2015 04 Platou Monthly Vessel

2015 04 Platou Monthly Vessel

Uploaded by

ifebrianCopyright:

Available Formats

2015 04 Platou Monthly Vessel

2015 04 Platou Monthly Vessel

Uploaded by

ifebrianCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Copyright:

Available Formats

2015 04 Platou Monthly Vessel

2015 04 Platou Monthly Vessel

Uploaded by

ifebrianCopyright:

Available Formats

RSPlatouMonthly

April2015

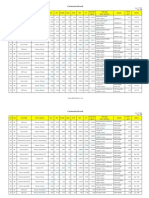

Supply,demandandutilizationrate,tankerfleet(10,000dwt+)

Analyticaltopicofthemonth:

500

140

450

130

400

120

Milldwt

150

350

110

300

100

250

90

200

80

150

70

05

06

07

08

Supply

09

10

11

Demand

12

13

14

15

Utilizationrate(%)

550

LNGshippingshould

reachacyclicalbottom

thissummer

Page2

Analysesandcomments.. 2

Worldeconomyandworldshipping .. 3

Utilizationrate

Newbuilding . 4

Supply,demandandutilizationrate,drybulkfleet(10,000dwt+)

140

Tankers|Freightmarket.. 5

700

130

Tankers|Saleandpurchase.. 6

600

120

500

110

400

100

300

90

200

80

100

05

06

07

08

Supply

RSPlatouEconomicResearchAS

Shipbroking|Oslo

09

10

Demand

11

12

13

14

Utilizationrate

Munkedamsveien62C

N0270Oslo,Norway

15

70

Bulkcarriers|Freightmarket 7

Utilizationrate(%)

Milldwt

800

Bulkcarriers|Saleandpurchase .. 8

Cellularcontainerships 9

LNGcarriers

10

Representativenewbuildingcontracts

11

Representativesecondhandsales.

12

Contactlist..

13

Tel.: +4723112000

Fax: +4723112300

ecr@platou.com

www.platou.com

RSPlatouMonthly

April2015

Analysesandcomments

LNGshippingshouldreachacyclicalbottomthissummer

TheLNGshippingmarketisinthemidstofacyclicaldownturn

causedbyanincreasinglyhigherfleetgrowthinparallelwitha

disappointinglowgrowthindemand.Asaresultshortterm

ratesformoderndualfuelledtonnagedroppedby$30,000per

dayinfirstquarterthisyearcomparedtoayearago.

Themostunexpecteddevelopmentintheshippingdemandhas

theseabornetradeofLNG,whichfellbyanestimated3

percentYoYduringthefirstquarterthisyear.Algeria,

Indonesia,PeruandQatarseemstohavereducedthe

productionlevelandcontributedtothesaiddropwhilethe

AngolanandEgyptianexportremainsshut.RecentlytheYemen

exporthasalsobeenhaltedduetosocialunrest.

OntheimportsidewehaveregisteredaslowdowninAsiaLNG

importsastheChineseeconomyislosingpace,Koreangas

demandishamperedbytherestartofnuclearpowerplants

andIndianLNGimportsarealsoreducedsofarthisyear.

ThishasledtoanincreasingshareoftheMiddleEasternLNG

productionsoldwestofSuez.InMarch,Qatarideliveriesto

Europedoubledyearonyearto2millionmt,thehighest

monthlyfigureonrecord.

TheEuropeangasmarkethastakenmoreofthesurplusLNG

andtheimportreached11millionmtintheperiodbetween

JanuaryandMarch,up23percentyearonyear.Marchsaw

particularlystrongimports,withover4millionmtlandedat

Europeanterminalsequaltoa32percentincreasefromthe

samemonthlastyear.

LowerAsianLNGimportscombinedwithnewproduction

capacityinOceaniathataresoldintoAsiahasledtoadropin

theinterbasintradeandthusreducedthetransportdistance

forLNGbyanestimated2percentduring1Q2015.

InsumtheshippingdemandforLNGcarriersin1Qthisyearhas

deterioratedbyanestimated4percentcomparedtoayear

ago.

Thefleetinfirstquarter2015hasgrownby9percentduring

thepastyearasanumberofnewbuildingshasenteredthe

marketandthusledtoan10percentfallintheutilizationrate

82percent.

However,goingforwardwedoexpectthemarketconditionsto

improve.Thereisanumberofnewproductionfacilitiessetto

startproductionthisyear.QueenslandLNG,an8.5millmt

Australianfacility,loadedthefirstcargoearlythisyearand

threeotherAustralianprojectsareexpectedtostartexporting

LNGduringthesecondhalfofthisyear;AustraliaLNG(4.5mill

mt),GladstoneLNG(7.8millmt)andGorgonLNG(5.2millmt).

Thereisalsoa2millmtLNGprojectinIndonesia,Donggi

SenoroLNG,comingonstreamlaterthisyear.Combinedthese

projectsshouldrisetheexportcapacityby16millmttoreach

300millmtthisyearandturnthenegativeyearonyeargrowth

seeninthefirstquartertoadoubledigitgrowthduringthelast

quarterofthisyear.

Transportdistanceisexpectedtocontinuetocontribute

negativelythroughouttheyearastherewillbeneedforless

AtlanticandMiddleEasternLNGinAsiaduetonewproduction

capacityinOceaniathataresoldonlongtermcontractsto

Asianbyuerswhichshouldresultinalowerinterbasintrade.

Wethusexpectshippingdemandtofallbyabout2percentYoY

inthesecondquarterthisyearbeforeturninginthethirdand

inthefourthquarterleaptowardsdoubledigitterritory.

Thefleetgrowthshouldbeatitshighestduringthefirsthalfof

thisyear;9to10percentYoY,anddropto7to8percent

duringthetwolastquartersoftheyearaccordingtothe

deliveryschedule.

Thebalanceshouldthusweakensomewhatfurtherduringthe

secondquarterinlinewiththenormalseasonalpattern.Inthe

thirdquartertheutilizationrateshouldstarttoincreaseas

demandgrowthisexpectedtoleapupwardscombinedwitha

somewhatweakergrowthinthefleet.

JrnBakkelund

RSPlatouEconomicResearch

RSPlatouEconomicResearchAS

Shipbroking|Oslo

RSPlatouMonthly

April2015

Worldeconomyandworldshipping

TheIMFofferedacautiouslyoptimisticviewoftheworldeconomyin

itsbiannualreview.The2015forecastwasleftunchangedat3.5%,a

slightimprovementonthe3.4%rateregisteredin2013and2014.The

2016forecastwasbumpedupby0.1%pointto3.8%,whichwould

representthebestperformancesince2011,ifcorrect.Developed

countriesareingeneralseenasdoingbetterandforecastswere

raisedformostEuropeancountriesaswellasJapan.Thefund

highlightedongoingheadwindsinemergingmarkets,however,an

importantchallengeforshipping.Dataoverthepastmonthconfirms

thefundsanalysisofthesituation.Europeanmacrofigureshave

surprisedontheupside.However,thishasbeencounteredbyamore

visibleslowdownintheUS,wheretheeconomyvirtuallystalledinQ1,

asthecutbacksinoilspendingandthestrengtheningoftheUSDhit

home.

WorldeconomyYoYchangein%

ForecastsforworldGDP,monthlyrevisionsYoYchangein%

GDPgrowth

US

Euroarea

China

Japan

India

World

Worldtrade

2014

2.4

0.9

7.4

0.1

7.2 (5.8)

3.3 (3.2)

3.4 (3.1)

Varioussources

2015

3.0 (3.2)

1.5 (1.4)

6.9 (7.1)

1.0 (1.1)

7.6 (6.7)

3.4

3.7 (3.8)

2016

2.8 (2.9)

1.8 (1.7)

6.8

1.7

8.0 (6.9)

3.8

4.7 (5.3)

()previousmonth,ifchanged

2014

4.3

4.4

84.4

2015F

5.2

4.5

84.9

3.75

3.50

3.25

3.00

2.75

Jan2014

WorldmerchantfleetYoYchangein%

Tonnagedemand

Fleetgrowth

Utilizationrate

4.00

2016F

5.1

4.6

85.3

Jul2014

2014

Jan2015

2015

2016

Seabornetrade YoYchangein%

40

MarketindicatorsYoYchangein%

Seabornetrade*

Oil

Drybulk

Oil

Oilconsumption

Crudeimports

World

US

China

US

China

Drybulk

Chinaimports

Total

Ironore

Steelproduction

China

US

Container

USimports

3Q/2014

2.2

2.9

Feb2015

1.1

2.1

11.9

15.1

10.6

Feb2015

8.7

7.4

3.4

7.9

Feb2015

5.7

30

4Q/2014

1.5

3.7

Mar2015

1.4

3.0

9.2

10.9

14.0

Mar2015

0.2

8.5

1.2

12.7

Mar2015

3.8

201502m

1.2

4.2

201503m

1.2

2.3

6.8

14.3

7.5

201503m

12.3

0.1

1.7

7.6

201503m

4.7

20

10

0

10

20

08

09

10

11

12

Drybulk

13

14

15

Oil

SteelpriceHRCBlackSea USD/ton

1200.0

1000.0

800.0

Commodityprices,endofmonth

Brentoilspot

HFOSingapore

Indianironore

Steamcoal

SteelHRCB.Sea

USD/bbl

USD/t

USD/t

USD/t

USD/t

Apr2014

109.0

588.0

109.5

72.8

513.0

Mar2015

53.3

308.5

53.5

58.4

385.0

Apr2015

63.8

365.0

58.5

58.6

350.0

600.0

400.0

200.0

0.0

2007 2008 2009 2010 2011 2012 2013 2014 2015

*Fordetailsonsourcesandmethods,visit www.platou.com/dnn_site/LinkClick.aspx?fileticket=CodSYdx5lSM%3d&tabid=536

RSPlatouEconomicResearchAS

Shipbroking|Oslo

RSPlatouMonthly

April2015

Newbuilding

deliveredthroughout2017.Inthecontainershipsector,Seaspan

extendedtheirorderof10,000TEUboxshipsatJiangsuNewYZJ

followingthedeclarationoftwooptions.Theshipsareduefor

deliveryinthefirsthalfof2017.Italsocametolightthisweekthat

ZhongfuShippingdeclaredoptionsfortwo2,100CEUPCTCsat

XiamenSB.Theshipsareduefordeliveryin2016and2017

respectively.

NewbuildingpricesinmillUSD

BuildingpricesfortankersMillUSD

Bulk*

Tank*

DAmicoannouncinganorderatHyundaiVinashinfor2x75,000

dwtLR1tankerswithdeliverydueinQ2andQ32017.DAmico

currentlyhavefour50,000dwtMRtankersandfour39,000dwt

Handysizetankersonorderattheshipyard.Inthedrysector,

TsuneishiCebuarereportedtohavetakenanorderfromanasyet

unconfirmedJapaneseshipownerforsixfirm38,300dwt

Handysizelogandbulkcarriers.Thevesselsarescheduledtobe

VLCC

Suezmax

Aframax

MRClean

Capesize

Kamsarmax

Ultramax(fromJan2013)

Dec2014

96/97

65

53/54

36

52

29

27

Mar2015

96/97

65

53/54

36

52

28

26

Apr2015

96/97

65

53/54

36/37

51

27

25

* TankersfromKoreanyards,bulkcarriersfromChineseyards

Tank*

Bulk*

89

27.7

VLCC

68

10.7

Suezmax

12.8

113

Aframax

489

20.1

Smaller

759

71.2

Total

289

57.5

Capesize

1.4

15

PostPanamax

26.5

Pan./Kamsarmax 329

34.1

Handy/Supramax 560

363

13.0

Handysize

1556 132.5

Total

150

125

100

75

50

25

0

Orderbookinno./milldwt

Total

175

Rest2015

20

7

33

200

260

109

5

146

258

174

692

6.2

1.0

3.8

8.0

19.0

20.9

0.5

11.6

15.7

6.2

54.9

2016

51

37

56

213

357

148

6

122

243

140

659

05

2017+

15.9 18 5.6

5.9 24 3.8

6.3 24 2.7

9.1 76 2.9

37.1 142 15.1

29.3 32 7.3

0.6

4 0.4

10.0 61 5.0

14.7 59 3.6

5.1 49 1.8

59.6 205 18.0

06

07

VLCC

08

09

10

Suezmax

11

12

13

Aframax

14

15

MRClean

BuildingpricesforbulkcarriersMillUSD

100

75

50

25

Bulk*

Tank*

Newordersinno./milldwt

VLCC

Suezmax

Aframax

Smaller

Total

Capesize

PostPanamax

Pan./Kamsarmax

Handy/Supramax

Handysize

Total

2014

27

8.5

39

6.2

29

3.2

204

7.3

299

25.1

138

28.4

2

0.2

122

9.7

362

21.8

185

6.8

809

66.9

2015YTD

12

3.7

15

2.4

14

1.6

14

1.0

55

8.7

3

0.7

0.2

2

6

0.5

29

1.7

40

1.4

80

4.5

Apr2015

0

0.0

2

0.3

6

0.7

2

0.2

10

1.2

0

0.0

0

0.0

0

0.0

0

0.0

6

0.2

6

0.2

0

05

06

07

08

Capesize

09

10

11

12

13

Kamsarmax/Panamax

14

Supramax

ExchangeratesLeft:CNY/USD|Right:JPY/USD

10

140

120

100

80

60

40

* Fortonnagedefinitions,visit www.platou.com/dnn_site/LinkClick.aspx?fileticket=CodSYdx5lSM%3d&tabid=536

05

RSPlatouEconomicResearchAS

Shipbroking|Oslo

15

06

07

08 09 10

CNY/USD

11

12 13

JPY/USD

14

15

RSPlatouMonthly

April2015

Tankers|Freightmarket

towardstheendoftheperiod.Suezmaxesandaframaxeswere

volatileatseasonallyverystronglevelsthroughthemonth.Thesurge

inEuropeanrefinerydemandinrecentmonthscontinuestosupport

bothsizeclasses.MRratesremainedresilientintheAtlantic,helped

byrenewedimportdemandontheUSEastCoast.LRratesweresofter

throughthemonth,notyetseeingmanypositiveeffectsofnew

refinerycapacitybeingbroughtonstreamintheMiddleEast.

Averagefreightratesin1,000USD/day

Weeklyspotratesforcrudecarriers#1,000USD/day

12mT/C

Spot

Aprilwasasteadymonthinthetankermarket,whichmustbe

consideredquiteremarkablegiventhismonthstrackrecordof

yieldinglowerrates.SeveralAsiarefineriesaredelayingnormal

maintenance,inresponsetofirmermargins.OPECproduction

remainednearatwoyearhighinresponse,ledbyajumpinIraq

exports.VLCCratesonthebenchmarkMEGAsiarouterosefromthe

WS50leveltothemidWS60sbeforesofteningsomewhat

VLCC

Suezmax

Aframax

LR2Clean

LR1Clean

MRClean

VLCC

Suezmax

Aframax

LR2Clean

LR1Clean

MRClean

2014YTD 2015YTD Mar2015 Apr2015

30.0

42.6

52.4

51.9

47.4

42.3

24.5

33.9

24.8

35.0

34.0

32.5

27.6

25.9

24.5

11.7

23.5

21.9

12.0

26.4

9.9

20.7

20.6

21.0

25.0

42.8

42.0

45.0

32.0

33.0

33.0

20.3

15.5

22.4

23.0

23.0

22.0

21.5

15.9

23.5

20.0

20.3

15.0

21.5

14.8

16.8

15.4

15.5

70

50

30

10

6Mar

20Mar

3Apr

VLCC

17Apr

Suezmax

Aframax

#

Forweeklyfreightrates,visit www.platou.com/dnn_site/EconomicResearch/WeeklyFreightRates.aspx

Worldwideaverages

Weeklyspotratesforcleancarriers#1,000USD/day

40

Tankerfleetdevelopmentinmilldwt*

VLCC

Suezmax

Aframax

Smaller

Totaltankerfleet

Deliveries Removals Fleetend

2015YTD 2015YTD Apr2015

1.6

0.5

195.6

1.1

0.0

77.5

1.6

100.3

0.2

1.9

0.6

111.2

6.2

1.3

484.6

YoY

in%

2.3

1.4

1.8

3.7

2.4

30

20

* Fortonnagedefinitions,visit www.platou.com/dnn_site/LinkClick.aspx?fileticket=CodSYdx5lSM%3d&tabid=536

10

6Mar

20Mar

Supply

Demand

Oilmarketinmillbpd

OECD

NonOECD

Worlddemand

MiddleEast

Africa

LatinAmerica

NorthAmerica

WesternEurope

Asia

FSU

Others

Worldsupply

Worldseaborneoiltrade

RSPlatouEconomicResearchAS

Shipbroking|Oslo

201403m 201503m YoYin%

45.9

0.3

45.7

47.9

2.1

46.9

93.7

1.2

92.6

23.4

1.5

23.7

7.4

7.4

0.5

7.2

7.4

2.9

18.1

19.6

8.2

3.5

3.5

0.8

7.7

7.7

0.1

14.0

14.0

0.1

11.2

2.1

11.0

92.2

94.5

2.5

2015F

2013

2014E

44.6

44.7

45.8

3Apr

MRClean

17Apr

LR1

LR2

#

Worldwideaverages

MiddleEastoilproduction(monthly)Millbpd

25

24

23

22

21

20

19

05

06

07

08

09

10

11

12

13

14

15

RSPlatouMonthly

April2015

Tankers|Saleandpurchase

Withchartermarketscontinuingtoholdfirmandseveraltanker

ownerspostingpositivequarterlyresults,theoptimism

experiencedthroughoutthepastfewmonthsisnowfirmly

establishedinthetankersector.EuronavannouncedQ1profitsof

$80.9m,comparedto$1.4minQ12014.ScorpioTankersalso

reportedalargeincreaseinQ1profitsyoy,upto$39.3mfrom

$1.9minQ12014

EstimatedvaluesinmillUSD

Secondhandvalues,5yearsoldMillUSD

310,000dwtresale

305,000dwt5years

300,000dwt10years

160,000dwtresale

160,000dwt5years

160,000dwt10years

115,000dwtresale

105,000dwt5years

105,000dwt10years

C75,000dwtresale

C75,000dwt5years

C50,000dwtresale

C47,000dwt5years

C47,000dwt10years

C37,000dwt5years

Apr2014 Feb2015 Mar2015 Apr2015

105.0

105.0

105.0

105.0

75.0

81.0

81.0

81.0

52.0

52.0

52.0

48.0

70.0

70.0

65.0

71.0

50.0

59.0

57.5

59.0

41.0

41.0

40.0

35.0

56.0

56.0

56.0

54.0

45.0

45.0

39.0

45.0

30.0

30.0

25.0

30.0

44.0

46.0

46.0

45.0

36.0

34.0

32.5

36.0

37.0

37.0

37.0

37.0

28.0

27.0

27.0

27.0

18.0

17.5

18.0

18.0

24.0

24.0

23.0

24.0

175

150

125

100

75

50

25

0

05

06

07

08

09

VLCC

10

11

12

Suezmax

13

14

15

Aframax

Secondhandvaluesforcleancarriers,40/45,000dwtMillUSD

60

BalticSale&PurchaseAssessmentsinmillUSD

AverageBalticpanelassessments

VLCC5yearsold305,000dwt

Aframax5yearsold105,000dwt

MRProd.5yearsold51,000dwt

13Apr

79.1

43.6

26.3

50

27Apr

79.0

43.6

26.3

40

30

20

10

DemolitionpricesinUSD/ldt

FarEast

Subcontinent*

* India/Bangladesh/Pakistan

Apr2014 Feb2015 Mar2015 Apr2015

n.a.

n.a.

325

n.a.

475

375

375

380

0

05

06

07

08

09

10

11

10yearsDH

12

13

14

15

5years

5yearssecondhandvaluesinpercentofnewbuildingprices

Soldforscrappingandotherremovals*inno./milldwt

2014YTD

4

1.2

2

0.3

11

1.0

10

0.3

27

2.8

0.5

14

41

3.4

VLCCdoublehull

Suezmaxdoublehull

Aframaxdoublehull

Smallerdoublehull

Totaldoublehull

Singlehull

Total

* Includingtotalloss/conversion/reclass

2015YTD

0

0.0

0

0.0

0.1

1

6

0.3

7

0.4

11

0.9

18

1.3

Apr2015

0

0.0

0.0

0

1

0.1

0

0.0

1

0.1

1

0.0

2

0.1

120

110

100

90

80

70

60

50

Fortonnagedefinitions,visit www.platou.com/dnn_site/LinkClick.aspx?fileticket=CodSYdx5lSM%3d&tabid=536

05

06

07

08

VLCC

RSPlatouEconomicResearchAS

Shipbroking|Oslo

09

10

11

Suezmax

12

13

14

15

Aframax

RSPlatouMonthly

April2015

Bulkcarriers|Freightmarket

lowerthaninthecomparableperiodlastyear.Steelimportsto

theUSdroppedmoderately,whilefertilizershipmentstoBrazil

continuedtoescalate.GrainexportfromSouthAmericaincreased

steadily,butamplesupplyofspottonnageresultedinonly

marginallyhigherfreightrates.

Averagefreightratesin1,000USD/day

Weeklyspotrates1,000USD/day

12mT/C

Spot

OnlyminorchangeswerenoticedinDryBulkearningsoverthe

lastmonth.Chineseimportsofironoreandminorbulk

commoditiesrecoveredsignificantlyfromverylowlevelsin

February,androsemorethan8percentcomparedwiththesame

monthlastyear.Coalimports,however,wasonlymarginally

higherthaninthepreviousmonthand33percent

Capesize

Panamax

Supramax

Handysize

Capesize

Panamax

Supramax

Handysize

2014YTD 2015YTD Mar2015 Apr2015

17.3

5.3

4.3

4.4

9.6

4.8

5.0

4.9

6.5

6.4

11.2

6.5

5.5

5.5

9.6

5.3

23.7

9.9

10.0

8.5

7.0

13.8

7.2

7.2

12.6

7.8

7.7

7.7

6.8

6.5

9.4

6.8

8

7

6

5

4

3

2

Forweeklyfreightrates,visit www.platou.com/dnn_site/EconomicResearch/WeeklyFreightRates.aspx

6Mar

20Mar

Capesize

Drybulkfleetdevelopmentinmilldwt

Deliveries* Removals Fleetend

2015YTD 2015YTD Apr2015

8.7

292.9

6.6

Capesize

51.1

PostPanamax

0.9

0.2

2.3

3.3

155.0

Panamax/Kamsarmax

Handymax/Supramax

5.9

1.1

165.6

Handysize

2.3

87.9

2.2

18.9

Totaldrybulkfleet

14.6

752.6

* Includingconversions

YoY

in%

2.1

3.8

2.2

5.9

0.5

2.9

3Apr

Panamax

17Apr

Supramax

Handysize

12monthsT/Crates1,000USD/day

175

150

125

100

75

50

Industrialproduction,YoYin%

USA

Euroarea

Japan

China

OtherAsia

25

2014

4.3

0.8

2.1

8.3

2.1

2015F

3.1

1.6

2.3

7.6

3.7

2016F

3.1

2.4

3.0

7.5

4.6

0

05

06

07

Capesize

08

09

10

Panamax

11

12

13

14

Supramax

15

Handysize

ChinesedrybulkimportsMilltons/month

100

Steelproductioninmilltons

USA

Japan

EU27

China

OtherAsia

Totalworld

201403m 201503m YoYin%

21.6

20.0

7.6

27.6

26.7

3.0

44.0

46.7

6.2

200.1

203.5

1.7

44.1

45.2

2.5

407.4

400.0

1.8

80

60

40

20

0

RSPlatouEconomicResearchAS

Shipbroking|Oslo

05

06

07

08 09

Ironore

10

11 12

Coal

13 14

Others

15

RSPlatouMonthly

April2015

Bulkcarriers|Saleandpurchase

DianaShippingannouncedthepurchaseofaCapesizeresale,

(180,000dwt,built2015,ShanghaiWaigaoqiao)fromclientsof

ScorpioBulkersfor$43m,duefordeliveryinAugustthisyear.This

followsScorpioBulkersrecentsalesoffourCapesizenewbuildings;

threefromDaewooMangaliascheduledfordeliveryin2015/16and

onefromSungdongduetodeliverin2016.Otherpublic

announcementsincludethatofGoldenOceanGroupLimitedwho,in

additiontoothertransactions,havesoldfourCapesize

newbuildingresalesfromunnamedChineseyards.Further

informationhasnotbeenforthcomingbutitisthoughtthataKorean

buyerisbehindthepurchases.GoldenOceanhasalsoagreedthesale

andcharterbackofeightCapesizebulkersfromtheiraffiliated

company,ShipFinanceInternationalLtd.Thepricewas$272mwith

timechartersbackfor10yearsatratesof$17,600forthefirst7years

and$14,900fortheremainder;thereisalsoaprofitsplitabovethese

baserates.

EstimatedvaluesinmillUSD

Secondhandvalues,5yearsoldMillUSD

180,000dwtresale

172,000dwt5years

170,000dwt10years

82,000dwtresale

74,000dwt5years

72,000dwt10years

60,000dwtresale

56,000dwt5years

50,000dwt10years

34,000dwtresale

32,000dwt5years

28,000dwt10years

Apr2014 Feb2015 Mar2015 Apr2015

48.0

63.0

48.0

49.0

52.0

34.0

33.0

34.0

21.0

40.0

22.0

22.0

28.5

28.5

36.0

28.5

16.5

29.5

17.0

17.5

13.0

22.5

13.0

13.0

27.5

27.5

28.0

34.0

16.0

27.0

16.5

16.0

11.0

11.5

11.0

22.0

21.5

26.0

22.5

21.5

21.0

13.5

14.5

13.5

9.5

16.0

10.0

9.5

BalticSale&PurchaseAssessmentsinmillUSD

AverageBalticpanelassessments

Capesize5yearsold172,000dwt

Panamax5yearsold74,000dwt

SuperHandy5yearsold56,000dwt

13Apr

31.6

16.6

16.3

120

80

40

0

05

06

Apr2014 Feb2015 Mar2015 Apr2015

n.a.

n.a.

n.a.

310

445

375

385

360

09

10

11

12

Panamax

13

14

15

Handymax

150

100

50

0

05

2015YTD

2014YTD

10

8.7

1.6 52

0

2

0.0

0.2

9

0.6 33

2.3

24

1.2 25

1.1

1.1 70

40

2.2

83

4.6 182

14.6

08

Capesize

06

07

08

09

Capesize

Soldforscrappinginno./milldwt

Capesize

PostPanamax

Panamax/Kamsarmax

Handymax/Supramax

Handysize

Total

07

Secondhandvalues,10yearsoldMillUSD

27Apr

31.2

16.7

16.2

DemolitionpricesinUSD/ldt

FarEast

Subcontinent*

* India/Bangladesh/Pakistan

160

Apr2015

21

3.7

0

0.0

12

0.9

0.1

3

18

0.6

54

5.2

10

11

12

Panamax

13

14

15

Handymax

5yearssecondhandvaluesinpercentofnewbuildingprices

200

175

150

125

100

75

50

05

06

07

08

Capesize

RSPlatouEconomicResearchAS

Shipbroking|Oslo

09

10

11

Panamax

12

13

14

15

Handymax

RSPlatouMonthly

April2015

Cellularcontainerships

Boxratescontinuedtodropinmosttradelanesoverthelast

month.Acontinuedinflowofnewcapacitydeliveredfromyards

combinedwithlimitedscrappingactivityresultedinhigherfleet

growththandemandincrease.PortstatisticssuggestsEuropean

boxvolumesroselessthan5percent,whileUScontainerimports

fromAsiaclimbed3percentandfromEuropeby7percent.

Intheemergingtrades,boxvolumesincreasedfurther,buta

somewhatslowerpacetoAfricaandSouthAmericathaninrecent

months.

Inthechartermarket,acoupleoffixtureswerenoticedat

generallyunchangedratescomparedwithonemonthago.

Averagecharterratesin1,000USD/day

12monthT/Crates1,000USD/day

2014YTD 2015YTD Mar2015 Apr2015

6.0

6.9

6.8

7.5

8.0

7.4

9.3

8.0

12.7

14.8

14.8

7.9

14.7

17.1

18.0

18.0

1,000TEU

1,700TEU

4,500TEU

5.600TEU

60

50

40

30

20

ContainerfleetdevelopmentinmillTEU

Below1,000TEU

1,0001,999TEU

2,0003,999TEU

4,0005,999TEU

6,0007,999TEU

8,0009,999TEU

10,000+TEU

Totalcontainerfleet

Deliveries Removals Fleetend

2015YTD 2015YTD Apr2015

0.60

0.00

0.01

0.01

0.02

1.73

2.53

0.03

0.03

0.02

4.56

0.03

0.01

0.00

1.87

0.00

3.64

0.15

0.00

0.29

3.69

18.62

0.07

0.53

YoY

in%

3.4

0.0

0.8

1.4

1.5

11.1

28.2

7.0

10

0

05

06

07

08

09

5,600TEU

10

11

4,500TEU

12

13

1,700TEU

14

15

1,000TEU

BuildingpricesMillUSD

120

100

80

Orderbookinno./millTEU

TEU

Below1,000

1,0001,999

2,0003,999

4,0005,999

6,0007,999

8,0009,999

10,000+

Total

Total

0 0.00

81 0.12

95 0.25

9 0.04

2 0.01

82 0.75

151 2.32

420 3.49

Rest2015

2016

0

0

0.00

0.00

32

0.05 42

0.06

42

0.11 31

0.08

6

3

0.03

0.01

0.00

2

0

0.01

0.48 27

0.25

53

43

0.66 52

0.74

178

1.34 155

1.14

2017+

0.00

0

0.01

7

22

0.07

0

0.00

0

0.00

2

0.02

56

0.92

1.01

87

60

40

20

0

05

06

07

9,000TEU

08

09

10

11

6,000TEU

12

13

4,500TEU

14

15

1,700TEU*

*Geared

ChinaContainerizedFreightIndex(CCFI)USD/TEU

Newordersinno./millTEU

Below1,000TEU

1,0001,999TEU

2,0003,999TEU

4,0005,999TEU

6,0007,999TEU

8,0009,999TEU

10,000+TEU

Total

2014

0.00

4

57

0.08

21

0.05

0

0.00

0

0.00

19

0.18

54

0.78

1.09

155

2015YTD

0

0.00

2

0.00

0.04

11

0.01

2

0

0.00

0.00

0

42

0.72

57

0.76

Apr2015

0

0.00

0

0.00

0.00

0

0.00

0

0

0.00

0

0.00

0.19

15

15

0.19

2250

2000

1750

1500

1250

1000

750

10

11

12

ChinatoN.Europe

ChinatoUSWC

RSPlatouEconomicResearchAS

Shipbroking|Oslo

13

14

15

ChinatoS.Europe

ChinatoUSEC

RSPlatouMonthly

April2015

LNGcarriers

Shorttermratesremainedunderpressureasdemandfortonnage

continuedtobeweakandfleetgrowthwereatitshighestlevel

since2010.YemenLNGdeclaredforcemajeureandhaltedall

productionfromthe6.7millmtfacilityduetothesecurity

situationinthevicinityofBalhaf.Shellannounceda$70blnbid

forBGGroupwhichwillcreateanewhugeplayerintheLNG

arena.FollowingshelltakeoveroftheLNGassetsofRepsollast

year,itsglobalvolumeweretakentoaround24millmtwhichwill

increasetomorethe40uponcompletionoftheBGmerger.In

Japan,acourtrejectedabidtoblocktherestartoftwonuclear

reactorsoperatedbyKyushuElectricPowerCo.,easingthewayfor

theresumptionofnuclearpowerinJapanforthefirsttimein

morethanayearandahalf.

Averagecharterratesin1,000USD/day

Freightrates1,000USD/day

2014YTD 2015YTD Mar2015 Apr2015

60

25

31

138145kcbmSTSpot

25

44

41

155160kcbmDFDET/C

73

38

LNGcarrierfleetdevelopmentinno./millcbm

1,000cbm

1050

50100

100200

200+

Total

Deliveries

2015YTD

0

0.00

0

0.00

11

1.81

0

0.00

1.81

11

Removals

Fleetend

YoY

2015YTD

Apr2015

in%

0

8

0.00

0.23 0.0

0.16 25

2

0.61 33.4

0

0.00 352 51.95 12.1

0

0.00 45 10.30 0.0

0.16 430 63.08 9.2

2

Orderbookinno./millcbm

1,000cbm

1050

50100

100200

200+

Total

Total

Rest2015

15

8

0.21

0.42

0.00

0

0

0.00

142 24.18 26

4.29

1

0.26

0

0.00

158 24.86 34

4.50

160

140

120

100

80

60

40

20

0

05

06

07

08

09

10

Spot,145ksteam

11

12

13

14

15

12mT/C,160kDFDE

BuildingpricesforLNGcarriersMillUSD

2016

4

0.11

0

0.00

37

6.32

1

0.26

42

6.69

2017+

0.10

3

0

0.00

79 13.57

0

0.00

82 13.67

250

225

200

175

Newordersinno./millcbm

1,000cbm

1050

50100

100200

200+

Total

2014

5

0.12

0

0.00

67 11.50

0.00

0

72 11.62

2015YTD

0.10

3

0

0.00

6

1.06

0

0.00

1.16

9

Apr2015

0

0.00

0

0.00

0

0.00

0.00

0

0

0.00

150

125

05

06

07

08

09

10

11

155kcbm

12

13

14

15

173kcbm

NaturalgaspricesUSD/mmbtu

30

LNGimportsinmillmt

Japan

Korea

China

201404m

23.7

12.8

5.6

201503m

24.3

10.3

5.1

YoYin%

2.4

19.5

8.9

25

20

15

10

5

0

05

06

07

08

HenryHub

RSPlatouEconomicResearchAS

Shipbroking|Oslo

09

10

NBP

11

12

13

14

15

LNGspotAsia

10

RSPlatouMonthly

April2015

Representativereportednewbuildingcontracts

Tank

Capacity

2x155,000dwt

4x115,000dwt

4x115,000dwt

2x75,000dwt

2x38,000dwt

Shipyard

SamsungHI

SamsungHI

SamsungHI

HyundaiVinashin

KitanihonZosen

Owner

CardiffMarineInc.

CardiffMarineInc.

UniseaShippingLtd.

D'AmicoSoc.diNav.

DounKisenK.K.

Reportedprice/unit

Shipyard

TsuneishiCebu

Owner

UnknownJapanese

Reportedprice/unit

Delivery

2017

Shipyard

JiangsuNewYZJ

HyundaiSamhoHI

HHICPhil.Inc.

HHICPhil.Inc.

Owner

SeaspanCorporation

HapagLloydCont

SeaspanCorporation

CMACGM

Reportedprice/unit

Delivery

2017

2016

2017

2017

Shipyard

JiangnanChangxing

Owner

CSSCShipping(HK)

Reportedprice/unit

74 millUSD

Delivery

2017

Shipyard

CSCJinlingShipyard

HyundaiSamhoHI

MinamiNippon

Owner

AnjiAutomotive

NOCC

MitsuiO.S.K.Lines

Reportedprice/unit

Delivery

2017

2016/17

2017/18

57.5 millUSD

44 millUSD

Delivery

2016

2017

2017

2017

2018

Bulk

Capacity

6x38,000dwt

Container

Capacity

2x10,000TEU

5x10,500TEU

5x11,000TEU

3x20,600TEU

LPG

Capacity

2x85,000cbm

PCTC

Capacity

1x3,800cars

2x6,400cars

4x6,400cars

RSPlatouEconomicResearchAS

Shipbroking|Oslo

11

RSPlatouMonthly

April2015

Representativesecondhandsales

Tank

Name

OlympicHawk

BeijingSunrise

DalianGlory

Capacity

300000 dwt

113000 dwt

302000 dwt

Built

2000/Korea

2009/Korea

2011/Japan

Price

34.5 millUSD

"

165 millUSD

Buyers

HongKong

"

China

Comments

ENBLOC

Chemical/Product

Name

Clio

StavangerPrince

Atlantik

Alga

Maemi

Odin

Capacity

113000

109000

105000

38000

20000

19000

Built

Price

2008/China

Region36 millUSD

2002/China

19.3 millUSD

1998/Korea

12.5 millUSD

2012/Korea

27.25 millUSD

2008/Japan

Region23 millUSD

2003/Portugal

9.8 millUSD

Buyers

Germany

Greece

Ukraine

Denmark

Netherlands

Undisclosed

Comments

dwt

dwt

dwt

dwt

dwt

dwt

Capacity

171000

173000

81000

81000

81000

78000

76000

73000

73000

56000

47000

46000

45000

45000

45000

44000

43000

43000

33000

29000

29000

28000

28000

27000

Built

Price

2000/Japan

"

2000/Japan

18.9 millUSD

2011/Korea

17.5 millUSD

2011/Korea

17.95 millUSD

2011/Korea

17.7 millUSD

2001/Japan

Region7 millUSD

2011/China

12.2 millUSD

1998/Korea

4.5 millUSD

2000/Korea

Excess6 millUSD

2007/Japan

Low12 millUSD

1997/Korea

4.7 millUSD

1995/Japan

4.5 millUSD

1995/Japan

3.9 millUSD

1997/Korea

4.8 millUSD

1994/Japan

4 millUSD

1992/Japan

3.4 millUSD

1995/Korea

4.2 millUSD

1997/Croatia

3.55 millUSD

2010/China

6.5 millUSD

1995/China

3 millUSD

2008/Japan

9.25 millUSD

1998/China

High3 millUSD

2001/Germany

20.2 millUSD

1996/Korea

3.9 millUSD

Buyers

"

Greece

Greece

Greece

Greece

Undisclosed

Greece

China

Undisclosed

Undisclosed

Undisclosed

China

Undisclosed

Undisclosed

China

China

Undisclosed

Greece

Taiwan

Turkey

Turkey

Undisclosed

Canada

Syria

Comments

dwt

dwt

dwt

dwt

dwt

dwt

dwt

dwt

dwt

dwt

dwt

dwt

dwt

dwt

dwt

dwt

dwt

dwt

dwt

dwt

dwt

dwt

dwt

dwt

Bulk

Name

Chitose

Onoe

PrabhuMohini

PrabhuSher

UnityPride

Shiyo

DewiLaksmi

AgiosEfraim

Pontodamon

NobleHawk

Kite

SeaRose

AmberHalo

AristeaM

OrchidOcean

Zenovia

Blackfin

DonFraneBulic

NewSailingStar

Dobrota

IndigoOcean

Sanaga

Stones

Kotsikas

RSPlatouEconomicResearchAS

Shipbroking|Oslo

ENBLOC

12

RSPlatouMonthly

April2015

Contactlist

Oslo

RSPlatouASA

Munkedamsveien62C

0270Oslo

Norway

Tel: +4723112000

Fax: +4723112300

office@platou.com

RSPlatouShipbrokers

SaleandPurchase

Newbuilding

Tank

DryCargo

Car

EconomicResearch

RSPlatouOffshore

Tel: +4723112000

Fax: +4723112388

off@platou.com

RSPlatouMarketsAS

Tel: +4722016300

Fax: +4722016310

office@platoumarkets.com

+4723112500

+4723112650

+4722510520

+4723112450

+4723112600

+4723112000

snp@platou.com

new@platou.com

tankers.oslo@platou.com

dry@platou.com

car@platou.com

ecr@platou.com

RSPlatouProjectFinanceAS

Tel: +4723112000

Fax: +4723112327

finans@platou.com

Geneva

Houston

Moscow

RSPlatouGeneveSA

19,RuedelaCorraterie

CH1204Geneva

Switzerland

Tel: +41227151800

Fax: +41227151820

dry@platou.ch

RSPlatouHouston,Inc.

1221McKinneySt.

Suite3275

Houston,Texas77010

USA

Tel: +12814455600

Fax: +12814451090

tankers.houston@platou.com

RSPlatouASA,Moscow

BronnayaPlaza,Bldg.1,Floor7

32,SadovaKudrinskayaSt.

Moscow123001,Russia

Tel: +74957879922

Fax: +74957879929

moscow@platou.com

Piraeus

Shanghai

Singapore

RSPlatouHellasLtd.

13FilellinonStr.

18536Piraeus

Greece

Tel: +302104294070

Fax: +302104294071

snp@platou.gr

dry@platou.gr

RSPlatouASAShanghaiRepr.Office

LippoPlaza,Unit22122213

222HuaiHaiZhongRoad

Shanghai200021,China

Tel: +862153965959

Fax: +862153965665

pshang@platou.com

new.shanghai@platou.com

snp.shanghai@platou.com

RSPlatou(Asia)Pte.Ltd.

3TemasekAvenue

#2001CentennialTower

Singapore039190

Tel: +6563368733

Fax: +6563368740

snp@platou.com.sg

dry@platou.com.sg

offshore@platou.com.sg

Whilecarehasbeentakentoensuretheinformationinthisreportisaccurate,itisageneral

guideandnotintendedtoberelieduponforanyspecificpurpose.RSPlatouASA,its

affiliates,directorsandemployeesarenotresponsibleorliableforanylossesorconse

quences,whatsoever,arisingfromanyerrors,lackofcorrectness,inaccuracyor

incompletenessoftheinformationcontainedherein.Reproducinganymaterialsfromthis

reportwithoutpriorapprovalfromRSPlatouASAisstrictlyforbidden.Allmattersrelatingto

thisreportshallbegovernedbythelawsofNorway,andanydisputearisinginrespectof

thispresentationissubjecttotheexclusivejurisdictionofNorwegiancourtswithOsloas

legalvenue.

RSPlatouEconomicResearchAS

Shipbroking|Oslo

13

You might also like

- Significiant Ships 2010Document0 pagesSignificiant Ships 2010Sven LosNo ratings yet

- Continental Emsco F-1000 Mud PumpDocument13 pagesContinental Emsco F-1000 Mud Pumpifebrian100% (5)

- ETL Design TemplateDocument14 pagesETL Design TemplateachvmNo ratings yet

- RS Platou Global Support Vessel Monthly February 2012Document15 pagesRS Platou Global Support Vessel Monthly February 2012kelvin_chong_38No ratings yet

- Shipping Statistics and Market ReviewDocument17 pagesShipping Statistics and Market ReviewMiguel PachecoNo ratings yet

- Programme: LNG Shipping - Recent Trends and ProspectsDocument16 pagesProgramme: LNG Shipping - Recent Trends and Prospectsturtletrader123456No ratings yet

- Dry Bulk Shipping-An Opportunity or An Illusion - Yu Jiang LisarainDocument17 pagesDry Bulk Shipping-An Opportunity or An Illusion - Yu Jiang LisarainInstitute for Global Maritime Studies Greek ChapterNo ratings yet

- Platou Monthly December 2009bDocument11 pagesPlatou Monthly December 2009bWisnu KertaningnagoroNo ratings yet

- Shipping Monthly Report - October 2011: Freight ForwardDocument15 pagesShipping Monthly Report - October 2011: Freight ForwardAtul TandonNo ratings yet

- Shipping ResearchDocument14 pagesShipping ResearchbharathkrishnaimuNo ratings yet

- Clarksons ReportDocument49 pagesClarksons ReportShawnNo ratings yet

- Osv Outlook ClarksonsDocument36 pagesOsv Outlook ClarksonstranquocvinhtechNo ratings yet

- Liner Wars Trilogy, TOC Asia Presentation by Tan Hua JooDocument21 pagesLiner Wars Trilogy, TOC Asia Presentation by Tan Hua JooTan Hua JooNo ratings yet

- 2013 05 24 AgS Mon Industriall Lux 11Document12 pages2013 05 24 AgS Mon Industriall Lux 11fiskalNo ratings yet

- MOL in The IndustryDocument0 pagesMOL in The IndustrypothirajkalyanNo ratings yet

- IC August 2014Document68 pagesIC August 2014sabah8800No ratings yet

- Aluminium Zeitung 01-02-11Document100 pagesAluminium Zeitung 01-02-11Jose DenizNo ratings yet

- 2013 02 14 Dvfa enDocument43 pages2013 02 14 Dvfa enteni1968No ratings yet

- Shipbuilding Time To ChangeDocument36 pagesShipbuilding Time To ChangeAdlerNSNo ratings yet

- Baltic Sea Sewage Port Reception Facilities. HELCOM Overview 2014Document98 pagesBaltic Sea Sewage Port Reception Facilities. HELCOM Overview 2014Sandro AraújoNo ratings yet

- Pareto - Shipping Market OutlookDocument39 pagesPareto - Shipping Market OutlookSterios SouyoutzoglouNo ratings yet

- IMP Market Outlook SRODocument22 pagesIMP Market Outlook SRObhavin183No ratings yet

- Daily Power Consumption SEP-OCTDocument61 pagesDaily Power Consumption SEP-OCTPavan KumarNo ratings yet

- Weekly Plus - 2013 Issue 31 (02.08.2013)Document12 pagesWeekly Plus - 2013 Issue 31 (02.08.2013)Randora LkNo ratings yet

- Weekly Plus - 2013 Issue 35 (30.08.2013)Document12 pagesWeekly Plus - 2013 Issue 35 (30.08.2013)Randora LkNo ratings yet

- No of Elements R4 ProgDocument1 pageNo of Elements R4 ProgJoe PsNo ratings yet

- D'Auteuil (Port of Sept-Iles)Document19 pagesD'Auteuil (Port of Sept-Iles)Moises Guilherme Abreu BarbosaNo ratings yet

- Offshore DrillingDocument28 pagesOffshore DrillingBull WinkleNo ratings yet

- LNG Full Report MGG 2012 04 02 1Document236 pagesLNG Full Report MGG 2012 04 02 1turs133725No ratings yet

- Ge Shipping Feb 14 PresentationDocument34 pagesGe Shipping Feb 14 PresentationdiffsoftNo ratings yet

- LNG 20150116Document11 pagesLNG 20150116Rajeshkumar ElangoNo ratings yet

- Spare Part Inventory Analysis Report: Normal Distribution-Curve EOQ ModelDocument1 pageSpare Part Inventory Analysis Report: Normal Distribution-Curve EOQ ModelRanjan ShankarNo ratings yet

- Intermodal Weekly 16-2013Document8 pagesIntermodal Weekly 16-2013Wisnu KertaningnagoroNo ratings yet

- Platou MonthlyDocument14 pagesPlatou MonthlyTomislav MatoševićNo ratings yet

- Grit Blasting and Painting Work Details - January 2014Document4 pagesGrit Blasting and Painting Work Details - January 2014Fasil ParuvanathNo ratings yet

- Ports and EnviDocument4 pagesPorts and EnviValerie Masita HariadiNo ratings yet

- Sasaki CR 20080825Document4 pagesSasaki CR 20080825Dong TranNo ratings yet

- Chinese Construction Bubble - Preparing For A Potential BurstDocument24 pagesChinese Construction Bubble - Preparing For A Potential BurstlmlletNo ratings yet

- ITEM 1.1.2:: Imbalances in The Shipbuilding Industry: Magnitude, Causes & Potential Policy ImplicationsDocument24 pagesITEM 1.1.2:: Imbalances in The Shipbuilding Industry: Magnitude, Causes & Potential Policy Implicationsshannel jacksonNo ratings yet

- Market Reserch Report-Marine Equipment - IndiaDocument30 pagesMarket Reserch Report-Marine Equipment - IndiaManoj KhankaNo ratings yet

- Supplychainmanagementin RINLsteelplantDocument21 pagesSupplychainmanagementin RINLsteelplantfaheemgames786No ratings yet

- Statistics Report: October 2012Document22 pagesStatistics Report: October 2012Ben RossNo ratings yet

- Dry BulkDocument28 pagesDry BulkyousfinacerNo ratings yet

- Shipping Intelligence 26.novDocument20 pagesShipping Intelligence 26.novleejingsongNo ratings yet

- The World Market For Diesel LocomotivesDocument10 pagesThe World Market For Diesel LocomotivesPaul MaposaNo ratings yet

- Daily Report 20141201Document3 pagesDaily Report 20141201Joseph DavidsonNo ratings yet

- Finance Source: Database Coverage ListDocument8 pagesFinance Source: Database Coverage ListJatin PandeNo ratings yet

- Site Visit: Mogalakwena Mine and Polokwane Smelter: April 12 2010Document39 pagesSite Visit: Mogalakwena Mine and Polokwane Smelter: April 12 2010pldevNo ratings yet

- 1-1645 MR Ralph LeszczynskiDocument18 pages1-1645 MR Ralph LeszczynskiVangelis ZaimisNo ratings yet

- LNG Sss Public Final ReportDocument57 pagesLNG Sss Public Final ReportH.J.PetersenNo ratings yet

- The Multipurpose & Heavy Lift Transportation Outlook 12 March 2014 Tina LiuDocument25 pagesThe Multipurpose & Heavy Lift Transportation Outlook 12 March 2014 Tina Liuromal_sd1309No ratings yet

- Weekly Plus - 2013 Issue 33 (16.08.2013)Document12 pagesWeekly Plus - 2013 Issue 33 (16.08.2013)Randora LkNo ratings yet

- The Role of Supply Vessels in Offshore LogisticsDocument24 pagesThe Role of Supply Vessels in Offshore LogisticsCharles SilvaNo ratings yet

- Australia's Maritime Petroleum Supply ChainDocument43 pagesAustralia's Maritime Petroleum Supply ChainRachmat Baruna KresnaNo ratings yet

- PPP Position Paper Ports 122k9Document42 pagesPPP Position Paper Ports 122k9pragya89No ratings yet

- News Coverage - France: Economy and Business News From The Past WeekDocument5 pagesNews Coverage - France: Economy and Business News From The Past Weekapi-248259954No ratings yet

- SWISS Traffic Figures: January 2011Document4 pagesSWISS Traffic Figures: January 2011amitc5No ratings yet

- MT Slides Logistics (14 NovDocument24 pagesMT Slides Logistics (14 NovRyan Tw ChoumingNo ratings yet

- PSV Charter Rate 2Document2 pagesPSV Charter Rate 2Wisnu KertaningnagoroNo ratings yet

- BR Swindon Type 1 0-6-0 Diesel-Hydraulic Locomotives—Class 14: Their Life in IndustryFrom EverandBR Swindon Type 1 0-6-0 Diesel-Hydraulic Locomotives—Class 14: Their Life in IndustryNo ratings yet

- Step 1 Packer Is Then Inflated To Hold ESPDocument3 pagesStep 1 Packer Is Then Inflated To Hold ESPifebrianNo ratings yet

- MudMaster HPHT Pistons Mud PumpDocument2 pagesMudMaster HPHT Pistons Mud PumpifebrianNo ratings yet

- Accel - Band Trading RulesDocument2 pagesAccel - Band Trading RulesifebrianNo ratings yet

- 07 Rig List July 2016Document17 pages07 Rig List July 2016ifebrianNo ratings yet

- 04 Rig List April 2016Document17 pages04 Rig List April 2016ifebrianNo ratings yet

- 07 Rig List July 2016Document17 pages07 Rig List July 2016ifebrianNo ratings yet

- 09 Rig List September 2016Document17 pages09 Rig List September 2016ifebrianNo ratings yet

- 02 Rig List February 2016Document17 pages02 Rig List February 2016ifebrianNo ratings yet

- Jan 28.5 Feb 31.62 Mar 36.52 Apr 40.51 May 48.46 Jun 47.56 Jul 40.98 Aug 43.98 Sep 47.37 Oct 49.18 Nov DecDocument2 pagesJan 28.5 Feb 31.62 Mar 36.52 Apr 40.51 May 48.46 Jun 47.56 Jul 40.98 Aug 43.98 Sep 47.37 Oct 49.18 Nov DecifebrianNo ratings yet

- 01 Rig List January 2016Document17 pages01 Rig List January 2016ifebrianNo ratings yet

- 05 Rig List May 2016Document17 pages05 Rig List May 2016ifebrianNo ratings yet

- MCM CENTRIFUGAL PUMP Catalog LOW PDFDocument62 pagesMCM CENTRIFUGAL PUMP Catalog LOW PDFifebrianNo ratings yet

- 01 Rig List January 2016Document17 pages01 Rig List January 2016ifebrianNo ratings yet

- Mountain Petroleum Corporation P & A Wellbore Diagram - 4/12/2013 Smith-Whomble 1-3 API #05-125-06162-00 NESW Sec. 3-T2S-R43W Yuma County, ColoradoDocument1 pageMountain Petroleum Corporation P & A Wellbore Diagram - 4/12/2013 Smith-Whomble 1-3 API #05-125-06162-00 NESW Sec. 3-T2S-R43W Yuma County, ColoradoifebrianNo ratings yet

- Ayaz Nujuraully - 59376351 1Document12 pagesAyaz Nujuraully - 59376351 1AzharNo ratings yet

- Volvo Cars 11Document45 pagesVolvo Cars 11summerNo ratings yet

- Multipair Triad 1Document4 pagesMultipair Triad 1jewdNo ratings yet

- Media Requirements and Procedures Revised 090821Document3 pagesMedia Requirements and Procedures Revised 090821heather valenzuelaNo ratings yet

- AYUSHYA SUKTAM - Gleanings From Sanskrit LiteratureDocument5 pagesAYUSHYA SUKTAM - Gleanings From Sanskrit LiteratureRajesh RamakrishnanNo ratings yet

- 100+ C Programs PDFDocument94 pages100+ C Programs PDFAjay GUNo ratings yet

- Modeling Improvement of The Four Parameter Model For Photovoltaic ModulesDocument11 pagesModeling Improvement of The Four Parameter Model For Photovoltaic ModulesBranislavPetrovicNo ratings yet

- LAC SESSION TEMPLATE DISTRICT MUNICIPAL SCHOOL LEVEL Revised 8 17 2017Document3 pagesLAC SESSION TEMPLATE DISTRICT MUNICIPAL SCHOOL LEVEL Revised 8 17 2017Jakie UbinaNo ratings yet

- SampleTank 4 User ManualDocument175 pagesSampleTank 4 User ManualJAIME ANDRES MORALES DUARTENo ratings yet

- CEHv6 1DayPrepPracticeQuestionsDocument127 pagesCEHv6 1DayPrepPracticeQuestionsElvis Garcia Reyes100% (1)

- Gesamtkatalog 2016 17 Englisch-1Document340 pagesGesamtkatalog 2016 17 Englisch-1Dusan SofrenicNo ratings yet

- 2010.CE-I (SPL) .IRUSSOR.W&M.1 Dated11.08.2011Document1 page2010.CE-I (SPL) .IRUSSOR.W&M.1 Dated11.08.2011सुखबीर बेचारा..0% (1)

- F.y.bms (B.s.college)Document13 pagesF.y.bms (B.s.college)Jatin ParmarNo ratings yet

- MBSD Value Engineering Report 30 July 2014 2Document56 pagesMBSD Value Engineering Report 30 July 2014 2Martens HategeNo ratings yet

- Official Notification For DRDO Recruitment 2017Document4 pagesOfficial Notification For DRDO Recruitment 2017Kabya SrivastavaNo ratings yet

- Latth Et Al. (2022) - Prevent It 1 - ARTIGOdoRCTDocument9 pagesLatth Et Al. (2022) - Prevent It 1 - ARTIGOdoRCTInês FerreiraNo ratings yet

- Sop of Ipc-2Document3 pagesSop of Ipc-2Jahanzeb KhanNo ratings yet

- 1" Mechanical Fuel Meter: User'S ManualDocument7 pages1" Mechanical Fuel Meter: User'S ManualENT ENTNo ratings yet

- Vehicle DynamicsDocument19 pagesVehicle DynamicsIshmael MvunyiswaNo ratings yet

- All About Steering System.Document12 pagesAll About Steering System.Ramprabu Chandrasekar100% (1)

- Benmap-Ce User Manual March 2015Document545 pagesBenmap-Ce User Manual March 2015lidysNo ratings yet

- RUBRICDocument2 pagesRUBRICShaarumathi ElangovanNo ratings yet

- Implementation of Victim Compensation Scheme Leaves A Lot To Be DesiredDocument7 pagesImplementation of Victim Compensation Scheme Leaves A Lot To Be DesiredRajivSmithNo ratings yet

- KR 6 R700 Sixx: Workspace GraphicDocument1 pageKR 6 R700 Sixx: Workspace GraphicIhateyouNo ratings yet

- Department of Management Sciences: Financial Project Adamjee Insurance CompanyDocument85 pagesDepartment of Management Sciences: Financial Project Adamjee Insurance Companyahmed31435828309749No ratings yet

- GR No 100150Document13 pagesGR No 100150Ranger Rodz TennysonNo ratings yet

- 2nd PU Political Science Model QP 3Document7 pages2nd PU Political Science Model QP 3Prasad C M67% (9)

- MobilityPack1-Posting of Drivers FactsheetDocument1 pageMobilityPack1-Posting of Drivers Factsheetfabiperis87No ratings yet