Rbiformat 092009

Rbiformat 092009

Uploaded by

Ketan VermaCopyright:

Available Formats

Rbiformat 092009

Rbiformat 092009

Uploaded by

Ketan VermaOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Copyright:

Available Formats

Rbiformat 092009

Rbiformat 092009

Uploaded by

Ketan VermaCopyright:

Available Formats

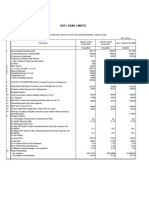

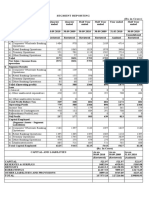

Union Bank of India

UNAUDITED FINANCIAL RESULTS FOR THE QUARTER AND HALF YEAR ENDED 30.09.2009

(Rs. in lacs)

Sr. Particulars Quarter Ended Half Year Ended Year Ended

No. 30.09.2009 30.09.2008 30.09.2009 30.09.2008 31.03.2009

(Reviewed) (Reviewed) (Reviewed) (Reviewed) (Audited)

1 Interest earned ( a+b+c+d ) 320558 282897 638086 534128 1188938

a) Interest/Discount on Advances/Bills 234135 214095 469395 398239 889336

b) Income on investments 83742 67009 163648 133144 283086

c) Interest on balances with RBI and other interbank funds 1381 1671 3320 2512 6801

d) Others 1300 122 1723 233 9715

2 Other Income 55532 28556 108404 52813 148255

3 Total Income ( 1+2 ) 376090 311453 746490 586941 1337193

4 Interest Expended 234218 185596 471584 357915 807581

5 Operating Expenses ( i+ii ) 60864 55885 115149 97453 221412

i) Employees cost 30585 29163 60639 51632 115188

ii) Other operating expenses 30279 26722 54510 45821 106224

6 Total Expenditure ( 4+5 ) 295082 241481 586733 455368 1028993

(excluding provisions & contingencies)

7 Operating Profit {before prov. & contigenies} (3-6 ) 81008 69972 159757 131573 308200

8 Provisions ( other than tax ) and Contingencies 13498 20326 32528 49898 73745

9 Exceptional Items 0 0 0 0 0

10 Profit (+) / Loss(-) from Ordinary Activities before tax (7-8-9) 67510 49646 127229 81675 234455

11 Tax expense 17000 13500 32500 22700 61800

12 Net Profit (+) / Loss(-) from Ordinary Activities after Tax (10-11) 50510 36146 94729 58975 172655

13 Extraordinary items (net of tax expense) 0 0 0 0 0

14 Net Profit (+) / Loss (-) for the period (12-13) 50510 36146 94729 58975 172655

15 Paid -up equity share capital 50512 50512 50512 50512 50512

16 Reserves excluding Revaluation Reserves 654926

(as per Balance sheet of previous accounting year)

17 Analytical Ratios

i) Percentage of shares held by

Government of India (%) 55.43 55.43 55.43 55.43 55.43

ii) a) Capital Adequacy Ratio (%) - Basel I - 12.53 - 12.53 12.01

b) Capital Adequacy Ratio (%) - Basel II 13.76 - 13.76 - 13.27

iii) Earning per share(EPS) at face value Rs.10/- (Rs.)

a) Basic and diluted EPS before Extraordinary items (net of tax expense) for the

10.00 7.16 18.75 11.68 34.18

period, for the year to date and for the previous year (not annualised)

b) Basic and diluted EPS after Extraordinary items for the period, for the year to

10.00 7.16 18.75 11.68 34.18

date and for the previous year (not annualised)

iv ) NPA Ratios

a) Gross NPA 191858 167472 191858 167472 192334

b) Net NPA 22293 11620 22293 11620 32594

c) % Gross NPA 1.93 1.93 1.93 1.93 1.96

d) % Net NPA 0.23 0.14 0.23 0.14 0.34

e) Return on Assets (annualised) (%) 1.25 1.12 1.19 0.93 1.27

18 Public Shareholding

No. of Shares (in lacs) 2251 2251 2251 2251 2251

% of Shareholding 44.57 44.57 44.57 44.57 44.57

19 Promoters and Promoter Group Shareholding

(a) Pledged / Encumbered

No. of Shares Nil Nil Nil Nil Nil

Percentage of shares ( as a percentage of the total sharteholding of

promoter and promoter group) Nil Nil Nil Nil Nil

Percentage of shares (as a percentage of the total share capital of the

company) Nil Nil Nil Nil Nil

(b) Non-encumbered

No. of Shares (in lacs) 2800 2800 2800 2800 2800

Percentage of shares ( as a percentage of the total sharteholding of

promoter and promoter group) 100% 100% 100% 100% 100%

Percentage of shares (as a percentage of the total share capital of the company) 55.43 55.43 55.43 55.43 55.43

You might also like

- Parts Manual: S135XL, S155XL (S6.00XL, S7.00XL) (B024)Document698 pagesParts Manual: S135XL, S155XL (S6.00XL, S7.00XL) (B024)vitor rodrigues100% (1)

- Acog Practice Bulletin: Pregestational Diabetes MellitusDocument21 pagesAcog Practice Bulletin: Pregestational Diabetes MellitusGia DuyNo ratings yet

- Schaum's Outline of Principles of Accounting I, Fifth EditionFrom EverandSchaum's Outline of Principles of Accounting I, Fifth EditionRating: 5 out of 5 stars5/5 (3)

- Accumulator Discharging and Charging Procedures (0738, 4263, 4264, 4331, 5077, 5077, 5081, 7474)Document24 pagesAccumulator Discharging and Charging Procedures (0738, 4263, 4264, 4331, 5077, 5077, 5081, 7474)Odai AlsaafinNo ratings yet

- Central Bank of IndiaDocument1 pageCentral Bank of IndiaRohit bitpNo ratings yet

- 1272380424153-SEBI - FORMAT March2010Document5 pages1272380424153-SEBI - FORMAT March2010Harshitha UchilNo ratings yet

- BsheetDocument4 pagesBsheetDeepak KumarNo ratings yet

- HDFC Bank Limited: (Excluding Provisions & Contingencies)Document4 pagesHDFC Bank Limited: (Excluding Provisions & Contingencies)ash82No ratings yet

- Solo Financial Results For Quarter and Year Ended March 31 2019Document3 pagesSolo Financial Results For Quarter and Year Ended March 31 2019BILLA SAMUELNo ratings yet

- 6month Audited ResultsDocument2 pages6month Audited ResultsJessica HarveyNo ratings yet

- Com Merx Npoint ServletsDocument1 pageCom Merx Npoint Servletssgoswami_1No ratings yet

- Q4FY09 StandaloneDocument2 pagesQ4FY09 Standalonesangeetachandra87No ratings yet

- Sep 2010-Audited ResultsDocument2 pagesSep 2010-Audited ResultsRam KumarNo ratings yet

- Karnataka Bank LTDDocument7 pagesKarnataka Bank LTDVishal BhojaniNo ratings yet

- MRF QTR 1 14 15 PDFDocument1 pageMRF QTR 1 14 15 PDFdanielxx747No ratings yet

- Sep 2010-Audited ResultsDocument2 pagesSep 2010-Audited Resultssalilsingh86No ratings yet

- Fin ResultsDocument2 pagesFin Resultsparimal2010No ratings yet

- Allahabad Bank:, Ill IutuiDocument17 pagesAllahabad Bank:, Ill IutuiAnupamdwivediNo ratings yet

- MRF Limited: (Rs. in Lakhs)Document2 pagesMRF Limited: (Rs. in Lakhs)danielxx747No ratings yet

- Re: Bank of Baroda - Reviewed Standalone & Consolidated Financial Results - Q2 (FY2022-23) - Regulation 33 of SEBI (LODR) Regulations, 2015Document43 pagesRe: Bank of Baroda - Reviewed Standalone & Consolidated Financial Results - Q2 (FY2022-23) - Regulation 33 of SEBI (LODR) Regulations, 2015Mahesh DhalNo ratings yet

- Polo 1Document2 pagesPolo 1Kaif KidwaiNo ratings yet

- Review Report 311210Document1 pageReview Report 311210Hriday PandeyNo ratings yet

- Announces Q3 Results (Standalone) & Limited Review Report (Standalone) For The Quarter Ended December 31, 2016 (Result)Document8 pagesAnnounces Q3 Results (Standalone) & Limited Review Report (Standalone) For The Quarter Ended December 31, 2016 (Result)Shyam SunderNo ratings yet

- Fy 2010-11Document3 pagesFy 2010-11chhayachouhanNo ratings yet

- Standalone Financial Results, Limited Review Report For December 31, 2016 (Result)Document3 pagesStandalone Financial Results, Limited Review Report For December 31, 2016 (Result)Shyam SunderNo ratings yet

- Uco BankDocument8 pagesUco BankRishabh KumarNo ratings yet

- PDF Fin1 25-May-2007Document2 pagesPDF Fin1 25-May-2007Mufeed UbaidNo ratings yet

- QR September 2009 VILDocument3 pagesQR September 2009 VILsamarth6665No ratings yet

- The Accompanying Notes Are An Integral Part of The Financial StatementsDocument11 pagesThe Accompanying Notes Are An Integral Part of The Financial StatementsRavi BhartiaNo ratings yet

- Q 3 March 2010Document2 pagesQ 3 March 2010Saurabh SinghNo ratings yet

- Bse Limited The National Stock Exchange of India LimitedDocument8 pagesBse Limited The National Stock Exchange of India LimitedFareen SyedNo ratings yet

- LVB Audited Financials 31032019Document9 pagesLVB Audited Financials 31032019Maran VeeraNo ratings yet

- Final2010 PressAddwith CFSDocument1 pageFinal2010 PressAddwith CFStihadaNo ratings yet

- Ramco Q3 2019-20Document4 pagesRamco Q3 2019-20VIGNESH RKNo ratings yet

- Publication 30-06-09Document2 pagesPublication 30-06-09SuhasNo ratings yet

- Standalone Financial Results, Limited Review Report For December 31, 2016 (Result)Document3 pagesStandalone Financial Results, Limited Review Report For December 31, 2016 (Result)Shyam SunderNo ratings yet

- Fin Results - 31.03.2024 - EngDocument8 pagesFin Results - 31.03.2024 - EngMadhuparna ChakrabortyNo ratings yet

- Statement of Audited Financial Results For The Quarter and Year Ended 31 March 2017Document11 pagesStatement of Audited Financial Results For The Quarter and Year Ended 31 March 2017Narsingh Das AgarwalNo ratings yet

- Tml q4 Fy 23 Consolidated ResultsDocument5 pagesTml q4 Fy 23 Consolidated Resultsprajwalchaurasia8No ratings yet

- (Lacs) Statement of Standalone Unaudited Results For The Quarter Ended March 31, 2013Document4 pages(Lacs) Statement of Standalone Unaudited Results For The Quarter Ended March 31, 2013Ravi AgarwalNo ratings yet

- The Catholic Syrian Bank LimitedDocument2 pagesThe Catholic Syrian Bank Limitedsaravanan aNo ratings yet

- BOIResultDocument8 pagesBOIResultAbhishek ParmarNo ratings yet

- Standalone Financial Results, Limited Review Report For December 31, 2016 (Result)Document6 pagesStandalone Financial Results, Limited Review Report For December 31, 2016 (Result)Shyam SunderNo ratings yet

- Balance Sheet AnalysisDocument8 pagesBalance Sheet Analysisramyashraddha18No ratings yet

- CMA NewDocument7 pagesCMA NewKrishna MohanNo ratings yet

- National Stock Exchange of India LimitedDocument2 pagesNational Stock Exchange of India LimitedAnonymous DfSizzc4lNo ratings yet

- Uflex Audited Consolidated Results 31st March 2019Document4 pagesUflex Audited Consolidated Results 31st March 2019markelonnNo ratings yet

- KER2Document11 pagesKER2CA Akash AgrawalNo ratings yet

- Capital FirstDocument92 pagesCapital FirstviswanathNo ratings yet

- Aurobindo Mar20Document10 pagesAurobindo Mar20free meNo ratings yet

- L 1 Rev Acc 31 12 2019Document1 pageL 1 Rev Acc 31 12 2019V KeshavdevNo ratings yet

- Cipla - Unaudited Fin Result For The Quarter Ended 30th June 2010Document4 pagesCipla - Unaudited Fin Result For The Quarter Ended 30th June 2010thelostbardNo ratings yet

- Dec 2021Document2 pagesDec 2021akshay kausaleNo ratings yet

- Segment Reporting (Rs. in Crore)Document4 pagesSegment Reporting (Rs. in Crore)Vishal ModiNo ratings yet

- Financial Results of Hardwyn India Sept 2023Document9 pagesFinancial Results of Hardwyn India Sept 2023prashant_natureNo ratings yet

- Go Rural FM AssignmentDocument31 pagesGo Rural FM AssignmentHumphrey OsaigbeNo ratings yet

- December22 AGMDocument2 pagesDecember22 AGMakshay kausaleNo ratings yet

- November12 AGMDocument4 pagesNovember12 AGMakshay kausaleNo ratings yet

- Kinetic Engineering Limited Regd - Off.: D-1 Block, Plot No.18/2, Chinchwad, Pune - 411019Document4 pagesKinetic Engineering Limited Regd - Off.: D-1 Block, Plot No.18/2, Chinchwad, Pune - 411019karmjeethundalNo ratings yet

- Vinyl Chemicals (India) LTDDocument6 pagesVinyl Chemicals (India) LTDRAROLINKSNo ratings yet

- Financial Results, Limited Review Report For December 31, 2015 (Result)Document4 pagesFinancial Results, Limited Review Report For December 31, 2015 (Result)Shyam SunderNo ratings yet

- Financial Results - Q1 FY24Document6 pagesFinancial Results - Q1 FY24kamlajshekharNo ratings yet

- Q3- 2021 Supreme IndustryDocument11 pagesQ3- 2021 Supreme IndustrychipmartsalesNo ratings yet

- Druid Spell ListDocument23 pagesDruid Spell ListKarine LahaieNo ratings yet

- THE MEANING AND PURPOSE OF HUMAN SEXUALITY by Samuel B. BataraDocument3 pagesTHE MEANING AND PURPOSE OF HUMAN SEXUALITY by Samuel B. BataraSamu BataNo ratings yet

- Fracture of Shaft FemurDocument55 pagesFracture of Shaft FemurFadliArifNo ratings yet

- Data Table Translation FileDocument1 pageData Table Translation FileGat SolzaimaNo ratings yet

- DSASW0071941Document68 pagesDSASW0071941ali mohammedNo ratings yet

- Laboratory Information SystemDocument3 pagesLaboratory Information SystemhasselNo ratings yet

- Rocky Mountain Chocolate Factory IncDocument13 pagesRocky Mountain Chocolate Factory IncIza Balagtas0% (1)

- Appendix A - SUNTECH Datasheet PDFDocument2 pagesAppendix A - SUNTECH Datasheet PDFKhalid El MasryNo ratings yet

- Paul and Timothy Final ProposalDocument33 pagesPaul and Timothy Final ProposalEpa PaulNo ratings yet

- General EducationDocument2 pagesGeneral EducationApril Joyce Narciso ArceoNo ratings yet

- ICAAP KnowledgeDocument32 pagesICAAP KnowledgeAsim JavedNo ratings yet

- Presentation Social Isolation2Document20 pagesPresentation Social Isolation2MariagmzNo ratings yet

- A Descriptive Study of The Attitude and Experiences of Donor Mothers in A Human Milk Bank at A Tertiary Healthcare CentreDocument8 pagesA Descriptive Study of The Attitude and Experiences of Donor Mothers in A Human Milk Bank at A Tertiary Healthcare CentreIJAR JOURNALNo ratings yet

- CVXVXDocument2 pagesCVXVXRahul JainNo ratings yet

- Water Quality MonitoringDocument3 pagesWater Quality MonitoringJoa YupNo ratings yet

- Low Sac NozzleDocument2 pagesLow Sac NozzleNguyễn Đình ĐứcNo ratings yet

- CBSE - GR 8 - Final Website Syllabus - Half Yearly - AY 21-22 - SZDocument13 pagesCBSE - GR 8 - Final Website Syllabus - Half Yearly - AY 21-22 - SZashwinimadavanNo ratings yet

- Accepted Manuscript: Journal of The Neurological SciencesDocument31 pagesAccepted Manuscript: Journal of The Neurological SciencesZelNo ratings yet

- Process Mapping in A Dental Clinic PDFDocument29 pagesProcess Mapping in A Dental Clinic PDFmikelNo ratings yet

- Final Main TextDocument2 pagesFinal Main TextCedric EscobiaNo ratings yet

- Report Separations FinalDocument6 pagesReport Separations FinalBrian MasauliNo ratings yet

- Assignment No. 1: Course: Hydraulic Engineering I&D-501 Due Date: 12 March 2021Document2 pagesAssignment No. 1: Course: Hydraulic Engineering I&D-501 Due Date: 12 March 2021Aarish MaqsoodNo ratings yet

- Ficha TécnicaDocument3 pagesFicha TécnicaCabire Isabel Maza MartínezNo ratings yet

- Underground Water Tanks: ... A Hygienic Way of Water StorageDocument2 pagesUnderground Water Tanks: ... A Hygienic Way of Water Storagearjun 11No ratings yet

- RCC Study Skills Workshop 03 ExamsDocument39 pagesRCC Study Skills Workshop 03 Examssohailamin002No ratings yet

- X-RaysDocument118 pagesX-RaysKross OgbeborNo ratings yet

- Characterization of Polymer Molecular Mass Distribution From Rheological MeasurementsDocument18 pagesCharacterization of Polymer Molecular Mass Distribution From Rheological MeasurementsInorfTIVE Reciclagem TecnológicaNo ratings yet