Appointment and Remuneration of Managerial Personnel: © The Institute of Chartered Accountants of India

Appointment and Remuneration of Managerial Personnel: © The Institute of Chartered Accountants of India

Uploaded by

Navin Man Singh ShresthaCopyright:

Available Formats

Appointment and Remuneration of Managerial Personnel: © The Institute of Chartered Accountants of India

Appointment and Remuneration of Managerial Personnel: © The Institute of Chartered Accountants of India

Uploaded by

Navin Man Singh ShresthaOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Copyright:

Available Formats

Appointment and Remuneration of Managerial Personnel: © The Institute of Chartered Accountants of India

Appointment and Remuneration of Managerial Personnel: © The Institute of Chartered Accountants of India

Uploaded by

Navin Man Singh ShresthaCopyright:

Available Formats

4

Appointment and Remuneration of

Managerial Personnel

1. Introduction

"Chief Executive Officer" [Section 2(18)] means an officer of a company, who has been

designated as such by it.

"Chief Financial Officer" [Section 2(19)] means a person appointed as the Chief Financial

Officer of a company.

"Company Secretary" or "secretary" [Section 2(24)] means a company secretary as

defined in clause (c) of sub-section (1) of section 2 of the Company Secretaries Act, 1980 (56

of 1980) who is appointed by a company to perform the functions of a company secretary

under this Act;

"Company secretary in practice" [Section 2(25)] means a company secretary who is

deemed to be in practice under sub-section (2) of section 2 of the Company Secretaries Act,

1980 (56 of 1980).

"Key managerial personnel" [Section 2(51)], in relation to a company, means—

(i) the Chief Executive Officer or the managing director or the manager;

(ii) the company secretary;

(iii) the whole-time director;

(iv) the Chief Financial Officer; and

(v) such other officer as may be prescribed.

"Manager" [Section 2(53)] means an individual who, subject to the superintendence, control

and direction of the Board of Directors, has the management of the whole, or substantially the

whole, of the affairs of a company, and includes a director or any other person occupying the

position of a manager, by whatever name called, whether under a contract of service or not.

Managing Director [Section 2(54)]: Section 2(54) of the Companies Act, 2013 defines a

“Managing Director” as a director who is entrusted with substantial powers of management of

the affairs of the company by:

(i) virtue of the articles of a company or

© The Institute of Chartered Accountants of India

4.2 Corporate and Allied Laws

(ii) an agreement with the company or

(iii) a resolution passed in its general meeting, or by its Board of Directors,

and includes a director occupying the position of the managing director, by whatever name

called.

Explanation to Section 2 (54) clarifies that substantial powers of the management shall not be

deemed to include the power to do such administrative acts of a routine nature when so

authorised by the Board such as:

(i) the power to affix the common seal of the company to any document or

(ii) to draw and endorse any cheque on the account of the company in any bank or

(iii) to draw and endorse any negotiable instrument or

(iv) to sign any certificate of share or

(v) to direct registration of transfer of any share.

Whole Time Director [Section 2(94)]: “Whole-time director” includes a director in the whole-

time employment of the company.

2. Appointment of Managing Director, Whole Time Director or

Manager [Section 196]

Section 196 of the Companies Act, 2013 provides for the provisions for appointment of

Managing Director, Whole Time Director or Manager. According to this section:

(i) A company shall not appoint or employ a managing director and a manager at the same

time. [Section 196(1)]

(ii) Tenure [section 196(2)]:

(a) No company shall appoint or re-appoint any person as its managing director, whole-

time director or manager for a term exceeding five years at a time.

(b) It is further provided that no re-appointment shall be made earlier than one year

before the expiry of his term.

Example: ‘X’ was appointed as Managing Director for life by the Articles of Association

of a private company incorporated on 1st June, 2016. Examine in this connection, Can ‘X’

be appointed for life as Managing Director?

Answer: Section 196(2) of the Companies Act, 2013 lays down that no company shall

appoint or re-appoint any person as its managing director, whole-time director or

manager for a term exceeding five years at a time. No concession or exception is allowed

by the Act to private companies. Hence, ‘X’ cannot be appointed as Managing Director

© The Institute of Chartered Accountants of India

Appointment and Remuneration of Managerial Personnel 4.3

for life in a private company.

(iii) Disqualification: For appointing a person as a Managing Director, whole-time director or

manager, firstly he shall not be disqualified for appointment as a director under section

164.

As per section 196(3), no company shall appoint or continue the employment of any

person as managing director, whole-time director or manager who-

(a) is below the age of 21 years or has attained the age of 70 years.

Provided that a person who has attained the age of seventy years may be appointed

to such office by the passing of a special resolution in which case the explanatory

statement annexed to the notice for such motion shall indicate the justification for

appointing such person.

(b) is an undischarged insolvent or has at any time been adjudged as an insolvent; or

(c) has at any time suspended payment to his creditors or makes, or has at any time

made, a composition with them; or

(d) has at any time been convicted by a court of an offence and sentenced for a period

of more than six months.

(e) Schedule V to the Companies Act, 2013, has prescribed additional conditions for

managing or whole-time director or a manager to be eligible for appointment without

approval of Central Government:

(1) he had not been sentenced to imprisonment for any period, or to a fine

exceeding one thousand rupees, for the conviction of an offence under 16 Acts

as specified under Schedule V.

(2) he had not been detained for any period under the Conservation of Foreign

Exchange and Prevention of Smuggling Activities Act, 1974:

Provided that where the Central Government has given its approval to the

appointment of a person convicted or detained under para (1) or para (2), as

the case may be, no further approval of the Central Government shall be

necessary for the subsequent appointment of that person if he had not been so

convicted or detained subsequent to such approval.

(3) where he is a managerial person in more than one company, he draws

remuneration from one or more companies subject to the ceiling provided in

section V of Part II

(4) he is resident of India.

Explanation I: Here, resident in India includes a person who has been staying in

India for a continuous period of not less than twelve months immediately preceding

© The Institute of Chartered Accountants of India

4.4 Corporate and Allied Laws

the date of his appointment as a managerial person and who has come to stay in

India,-

(a) for taking up employment in India; or

(b) for carrying on a business or vacation in India.

Explanation II: This condition shall not apply to the companies in Special Economic

Zones as notified by Department of Commerce from time to time:

Provided that a person, being a non-resident in India shall enter India only after

obtaining a proper Employment Visa from the concerned Indian mission abroad. For

this purpose, such person shall be required to furnish, along with the visa

application form, profile of the company, the principal employer and terms and

conditions of such person’s appointment.

(iv) Procedure of appointment [section 196(4)]:

(1) Subject to the provisions of section 197 and Schedule V, a managing director,

whole-time director or manager shall be appointed, and the terms and conditions of

such appointment and remuneration payable be

(i) approved by the Board of Directors at a meeting.

(ii) approved by shareholders by a resolution at the next general meeting of the

company.

(2) In case such appointment is at variance to the conditions specified in the Schedule

V of the Companies Act, 2013, the appointment shall be approved by the Central

Government.

(3) The notice convening Board or general meeting for considering such appointment

shall include the terms and conditions of such appointment, remuneration payable

and such other matters including interest, of a director or directors in such

appointments, if any.

(4) A return in the prescribed form along with the prescribed fee shall be filed with the

Registrar within sixty days of such appointment.

(v) Validity of acts [Section 196(5)]: Subject to the provisions of this Act, where an

appointment of a managing director, whole-time director or manager is not approved by

the company at a general meeting, any act done by him before such approval shall

deemed to be valid.

Example: A Managing Director is appointed in board meeting on 1 st June, 2017. General

meeting was to be held on 7th June, 2017 for approval of the same. The Managing

© The Institute of Chartered Accountants of India

Appointment and Remuneration of Managerial Personnel 4.5

Director executed an agreement on 3rd June, 2017. The General meeting was held

accordingly on 7th June, 2017 but did not approve the appointment of Managing Director.

Whether the executed agreement by Managing Director is valid?

Answer: Yes, the agreement is valid. Acts done by the managing director from 1st June,

2017 to 7th June, 2017 i.e. upto the non approval of the general meeting, shall be valid

subject to the provisions of this Act.

Exemptions

(i) In case of Government Companies, section 196(2), (4) and (5) shall not apply

(Notification No. G.S.R. 463(E) dated 5th June, 2015).

(ii) In case of Private companies section 196(4) and (5) shall not apply (Notification

No. G.S.R. 464(E) dated 5th June, 2015).

(iii) In case of Specified IFSC Public Company - Sub-section (4) of section 196 shall

not apply (Notification Dated 4th January, 2017)

3. Appointment of Key Managerial Personnel [Section 203]

Section 203 of the Companies Act, 2013 lays down the provisions for appointment of Key

Managerial Personnel of companies.

(i) Who is KMP [section 203(1)]: Every company belonging to such class or classes of

companies as may be prescribed, shall have the following whole time key managerial

personnel:-

(a) Managing Director, or Chief Executive Officer or Manager and in their absence, a

Whole-time Director;

(b) Company Secretary; and

(c) Chief Financial Officer.

According to Rule 8 of the Companies (Appointment and Remuneration of Managerial

Personnel) Rules, 2014 every listed company and every other public company having a

paid-up share capital of ` 10 crore or more shall have whole-time key managerial

personnel.

Further, as per the Companies (Appointment and Remuneration of Managerial

Personnel) Amendment Rules, 2014, a company other than a company covered under

Rule 8 above, which has a paid up share capital of ` 5 crore or more shall have a whole-

time company secretary.

With the insertion of Rule 8 A to the above rules, it is now mandatory of every other

company to have a whole time company secretary if it’s paid up share capital is ` 5

Crores or more.

© The Institute of Chartered Accountants of India

4.6 Corporate and Allied Laws

(ii) Prohibition on individual to be appointed as chairperson as well as Managing

Director or Chief Executive Officer at the same time [Proviso to section 203(1)]:

An individual shall not be appointed or reappointed as the chairperson of the company, in

pursuance of the articles of the company, as well as the managing director or Chief

Executive Officer of the company at the same time unless,—

(a) the articles of such a company provide otherwise; or

(b) the company does not carry multiple businesses. [First proviso to section 203(1)]

Provided that the above mentioned prohibition shall not apply to such class of

companies engaged in multiple businesses and which has appointed one or more Chief

Executive Officers for each such business as may be notified by the Central Government.

[Second proviso to section 203(1)]

The MCA vide Notification No. S.O. 1913(E) dated 25 th July, 2014 notifies that public

companies having paid-up share capital of ` 100 crore or more and annual turnover of

` 1,000 or more which are engaged in multiple businesses and have appointed Chief

Executive Officer for each such business shall be the class of companies for the purpose

of the second proviso to sub-section (1) of section 203 of the said Act.

Explanation- For the purpose of this notification, the paid-up share capital and the annual

turnover shall be decided on the basis of the latest audited balance sheet.

(iii) Conditions for appointment:

(a) Every whole-time key managerial personnel of a company shall be appointed by

means of a resolution of the Board containing the terms and conditions of the

appointment including the remuneration. [Section 203 (2)]

(b) A whole-time key managerial personnel shall not hold office in more than one

company at the same time except in its subsidiary company. [Section 203 (3)]

Provided that nothing in the above sub section shall disentitle a key managerial

personnel from being a director in any company with the permission of the Board.

(iv) Managing Director or manager in more than one company [Third proviso to section

203(3)]:

(a) A company may appoint or employ a person as its managing director, if he is the

managing director or manager of one, and of not more than one, other company.

(b) Such appointment or employment is made or approved by a resolution passed at a

meeting of the Board with the consent of all the directors present at the meeting.

(c) It is further provided that specific notice of such meeting, and of the resolution to be

moved thereat has been given to all the directors then in India.

© The Institute of Chartered Accountants of India

Appointment and Remuneration of Managerial Personnel 4.7

(v) Casual Vacancy [section 203(4)]: If the office of any whole-time KMP is vacated, the

resulting vacancy shall be filled-up by the Board at a meeting of the Board within a period

of six months from the date of such vacancy.

(vi) Penalty for contravention [Section 203(5)]:

(a) On company: If a company contravenes the provisions of this section, the

company shall be punishable with fine which shall not be less than ` 1 lac but

which may extend to ` 5 Lacs.

(b) On director and KMP: Every director and KMP of the company who is in default

shall be punishable with fine which may extend to ` 50,000 and where the

contravention is a continuing one, with a further fine which may extend to ` 1,000

for every day after the first during which the contravention continues.

Exemptions

In case of Government companies, after sub-section (4), the following sub-section

shall be inserted vide Notification No. G.S.R. 463(E) dated 5th June, 2015, namely:

“(4A) The provisions of sub-section (1), (2), (3) and (4) of this section shall not apply

to a managing director or Chief Executive Officer or manager and in their absence,

a whole-time director of the Government company.”

4. Functions of company secretary [Section 205]

Once the Company Secretary is appointed in terms of requirements of section 203, the

Company Secretary shall perform the functions covered under Section 205.

(i) Functions of the Company Secretary: According to Section 205(1) read with the Rule

10 of the Companies (Appointment and Remuneration of Managerial Personnel) Rules, 2014,

the functions of the company secretary shall include,—

(a) to report to the Board about compliance with the provisions of this Act, the rules made

thereunder and other laws applicable to the company;

(b) to ensure that the company complies with the applicable secretarial standards;

(c) to provide to the directors of the company, collectively and individually, such guidance as

they may require, with regard to their duties, responsibilities and powers;

(d) to facilitate the convening of meetings and attend Board, committee and general

meetings and maintain the minutes of these meetings;

(e) to obtain approvals from the Board, general meeting, the government and such other

authorities as required under the provisions of the Act;

(f) to represent before various regulators, and other authorities under the Act in connection

with discharge of various duties under the Act;

© The Institute of Chartered Accountants of India

4.8 Corporate and Allied Laws

(g) to assist the Board in the conduct of the affairs of the company;

(h) to assist and advise the Board in ensuring good corporate governance and in complying

with the corporate governance requirements and best practices; and

(i) to discharge such other duties as have been specified under the Act or rules; and

(j) such other duties as may be assigned by the Board from time to time.

Here, the expression “secretarial standards” means secretarial standards issued by the

Institute of Company Secretaries of India constituted under section 3 of the Company

Secretaries Act, 1980 and approved by the Central Government.

(ii) According to Section 205 (2), the provisions contained in section 204 and section 205

shall not affect the duties and functions of the Board of Directors, chairperson of the company,

managing director or whole-time director under this Act, or any other law for the time being in

force.

5. Central Government or company to fix limit with regard to

remuneration [Section 200]

According to section 200 of the Companies Act, 2013, notwithstanding anything contained in

this Chapter, the Central Government or a company may, while according its approval under

section 196, to any appointment or to any remuneration under section 197 in respect of cases

where the company has inadequate or no profits, fix the remuneration within the limits

specified in this Act, at such amount or percentage of profits of the company, as it may deem

fit and while fixing such remuneration the Central Government shall have regard to:

(a) the financial position of the company;

(b) the remuneration or commission drawn by the individual concerned in any other

capacity;

(c) the remuneration or commission drawn by him from any other company;

(d) professional qualifications and experience of the individual concerned;

(e) any other matters as may be prescribed.

According to Rule 6 of the Companies (Appointment and Remuneration of Managerial

Personnel) Rules, 2014, for the purposes of clause (e) above the Central Government or the

company shall have regard to the following matters, namely:-

(1) the Financial and operating performance of the company during the three preceding

financial years.

(2) the relationship between remuneration and performance.

(3) the principle of proportionality of remuneration within the company, ideally by a rating

© The Institute of Chartered Accountants of India

Appointment and Remuneration of Managerial Personnel 4.9

methodology which compares the remuneration of directors to that of other directors on

the board and employees or executives of the company.

(4) whether remuneration policy for directors differs from remuneration policy for other

employees and if so, an explanation for the difference.

(5) the securities held by the director, including options and details of the shares pledged as

at the end of the preceding financial year.

6. Overall maximum managerial remuneration and managerial

remuneration in case of absence or inadequacy of profits [Section 197]

Section 197 of the Companies Act, 2013 lays down the provisions for overall maximum

managerial remuneration by every public company and managerial remuneration in case of

absence or inadequacy of profits. The section read with Schedule V defines maximum

remuneration payable to KMPs. This section does not apply to the private company.

According to this section:

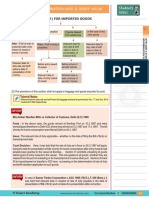

(i) Overall Maximum Managerial Remuneration [Section 197(1)]

(a) The overall managerial remuneration to the Directors including

managing director, whole time director and manager in respect

of any financial year is summarized as under:

S. No. Conditions Maximum remuneration Conditions when

in any financial year remuneration can exceed

as referred in column (b)

(a) (b) (c)

(i) Overall limit 11% of the net profits of Company in general

the company for that meeting with approval of

financial year Central Government

subject to provisions of

Schedule V

(ii) If there is one Managing 5% of the net profits of With the approval of the

director/ Whole time director/ the company for that year company in general

manager meeting this limit may be

exceeded.

(iii) If there is more than one 10% of the net profits With the approval of the

Managing director/ Whole company in general

time director/ manager meeting this limit may be

exceeded.

© The Institute of Chartered Accountants of India

4.10 Corporate and Allied Laws

(iv) If there is directors who are 1% of the net profits of Approval of the company

neither Managing director nor the company if there is a in general meeting is

whole time directors managing director or a required.

whole time director

(v) If there are directors who are 3% of the net profits of Approval of the company

neither Managing director nor the company if there is in general meeting is

whole time directors no managing director or required.

whole time director

Section 197(2) provides that above percentages shall be exclusive of any fees payable to

directors under section 197(5).

(b) Section 197(8) further provides that the net profits shall be computed in the manner laid

down in section 198 except that the remuneration of the directors shall not be deducted

from the gross profits.

(ii) No profits or profits are inadequate [Section 197(3) & (11)]

(a) If in any financial year, a company has no profits or its profits are inadequate, the

company shall not pay by way of remuneration any sum exclusive of sitting fees to its

directors, including any managing or whole- time director or manager except in

accordance with the provisions of Schedule V.

(b) If the company is not able to comply with such provisions of Schedule V in the above

case, then previous approval of the Central Government shall be taken.

(c) In cases where Schedule V is applicable on grounds of no profits or inadequate profits,

any provision relating to the remuneration of any director which purports to increase or

has the effect of increasing the amount thereof, whether the provision be contained in the

company’s memorandum or articles, or in an agreement entered into by it, or in any

resolution passed by the company in general meeting or its Board, shall not have any

effect unless such increase is in accordance with the conditions specified in that

Schedule and if such conditions are not being complied, the approval of the Central

Government had been obtained.

Section II of part II of Schedule V- Remuneration payable by companies having no profit

or inadequate profit without Central Government approval

Where in any financial year during the currency of tenure of a managerial person, a company

has no profits or its profits are inadequate, it may, without Central Government approval, pay

remuneration to the managerial person not exceeding, the limits under (A) and (B) given

below:-

© The Institute of Chartered Accountants of India

Appointment and Remuneration of Managerial Personnel 4.11

(A):

(1) (2)

Where the effective capital is Limit of yearly remuneration payable

shall not exceed (Rupees)

(i) Negative or less than 5 crores 60 Lakhs

(ii) 5 crores and above but less than 100 84 Lakhs

crores

(iii) 100 crores and above but less than 250 120 Lakhs

crores

(iv) 250 crores and above 120 lakhs plus 0.01% of the effective

capital in excess of ` 250 crores:

Provided that the above limits shall be doubled if the resolution passed by the shareholders is

a special resolution.

Explanation- It is hereby clarified that for a period less than one year, the limits shall be pro-

rated.

(B):

In case of a managerial person who is functioning in a professional capacity, no approval of

Central Government is required, if such managerial person is not having any interest in the

capital of the company or its holding company or any of its subsidiaries directly or indirectly or

through any other statutory structures and not having any, direct or indirect interest or related

to the directors or promoters of the company or its holding company or any of its subsidiaries

at any time during the last two years before or on or after the date of appointment and

possesses graduate level qualification with expertise and specialised knowledge in the field in

which the company operates:

Provided that any employee of a company holding shares of the company not exceeding 0.5%

of its paid up share capital under any scheme formulated for allotment of shares to such

employees including Employees Stock Option Plan or by way of qualification shall be deemed

to be a person not having any interest in the capital of the company;

Provided further that the limits specified under items (A) and (B) of this section shall apply, if-

(i) payment of remuneration is approved by a resolution passed by the Board and, in the

case of a company covered under sub-section (1) of suction 178 also by the Nomination

and Remuneration Committee;

(ii) the company has not committed any default in repayment of any of its debts (including

public deposits) or debentures or interest payable thereon for a continuous period of

© The Institute of Chartered Accountants of India

4.12 Corporate and Allied Laws

thirty days in the preceding financial year before the date of appointment of such

managerial person and in case of a default, the company obtains prior approval from

secured creditors for the proposed remuneration and the fact of such prior approval

having been obtained is mentioned in the explanatory statement to the notice convening

the general meeting;

(iii) an ordinary resolution or a special resolution, as the case may be, has been passed for

payment of remuneration as per the limits laid down in item (A) or a special resolution

has been passed for payment of remuneration as per item (13), at the general meeting of

the company for a period not exceeding three years.

(iv) a statement along with a notice calling the general meeting referred to in clause (iii) is

given to the shareholders containing the following information, namely:-

I. General information:

(1) Nature of industry

(2) Date or expected date of commencement of commercial production

(3) In case of new companies, expected date of commencement of activities as

per project approved by financial institutions appearing in the prospectus

(4) Financial performance based on given indicators

(5) Foreign investments or collaborations, if any.

II. Information about the appointee:

(1) Background details

(2) Past remuneration

(3) Recognition or awards

(4) Job profile and his suitability

(5) Remuneration proposed

(6) Comparative remuneration profile with respect to industry, size of the

company, profile of the position and person (in case of expatriates the

relevant details would be with respect to the country of his origin)

(7) Pecuniary relationship directly or indirectly with the company, or relationship

with the managerial personnel, if any.

III. Other information:

(1) Reasons of loss or inadequate profits

(2) Steps taken or proposed to be taken for improvement

(3) Expected increase in productivity and profits in measurable terms

© The Institute of Chartered Accountants of India

Appointment and Remuneration of Managerial Personnel 4.13

IV. Disclosures: The following disclosures shall be mentioned in the Board of Director’s

report under the heading “Corporate Governance”, if any, attached to the Financial

statement:

(i) all elements of remuneration package such as salary, benefits, bonuses, stock

options, pension, etc., of all the directors;

(ii) details of fixed component. and performance linked incentives along with the

performance criteria;

(iii) service contracts, notice period, severance fees; and

(iv) stock option details, if any, and whether the same has been issued at a

discount as well as the period over which accrued and over which exercisable.

Explanation: For the purposes of Section II of this part, “Statutory Structure” means any

entity which is entitled to hold shares in any company formed wider any statute.

(iii) Determination of remuneration [Section 197(4)]

(a) The remuneration payable to the directors of a company, including any managing or

whole-time director or manager, shall be determined, in accordance with and subject to

the provisions of this section, either

(i) by the articles of the company, or

(ii) by a resolution or,

(ii) if the articles so require, by a special resolution, passed by the company in general

meeting, and

(b) the remuneration payable to a director determined aforesaid shall be inclusive of the

remuneration payable to him for the services rendered by him in any other capacity.

(c) Any remuneration for services rendered by any such director in other capacity shall not

be so included if—

(1) the services rendered are of a professional nature; and

(2) in the opinion of the Nomination and Remuneration Committee, if the company is

covered under sub-section (1) of section 178, or the Board of Directors in other

cases, the director possesses the requisite qualification for the practice of the

profession.

Example: Star Health Specialties Ltd. owns a Multi-Specialty Hospital in Chennai. Dr.

Hamilton, a practicing Heart Surgeon, has been appointed by the company as its

director and it wants to pay him fee, on case to case basis, for surgery performed on the

patients at the hospital. A question has arisen whether payment of such fee to him

would amount to payment of managerial remuneration to a director subject to any

restriction under the Companies Act, 2013.

© The Institute of Chartered Accountants of India

4.14 Corporate and Allied Laws

Answer: In the given case, Dr. Hamilton has been appointed as a director. He has to be

paid a fee for surgeries performed by him; it shall be fully possible under section 197(4)

which states that the remuneration payable to the directors including managing or whole-

time director or manager shall be inclusive of the remuneration payable for the services

rendered by him in any other capacity except the following:

(a) the services rendered are of a professional nature; and

(b) in the opinion of the Nomination and Remuneration Committee (if applicable) or

the Board of Directors in other cases, the director possesses the requisite

qualification for the practice of the profession.

The company can therefore, pay a remuneration to Dr. Hamilton a fee for surgeries

performed by him as a professional fee which shall not be construed as a Managerial

Remuneration under the Act.

(iv) Sitting Fees to directors [Section 197(5)]:

(a) A director may receive remuneration by way of fee for attending meetings of the Board or

Committee thereof or for any other purpose whatsoever as may be decided by the Board.

(b) The sitting fees shall not exceed one lakh rupees per meeting of the Board or committee

thereof. [As per the Companies (Appointment and Remuneration of Managerial

personnel) Rules, 2014]

However, for Independent Directors and Women Directors, the sitting fee shall not be

less than the sitting fee payable to other directors.

(c) The percentages under sub-section (1) shall be exclusive of any sitting fees payable to

directors for attending meetings of the Board or committee thereof or for any other

purpose whatsoever as may be decided by the Board.

(d) Different fees for different classes of companies and fees in respect to independent

directors may be such as may be prescribed.

Example: The Article of Association of a listed company have fixed payment of sitting

fee for each Meeting of Directors subject to maximum of ` 30,000. In view of increased

responsibilities of independent directors of listed companies, the company proposes to

increase the sitting fee to ` 45,000 per meeting. Advise the company about the

requirement under the Companies Act, 2013 to give effect to the proposal.

Answer: Section 197(5) of the Companies Act, 2013 provides that a director may

receive remuneration by way of fee for attending the Board/Committee meetings or for

any other purpose as may be decided by the Board, provided that the amount of such

fees shall not exceed the amount as may be prescribed. The Central Government

through rules prescribed that the amount of sitting fees payable to a director for

attending meetings of the Board or committees thereof may be such as may be decided

© The Institute of Chartered Accountants of India

Appointment and Remuneration of Managerial Personnel 4.15

by the Board of directors or the Remuneration Committee thereof which shall not exceed

the sum of rupees 1 lakh per meeting of the Board or committee thereof. Further, the

Board may decide different sitting fee payable to independent and non-independent

directors other than whole-time directors.

From the above, it is clear that fee to independent directors can be increased from `

30,000 to ` 45,000 per meeting by passing a resolution in the Board Meeting and

alternating the Articles of Association by passing Special Resolution.

(v) Mode of payment of remuneration [Section 197(6)]: A director or manager may be

paid remuneration either by way of a monthly payment or at a specified percentage of

the net profits of the company or partly by one way and partly by the other.

(vi) Restriction on remuneration of Independent Director [Section 197(7)]:

Notwithstanding anything contained in any other provision of this Act but subject to the

provisions of this section, an independent director shall not be entitled to any stock

option and may receive remuneration by way of

(1) sitting fees in terms of section 197(5),

(2) reimbursement of expenses for participation in the Board and other meetings; and

(3) profit related commission as may be approved by the members.

(vii) Refund of excess remuneration paid to a director [Section 197(9)]: If any director

draws or receives, directly or indirectly, by way of remuneration any such sums in

excess of the limit prescribed by this section or without the prior sanction of the Central

Government, where it is required, he shall refund such sums to the company and until

such sum is refunded, hold it in trust for the company.

The company shall not waive the recovery of any sum refundable to it under sub-section

(9) unless permitted by the Central Government. [Section 197(10)]

(viii) Disclosure by listed company [Section 197(12)]:

(a) It shall disclose in the Board’s report, the ratio of the remuneration of each director to the

median employee’s remuneration and such other details as may be prescribed. The

details are prescribed under the Rule 5 of the Companies (Appointment and

Remuneration of Managerial personnel) Rules, 2014.

(b) The board’s report shall include a statement showing the names of the top ten

employees in terms of remuneration drawn and the name of every employee, who-

(i) if employed throughout the financial year, was in receipt of remuneration for that

year which, in the aggregate, was not less than one crore and two lakh rupees;

(ii) if employed for a part of the financial year, was in receipt of remuneration for any

part of that year, at a rate which, in the aggregate, was not less than eight lakh and

© The Institute of Chartered Accountants of India

4.16 Corporate and Allied Laws

fifty thousand rupees per month;

(iii) if employed throughout the financial year or part thereof, was in receipt of

remuneration in that year which, in the aggregate, or as the case may be, at a rate

which, in the aggregate, is in excess of that drawn by the managing director or

whole-time director or manager and holds by himself or along with his spouse and

dependent children, not less than two percent of the equity shares of the company.

(c) The statement referred to in above para (b) shall also indicate some particulars of the

above employees like designation, remuneration received, nature of employment,

qualification and experience, date of commencement of employment, age, last

employment held by such employee before joining the company, the percentage of equity

shares held by the employee in the company within the meaning of clause (iii) of para (b)

above, and whether any such employee is a relative of any director or manager of the

company and if so, name of such director or manager.

(ix) Insurance for indemnification [Section 197(13)]:

(a) Where any insurance is taken by a company on behalf of its managing director, whole-

time director, manager, Chief Executive Officer, Chief Financial Officer or Company

Secretary for indemnifying any of them against any liability in respect of any negligence,

default, misfeasance, breach of duty or breach of trust for which they may be guilty in

relation to the company, the premium paid on such insurance shall not be treated as part

of the remuneration payable to any such personnel.

(b) Provided that, if such person is proved to be guilty, the premium paid on such insurance

shall be treated as part of the remuneration.

(x) Receiving Commission [Section 197(14)]: Subject to the provisions of this section, any

director who is in receipt of any commission from the company and who is a managing or

whole-time director of the company shall not be disqualified from receiving any

remuneration or commission from any holding company or subsidiary company of such

company subject to its disclosure by the company in the Board’s report.

(xi) Contravention [Section 197(15)]: If any person contravenes the provisions of section

197, he shall be punishable with fine which shall not be less than ` 1 Lakh but which

may extend to ` 5 Lakhs.

Exemptions

(i) In case of Government Companies, section 197 shall not apply (Notification No.

G.S.R. 463(E) dated 5th June, 2015).

(ii) In case of Nidhis, second proviso to sub-section (1) of section 197 shall apply with

the modification that the remuneration of a director who is neither managing director

nor whole-time director or manager for performing special services to the Nidhis

© The Institute of Chartered Accountants of India

Appointment and Remuneration of Managerial Personnel 4.17

specified in the articles of association may be paid by way of monthly payment

subject to the approval of the company in general meeting and also to the

provisions of section 197:

Provided that no approval of the company in general meeting shall be required

where,-

(a) a Nidhi does not have a managing director or a whole-time director or a

manager;

(b) the remuneration payable during a financial year to all the directors of the Nidhi

does not exceed ten per cent. of the net profits of such Nidhi or fifteen lakh

rupees, whichever is less; and

(c) a remuneration payable under clause (b) is approved by a special resolution

passed in this behalf by the Nidhi (Notification No. G.S.R. 465(E) dated 5th

June, 2015)

(iii) In case of Specified IFSC Public Company - Section 197 shall not apply

(Notification Dated 4th January, 2017)

7. Recovery of managerial remuneration in certain cases [Section 199]

Section 199 of the Companies Act, 2013 provides for recovery of remuneration in certain

cases. According to this section:

Without prejudice to any liability incurred under the provisions of this Act or any other law for

the time being in force, where a company is required to re-state its financial statements due to

fraud or non-compliance with any requirement under this Act and the rules made thereunder,

the company shall recover from any past or present managing director or whole-time director

or manager or Chief Executive Officer (by whatever name called) who, during the period for

which the financial statements are required to be re-stated, received the remuneration

(including stock option) in excess of what would have been payable to him as per restatement

of financial statements.

8. Calculation of profits [Section 198]

According to section 198 of the Companies Act, 2013:

Net profits for the purpose of managerial remuneration payable under section

197 shall be calculated as follows:

(i) Credit shall be given for the sums specified in section 198(2)

Add: Bounties and subsidies received from any Government, or any public authority

constituted or authorised in this behalf, by any Government, unless and except in so far as the

Central Government otherwise directs.

© The Institute of Chartered Accountants of India

4.18 Corporate and Allied Laws

(ii) Credit shall not be given for those specified in section 198(3)

Less: (if credited to the P & L A/c for arriving at Profit before tax

(a) profits, by way of premium on shares or debentures of the company, which are issued or

sold by the company;

(b) profits on sales by the company of forfeited shares;

(c) profits of a capital nature including profits from the sale of the undertaking or any of the

undertakings of the company or of any part thereof;

(d) profits from the sale of any immovable property or fixed assets of a capital nature

comprised in the undertaking or any of the undertakings of the company, unless

the business of the company consists, whether wholly or partly, of buying and selling any

such property or assets:

Provided that where the amount for which any fixed asset is sold exceeds the written-

down value thereof, credit shall be given for so much of the excess as is not higher than

the difference between the original cost of that fixed asset and its written- down value;

(e) any change in carrying amount of an asset or of a liability recognised in equity reserves

including surplus in profit and loss account on measurement of the asset or the liability

at fair value.

(iii) Sums specified in section 198(4) shall be deducted

(a) all the usual working charges;

(b) directors’ remuneration;

(c) bonus or commission paid or payable to any member of the company’s staff, or to

any engineer, technician or person employed or engaged by the company, whether

on a whole-time or on a part-time basis;

(d) any tax notified by the Central Government as being in the nature of a tax on

excess or abnormal profits;

(e) any tax on business profits imposed for special reasons or in special circumstances

and notified by the Central Government in this behalf;

(f) interest on debentures issued by the company;

(g) interest on mortgages executed by the company and on loans and advances

secured by a charge on its fixed or floating assets;

(h) interest on unsecured loans and advances;

(i) expenses on repairs, whether to immovable or to movable property, provided the

repairs are not of a capital nature;

(j) outgoings inclusive of contributions made under section 181;

(k) depreciation to the extent specified in section 123;

© The Institute of Chartered Accountants of India

Appointment and Remuneration of Managerial Personnel 4.19

(l) the excess of expenditure over income, which had arisen in computing the net

profits in accordance with this section in any year which begins at or after the

commencement of this Act, in so far as such excess has not been deducted in any

subsequent year preceding the year in respect of which the net profits have to be

ascertained;

(m) any compensation or damages to be paid in virtue of any legal liability including a

liability arising from a breach of contract;

(n) any sum paid by way of insurance against the risk of meeting any liability such as is

referred to in clause (m) above;

(o) debts considered bad and written off or adjusted during the year of account.

(iv) Sums specified in section 198(5) shall not be deducted:

(a) income-tax and super-tax payable by the company under the Income-tax Act, 1961,

or any other tax on the income of the company not falling under clauses (d) and (e)

of sub-section (4) of Section 198;

(b) any compensation, damages or payments made voluntarily, that is to say, otherwise

than in the nature of a liability such as is referred to in clause (m) of sub-section (4)

of section 198;

(c) loss of a capital nature including loss on sale of the undertaking or any of the

undertakings of the company or of any part thereof not including any excess of the

written-down value of any asset which is sold, discarded, demolished or destroyed

over its sale proceeds or its scrap value;

(d) any change in carrying amount of an asset or of a liability recognised in equity

reserves including surplus in profit and loss account on measurement of the asset

or the liability at fair value.

9. Forms of, and procedure in relation to, certain applications

[Section 201]

When the company is not complying with condition given in Schedule V, then the company

would apply to Central Government for approval and the process for approval is given in

section 201.

According to section 201 of the Companies Act, 2013:

(i) Every application made to the Central Government under this Chapter shall be in

prescribed form and shall be accompanied by fee as may be specified for the purpose.

(ii) Before any application is made by a company to the Central Government under any of

the sections aforesaid, there shall be issued by or on behalf of the company a general

notice to the members thereof, indicating the nature of the application proposed to be

made.

(iii) Such notice shall be published at least once in a newspaper in the principal language of

© The Institute of Chartered Accountants of India

4.20 Corporate and Allied Laws

the district in which the registered office of the company is situate and circulating in that

district, and at least once in English in an English newspaper circulating in that district.

(iv) The copies of the notices, together with a certificate by the company as to the due

publication thereof, shall be attached to the application.

(v) Rule 7 of the Companies (Appointment and Remuneration of Managerial Personnel)

Rules, 2014, prescribes that the companies other than listed companies and subsidiary

of a listed company may without Central Government approval pay remuneration to its

managerial personnel, in the event of no profit or inadequate profit beyond ceiling

specified in Section II, Part II of Schedule V, subject to complying with the following

conditions namely:-

(a) Payment of remuneration is approved by a resolution passed by the Board and, in

the case of a company covered under sub-section (1) of section 178 also by the

Nomination and Remuneration Committee, if any. While doing so, the clear reason

and justification for payment of remuneration beyond the said limit has to be

recorded in writing.

(b) The company has not made any default in repayment of any of its debts (including

public deposits) or debentures or interest payable thereon, preference shares and

dividend on preference shares for a continuous period of thirty days in the

preceding financial year before the date of payment to such managerial personnel.

(c) The approval of shareholders by way of a special resolution at a general meeting of

the company for payment of remuneration for a period not exceeding three years.

(d) a statement along-with a notice calling the general meeting referred to above point

(c), shall contain the information as per sub clause (iv) of second proviso to clause

(B) of section II of part-II of Schedule V of the Act including reasons and justification

for payment of remuneration beyond the said limit.

(e) The company has filed Balance Sheet and Annual Return which are due to be filed

with the Registrar of Companies.

(f) Every such application seeking approval shall be made to the Central Government

within a period of ninety days from the date of such appointment.

10. Compensation for loss of office of managing or whole-time

Director or Manager [Section 202]

Section 202 of the Companies Act, 2013 provides the provisions for compensation for loss of

office of managing or whole-time director or manager as under:

(i) A company may make payment to a managing or whole-time director or manager, but not

to any other director, by way of compensation for loss of office, or as consideration for

retirement from office or in connection with such loss or retirement.

© The Institute of Chartered Accountants of India

Appointment and Remuneration of Managerial Personnel 4.21

(ii) No payment of compensation shall be made in the following cases:

(a) where the director resigns from his office as a result of the reconstruction of the

company, or of its amalgamation with any other body corporate or bodies corporate,

and is appointed as the managing or whole-time director, manager or other officer of

the reconstructed company or of the body corporate resulting from the

amalgamation;

(b) where the director resigns from his office otherwise than on the reconstruction of the

company or its amalgamation as aforesaid;

(c) where the office of the director is vacated under sub-section (1) of section 167;

(d) where the company is being wound up, whether by an order of the Tribunal or

voluntarily, provided the winding up was due to the negligence or default of the

director;

(e) where the director has been guilty of fraud or breach of trust in relation to, or of

gross negligence in or gross mismanagement of, the conduct of the affairs of the

company or any subsidiary company or holding company thereof; and

(f) where the director has instigated, or has taken part directly or indirectly in bringing

about, the termination of his office.

(iii) The compensation payable to such managing director or whole-time director or manager

shall not exceed the remuneration he would have earned if he would have been in office

for the remainder of his term or three years, whichever is shorter, calculated on the

basis of the average remuneration earned by him during a period of three years

immediately preceding the date on which he ceased to hold such office, or where he held

the office of less than three years, then for such shorter period.

(iv) No such payment however can be made at all if winding up of the company is

commenced whether before or within 12 months after, the date on which he ceased to

hold office, if the assets on winding up (after deducting expenses on winding up) are not

sufficient to repay the shareholders the capital, including premiums if any, contributed by

them.

(v) Nothing in this section shall be deemed to prohibit the payment to a managing or whole-

time director, or manager, of any remuneration for services rendered by him to the

company in any other capacity.

11. Secretarial Audit for bigger Companies [Section 204]

Section 204 of the Companies Act, 2013 provides the provisions for secretarial audit for bigger

companies which are as under:

(i) Companies that are required to conduct secretarial audit: Under Section 204(1),

every listed company and a company belonging to other class of companies as may be

prescribed, shall annex with its Board’s report made in terms of section 134 (3), a

© The Institute of Chartered Accountants of India

4.22 Corporate and Allied Laws

secretarial audit report, given by a company secretary in practice, in such form as may

be prescribed.

Rule 9 of the Companies (Appointment and Remuneration of Managerial Personnel)

Rules, 2014 provides that for the purposes of section 204 (1), the other class of

companies shall be as under:

(a) Every public company having a paid up share capital of ` 50 crore or more; or

(b) Every public company having a turnover of ` 250 crore or more.

The format of the Secretarial Audit Report shall be in Form No. MR. 3.

(ii) Duty of the company:

(a) It shall be the duty of the company to give all assistance and facilities to the

company secretary in practice, for auditing the secretarial and related records of the

company [Section 204(2)].

(b) The Board of Directors, in their Report prepared under section [134(3)] shall explain

in full any qualification or observation or other remarks made by the company

secretary in practice in his report [Section 204 (3)].

(iii) Contravention [Section 204(4)]: If a company or any officer of the company or the

company secretary in practice, contravenes the provisions of this section, then

(a) the company; or

(b) every officer of the company; or

(c) the company secretary in practice,

who is in default, shall be punishable with fine which shall not be less than ` 1 Lac but

which may extend to ` 5 Lacs.

12. Managerial Remuneration as per Part II, Part III and Part IV of

Schedule V

Part II

(i) Section I- Remuneration payable by companies having profits: Subject to the

provisions of section 197, a company having profits in a financial year may pay remuneration

to a managerial person or persons not exceeding the limits specified in such section.

(ii) Section II- Remuneration payable by companies having no profit or inadequate

profit without Central Government approval [Discussed in Para 6 of the Study material

u/s Section 197(3)]

(iii) Section III— Remuneration payable by companies having no profit or inadequate

profit without Central Government approval in certain special circumstances: In the

following circumstances a company may, without the Central Government approval, pay

© The Institute of Chartered Accountants of India

Appointment and Remuneration of Managerial Personnel 4.23

remuneration to a managerial person in excess of the amounts provided in Section II above:—

(a) where the remuneration in excess of the limits specified in Section I or II is paid by any

other company and that other company is either a foreign company or has got the

approval of its shareholders in general meeting to make such payment, and treats this

amount as managerial remuneration for the purpose of section 197 and the total

managerial remuneration payable by such other company to its managerial persons

including such amount or amounts is within permissible limits under section 197.

(b) where the company—

(i) is a newly incorporated company, for a period of seven years from the date of its

incorporation, or

(ii) is a sick company, for whom a scheme of revival or rehabilitation has been ordered

by the Board for Industrial and Financial Reconstruction for a period of five years

from the date of sanction of scheme of revival, or

(iii) is a company in relation to which a resolution plan has been approved by the

National Company Law Tribunal under the Insolvency and Bankruptcy Code, 2016

for a period of five years from the date of such approval, it may pay remuneration up

to two times the amount permissible under section II.

(c) where remuneration of a managerial person exceeds the limits in Section II but the

remuneration has been fixed by the Board for Industrial and Financial Reconstruction or

the National Company Law Tribunal:

Provided that the limits under this Section shall be applicable subject to meeting all the

conditions specified under Section II and the following additional conditions:-

(i) except as provided in para (a) of this Section, the managerial person is not

receiving remuneration from any other company;

(ii) the auditor or Company Secretary of the company or where the company has not

appointed a Secretary, a Secretary in whole-time practice, certifies that all secured

creditors and term lenders have stated in writing that they have no objection for the

appointment of the managerial person as well as the quantum of remuneration and

such certificate is filed along with the return as prescribed under sub-section (4)

of section 196.

(iii) the auditor or Company Secretary or where the company has not appointed a

secretary, a secretary in whole-time practice certifies that there is no default on

payments to any creditors, and all dues to deposit holders are being settled on time.

(d) a company in a Special Economic Zone as notified by Department of Commerce from

time to time which has not raised any money by public issue of shares or debentures in

© The Institute of Chartered Accountants of India

4.24 Corporate and Allied Laws

India, and has not made any default in India in repayment of any of its debts (including

public deposits) or debentures or interest payable thereon for a continuous period of

thirty days in any financial year, may pay remuneration up to ` 2,40,00,000 per annum.

(iv) Section IV— Perquisites not included in managerial remuneration:

1. A managerial person shall be eligible for the following perquisites which shall not be

included in the computation of the ceiling on remuneration specified in Section II and Section

III:-

(a) Contribution to provident fund, superannuation fund or annuity fund to the extent these

either singly or put together are not taxable under the Income-tax Act, 1961 (43 of 1961);

(b) gratuity payable at a rate not exceeding half a month’s salary for each completed year of

service; and

(c) Encashment of leave at the end of the tenure.

2. In addition to the perquisites specified in paragraph 1 of this section, an expatriate

managerial person (including a non-resident Indian) shall be eligible to the following

perquisites which shall not be included in the computation of the ceiling on remuneration

specified in Section II or Section III—

(a) Children’s education allowance: In case of children studying in or outside India, an

allowance limited to a maximum of ` 12,000 per month per child or actual expenses

incurred, whichever is less. Such allowance is admissible up to a maximum of two

children.

(b) Holiday passage for children studying outside India or family staying abroad: Return

holiday passage once in a year by economy class or once in two years by first class to

children and to the members of the family from the place of their study or stay abroad to

India if they are not residing in India, with the managerial person.

(c) Leave travel concession: Return passage for self and family in accordance with the rules

specified by the company where it is proposed that the leave be spent in home country

instead of anywhere in India.

Explanation I.—For the purposes of Section II of this Part, “effective capital” means the

aggregate of the paid-up share capital (excluding share application money or advances

against shares); amount, if any, for the time being standing to the credit of share premium

account; reserves and surplus (excluding revaluation reserve); long-term loans and deposits

repayable after one year (excluding working capital loans, over drafts, interest due on loans

unless funded, bank guarantee, etc., and other short-term arrangements) as reduced by the

aggregate of any investments (except in case of investment by an investment company whose

principal business is acquisition of shares, stock, debentures or other securities), accumulated

losses and preliminary expenses not written off.

© The Institute of Chartered Accountants of India

Appointment and Remuneration of Managerial Personnel 4.25

Explanation II.—

(a) Where the appointment of the managerial person is made in the year in which company

has been incorporated, the effective capital shall be calculated as on the date of such

appointment;

(b) In any other case the effective capital shall be calculated as on the last date of the

financial year preceding the financial year in which the appointment of the managerial

person is made.

Explanation III.— For the purposes of this Schedule, ‘‘family’’ means the spouse, dependent

children and dependent parents of the managerial person.

Explanation IV.— The Nomination and Remuneration Committee while approving the

remuneration under Section II or Section III, shall—

(a) take into account, financial position of the company, trend in the industry, appointee’s

qualification, experience, past performance, past remuneration, etc.;

(b) be in a position to bring about objectivity in determining the remuneration package while

striking a balance between the interest of the company and the shareholders.

Explanation V.— For the purposes of this Schedule, “negative effective capital” means the

effective capital which is calculated in accordance with the provisions contained in Explanation

I of this Part is less than zero.

Explanation VI.— For the purposes of this Schedule:—

(A) “current relevant profit” means the profit as calculated under section 198 but without

deducting the excess of expenditure over income referred to in sub-section 4

(l) thereof in respect of those years during which the managerial person was not an

employee, director or shareholder of the company or its holding or subsidiary companies.

(B) “Remuneration” means remuneration as defined in clause (78) of section 2 and includes

reimbursement of any direct taxes to the managerial person.

(v) Section V—Remuneration payable to a managerial person in two companies:

Subject to the provisions of sections I to IV, a managerial person shall draw remuneration from

one or both companies, provided that the total remuneration drawn from the companies does

not exceed the higher maximum limit admissible from any one of the companies of which he is

a managerial person.

PART III- Provisions applicable to Parts I and II of this Schedule

1. The appointment and remuneration referred to in Part I and Part II of this Schedule shall

be subject to approval by a resolution of the shareholders in general meeting.

© The Institute of Chartered Accountants of India

4.26 Corporate and Allied Laws

2. The auditor or the Secretary of the company or where the company is not required to

appointed a Secretary, a Secretary in whole-time practice shall certify that the requirement of

this Schedule have been complied with and such certificate shall be incorporated in the return

filed with the Registrar under sub-section (4) of section 196.

PART IV: Exemption by the Central Government

The Central Government may, by notification, exempt any class or classes of companies from

any of the requirements contained in this Schedule.

The MCA vide General Circular No. 07/2015 dated 10th April, 2015 has clarified that a

managerial person who has been appointed in accordance with provisions of Schedule XIII of

the Companies Act, 1956, may continue to receive remuneration for his remaining term in

accordance with terms and conditions approved by company as per relevant provisions of

Schedule XIII of 1956 Act even if the part of his/her tenure falls after 1st April, 2014.

RELEVANT AMENDMENTS

Amendments through the Companies (Amendment) Act, 2017

Relevant Amendment Status

Sections

Amendment in clause (51), — Notified

in Section (a) in sub-clause (iv), the word "and" shall be omitted; till 30th

2(51) April,

(b) for sub-clause (v), the following sub-clauses shall be

2018

substituted, namely:—

"(v) such other officer, not more than one level below the

directors who is in whole-time employment, designated

as key managerial personnel by the Board; and

(vi) such other officer as may be prescribed;"

Amendment In section 196 of the principal Act,— Not

of section (a) in sub-section (3), in clause (a), after the proviso, the notified

196 following proviso shall be inserted, namely:— till 30th

April,

“Provided further that where no such special resolution is

2018

passed but votes cast in favour of the motion exceed the

votes, if any, cast against the motion and the Central

Government is satisfied, on an application made by the

Board, that such appointment is most beneficial to the

company, the appointment of the person who has attained

the age of seventy years may be made.”;

© The Institute of Chartered Accountants of India

Appointment and Remuneration of Managerial Personnel 4.27

(b) in sub-section (4), for the words “specified in that

Schedule”, the words “specified in Part I of that Schedule”

shall be substituted.

Amendment In section 197 of the principal Act,— Not

of Section (a) in sub-section (1),— notified

197 till 30th

(i) in the first proviso, the words "with the approval of

April,

the Central Government," shall be omitted;

2018

(ii) in the second proviso, after the words "general

meeting,", the words "by a special resolution," shall be

inserted;

(iii) after the second proviso, the following proviso shall

be inserted, namely:—

"Provided also that, where the company has

defaulted in payment of dues to any bank or public

financial institution or non-convertible debenture

holders or any other secured creditor, the prior

approval of the bank or public financial institution

concerned or the non-convertible debenture holders

or other secured creditor, as the case may be, shall

be obtained by the company before obtaining the

approval in the general meeting.";

(b) in sub-section (3), the words "and if it is not able to

comply with such provisions, with the previous approval

of the Central Government" shall be omitted;

(c) for sub-section (9), the following sub-section shall be

substituted, namely:—

"(9) If any director draws or receives, directly or

indirectly, by way of remuneration any such sums in

excess of the limit prescribed by this section or without

approval required under this section, he shall refund

such sums to the company, within two years or such

lesser period as may be allowed by the company, and

until such sum is refunded, hold it in trust for the

company.";

(d) in sub-section (10),—

(i) for the words "permitted by the Central Government",

the words "approved by the company by special

resolution within two years from the date the sum

© The Institute of Chartered Accountants of India

4.28 Corporate and Allied Laws

becomes refundable" shall be substituted;

(ii) the following proviso shall be inserted, namely:—

"Provided that where the company has defaulted in

payment of dues to any bank or public financial

institution or non-convertible debenture holders or

any other secured creditor, the prior approval of the

bank or public financial institution concerned or the

non-convertible debenture holders or other secured

creditor, as the case may be, shall be obtained by

the company before obtaining approval of such

waiver.";

(e) in sub-section (11), the words "and if such conditions are not

being complied, the approval of the Central Government

had been obtained" shall be omitted;

(f) after sub-section (15), the following sub-sections shall be

inserted, namely:—

"(16) The auditor of the company shall, in his report under

section 143, make a statement as to whether the

remuneration paid by the company to its directors is

in accordance with the provisions of this section,

whether remuneration paid to any director is in

excess of the limit laid down under this section and

give such other details as may be prescribed.

(17) On and from the commencement of the Companies

(Amendment) Act, 2017, any application made to the

Central Government under the provisions of this

section [as it stood before such commencement],

which is pending with that Government shall abate,

and the company shall, within one year of such

commencement, obtain the approval in accordance

with the provisions of this section, as so amended."

Amendment In section 198 of the principal Act,— Not

of Section (i) in sub-section (3),— notified

198 till 30th

(a) in clause (a), after the words “sold by the company”,

April,

the words, letter, brackets and figures “unless the

2018

company is an investment company as referred to in

clause (a) of the Explanation to section 186” shall be

inserted;

© The Institute of Chartered Accountants of India

Appointment and Remuneration of Managerial Personnel 4.29

(b) after clause (e), the following clause shall be inserted,

namely:—

“(f) any amount representing unrealised gains,

notional gains or revaluation of assets.”;

(ii) in sub-section (4), in clause (l), the words "which begins

at or after the commencement of this Act" shall be

omitted.

Amendment In section 200 of the principal Act, the words "the Central Not

of section Government or" appearing at both the places shall be omitted. notified

200. till 30th

April,

2018

Amendment In section 201 of the principal Act,— Not

of section (a) in sub-section (1), for the words "this Chapter", the word notified

201. and figures "section 196" shall be substituted; till 30th

April,

(b) in sub-section (2), in clause (a), for the words "any of the

2018

sections aforesaid", the word and figures "section 196"

shall be substituted.

© The Institute of Chartered Accountants of India

You might also like

- Henkel 2016 Annual ReportDocument202 pagesHenkel 2016 Annual ReportjonnyNo ratings yet

- KMPDocument31 pagesKMPGautam IyerNo ratings yet

- 1 - Appointment and Remuneration of Managerial Person (20!06!19)Document31 pages1 - Appointment and Remuneration of Managerial Person (20!06!19)AakashNo ratings yet

- Appointment and Remuneration of M (1)Document25 pagesAppointment and Remuneration of M (1)sakshamNo ratings yet

- APPOINTMENTDocument3 pagesAPPOINTMENTKeerthanaNo ratings yet

- APPOINTMENT & REMUNERATION cover.p65Document4 pagesAPPOINTMENT & REMUNERATION cover.p65KeerthanaNo ratings yet

- CH 2 (52 Pages)Document52 pagesCH 2 (52 Pages)Dipin GargNo ratings yet

- Appointment and Remuneration of Managerial PersonnelDocument20 pagesAppointment and Remuneration of Managerial PersonnelMuhammed ShabeebNo ratings yet

- Chapter 14 KMPDocument11 pagesChapter 14 KMPjaoceelectricalNo ratings yet

- 74850bos60513 m1 cp2Document52 pages74850bos60513 m1 cp2SlyArnieNo ratings yet

- Legal Provisions Relating To Managing Director / Whole-Time DirectorDocument10 pagesLegal Provisions Relating To Managing Director / Whole-Time DirectorSoumitra ChawatheNo ratings yet

- Appointment and Remuneration of Managerial Personnel: Presentation by CA Anil SharmaDocument21 pagesAppointment and Remuneration of Managerial Personnel: Presentation by CA Anil SharmaMenuka SiwaNo ratings yet

- Appointment & Remuneration of Managerial Personnel (Sec 196 To Sec 205)Document24 pagesAppointment & Remuneration of Managerial Personnel (Sec 196 To Sec 205)naga jaganNo ratings yet

- 56 09 Appointment of Managerial Personnel Analysis Part IDocument6 pages56 09 Appointment of Managerial Personnel Analysis Part IAakriti ChawlaNo ratings yet

- Project Report Managerail Remuneration - FinalDocument28 pagesProject Report Managerail Remuneration - FinalBACNo ratings yet

- Lecture 4 - Key Managerial PersonnelDocument11 pagesLecture 4 - Key Managerial Personnel22bba044No ratings yet

- 274 DisqualificationDocument8 pages274 DisqualificationLucknow Chapter Nirc IcsiNo ratings yet

- Appointment, Remunaration, Powers, Duties and Liabilities of The Auditor Appointmentand Audit of Share Capital and Pre-Incroparation ProfitDocument22 pagesAppointment, Remunaration, Powers, Duties and Liabilities of The Auditor Appointmentand Audit of Share Capital and Pre-Incroparation Profitirshad_cbNo ratings yet

- Establishment and Incorporation of Life Insurance Corporation of India. - (1) With EffectDocument17 pagesEstablishment and Incorporation of Life Insurance Corporation of India. - (1) With Effectravi adhwaryuNo ratings yet

- Whole Time DirectorDocument4 pagesWhole Time DirectorBHUVANA THANGAMANINo ratings yet

- Law S2 AnswersDocument7 pagesLaw S2 Answerskomalchandwani.dnlNo ratings yet

- Section 196 of Companies ActDocument3 pagesSection 196 of Companies ActPAYAL SENGUPTANo ratings yet

- Schedule Xiii (See Ss. 198, 269, 310 and 311) : AppointmentsDocument8 pagesSchedule Xiii (See Ss. 198, 269, 310 and 311) : Appointmentsm_ch_64No ratings yet

- Directors_Appointment_Duties etc_@clcstudents23_1Document7 pagesDirectors_Appointment_Duties etc_@clcstudents23_1amityadav10112001No ratings yet

- (Ii) (Iii) (Iv)Document7 pages(Ii) (Iii) (Iv)Vishwanth Sagar SNo ratings yet

- Chapter 2 - Directors: Company LawDocument27 pagesChapter 2 - Directors: Company LawKhyati SethNo ratings yet

- Appointment, Powers, Duties and Liabilities of The Auditor Appointment QualificationsDocument20 pagesAppointment, Powers, Duties and Liabilities of The Auditor Appointment QualificationsJawahar KumarNo ratings yet

- 5.1 OFFICERS OF COMPANY DIRECTOR NewDocument73 pages5.1 OFFICERS OF COMPANY DIRECTOR NewTengku Kamilia00No ratings yet

- Managerial Remuneration QBDocument24 pagesManagerial Remuneration QBMuhammed ShabeebNo ratings yet

- Mumbai Port Trust Acceptance of Employment After Retirement 1975Document11 pagesMumbai Port Trust Acceptance of Employment After Retirement 1975Latest Laws TeamNo ratings yet

- Topic 7 (Law303)Document43 pagesTopic 7 (Law303)carazamanNo ratings yet

- Appointment and Remuneration of Managerial Personnel: Companies Act 2013Document10 pagesAppointment and Remuneration of Managerial Personnel: Companies Act 2013Sahib AulakhNo ratings yet

- Audit and AssuranceDocument15 pagesAudit and AssuranceJones MaryNo ratings yet

- Draft_Agreement_Managing_Director_CEO_21022022Document9 pagesDraft_Agreement_Managing_Director_CEO_21022022advocate pathanNo ratings yet

- Independent Directors: Companies Act 2013, Rules Latest AmendmentsDocument43 pagesIndependent Directors: Companies Act 2013, Rules Latest Amendmentsgdmurugan2k7No ratings yet