2018-1383 Samsona, Melanie S.

2018-1383 Samsona, Melanie S.

Uploaded by

Melanie SamsonaCopyright:

Available Formats

2018-1383 Samsona, Melanie S.

2018-1383 Samsona, Melanie S.

Uploaded by

Melanie SamsonaCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Copyright:

Available Formats

2018-1383 Samsona, Melanie S.

2018-1383 Samsona, Melanie S.

Uploaded by

Melanie SamsonaCopyright:

Available Formats

Melanie S.

Samsona 2018-1383

CASH AND ACCRUAL BASIS OF ACCOUNTING

Compare and contrast cash and accrual basis of accounting.

The main difference between accrual and cash basis accounting lies in the timing of when

revenue and expenses are recognized.

Cash Basis of Accounting

It is a system that recognizes revenue when cash is received and recognizes expenses

when cash is paid. This method does not recognize accounts receivable or accounts payable.

Accrual Basis of Accounting

It is an accounting system that recognizes revenue when earned rather than when cash

is received and recognizes expenses as it is incurred rather than when cash is paid.

Items of Comparison Cash Basis Accrual Basis

Sales Includes: Includes:

● Cash sales ● Cash sales

● Collection of trade ● Credit sales (sale on

accounts receivable account)

● Collection of trade

notes receivable

Income other than sales Includes only those collected Includes those items earned

during the period during the period

Purchases Includes the following: Includes:

● Cash purchase ● Cash purchases

● Payment of trade ● Purchase on account

accounts payable

● Payment of trade

notes payable

● Payment in advance

to suppliers

Expenses, in general Includes only those expenses Includes those items that are

that are paid incurred regardless of when

paid

Depreciation Depreciation is typically Depreciation is typically

provided except when the provided.

cost of equipment was

treated as expense

Bad debts No bad debts expense is Doubtful accounts are treated

recognized since the cash as bad debts.

basis does not recognize

receivables. Although some

problems may give an

indication that the accounts

written off were charged to

bad debt expense.

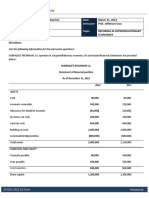

PROBLEM 5-11

The following balances have been excerpted from Potassium’s Statement of

Financial Position for the year 2018:

January 1 December 31

Accounts receivable 200,000 300,000

Allowance for bad debts 20,000 30,000

Merchandise Inventory 380,000 330,000

Accounts payable 150,000 100,000

Accounts receivable written off 50,000

Cash received from customers 1,498,000

Cash paid to trade creditors 1,200,000

Sales discounts 20,000

Purchase returns 10,000

Rental receivables 70,000 80,000

Rental payable 60,000 35,000

Cash received from tenants 120,000

Additional information:

● Collections from customers included customer’s deposit of ₱80,000 of

which ₱20,000 selling price of goods were already shipped and

received by the customer. The shipment of goods was not recorded by

the company although the cost of merchandise was properly excluded

in the count.

● Collections from customers also included ₱30,000 payment from

customers of accounts receivable in which a check dated January 15,

2019 was received.

● Collections also included recovery of accounts previously written off

amounting to ₱8,000.

● Included in the payment to trade creditors was a check drawn and

recorded by the company to the supplier in December 2018 amounting

to ₱20,000 which was delivered to the payee on January 10, 2019.

● Also, the company did not record payment to supplier amounting to

₱30,000.

Questions:

Determine the accrual balance of the following as of December 31, 2018:

1. Net sales

a. P 1,400,000

b. P 1,550,000

c. P 1,470,000

d. P 1,570,000

2. Net purchases

a. P 1,130,000

b. P 1,160,000

c. P 1,140,000

d. P 1,170,000

3. Cost of Sales

a. P 1,180,000

b. P 1,210,000

c. P 1,490,000

d. P 1,220,000

4. Rent income

a. P 130,000

b. P 155,000

c. P 145,000

d. P 135,000

5. Bad debts expense

a. P 52,000

b. P 60,000

c. P 22,000

d. P 12,000

Solutions:

Question no. 1

Accounts receivable

Beg. Balance 200,000 300,000 Balance end

Recoveries 8,000 20,000 Sales discounts

Sales (squeezed) 1,570,000 1,408,000 Collections including recoveries

50,000 Accounts written-off

Total 1,778,000 1,778,000

Cash received from customers 1,498,000

Customer’s deposit (80,000)

Goods already shipped and received 20,000

Post-dated check (30,000)

Collections including recoveries 1,408,000

Sales 1,570,000

Less: Sales discount 20,000

Net Sales 1,550,000

Question no. 2

Accounts payable

Payment 1,210,000 150,000 Beg. Balance

Purchase ret. and allow. 10,000 1,170,000 Purchases (squeezed)

Balance end 100,000

Total 1,320,000 1,320,000

Cash paid to trade creditors 1,200,000

Undelivered check (20,000)

Unrecorded payment to supplier 30,000

Payment 1,210,000

Purchases 1,170,000

Less: Purchases discount 10,000

Net Purchases 1,160,000

Question no. 3

Merchandise inventory

Beg. Balance 380,000 330,000 Balance end

Net Purchases 1,160,000 1,210,000 Cost of Sales (squeezed)

Total 1,540,000 1,540,000

Question no. 4

Rent Receivable

Beg. Balance 70,000 80,000 Balance end

Rent income (squeezed) 130,000 120,000 Collections

Total 200,000 200,000

Question no. 5

Allowance for Doubtful accounts

Accounts written off 50,000 20,000 Beg. Balance

Balance end 30,000 52,000 Doubtful acc. exp. (squeezed)

8,000 Recoveries

Total 80,000 80,000

PROBLEM 5-13 Comprehensive

You are engaged in the audit of the financial statements of Julie Ann Corporation for

the year ended December 31, 2018. The following information was prepared by the

bookkeeper.

Cash receipts:

Collection on accounts receivable ₱1,513,000

Less: Cash discounts taken 13,000 ₱1,500,000

Cash sales of merchandise 160,000

Sale of warehouse equipment 12,000

Insurance proceeds from boiler explosion 42,000

Sale of land on November 3 20,000

Cash disbursements:

Payments to trade creditors ₱1,206,000

General and administrative expenses 204,000

Cash purchases of merchandise 120,000

Repairs made on warranty contracts 6,400

Purchases of land on May 1 16,000

Purchase on November 10 of 100 shares of Tommy 24,000

Co. stock

Supplementary information:

1. The following account balances were taken from the general ledger:

December 31, December 31,

2017 2018

Accounts receivable ₱124,000 ₱146,000

Inventory 186,000 190,000

Prepaid gen. and admin. expenses 9,600 8,400

Accrued gen and admin. expenses 7,000 9,000

Accounts payable 382,000 410,000

2. Depreciation for 2018 was ₱84,000.

3. The warehouse equipment sold during 2018 was acquired in 2011 at a cost of

₱25,000. The double-declining method of depreciation was used and

accumulated charges were ₱16,000 at date of sale. If the straight-line method

had been used, the accumulated depreciation at date of sale would have

been ₱10,000.

4. An explosion occurred on January 15, 2018 in which a boiler, not the

structural component of a building, was completely destroyed. It was

purchased in January 2010 at a cost of ₱48,000, depreciation was recorded

by the straight-line method and ₱20,000 had accumulated at the date of the

explosion.

5. Land was purchased on May 1, 2018 and was used as a storage facility. It

was found to be unsuitable for this purpose and was sold on November 1,

2018.

Questions:

Based on the above information, compute the adjusted balance of the following accounts as of

December 31, 2018:

1. Gross sales

a. P 1,535,000

b. P 1,695,000

c. P 1,522,000

d. P 1,362,000

2. Net sales

a. P 1,522,000

b. P 1,509,000

c. P 1,682,000

d. P 1,349,000

3. Total purchases

a. P 1,234,000

b. P 1,178,000

c. P 1,298,000

d. P 1,354,000

4. Cost of Sales

a. P 1,350,000

b. P 1,230,000

c. P 1,174,000

d. P 1,358,000

5. General and administrative expenses

a. P 204,000

b. P 207,200

c. P 211,200

d. P 204,800

6. Total operating expenses

a. P 297,600

b. P 291,200

c. P 294,400

d. P 295,200

7. Gain or loss on sale of land

a. P 4,000 gain

b. P 4,000 loss

c. P 16,000 loss

d. Nil

8. Gain or loss on sale of warehouse equipment

a. P 5,000 loss

b. P 13,000 loss

c. P 3,000 gain

d. P 12,000 gain

9. Gain or loss as a result of January 15, explosion.

a. P 6,000 loss

b. P 14,000 gain

c. P 28,000 loss

d. P 42,000 gain

10. Net income

a. P 55,400

b. P 61,800

c. P 35,400

d. P 47,400

Solutions:

Question no. 1

Accounts receivable trade

Beg.Balance 124,000 146,000 Balance end

Sales on account (squeezed) 1,535,000 13,000 Salesdiscount

1,500,000 Collections

Total 1,659,000 1,659,000

Sales on account 1,535,000

Add: Cash sales 160,000

Total sales 1,695,000

Question no. 2

Gross sales 1,695,000

Less: Sales discount 13,000

Net sales 1,682,000

Question no. 3

Accounts Payable

Payments 1,206,000 382,000 Beg. Balance

Balance end 410,000 1,234,000 Purchases (squeezed)

Total 1,616,000 1,616,000

Purchases on account 1,234,000

Add: Cash purchases 120,000

Total Purchases 1,354,000

Question no. 4

Merchandise Inventory

Beg.Balance 186,000 190,000 Balance end

Net purchases 1,354,000 1,350,000 Cost of sales (squeezed)

Total 1,540,000 1,540,000

Question no. 5

Prepaid General & Administrative Expenses/Accrued General & Administrative Expenses

Beg. Balance - Prepaid Interest 9,600 8,400 Balance end - Prepaid Interest

Balance end – Accrued Interest 9,000 7,000 Beg. Balance – Accrued Interest

Payments 204,000 207,200 Expenses

Total 222,600 222,600

Question no. 6

General and administrative expense 207,200

Depreciation expense 84,000

Warranty expense 6,400

Total operating expense 297,600

Question no. 7

Selling price of land 20,000

Less: Book value of land 16,000

Gain on sale of land 4,000

Question no. 8

Selling Price 12,000

Less: Book value

Cost 25,000

Less: Accumulated depreciation 16,000 9,000

Gain on sale of warehouse equipment 3,000

Question no. 9

Selling Price 42,000

Less: Book value

Cost 48,000

Less: Accumulated depreciation 20,000 28,000

Gain on sale of boiler 14,000

Question no. 10

Net sales 1,682,000

Less: Cost of Sales (1,350,000)

Gross Profit 332,000

Less: Operating expenses 297,600

Gain on sale (14,000+3,000+4,000) 21,000

Net income 55,400

You might also like

- Anatomy MnemonicsDocument4 pagesAnatomy Mnemonicskiara91% (56)

- Accounting Errors 8-9 (Answers)Document2 pagesAccounting Errors 8-9 (Answers)angela pajelNo ratings yet

- Audit of Cash - Exercise 2 (Solution)Document5 pagesAudit of Cash - Exercise 2 (Solution)Gazelle Calma100% (1)

- Jensen Shoes Lyndon Brook's StoryDocument7 pagesJensen Shoes Lyndon Brook's StoryMayur AlgundeNo ratings yet

- Requirement: Prepare Journal Entries in The Books of The Home Office and in The Books of The Branch Office ForDocument2 pagesRequirement: Prepare Journal Entries in The Books of The Home Office and in The Books of The Branch Office ForvonnevaleNo ratings yet

- Partnership Formation Activity 2Document4 pagesPartnership Formation Activity 2Shaira Untalan100% (1)

- Nepomuceno, Henry James B. - Ast Quiz 5Document2 pagesNepomuceno, Henry James B. - Ast Quiz 5Mitch Tokong MinglanaNo ratings yet

- Financial Statement Analysis ExerciseDocument5 pagesFinancial Statement Analysis ExerciseMelanie SamsonaNo ratings yet

- Samsona-Case-Act 122 5 - 3GDocument4 pagesSamsona-Case-Act 122 5 - 3GMelanie Samsona100% (2)

- CASE ANALYSIS - Don Masters and Assoicates Law OfficeDocument1 pageCASE ANALYSIS - Don Masters and Assoicates Law OfficeMelanie Samsona0% (1)

- Project On Rehabilitation and Resettlement Under The Rfctlarr Act, 2013 - Submitted ToDocument19 pagesProject On Rehabilitation and Resettlement Under The Rfctlarr Act, 2013 - Submitted ToAmit kayallNo ratings yet

- Cash and Accrual Basis: Topic OverviewDocument20 pagesCash and Accrual Basis: Topic OverviewAngelieNo ratings yet

- Activity-Chapter 7: Ans. None of These SolutionDocument1 pageActivity-Chapter 7: Ans. None of These SolutionRandelle James FiestaNo ratings yet

- Solved Problem 1 A Partial List of The Accounts and Ending Accounts... - Course HeroDocument5 pagesSolved Problem 1 A Partial List of The Accounts and Ending Accounts... - Course Herojau chiNo ratings yet

- Chapter 15 - AnswerDocument18 pagesChapter 15 - AnswerCrisalie BocoboNo ratings yet

- ABC FX Summer 22 23Document16 pagesABC FX Summer 22 23Patricia EsplagoNo ratings yet

- Accounting For Special Transactions p1 - CompressDocument10 pagesAccounting For Special Transactions p1 - CompressALINA, Jhon Czery C.0% (1)

- Advacc1 Accounting For Special Transactions (Advanced Accounting 1)Document24 pagesAdvacc1 Accounting For Special Transactions (Advanced Accounting 1)Dzulija Talipan100% (1)

- Exercises/Assignments Answer The Following ProblemsDocument22 pagesExercises/Assignments Answer The Following ProblemsLuigi Enderez BalucanNo ratings yet

- Quiz in AuditingDocument2 pagesQuiz in AuditingRose Medina Baronda100% (1)

- Answer KeyDocument6 pagesAnswer KeyClaide John OngNo ratings yet

- Chap 15Document17 pagesChap 15pdmallari12No ratings yet

- Accounting Errors 8-7 (Answers)Document2 pagesAccounting Errors 8-7 (Answers)angela pajel0% (1)

- IA3 Chapter 15 AnswersDocument1 pageIA3 Chapter 15 AnswersBea TumulakNo ratings yet

- Practice Set 1 (Modules 1 - 3) 371Document8 pagesPractice Set 1 (Modules 1 - 3) 371Marielle CastañedaNo ratings yet

- Chapter 1-4 Review QuestionsDocument24 pagesChapter 1-4 Review QuestionsSophia JunelleNo ratings yet

- Auditing Problem 4Document4 pagesAuditing Problem 4jhobsNo ratings yet

- Pre Buscomok PDF FreeDocument9 pagesPre Buscomok PDF FreeheyNo ratings yet

- Lesson 2 (Week 2) - Investment in Equity SecuritiesDocument10 pagesLesson 2 (Week 2) - Investment in Equity SecuritiesMonica MonicaNo ratings yet

- Illustration Financial Reptg. in HyperinflationaryDocument4 pagesIllustration Financial Reptg. in HyperinflationaryKian Gaboro100% (1)

- Business Combination Praacc DayagDocument19 pagesBusiness Combination Praacc DayagmamimomashesheNo ratings yet

- Chapter 2Document35 pagesChapter 2Ellah GedalanonNo ratings yet

- Dayag Solution To Chapter 20Document46 pagesDayag Solution To Chapter 20June KooNo ratings yet

- Practice Problems AcctgDocument10 pagesPractice Problems AcctgRichard ColeNo ratings yet

- Afar302 A - ConsignmentDocument5 pagesAfar302 A - ConsignmentNicole Teruel0% (1)

- 2015 Solman AsuncionDocument219 pages2015 Solman AsuncionMarwin AceNo ratings yet

- Problem 3&5Document17 pagesProblem 3&5panda 1No ratings yet

- Franchise QuizDocument3 pagesFranchise QuizDante Nas JocomNo ratings yet

- Audit of Receivables: Problem No. 1Document6 pagesAudit of Receivables: Problem No. 1Kathrina RoxasNo ratings yet

- AT7Document8 pagesAT7gazer beamNo ratings yet

- Numbers 19, 20 and 21 (Corporate Liquidation)Document2 pagesNumbers 19, 20 and 21 (Corporate Liquidation)Tk KimNo ratings yet

- Grace-AST Module 6Document2 pagesGrace-AST Module 6Devine Grace A. MaghinayNo ratings yet

- LTCC Quiz W AnsDocument4 pagesLTCC Quiz W AnsalyNo ratings yet

- Total Liabilities Total AssetsDocument4 pagesTotal Liabilities Total AssetsAngelica CondenoNo ratings yet

- p3 Acc 110 ReviewerDocument12 pagesp3 Acc 110 ReviewerRona Amor MundaNo ratings yet

- F - SAS DAY 26 FINAL COMPREHENSIVE EXAM - PDF - 194557631Document18 pagesF - SAS DAY 26 FINAL COMPREHENSIVE EXAM - PDF - 194557631Christian Jade Siccuan AglibutNo ratings yet

- Chapter 10 - Teacher's Manual - Afar Part 1Document20 pagesChapter 10 - Teacher's Manual - Afar Part 1Angelic67% (3)

- Aud Theo Dept. MIDTERM EXAMDocument8 pagesAud Theo Dept. MIDTERM EXAMChristine Joy OriginalNo ratings yet

- Answer-Key Chapter-6 RevisedDocument5 pagesAnswer-Key Chapter-6 RevisedMcy CaniedoNo ratings yet

- Aaconapps2 00-C91pb2aDocument21 pagesAaconapps2 00-C91pb2aJane DizonNo ratings yet

- Module 8 - Home-OfficeDocument16 pagesModule 8 - Home-OfficeNiki DimaanoNo ratings yet

- Afar302 A - FranchisingDocument3 pagesAfar302 A - FranchisingNicole TeruelNo ratings yet

- Aud Theo Compilation1Document97 pagesAud Theo Compilation1AiahNo ratings yet

- Maria Claudine B. Fortaliza. Basic Earnings Per Share Average Shares 1. (IFRS)Document14 pagesMaria Claudine B. Fortaliza. Basic Earnings Per Share Average Shares 1. (IFRS)maria evangelistaNo ratings yet

- BSA2201 BDD MBCarolino M8Activityno.2Document5 pagesBSA2201 BDD MBCarolino M8Activityno.2Earl Carolino100% (1)

- Week 4 - Long-Term Construction Contracts (LTCC) : SolutionDocument4 pagesWeek 4 - Long-Term Construction Contracts (LTCC) : SolutionJanna Mari FriasNo ratings yet

- Problem 4: Multiple Choice - ComputationalDocument5 pagesProblem 4: Multiple Choice - ComputationalKATHRYN CLAUDETTE RESENTENo ratings yet

- Exercises: Financial Accounting and ReportingDocument6 pagesExercises: Financial Accounting and ReportingIvy NisorradaNo ratings yet

- Iacc 1 - Quizzer Cash and Cash EquivalentDocument3 pagesIacc 1 - Quizzer Cash and Cash EquivalentJerry Toledo0% (1)

- Evidence and Performance of Substantive TestingDocument49 pagesEvidence and Performance of Substantive Testing2019-202518No ratings yet

- Enrichment Learning Activity: Name: Date: Year and Section: Instructor: Module #: TopicDocument6 pagesEnrichment Learning Activity: Name: Date: Year and Section: Instructor: Module #: TopicImthe OneNo ratings yet

- Afar - Partnership, Corporate Liquadation & Home Office and BranchDocument31 pagesAfar - Partnership, Corporate Liquadation & Home Office and BranchMitch MinglanaNo ratings yet

- Documento - MX Ap Receivables Quizzer QDocument10 pagesDocumento - MX Ap Receivables Quizzer QMiel Viason CañeteNo ratings yet

- The Auditor Is Auditing Financial Statements For The Year Ended December 31Document2 pagesThe Auditor Is Auditing Financial Statements For The Year Ended December 31Something ChicNo ratings yet

- 2018-0232 Beldia, Pitchie Mae G. ACT142: Auditing and Assurance: Concepts and Application 1Document8 pages2018-0232 Beldia, Pitchie Mae G. ACT142: Auditing and Assurance: Concepts and Application 1Melanie SamsonaNo ratings yet

- Cash and Accrual Basis and Single EntryDocument21 pagesCash and Accrual Basis and Single EntryJohn Mark FernandoNo ratings yet

- Case Analysis - Hockey Camp-CvpDocument2 pagesCase Analysis - Hockey Camp-CvpMelanie Samsona100% (1)

- Specialized Industry HospitalDocument44 pagesSpecialized Industry HospitalMelanie SamsonaNo ratings yet

- Assignment #2Document18 pagesAssignment #2Melanie Samsona100% (1)

- TORSIONDocument25 pagesTORSIONMelanie SamsonaNo ratings yet

- Impact of Time On StudentsDocument10 pagesImpact of Time On StudentsMelanie SamsonaNo ratings yet

- Case Analysis - Hockey Camp-CvpDocument2 pagesCase Analysis - Hockey Camp-CvpMelanie Samsona100% (1)

- FilmmakingDocument10 pagesFilmmakingMelanie Samsona100% (2)

- Corliss EngineDocument1 pageCorliss EngineMelanie SamsonaNo ratings yet

- 5TH ActivityDocument15 pages5TH ActivityMelanie SamsonaNo ratings yet

- Impact of Time On Students' Academic PerformanceDocument14 pagesImpact of Time On Students' Academic PerformanceMelanie SamsonaNo ratings yet

- Double Acting Air CylinderDocument1 pageDouble Acting Air CylinderMelanie SamsonaNo ratings yet

- Air FilterDocument1 pageAir FilterMelanie SamsonaNo ratings yet

- ENS 164 SyllabusDocument1 pageENS 164 SyllabusMelanie SamsonaNo ratings yet

- Stress: Normal Stress Shearing Stress Bearing StressDocument79 pagesStress: Normal Stress Shearing Stress Bearing StressMelanie Samsona100% (1)

- Stress: Normal Stress Shearing Stress Bearing StressDocument23 pagesStress: Normal Stress Shearing Stress Bearing StressMelanie SamsonaNo ratings yet

- STRAINDocument30 pagesSTRAINMelanie SamsonaNo ratings yet

- Senior High School Electronic Class Record: InstructionsDocument39 pagesSenior High School Electronic Class Record: InstructionsMelanie SamsonaNo ratings yet

- ENS181 Seatwork 10 - Samsona - A1Document12 pagesENS181 Seatwork 10 - Samsona - A1Melanie SamsonaNo ratings yet

- Grade 11-TVL 3 Aviso 2018-2019Document42 pagesGrade 11-TVL 3 Aviso 2018-2019Melanie SamsonaNo ratings yet

- Grade 11-Abm 3 HamiltonDocument45 pagesGrade 11-Abm 3 HamiltonMelanie SamsonaNo ratings yet

- Module 4 Estate Taxation 3Document4 pagesModule 4 Estate Taxation 3Melanie SamsonaNo ratings yet

- ENS 181 - Seatwork No. 1 - Samsona - A1Document1 pageENS 181 - Seatwork No. 1 - Samsona - A1Melanie SamsonaNo ratings yet

- Happy MeDocument1 pageHappy MeMelanie SamsonaNo ratings yet

- Koronadal National Comprehensive High School-Senior High SchoolDocument60 pagesKoronadal National Comprehensive High School-Senior High SchoolMelanie SamsonaNo ratings yet

- ABE051 - 2nd MAjor ExamDocument1 pageABE051 - 2nd MAjor ExamMelanie SamsonaNo ratings yet

- Agricultural and Biosystems Engineering Department: College of AgricultureDocument1 pageAgricultural and Biosystems Engineering Department: College of AgricultureMelanie SamsonaNo ratings yet

- PESA District Profile Umerkot Sindh PakistanDocument59 pagesPESA District Profile Umerkot Sindh Pakistanعلی احمد100% (1)

- Week 4 Assessment TestDocument4 pagesWeek 4 Assessment TestRosalyn Dublin NavaNo ratings yet

- Baze Petroleum and Gas Engineering HandbookDocument34 pagesBaze Petroleum and Gas Engineering HandbookCliffordNo ratings yet

- ATC HandbookDocument15 pagesATC HandbookPrintet08No ratings yet

- Pediatric Rhinosinusitis Hassan H. Ramadan Ebook All Chapters PDFDocument62 pagesPediatric Rhinosinusitis Hassan H. Ramadan Ebook All Chapters PDFsledznuoma100% (3)

- Chapter 10 Photosynthesis Homework AnswersDocument6 pagesChapter 10 Photosynthesis Homework Answersafeuceblj100% (1)

- Mun of Cavite vs. RojasDocument5 pagesMun of Cavite vs. RojasKya CabsNo ratings yet

- RC 9 2024 0097 - enDocument8 pagesRC 9 2024 0097 - enMonitoreamosNo ratings yet

- My Friend: Form 5 Reading Comprehension Task I. Read The Text and Do The TasksDocument2 pagesMy Friend: Form 5 Reading Comprehension Task I. Read The Text and Do The TasksLarysa HoncharenkoNo ratings yet

- Case Study On NokiaDocument5 pagesCase Study On NokiaMinahil SaleemNo ratings yet

- Nucleic Acid: Group 2 ReportDocument20 pagesNucleic Acid: Group 2 ReportDiePalAPieNo ratings yet

- Tetilecalculations 140802091855 Phpapp02Document86 pagesTetilecalculations 140802091855 Phpapp02Sobia Waseem100% (3)

- 18CS61 SSC II IA Question BankDocument4 pages18CS61 SSC II IA Question Bank4AL20CS016ANIRUDH HNNo ratings yet

- Linkage and Sex DeterminationDocument33 pagesLinkage and Sex DeterminationSwapna GirishNo ratings yet

- تعزيز الشمول المالي كمدخل استراتيجي لدعم الاستقرار المالي في العالم العربي PDFDocument14 pagesتعزيز الشمول المالي كمدخل استراتيجي لدعم الاستقرار المالي في العالم العربي PDFHisham DaelNo ratings yet

- 'Tryst With Destiny': By: Jawaharlal NehruDocument2 pages'Tryst With Destiny': By: Jawaharlal NehruMohammad Yaqub AbdulNo ratings yet

- Solution: 3 Thalia ST, 3011 Limassol, Cyprus - P.O. Box 55523, 3780 Limassol, Cyprus - Vat Registration #: CY10288069EDocument7 pagesSolution: 3 Thalia ST, 3011 Limassol, Cyprus - P.O. Box 55523, 3780 Limassol, Cyprus - Vat Registration #: CY10288069EVladyslavNo ratings yet

- How To Apply For FREE PCSO Individual Medical Assistance Program (IMAP)Document6 pagesHow To Apply For FREE PCSO Individual Medical Assistance Program (IMAP)Adonis Zoleta Aranillo100% (1)

- The Physiology of 2nd Stage, Method of Delivery On - 241115 - 112925Document35 pagesThe Physiology of 2nd Stage, Method of Delivery On - 241115 - 112925Imelda FitriNo ratings yet

- Smart India Hackathon: Ministry/Organization Name/Student InnovationDocument4 pagesSmart India Hackathon: Ministry/Organization Name/Student Innovationmusharrafabrar694No ratings yet

- Little StarDocument2 pagesLittle StarNitinAgnihotriNo ratings yet

- 3com AP 9552 - Guia de Acesso RápidoDocument83 pages3com AP 9552 - Guia de Acesso Rápidoivanilson_galdinoNo ratings yet

- Manahan-Vs ECCDocument7 pagesManahan-Vs ECCAnna Kristina Felichi ImportanteNo ratings yet

- Dogecoin Paper Wallet GeneratorDocument3 pagesDogecoin Paper Wallet Generatorpri soum0% (1)

- Corporate Social Responsibility ("CSR") Policy BMW India Private LimitedDocument7 pagesCorporate Social Responsibility ("CSR") Policy BMW India Private LimitedAyan Karmakar100% (1)

- Jean-Paul Sartre: Existential "Freedom" and The Political: Written by Yvonne ManziDocument9 pagesJean-Paul Sartre: Existential "Freedom" and The Political: Written by Yvonne ManziShalvaNo ratings yet

- Sample ACAS QuestionnaireDocument4 pagesSample ACAS QuestionnaireReynalyn OrtizNo ratings yet