Low

0 Absent

Ease of access is the primary driver to healthcare. In this context, the use of mobile

technology is very well suited and hence role of mobility as a technology is paramount.

Given the high mobile penetration, it serves as a convenient and acceptable method to

communicate with the patients.

Since accessibility is the primary driver, there is an innate need for agility and scalability

in IT systems to expand the reach of healthcare. The Cloud is an obvious choice but

concerns around security particularly in the context of healthcare privacy standards have

inhibited the large scale adoption of Cloud until now. Going forward, as the industry

works towards addressing this challenge, sector would witness wider adoption of cloud.

In addition to this, it also must be considered that no technology can deliver

effectiveness in isolation. All these disruptive technologies are complementary and

when used in the right mix they are bound to bring in efficiency and effectiveness in the

delivery of healthcare services. It is also an expectation that the convergence would

reduce the cost and help healthcare firms in reaching out to their target audience.

Arvind Sivaramakrishnan

CIO, Apollo Hospitals Enterprise Ltd.

2013 KPMG, an Indian Registered Partnership and a member firm of the KPMG network of independent member firms affiliated with KPMG International Cooperative (KPMG International), a Swiss entity. All rights reserved.

Six converging technology trends | 29

Enabling technology transformations

IT is playing a critical role in changing the face and fate of

the modern healthcare sector. Technology trends such as

mobility, cloud, augmented reality, social media, etc. are

making significant strides and are propelling the sector for

incremental growth.

Big data

While the healthcare sector is poised for growth, at the

same time, it is plagued with challenges. The primitive

state of healthcare, especially in developing economies,

can still be associated with paper prescription and manual

health records. This brings in a challenge of managing large

amount of unstructured data coming from various sources.

In more developed economies, because of the emergence

of electronic health records (EHRs) and patient care devices,

patient data is getting digitalized leading to data deluge. In

addition, healthcare costs are rising in countries such as

US, where healthcare providers suffer the constant financial

strain of providing treatments that are often not paid for or

paid for only in part. Insurance industry is also facing a similar

challenge, wherein, finding genuine claims and compensating

providers for high-cost treatments is becoming increasingly

challenging. It is because of all this that the healthcare sector

is witnessing a three-pronged data challenge in terms of

volume (large quantities of data), variety (structure and

unstructured), and velocity (rate of data generation). This

induces a need for big data analytics platforms to get useful

intelligence from tens of thousands of patient records.

For example, a number of US largest integrated delivery

networks such as Cleveland Clinic, MedStar, University

Hospitals, St. Joseph Health System, Catholic Health

Partners and Summa Health System use the big data

platform for real-time exploration, performance and predictive

analytics of clinical data.5

IBM recently launched big data software

called Patient Care and Insights, an

application that processes health records

from hospitals, physicians and insurers and

then models outcomes and treatments.

It also automates workflow and paper

processes.

Source: IBM eyes vertical applications for big data, October 2012, ZDnet

5 Big Data The Next Big Thing, September 2012, NASSCOM

2013 KPMG, an Indian Registered Partnership and a member firm of the KPMG network of independent member firms affiliated with KPMG International Cooperative (KPMG International), a Swiss entity. All rights reserved.

30 | Six converging technology trends

Cloud

Despite skepticism due to compliance with regulations

such as HIPAA, the healthcare sector is now witnessing

the increased adoption of cloud computing.6 Offering

benefits such as lowered costs and reduced clerical effort

of maintaining data, cloud computing makes it possible for

healthcare organizations to access and retrieve information

stored in scattered systems in real time. Thus, personnel can

focus increasingly on critical matters cost-effectively and

efficiently.

Therefore, solutions such as electronic medical records

(EMR), telemedicine, patient management, and medical

imaging are gradually shifting to cloud. These cloud services

can now also be integrated with special medical hardware

(embedded systems) for remote patient monitoring.7

Due to benefits like these, cloud market is poised for growth.

Healthcare spending on cloud is nearly USD 1.8 billion as

of 2011, despite market penetration of merely 4 percent,

indicating immense potential for growth.8

Rural healthcare provider Carroll County

Memorial Hospital (CCMH) in Kentucky

selected iSALUS Healthcares cloud-based

solution OfficeEMR as it begins its Electronic

Health Records (EHR) transition.

Source: Kentucky rural healthcare provider uses cloudbased EHR, October 2012, EHR Intelligence

http://www.marksandspencer.com/

Healthcare Magic, started in 2008, is a healthcare

portal which helps patients find doctors by specialty

in India, the UK and the US. The portal provides

information on diseases and conditions and facilitates

online communication between patients and doctors.

It gets funding from sponsorships and advertisements

and also sells different membership plans to patients

for interaction with doctors.

Source: Increasing Importance of Social Media in Healthcare, Issues

Monitor, October 2011, KPMG International

A May 2011 Pew Research Centers Internet

study showed that, of 3,001 US adults

surveyed, approximately 80 percent of

the internet users use online media for

healthcare information. The same study

also revealed that 15 percent of US adults

use their cell phone to access healthcare

information.

An online survey conducted by Max Bupa

Health Insurance in 2010 revealed that of

1,004 Indians surveyed, 39 percent use the

internet for general healthcare information.

Source: Increasing importance of social media in

healthcare, October 2011, KPMG

Social media

Mobility

Social media tools are gaining popularity, serving as an easy

and cost-effective solution for both healthcare providers

and patients. The internet, which was once a source of

one-way communication only, has transformed into one

that facilitates two-way interaction and information sharing.

Healthcare providers can now monitor their patients in a

virtual environment, thus giving impetus to remote patient

care and monitoring. It also transforms the patient-doctor

communication from one-to-one to one-to-many; wherein,

doctors reach out to a number of online users using the

internet.

Increasing integration of mobility with healthcare is giving

rise to mHealth. From a physicians perspective, a physician

no longer has to rely solely on bedside terminal to retrieve

patient health or medical information, while from a patients

perspective; a patient can seek medical advice more often

and have flexibility in terms of point of care. mHealth can be