DC 1

DC 1

Uploaded by

hemanggorCopyright:

Available Formats

DC 1

DC 1

Uploaded by

hemanggorOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Copyright:

Available Formats

DC 1

DC 1

Uploaded by

hemanggorCopyright:

Available Formats

INTERNATIONAL

Asian shares tumbled on Wednesday as oil prices dropped for a third day, prompting investors to seek shelter in

safe-haven assets and lifting bonds and gold to multi-month highs. U.S. stocks closed sharply lower Tuesday as

renewed declines in oil prices weighed amid mixed reaction to some key earnings reports. U.S. oil

futures extended losses after data from the American Petroleum Institute showed a 3.8 million

inventory build. The front-month contract for West Texas Intermediate (WTI) fell to $29.63 after it

settled at $29.88 a barrel, down 5.5 percent, or $1.74.Brent for April delivery dropped $1.79, or 5.23

percent, to $32.43 a barrel, after touching a low of $32.23, down 5.9 percent, in the session. Hopes for an

agreement to cut production dimmed this week as no deal has emerged and talks between Russia's energy

minister and Venezuela's oil minister on Monday failed to result in any clear plan to reduce output. European

markets tumbled to close sharply lower on Tuesday, as concerns over oil prices haunted traders and investors

worldwide. Gold trimmed its gains Tuesday afternoon after touching three-month highs in the morning,

underpinned by global growth concerns and as another sharp drop in the oil price pushed investors towards safehaven assets. Spot gold touched $1,131.40 an ounce early on Tuesday, its strongest since Nov. 3.

National

Nifty - ended lower on Tuesday on account of sustained selling by fund and retail investors amid weak global cues.

Sentiment was under pressure after the Reserve Bank of India (RBI) has kept its key policy rates unchanged, opting

to wait for the governments annual budget statement at the end of February for further easing. Meanwhile,

Moodys Investors Services report that RBIs target to bring down retail inflation at 5 per cent by March 2017 will

face some risks from monsoon uncertainty and execution of 7th Pay Panel recommendations, while macroeconomic factors will be critical for sustaining growth. Besides, depreciation in Indian rupee too dampened the

sentiments. The rupee depreciated by 12 paise to trade at 67.96 against the US dollar at the time of equity markets

closing. Back home, after getting a flat-to-positive opening , benchmark were alternating between positive and

negative territory for the most part of day, but sharp selling was witnessed in the last leg of hour that dragged the

market intraday low, and Nifty ended with loss of over 100 points.

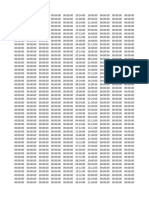

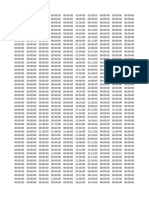

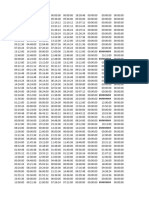

Nifty was down by 100.40 points or 1.33% to settle at 7,455.55. Nifty February 2016 futures closed 7474.95 on

Tuesday at a premium of 19.40 points over spot closing of 7,455.55, while Nifty March 2016 futures ended at

7490.35 at a premium of 34.80 points over spot closing. Nifty February futures saw contraction of 0.73 million (mn)

units, taking the total outstanding open interest (OI) to 19.33 million (mn) units.

The top gainers from the F&O segment were United Breweries, Just Dial and Oracle Financial Services Software. On

the other hand, the top losers were Vedanta, Tata Steel and Steel Authority of India. In the index options segment,

maximum OI was being seen in the 7500-8000 calls and 7000-7500 puts. Among Nifty calls, 7600 SP from the

February month expiry was the most active call with an addition of 0.27 million open interests. Among Nifty puts,

7500 SP from the February month expiry was the most active put with a contraction of 0.12 million open interests.

The maximum OI outstanding for Calls was at 7600 SP (4.23 mn) and that for Puts was at 7400 SP (4.24 mn). In

today's session, while the traders preferred to exit 7400 put, heavy buildup was seen in the 7200 put. On the other

hand, traders exited from 7400 Call, while 7900 call witnessed considerable OI addition. Nifty Put Call Ratio (PCR)

finally stood at 0.99 for February month contract.

You might also like

- 1701 Bir FormDocument12 pages1701 Bir Formbertlaxina0% (1)

- OMWealth OldMutualWealthLifeWrappedInvestmentDocument2 pagesOMWealth OldMutualWealthLifeWrappedInvestmentJohn Smith100% (1)

- Suggested Chapters and Parts of A Feasibility StudyDocument4 pagesSuggested Chapters and Parts of A Feasibility StudyRofela Hrtlls75% (4)

- Ducati Valuation - LPDocument11 pagesDucati Valuation - LPuygh gNo ratings yet

- Infosys Limited - Letter of Offer PDFDocument70 pagesInfosys Limited - Letter of Offer PDFAvinash PatraNo ratings yet

- BUS5111 Written Assignment Unit 3Document7 pagesBUS5111 Written Assignment Unit 3DaveNo ratings yet

- DatacfDocument2 pagesDatacfhemanggorNo ratings yet

- Treasury Daily 01 14 16Document5 pagesTreasury Daily 01 14 16patrick-lee ellaNo ratings yet

- Equity Research Lab: Derivative Report 19Th FebDocument9 pagesEquity Research Lab: Derivative Report 19Th FebAru MehraNo ratings yet

- Dipak STK MKTDocument9 pagesDipak STK MKTdipak_pandey_007No ratings yet

- Treasury Daily 01 13 16Document4 pagesTreasury Daily 01 13 16patrick-lee ellaNo ratings yet

- Daily Metals and Energy Report, May 24 2013Document6 pagesDaily Metals and Energy Report, May 24 2013Angel BrokingNo ratings yet

- Treasury Daily 01 15 16Document5 pagesTreasury Daily 01 15 16patrick-lee ellaNo ratings yet

- Daily Metals and Energy Report July 25 2013Document6 pagesDaily Metals and Energy Report July 25 2013Angel BrokingNo ratings yet

- Daily Metals and Energy Report, February 20Document6 pagesDaily Metals and Energy Report, February 20Angel BrokingNo ratings yet

- Treasury Daily 01 18 16Document4 pagesTreasury Daily 01 18 16patrick-lee ellaNo ratings yet

- Daily Metals and Energy Report December 6Document6 pagesDaily Metals and Energy Report December 6Angel BrokingNo ratings yet

- Treasury Daily 01 28 16Document5 pagesTreasury Daily 01 28 16patrick-lee ellaNo ratings yet

- Daily Metals and Energy Report, June 26 2013Document6 pagesDaily Metals and Energy Report, June 26 2013Angel BrokingNo ratings yet

- World Exchange Rates: Currency Report 29th July 2013Document2 pagesWorld Exchange Rates: Currency Report 29th July 2013nishantjain95No ratings yet

- Daily Metal and Energy Report, 24 January 2013Document6 pagesDaily Metal and Energy Report, 24 January 2013Angel BrokingNo ratings yet

- Daily Metals and Energy Report November 9Document6 pagesDaily Metals and Energy Report November 9Angel BrokingNo ratings yet

- Daily Equity ReportDocument5 pagesDaily Equity ReportJijoy PillaiNo ratings yet

- Morning NewsDocument4 pagesMorning NewsRam SanyalNo ratings yet

- Treasury Daily 01 29 16Document5 pagesTreasury Daily 01 29 16patrick-lee ellaNo ratings yet

- Daily Metals and Energy Report December 03Document6 pagesDaily Metals and Energy Report December 03Angel BrokingNo ratings yet

- Daily Metals and Energy Report, May 31 2013Document6 pagesDaily Metals and Energy Report, May 31 2013Angel BrokingNo ratings yet

- Dates and CommentryDocument12 pagesDates and CommentryprinceasatiNo ratings yet

- Daily Metals and Energy Report, June 18 2013Document6 pagesDaily Metals and Energy Report, June 18 2013Angel BrokingNo ratings yet

- Daily Metals and Energy Report, July 30 2013Document6 pagesDaily Metals and Energy Report, July 30 2013Angel BrokingNo ratings yet

- Commodity Weekly Technical Report 06 Jan To 10 Jan.Document6 pagesCommodity Weekly Technical Report 06 Jan To 10 Jan.Sunil MalviyaNo ratings yet

- Daily Metals and Energy Report, July 10 2013Document6 pagesDaily Metals and Energy Report, July 10 2013Angel BrokingNo ratings yet

- Daily Metals and Energy Report, July 1 2013Document6 pagesDaily Metals and Energy Report, July 1 2013Angel BrokingNo ratings yet

- Daily Metals and Energy Report, April 03Document6 pagesDaily Metals and Energy Report, April 03Angel BrokingNo ratings yet

- Daily Metals and Energy Report, June 17 2013Document6 pagesDaily Metals and Energy Report, June 17 2013Angel BrokingNo ratings yet

- Daily Metals and Energy Report, April 22Document6 pagesDaily Metals and Energy Report, April 22Angel BrokingNo ratings yet

- Daily Metals and Energy Report December 7Document6 pagesDaily Metals and Energy Report December 7Angel BrokingNo ratings yet

- Fear of Hard Brexit' Led Sterling Below Thirty Year LevelDocument4 pagesFear of Hard Brexit' Led Sterling Below Thirty Year LevelDynamic LevelsNo ratings yet

- Daily Metals and Energy Report September 5 2013Document6 pagesDaily Metals and Energy Report September 5 2013Angel BrokingNo ratings yet

- Daily Metals and Energy Report November 29Document6 pagesDaily Metals and Energy Report November 29Angel BrokingNo ratings yet

- Treasury Daily 01 20 16Document4 pagesTreasury Daily 01 20 16patrick-lee ellaNo ratings yet

- Content: Precious Metals Energy Base Metals Important Events For TodayDocument6 pagesContent: Precious Metals Energy Base Metals Important Events For Todayvisheh_mba3No ratings yet

- Daily Metals and Energy Report, February 14Document6 pagesDaily Metals and Energy Report, February 14Angel BrokingNo ratings yet

- Daily Metals and Energy Report, May 17 2013Document6 pagesDaily Metals and Energy Report, May 17 2013Angel BrokingNo ratings yet

- Daily Metals and Energy Report, June 21 2013Document6 pagesDaily Metals and Energy Report, June 21 2013Angel BrokingNo ratings yet

- Daily Metals and Energy Report November 14Document6 pagesDaily Metals and Energy Report November 14Angel BrokingNo ratings yet

- Daily Metals and Energy Report, March 12Document6 pagesDaily Metals and Energy Report, March 12Angel BrokingNo ratings yet

- Equity Research Lab 23RD May Derivative ReportDocument9 pagesEquity Research Lab 23RD May Derivative ReportAru MehraNo ratings yet

- Daily Metals and Energy Report, July 24 2013Document6 pagesDaily Metals and Energy Report, July 24 2013Angel BrokingNo ratings yet

- Weekly Mutual Fund and Debt Report: Retail ResearchDocument14 pagesWeekly Mutual Fund and Debt Report: Retail ResearchGauriGanNo ratings yet

- Daily Metals and Energy Report, April 30Document6 pagesDaily Metals and Energy Report, April 30Angel BrokingNo ratings yet

- Daily Metals and Energy Report, February 07 2013Document6 pagesDaily Metals and Energy Report, February 07 2013Angel BrokingNo ratings yet

- Daily Metals and Energy Report October 11Document6 pagesDaily Metals and Energy Report October 11Angel BrokingNo ratings yet

- Daily Metals and Energy Report December 13Document6 pagesDaily Metals and Energy Report December 13Angel BrokingNo ratings yet

- Daily Metals and Energy Report, August 7 2013Document6 pagesDaily Metals and Energy Report, August 7 2013Angel BrokingNo ratings yet

- Daily Metals and Energy Report, February 15Document6 pagesDaily Metals and Energy Report, February 15Angel BrokingNo ratings yet

- Daily Metals and Energy Report, August 21 2013Document6 pagesDaily Metals and Energy Report, August 21 2013Angel BrokingNo ratings yet

- Daily Metals and Energy Report, May 14 2013Document6 pagesDaily Metals and Energy Report, May 14 2013Angel BrokingNo ratings yet

- Daily Metals and Energy Report, July 9 2013Document6 pagesDaily Metals and Energy Report, July 9 2013Angel BrokingNo ratings yet

- RupeeDocument2 pagesRupeeprakhar shrivastavaNo ratings yet

- Daily Metals and Energy Report, July 17 2013Document6 pagesDaily Metals and Energy Report, July 17 2013Angel BrokingNo ratings yet

- Daily Metals and Energy Report, February 21Document6 pagesDaily Metals and Energy Report, February 21Angel BrokingNo ratings yet

- Bond Report Final Week 6Document2 pagesBond Report Final Week 6api-278033882No ratings yet

- Daily Metals and Energy Report November 19Document6 pagesDaily Metals and Energy Report November 19Angel BrokingNo ratings yet

- Real-Time Risk: What Investors Should Know About FinTech, High-Frequency Trading, and Flash CrashesFrom EverandReal-Time Risk: What Investors Should Know About FinTech, High-Frequency Trading, and Flash CrashesNo ratings yet

- Data Imp - 4Document101 pagesData Imp - 4hemanggorNo ratings yet

- T5Document70 pagesT5hemanggorNo ratings yet

- Data Imp - 5Document58 pagesData Imp - 5hemanggorNo ratings yet

- Data Imp - 1Document52 pagesData Imp - 1hemanggorNo ratings yet

- Data 1Document18 pagesData 1hemanggorNo ratings yet

- D F4Document37 pagesD F4hemanggorNo ratings yet

- PittiEngineering IC 01122023Document20 pagesPittiEngineering IC 01122023hemanggorNo ratings yet

- Taron Date 6Document112 pagesTaron Date 6hemanggorNo ratings yet

- Taron Date 4Document101 pagesTaron Date 4hemanggorNo ratings yet

- S.E.C. Form No. F-100Document2 pagesS.E.C. Form No. F-100RegieReyAgustinNo ratings yet

- Drill Business CombinationDocument4 pagesDrill Business CombinationPrankyJellyNo ratings yet

- Cash Management 11012018Document41 pagesCash Management 11012018narunsankarNo ratings yet

- ch03 Part7Document6 pagesch03 Part7Sergio HoffmanNo ratings yet

- An Is Perspective of Mergers and AcquisitionsDocument54 pagesAn Is Perspective of Mergers and AcquisitionsSonia BenitoNo ratings yet

- Dipifr Int 2010 Dec A PDFDocument11 pagesDipifr Int 2010 Dec A PDFPiyal Hossain100% (1)

- Intermediate Accounting II Chapter 17Document2 pagesIntermediate Accounting II Chapter 17izza zahratunnisaNo ratings yet

- Fatawa Islamic BanksDocument37 pagesFatawa Islamic BanksISLAMIC LIBRARYNo ratings yet

- Accounting For Income Tax-NotesDocument4 pagesAccounting For Income Tax-NotesMaureen Derial PantaNo ratings yet

- Leadership in Megaprojects and Production Management Lessons From The T5 Project CID Report No1Document19 pagesLeadership in Megaprojects and Production Management Lessons From The T5 Project CID Report No1LTE002No ratings yet

- Hotel Management Examen Final ApuntesDocument44 pagesHotel Management Examen Final ApuntesStanton Paola100% (1)

- Build Build Build ProgramDocument2 pagesBuild Build Build Programlanz kristoff rachoNo ratings yet

- Clinton 4Document531 pagesClinton 4MagaNWNo ratings yet

- Audit of ErrorsDocument27 pagesAudit of ErrorsGladys Dumag67% (3)

- AccountDocument274 pagesAccountGurvinder SinghNo ratings yet

- Planning & Development: The Nature of LondonDocument2 pagesPlanning & Development: The Nature of Londonapi-224336109No ratings yet

- Uos Outline Finc3017 Sem2 2014Document5 pagesUos Outline Finc3017 Sem2 2014suseeexNo ratings yet

- Module 6 - LiabilitiesDocument11 pagesModule 6 - LiabilitiesLuiNo ratings yet

- Saraswat Bank V/s Southindian Cooperative BankDocument24 pagesSaraswat Bank V/s Southindian Cooperative BankBhavana SaripalliNo ratings yet

- Koito Case Questions 2,3,4Document2 pagesKoito Case Questions 2,3,4Simo RajyNo ratings yet

- CMO Marketing Communications VP in New York Resume Jean WiskowskiDocument3 pagesCMO Marketing Communications VP in New York Resume Jean WiskowskiJeanWiskowskiNo ratings yet

- What Are They? How Do They Differ From "Traditional" Investments?Document3 pagesWhat Are They? How Do They Differ From "Traditional" Investments?api-118535366No ratings yet

- Jfe 5 6 1 PDFDocument6 pagesJfe 5 6 1 PDFThejo JoseNo ratings yet

- On InflationDocument35 pagesOn InflationManoj ChahalNo ratings yet