Chapter 3 Answers

Chapter 3 Answers

Uploaded by

PattraniteCopyright:

Available Formats

Chapter 3 Answers

Chapter 3 Answers

Uploaded by

PattraniteCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Copyright:

Available Formats

Chapter 3 Answers

Chapter 3 Answers

Uploaded by

PattraniteCopyright:

Available Formats

lOMoARcPSD|7242917

SM-Ch03-5e-Fundamentals of Cost Accounting Lanen

Cost Accounting (Silliman University)

StuDocu is not sponsored or endorsed by any college or university

Downloaded by Mary Joy Banzon (mariapadillaxx@gmail.com)

lOMoARcPSD|7242917

3

Fundamentals of Cost-Volume-Profit Analysis

Solutions to Review Questions

3-1.

Profit = TR – TC

= PX – VX – F

= (P – V)X – F

where

Profit = operating profit,

TR = total revenue,

TC = total costs,

P = average unit selling price,

V = average unit variable cost,

X = quantity of units,

F = total fixed costs for the period.

3-2.

Total costs = Total variable costs plus total fixed costs.

3-3.

Total contribution margin: Total selling price – Variable manufacturing costs expensed –

Variable nonmanufacturing costs expensed = Total contribution margin.

Gross margin: Total selling price – Variable manufacturing costs expensed – Fixed

manufacturing costs expensed = Gross margin.

3-4.

Profit-volume analysis plots only the contribution margin line against volume, while cost-

volume-profit analysis plots total revenue and total costs against volume. Profit-volume

analysis is a simpler, but less complete, method of presentation.

3-5.

Costs that are ―fixed in the short run‖ are usually not fixed in the long run. In fact few, if

any, costs are fixed over a very long time horizon, because managers can make decisions

that change a firm’s cost structure.

©The McGraw-Hill Companies, Inc., 2017

Solutions Manual, Chapter 3 83

Downloaded by Mary Joy Banzon (mariapadillaxx@gmail.com)

lOMoARcPSD|7242917

3-6.

Operating leverage is the proportion of fixed costs in an organization’s cost structure. It is

important for managers because it determines how an increase in volume affects the

change in profits.

3-7.

The margin of safety is the excess of sales over the break-even volume. Managers can

use the margin of safety to understand how far sales can fall before the firm is operating at

a loss.

3-8.

Goal Seek is the function in Microsoft Excel that can be used for CVP analysis.

3-9.

Fixed costs + [Target profit/(1-t)]

Target volume (units) =

Unit contribution margin

3-10.

Income taxes do not affect the break-even equation because with zero income

(breakeven), there are no income taxes to pay.

3-11.

It is common to assume a fixed sales mix when solving for break-even volumes with

multiple products because the contribution margin depends on the relative quantities of

the individual products sold. If the sales mix is not fixed, the break-even volume is

indeterminate.

3-12.

Two common assumptions in CVP analysis are that unit prices and unit variable costs are

constant. It is also common to assume that fixed costs are constant over relatively large

volume ranges. Although these assumptions are common, they are not a necessary part

of CVP analysis. CVP analysis can accept many forms of price and cost relations with

volume. However, when more general relations are used, the common break-even

formulas will no longer hold.

©The McGraw-Hill Companies, Inc., 2017

84 Fundamentals of Cost Accounting

Downloaded by Mary Joy Banzon (mariapadillaxx@gmail.com)

lOMoARcPSD|7242917

Solutions to Critical Analysis and Discussion Questions

3-13.

There may be a difference between costs used in cost-volume-profit analysis and costs

expensed in financial statements. A common example is fixed manufacturing costs. Cost-

volume-profit analysis assumes fixed manufacturing costs are period costs, while they are

treated as product costs for financial reporting. If part of current production is inventoried,

some fixed manufacturing costs would not be expensed for financial reporting. On the

other hand, if current sales include all of current production plus some from inventory, all

fixed costs from this period plus some from previous periods would be expensed for

financial reporting.

3-14.

The accountant makes use of a linear representation to simplify the analysis of costs and

revenues. These simplifying assumptions are generally reasonable within a relevant range

of activity. Within this range, it is generally believed that the additional costs required to

employ nonlinear analysis cannot be justified in terms of the benefits obtained. Thus,

within this range, the linear model is considered the ―best‖ in a cost-benefit sense.

3-15.

As volume rises, it is likely that product markets will be saturated, leading to a need to cut

prices to maintain or increase volume. This price-cutting would result in a nonlinear

revenue function with a slope that becomes less steep (though still positive) as volume

increases. Moreover, as activity increases and approaches capacity constraints, costs

tend to rise more than proportionately. Overtime premiums and shift pay differentials

increase the unit labor costs. Similar costs may be incurred in terms of excess

maintenance costs for running machines beyond their optimal performance levels, higher

materials costs for any input commodity that is in short supply, and similar factors. These

factors tend to cause costs to rise more than proportionately with an increase in activity.

3-16.

Although the assumptions of CVP analysis appear relatively simplistic, CVP analysis is a

useful tool for understanding the relations among costs, volumes, and the resulting profit.

Clearly, the more important the decision, the more time that should be spent developing

good assumptions. However, CVP analysis is useful for developing intuition about the cost

structure of the firm.

3-17.

Although there are no ―profits‖ in a not-for-profit organization, these organizations are still

very concerned about the difference between inflows (from fees, grants, sales, or other

sources) and costs. Often the term ―surplus‖ will be used in place of profit and the

methods of CVP analysis can be applied in the same way that it is in a for-profit firm.

©The McGraw-Hill Companies, Inc., 2017

Solutions Manual, Chapter 3 85

Downloaded by Mary Joy Banzon (mariapadillaxx@gmail.com)

lOMoARcPSD|7242917

3-18.

Most business schools have relatively high fixed costs when volume is measured by the

number of students. Examples of these costs would be plant (buildings and grounds),

faculty and staff, and support (for example, computer resources). Variable costs are

relatively low. Therefore, most business schools would be characterized by high operating

leverage.

3-19.

High (or low) operating leverage is not a good (or bad) thing. It is the result of managerial

decisions about the resources to be used (and the structure of the costs that result).

Therefore, if it is better to use resources, which are more flexible, it might be preferable to

rent (lease). As a result, the operating leverage would be lower than a similar business

where a manager decided that is was better not to bear the risks of rising rents.

3-20.

The ―product‖ or ―service‖ for an airline consists of a flight between two city-pairs (for

example, Los Angeles to San Francisco). As you can imagine, the number of ―products‖

for any airline is very large. (In fact, it is even larger, if time-of-day is considered to be

another product.) Airlines often fly a mix of aircraft as well, further complicating the

analysis. Therefore, when you read statements such as this, be aware that the numbers

are given assuming a current mix of flights and aircraft. It does not mean that if an

individual flight has 63% of seats filled, the flight will break even.

3-21.

Because the price Luxe pays for the leased parking space is fixed (it does not depend on

how many times it is used), the cost per use falls as the number of times it is used

increases. This is the same phenomenon we saw in Chapter 2 when considering fixed

manufacturing overhead and fixed administrative costs.

3-22.

The per-unit lease cost is not appropriate to decide where to park the cars, because the

lease costs will not be affected by that decision.

©The McGraw-Hill Companies, Inc., 2017

86 Fundamentals of Cost Accounting

Downloaded by Mary Joy Banzon (mariapadillaxx@gmail.com)

lOMoARcPSD|7242917

Solutions to Exercises

3-23. (15 min.) Profit Equation Components.

b. Total revenue line

g. The profit area

f. The break-even point

Dollars

d. Slope = Variable cost per unit

a. Total cost line

c. The variable costs area

h. The loss area

h. Loss volume g. Profit volume

e. The fixed costs area

Volume

3-24. (15 min.) Profit Equation Components.

a. Total fixed costs (loss at zero volume)

b. Break-even point

c. Slope = contribution margin per unit

d. Profit line

e. Profit area

f. Net loss area

g. Zero profit line

©The McGraw-Hill Companies, Inc., 2017

Solutions Manual, Chapter 3 87

Downloaded by Mary Joy Banzon (mariapadillaxx@gmail.com)

lOMoARcPSD|7242917

3-25. (20 min.) Basic Decision Analysis Using CVP: Anu’s Amusement Center.

a. $2,400,000 75,000 tickets = $32 per ticket

b. $1,350,000 75,000 tickets = $18 per ticket

c. ($32.00 – $18.00) = $14 per ticket

d. Profit = ($32 – $18)X – $656,250

Let Profit = 0

0 = ($32.00 – $18.00)X – $656,250

$656,250

X=

$14

X = 46,875 tickets

e. Let Profit = $131,250

$131,250 = ($32 – $18)X – $656,250

$656,250 + $131,250

X=

$14

X = 56,250 tickets

3-26. (20 min.) Basic CVP Analysis: Dukey’s Shoe Station.

a. Break-even point is sales dollars = Fixed costs ÷ Contribution margin ratio

= $450,000 ÷ 0.40 = $1,125,000

b. Break-even point is sales dollars = Fixed costs ÷ Contribution margin ratio

= $450,000 ÷ 0.25 = $1,800,000

c. Sales dollars required = (Fixed costs + Desired profit) ÷ Contribution margin ratio

= ($450,000 + $100,000) ÷ 0.40 = $1,375,000

©The McGraw-Hill Companies, Inc., 2017

88 Fundamentals of Cost Accounting

Downloaded by Mary Joy Banzon (mariapadillaxx@gmail.com)

lOMoARcPSD|7242917

3-27. (25 min.) CVP Analysis—Ethical Issues: Mark Ting.

This problem is based on the experience of the authors at several companies.

The problem in this example, which is common, is that the guidelines the company has

established (for example, a high break-even point) lead to projects that would be valuable

in some way, but cannot meet the standard established by the company.

Mark believes, perhaps honestly, that the new product is valuable for the company.

However, the approach he has taken to support the product is unethical.

Mark should persuade the management of the company that the break-even requirement

is inappropriate.

3-28. (55 min.) Basic Decision Analysis Using CVP: Derby Phones.

a.

Profit = (P – V)X – F

$0 = ($270 – $120)X – $300,000

$150X = $300,000

$300,000

X=

$150

X = 2,000 units

b.

Profit = (P – V)X – F

$180,000 = ($270 – $120)X – $300,000

$150X = $480,000

$480,000

X=

$150

X= 3,200 units

©The McGraw-Hill Companies, Inc., 2017

Solutions Manual, Chapter 3 89

Downloaded by Mary Joy Banzon (mariapadillaxx@gmail.com)

lOMoARcPSD|7242917

3-29. (55 min.) Basic Decision Analysis Using CVP: Derby Phones.

a. Profit = ($270 – $120) 5,000 – $300,000

= $450,000

b. 10% price decrease. Now P = $243

Profit = ($243 – $120) x 5,000 – $300,000

= $315,000 Profit decreases by $135,000

20% price increase. Now P = $324

Profit = ($324 – $120) x 5,000 – $300,000

= $720,000 Profit increases by $270,000

c. 10% variable cost decrease. Now V = $108

Profit = ($270 – $108) x 5,000 – $300,000

= $510,000 Profit increases by $60,000

20% variable cost increase. Now V = $144

Profit = ($270 – $144) x 5,000 – $300,000

= $330,000 Profit decreases by $120,000

d. Profit = ($270 – $132) x 5,000 – $240,000

= $450,000 Profit remains the same.

©The McGraw-Hill Companies, Inc., 2017

90 Fundamentals of Cost Accounting

Downloaded by Mary Joy Banzon (mariapadillaxx@gmail.com)

lOMoARcPSD|7242917

3-30. (25 min.) Basic Decision Analysis Using CVP: Warner Clothing.

a.

Profit = (P – V)X – F

$0 = ($15 – $3)X – $42,000

$12X = $42,000

$42,000

X=

$12

X = 3,500 units

b.

Profit = (P – V)X – F

$30,000 = ($15 – $3)X – $42,000

$12X = $72,000

$72,000

X=

$12

X= 6,000 units

©The McGraw-Hill Companies, Inc., 2017

Solutions Manual, Chapter 3 91

Downloaded by Mary Joy Banzon (mariapadillaxx@gmail.com)

lOMoARcPSD|7242917

3-31. (30 min.) Basic Decision Analysis Using CVP: Warner Clothing.

a. Profit = ($15 – $3) 5,000 – $42,000

= $18,000

b. 10% price decrease. Now P = $13.50

Profit = ($13.50 – $3.00) x 5,000 – $42,000

= $10,500 Profit decreases by $7,500

20% price increase. Now P = $18

Profit = ($18 – $3) x 5,000 – $42,000

= $33,000 Profit increases by $15,000

c. 10% variable cost decrease. Now V = $2.70

Profit = ($15.00 – $2.70) x 5,000 – $42,000

= $19,500 Profit increases by $1,500

20% variable cost increase. Now V = $3.60

Profit = ($15.00 – $3.60) x 5,000 – $42,000

= $15,000 Profit decreases by $3,000

d. Profit = ($15.00 – $3.30) x 5,000 – $37,800

= $20,700 Profit increases by $2,700

©The McGraw-Hill Companies, Inc., 2017

92 Fundamentals of Cost Accounting

Downloaded by Mary Joy Banzon (mariapadillaxx@gmail.com)

lOMoARcPSD|7242917

3-32. (30 min.) Basic CVP Analysis: Pacific Parts.

$23 per unit.

Using the profit equation:

Profit = (P – V) x X – FC

$1,000,000 = ($30 – V) x 270,000 – $890,000

V = $6,210,000 ÷ 270,000

V = $23 per unit.

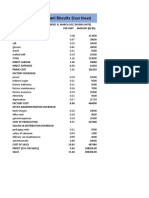

Using an income statement format (based on 270,000 units):

Amount Unit

Sales ............................................... $8,100,000 (a) $30

Variable cost .................................... 6,210,000 23 (c)

Contribution margin ......................... $1,890,000 (b) $7

Fixed costs ....................................... 890,000

Operating profit before taxes ............ $1,000,000

(a) $30 x 270,000 units = $8,100,000 (Sales)

(b) $1,000,000 + $890,000 = $1,890,000 (Contribution margin)

(c) $8,100,000 - $1,890,000 = $6,210,000 / 270,000 units = $23 (Unit variable cost)

3-33. (30 min.) Analysis of Cost Structure: The Greenback Store vs. One-Mart.

a. Greenback Store One-Mart

Amount Percentage Amount Percentage

Sales ................................ $800,000 100% $800,000 100%

Variable cost ....................... 600,000 75 200,000 25

Contribution margin ............$200,000 25% $600,000 75%

Fixed costs .......................... 40,000 5 440,000 55

Operating profit ...................$160,000 20% $160,000 20%

b. Greenback Store’s profits increase by $30,000 [= .25 x ($800,000 x .15)] and One

Mart’s profits increase by $90,000 [= .75 x ($800,000 x .15)].

©The McGraw-Hill Companies, Inc., 2017

Solutions Manual, Chapter 3 93

Downloaded by Mary Joy Banzon (mariapadillaxx@gmail.com)

lOMoARcPSD|7242917

3-34. (30 min.) Analysis of Cost Structure: Spring Company vs. Winters Company.

a. Spring Company Winters Company

Amount Percentage Amount Percentage

Sales ................................ $500,000 100% $500,000 100%

Variable cost ....................... 400,000 80 150,000 30

Contribution margin ............$100,000 20% $350,000 70%

Fixed costs .......................... 60,000 12 310,000 62

Operating profit ...................$ 40,000 8% $40,000 8%

b. Spring Company’s profits increase by $8,000 [= .20 x ($500,000 x .08)] and Winter

Company’s profits increase by $28,000 [= .70 x ($500,000 x .08)].

3-35. (15 min.) CVP and Margin of Safety: Bristol Car Service.

a.

Profit = (P – V)X – F

$0 = ($50 – $12)X – $2,736

$38X = $2,736

$2,736

X=

$38

X = 72 trips

b.

Margin of safety = 90 – 72

= 18 trips (25%)

©The McGraw-Hill Companies, Inc., 2017

94 Fundamentals of Cost Accounting

Downloaded by Mary Joy Banzon (mariapadillaxx@gmail.com)

lOMoARcPSD|7242917

3-36. (15 min.) CVP and Margin of Safety: Casey’s Cases.

a.

Profit = (P – V)X – F

$0 = ($30 – $26)X – $2,480

$4X = $2,480

$2,480

X=

$4

X = 620 cases

b.

Margin of safety = 700 – 620

= 80 cases (12.9%)

©The McGraw-Hill Companies, Inc., 2017

Solutions Manual, Chapter 3 95

Downloaded by Mary Joy Banzon (mariapadillaxx@gmail.com)

lOMoARcPSD|7242917

3-37. (20 min.) Using Microsoft Excel to Perform CVP Analysis: Derby Phones.

a. 2,000 units.

The following two screenshots show the setup and solution.

©The McGraw-Hill Companies, Inc., 2017

96 Fundamentals of Cost Accounting

Downloaded by Mary Joy Banzon (mariapadillaxx@gmail.com)

lOMoARcPSD|7242917

3-37 (continued).

b. 2,040 units.

The following two screenshots show the setup and solution.

©The McGraw-Hill Companies, Inc., 2017

Solutions Manual, Chapter 3 97

Downloaded by Mary Joy Banzon (mariapadillaxx@gmail.com)

lOMoARcPSD|7242917

3-38. (20 min.) Using Microsoft Excel to Perform CVP Analysis: Warner Clothing.

a. 3,500 units.

The following two screenshots show the setup and solution.

©The McGraw-Hill Companies, Inc., 2017

98 Fundamentals of Cost Accounting

Downloaded by Mary Joy Banzon (mariapadillaxx@gmail.com)

lOMoARcPSD|7242917

3-38(continued).

b. 4,250 units.

The following two screenshots show the setup and solution.

©The McGraw-Hill Companies, Inc., 2017

Solutions Manual, Chapter 3 99

Downloaded by Mary Joy Banzon (mariapadillaxx@gmail.com)

lOMoARcPSD|7242917

3-39. (20 min.) CVP With Income Taxes: Hunter & Sons.

a.

Profit = (P – V)X – F

$0 = ($550 – $330)X – $143,000

$143,000

X=

$220

X = 650 units

b. In order to achieve a profit of $39,600 after tax, Hunter & Sons must earn:

$66,000 = [$39,600 ÷ (1.00 – 0.40)] before taxes.

The number of units to earn $66,000 in operating profits is:

X = ($143,000 + $66,000) ÷ ($550 – $330) = 950 units

3-40. (20 min.) CVP With Income Taxes: Hammerhead Charters.

a.

Profit = (P – V)X – F

$0 = ($50 – $20)X – $6,000

$6,000

X=

$30

X = 200 trips

b. In order to achieve a profit of $9,000 after tax, Hammerhead Charters must earn:

$12,000 = [$9,000 ÷ (1.00 – 0.25)] before taxes.

The number of units to earn $75,000 in operating profits is:

X = ($6,000 + $12,000) ÷ ($50 – $20) = 600 trips

©The McGraw-Hill Companies, Inc., 2017

100 Fundamentals of Cost Accounting

Downloaded by Mary Joy Banzon (mariapadillaxx@gmail.com)

lOMoARcPSD|7242917

3-41. (20 min.) Multiproduct CVP Analysis: Rio Coffee Shoppe.’

First, compute the weighted-average contribution margin per unit:

= $0.96 = 60% x ($1.50 – $0.70) + 40% x ($2.50 – $1.30)

The total number of cups of regular coffee and lattes (X) to break even is:

Profit = (P – V)X – F

$0 = $0.96 X – $6,720

X = 7,000 cups

4,200 (= 60% x 7,000) cups of regular coffee

= and

2,800 (= 40% x 7,000) lattes

©The McGraw-Hill Companies, Inc., 2017

Solutions Manual, Chapter 3 101

Downloaded by Mary Joy Banzon (mariapadillaxx@gmail.com)

lOMoARcPSD|7242917

3-42. (20 min.) Multiproduct CVP Analysis: Mission Foods.

a. Profit = ($3.00 – $1.50) x 200,000 + ($4.50 – $2.25) x 300,000 – $117,000

= $858,000

b. First, compute the weighted-average contribution margin per unit:

= $1.95 = 40% x ($3.00 – $1.50) + 60% x ($4.50 – $2.25)

The total number of chicken and fish tacos (X) to break even is:

Profit = (P – V)X – F

$0 = $1.95 X – $117,000

X = 60,000 tacos

= 24,000 (= 40% x 60,000) chicken tacos and

36,000 (= 60% x 60,000) fish tacos

c. First, compute the weighted-average contribution margin per unit:

= $1.65 = 80% x ($3.00 – $1.50) + 20% x ($4.50 – $2.25)

The total number of chicken and fish tacos (X) to break even is:

Profit = (P – V)X – F

$0 = $1.65 X – $117,000

X = 70,910 tacos (rounding up)

= 56,728 (= 80% x 70,910) chicken tacos and

14,182 (= 20% x 70,910) fish tacos

©The McGraw-Hill Companies, Inc., 2017

102 Fundamentals of Cost Accounting

Downloaded by Mary Joy Banzon (mariapadillaxx@gmail.com)

lOMoARcPSD|7242917

Solutions to Problems

3-43. (35 min.) CVP Analysis and Price Changes: Argentina Partners.

a. Current profit = 60,000 units x ($30 – $15) – $700,000 = $200,000

Variable costs. New variable cost per unit:

Labor + Materials + Overhead

115% 50% $15 + 110% 25% $15 + 120% 25% $15 = $17.25

Price: New price = 110% $30 = $33.00

Fixed costs: New fixed costs = 105% $700,000 = $735,000

Sales: Profit target = $200,000

Profit = (P – V)X – F

$200,000 = ($33.00 – $17.25)X – $735,000

X = $935,000 ÷ ($33.00 – $17.25)

= 59,365 units (rounded)

or sales of 59,365 $33 = $1,959,045

b.

Profit target = $200,000 106% = $212,000

Profit = (P – V)X – F

$212,000 = ($33.00 – $17.25)X – $735,000

X = $947,000 ÷ ($33.00 – $17.25)

= 60,127 units (rounded)

or sales of 60,127 $33.00 = $1,984,191

c.

Profit = PX – VX – F

$212,000 = P(60,000) – ($17.25 60,000) – $735,000

P = $1,982,000 ÷ 60,000

P = $33.03 (rounded) or a 10.1% increase

©The McGraw-Hill Companies, Inc., 2017

Solutions Manual, Chapter 3 103

Downloaded by Mary Joy Banzon (mariapadillaxx@gmail.com)

lOMoARcPSD|7242917

3-44. (35 min.) CVP Analysis and Price Changes: Scholes Systems.

a. Current profit = 80,000 units x ($60 – $30) – $1,400,000 = $1,000,000

Variable costs. New variable cost per unit:

Labor + Materials + Overhead

115% 50% $30 + 110% 25% $30 + 120% 25% $30 = $34.50

Price: New price = 110% $60 = $66.00

Fixed costs: New fixed costs = 105% $1,400,000 = $1,470,000

Sales: Profit target = $1,000,000

Profit = (P – V)X – F

$1,000,000 = ($66.00 – $34.50)X – $1,470,000

X = $2,470,000 ÷ ($66.00 – $34.50)

= 78,413 units (rounded)

or sales of 78,413 $66 = $5,175,258

b.

Profit target = $1,000,000 106% = $1,060,000

Profit = (P – V)X – F

$1,060,000 = ($66.00 – $34.50)X – $1,470,000

X = $2,530,000 ÷ ($66.00 – $34.50)

= 80,318 units (rounded up)

or sales of 80,318 $66.00 = $5,300,988

c.

Profit = PX – VX – F

$1,060,000 = P(80,000) – ($34.50 80,000) – $1,470,000

Rearranging,

$1,060,000 + ($34.50 80,000) + $1,470,000 = P(80,000)

P = $5,290,000 ÷ 80,000

P = $66.13 (rounded) or a 10.2% increase

©The McGraw-Hill Companies, Inc., 2017

104 Fundamentals of Cost Accounting

Downloaded by Mary Joy Banzon (mariapadillaxx@gmail.com)

lOMoARcPSD|7242917

3-45. (20 min.) CVP Analysis―Missing Data: Breed Products.

a. $8.20

Because the volume is given, it is not necessary to know the fixed and variable costs

separately.

Profit = Revenues – Costs

Profit = 150,000 x Price – Costs

$600,000 = 150,000 P – $630,000

$1,230,000 = 150,000 P

P = $8.20

b. $1,125,000

Profit = Revenues – Costs

0.20 Revenues = (P – V)X – F

0.20 Revenues = Revenues – 0.6 Revenues – $225,000

0.20 Revenues = $225,000

Revenues = $1,125,000

c. 125,000 units (= $1,125,000 ÷ $9)

©The McGraw-Hill Companies, Inc., 2017

Solutions Manual, Chapter 3 105

Downloaded by Mary Joy Banzon (mariapadillaxx@gmail.com)

lOMoARcPSD|7242917

3-46. (20 min.) CVP Analysis―Missing Data: Remington Inc.

P = $20

There are several ways to approach this problem. Note that although we do not know

the fixed costs, they are irrelevant to the solution as we will see.

(1) Set this up as two equations with two unknowns (Price and the breakeven point).

Let P = Current price, BE the breakeven point at the current price, and FC fixed cost.

Then

BE = FC ÷ (P – $5) at the current price.

If the price is cut by 50 percent, we know that the breakeven point is tripled, so

(3 x BE) = FC ÷ [(0.5 x P) – $5].

Substituting the first equation in the second, we have:

[(3 x FC)/(P – $5)] = FC ÷ [(0.5 x P) – $5].

Solving for P yields P = $20.

(2) For the same fixed cost, if the new breakeven point is three times the old

breakeven point, the contribution margin at the current price must be three times the

contribution margin at 50 percent of the current price:

(P – $5) = 3 x [(0.5 x P) – $5]

Solving for P yields P = $20.

3-47. (20 min.) CVP Analysis With Subsidies: Suburban Bus Lines.

a.

Surplus = (P – V)X – F + Subsidy

$0 = ($1.00 – $1.50)X – $200,000 + $250,000

$0.50X = $50,000

$50,000

X=

$0.50

X = 100,000 riders

b. With 75,000 riders, Suburban will operate at a surplus because the subsidy more than

offsets the negative contribution margin plus fixed costs. It is ―below‖ break-even, but

because Suburban loses money on each rider ($1.00 revenue less the $1.50 variable

costs), it operates with a surplus below break-even and at a deficit above break-even.

©The McGraw-Hill Companies, Inc., 2017

106 Fundamentals of Cost Accounting

Downloaded by Mary Joy Banzon (mariapadillaxx@gmail.com)

lOMoARcPSD|7242917

3-48. (35 min.) CVP Analysis―Sensitivity Analysis: Alameda Tile.

a. Profit = (P – V) X – F

Profit = ($800 – $480) X – $160,000

0 = ($800 – $480) X – $160,000

X = $160,000 ÷ $320

= 500 students

b. Profit = ($800 – $480) X – $160,000

$80,000 = ($800 – $480) X – $160,000

X = $240,000 ÷ $320

= 750 students

c. (1) Profit = ($800 – $480) x 800 students – $160,000

= $96,000

c. (2) 10% price decrease. Now P = $720

Profit = ($720 – $480) x 800 students – $160,000

= $32,000 Profit decreases by $64,000

20% price increase. Now P = $960

Profit = ($960 – $480) x 800 students – $160,000

= $224,000 Profit increases by $128,000

c. (3) 10% variable cost decrease. Now V = $432

Profit = ($800 – $432) x 800 students – $160,000

= $134,400 Profit increases by $38,400

20% variable cost increase. Now V = $576

Profit = ($800 – $576) x 800 students – $160,000

= $19,200 Profit decreases by $76,800

©The McGraw-Hill Companies, Inc., 2017

Solutions Manual, Chapter 3 107

Downloaded by Mary Joy Banzon (mariapadillaxx@gmail.com)

lOMoARcPSD|7242917

3-48 (continued).

c. (4) 10% fixed cost decrease, 10% variable cost increase.

Now F = $144,000 and V = $528

Profit = ($800 – $528) x 800 students – $144,000

= $73,600 Profit decreases by $22,400

3-49. (35 min.) Extensions of the CVP Model―Semifixed (Step) Costs: Sam's

Sushi.

a. There are three possible break-even points (one with each additional lane):

1 lane: X = $33,000 ÷ ($10 – $4) = 5,500 meals

2 lanes: X = $39,000 ÷ ($10 – $4) = 6,500 meals

3 lanes: X = $52,500 ÷ ($10 – $4) = 8,750 meals

The break-even point with one lane is not feasible because it exceeds the maximum

number of meals for one lane.

Therefore, there are two break-even points: 6,500 meals and 8,750 meals.

b. To answer this question, we just need to check at the three maximum levels for each

lane alternative:

Alternative Profit (Loss)

1 lane [($10 — $4) x 5,000 meals – $33,000] = ($3,000)

2 lanes [($10 — $4) x 8,000 meals – $39,000] = $9,000

3 lanes [($10 — $4) x 10,000 meals – $52,500] = $7,500

Sam should operate 2 lanes.

©The McGraw-Hill Companies, Inc., 2017

108 Fundamentals of Cost Accounting

Downloaded by Mary Joy Banzon (mariapadillaxx@gmail.com)

lOMoARcPSD|7242917

3-50. (35 min.) Extensions of the CVP Model―Semifixed (Step) Costs: Cesar's

Bottlers.

a. There are three possible break-even points (one with each additional shift):

1 shift: X = $1,980 ÷ ($2.00 – $0.90) = 1,800 cases

2 shifts: X = $3,740 ÷ ($2.00 – $0.90) = 3,400 cases

3 shifts: X = $5,170 ÷ ($2.00 – $0.90) = 4,700 cases

Each of the three break-even points is feasible.

b. To answer this question, we just need to check at the three maximum levels for each

lane alternative:

Alternative Profit

1 shift [($2.00 - $0.90) x 2,000 cases – $1,980] = $220

2 shifts [($2.00 - $0.90) x 3,600 cases – $3,740] = $220

3 shifts [($2.00 - $0.90) x 5,000 cases – $5,170] = $330

Cesar should operate 3 shifts.

3-51. (15 min.) Extensions of the CVP Model—Taxes: Odd Wallow Drinks.

a.

X = $12,168,000 ÷ ($75 – $36) = 312,000 cases

b. In order to achieve a profit of $1,872,000 after tax, Odd Wallow must earn:

$3,120,000 = [$1,872,000 ÷ (100% – 40%)] before taxes.

The number of cases to earn $3,120,000 in operating profits is:

X = ($12,168,000 + $3,120,000) ÷ ($75 – $36) = 392,000 cases

©The McGraw-Hill Companies, Inc., 2017

Solutions Manual, Chapter 3 109

Downloaded by Mary Joy Banzon (mariapadillaxx@gmail.com)

lOMoARcPSD|7242917

3-52. (20 min.) Extensions of the CVP Model—Taxes: Frightproof Commuter

Airlines.

a.

0 = (P – V)X – F

0 = ($240 – $60)X – $8,640

$8,640 = ($240 – $60)X

X = $8,640 ÷ $180

= 48 passengers

b.

After-tax profits = [(P – V)X – F](1 – t)

$3,510 = [($240 – $60)X – $8,640](1 – .25)

$3,510 = ($180X – $8,640)(.75)

($3,510 ÷ .75) = $180X – $8,640

$4,680 + $8,640 = $180X

$180X = $13,320

X = $13,320 ÷ $180

X = 74 passengers

c. With a capacity of 70 passengers, Frightproof can break even (48 < 70), but will not be

able to earn $3,510 per flight after taxes (74 > 70).

3-53. (20 min.) Extensions of the CVP Model—Taxes: Central Co.

After tax profits = [(P – V)X – F](1 – t)

$187,200 = [($13 – $4) x 100,000 – $540,000](1 – t)

$187,200 = $360,000 – $360,000t

$360,000t = $172,800

t = $172,800 ÷ $360,000

= 0.48 or 48%

©The McGraw-Hill Companies, Inc., 2017

110 Fundamentals of Cost Accounting

Downloaded by Mary Joy Banzon (mariapadillaxx@gmail.com)

lOMoARcPSD|7242917

3-54. (20 min.) Extensions of the CVP Model—Taxes: Toys 4 Us.

a.

0 = (P – V)X – F

0 = ($1,200 – $750)X – $900,000

$900,000 = ($1,200 – $750)X

X = $900,000 ÷ $450

= 2,000 units

b.

After tax profits = [(P – V)X – F](1 – t)

$135,000 = [($1,200 – $750)X – $900,000](1 – .40)

$135,000 = ($450X – $900,000)(.60)

($135,000 ÷ .60) = $450X – $900,000

$225,000 + $900,000 = $450X

$450X = $1,125,000

X = $1,125,000 ÷ $450

X = 2,500 units

3-55. (40 min.) Extensions of the CVP Model—Taxes: Eagle Company.

a.

Sales ................................ $10,000,000 (= $400 x 25,000)

Variable costs .................. 4,125,000 (= $165 x 25,000)

Contribution margin .......... $5,875,000

Fixed costs ....................... 1,500,000

Before-tax profit ............... $ 4,375,000

Taxes (35% rate) ............. 1,531,250

After-tax profit .................. $ 2,843,750

©The McGraw-Hill Companies, Inc., 2017

Solutions Manual, Chapter 3 111

Downloaded by Mary Joy Banzon (mariapadillaxx@gmail.com)

lOMoARcPSD|7242917

3-55 (continued).

b.

Profit = (P – V)X – F

$0 = ($400 – $165)X – $1,500,000

$235X = $1,500,000

$1,500,000

X=

$235

X = 6,383 Units (rounded)

c.

Sales ................................ $11,200,000 (= $400 x 28,000)

Variable costs ................... 4,620,000 (= $165 x 28,000)

Contribution margin .......... $ 6,580,000

Fixed costs ....................... 1,800,000 (= $1,500,000 + $300,000)

Before-tax profit ................ $ 4,780,000

Taxes (35% rate) .............. 1,673,000

After-tax profit ................... $3,107,000

d.

Profit = (P – V)X – F

$0 = ($400 – $165)X – $1,800,000

$235X = $1,800,000

$1,800,000

X= = 7,660 units (rounded)

$235

Sales $ = $400 x 7,660 = $3,064,000

©The McGraw-Hill Companies, Inc., 2017

112 Fundamentals of Cost Accounting

Downloaded by Mary Joy Banzon (mariapadillaxx@gmail.com)

lOMoARcPSD|7242917

3-55 (continued).

e. $10,510,800

Fixed costs + [Target profit ÷ (1 − t)]

Target profit in units =

Unit contribution margin

$1,800,000 + [$2,843,750 ÷ (1 − .35)]

=

$235

$1,800,000 + $4,375,000

=

$235

= 26,277 units (rounded)

Sales dollars = $10,510,800 (= 26,277 x $400)

f. $3,926,154

Sales ................................ $11,200,000 (= $400 x 28,000)

Variable costs .................. 4,620,000 (= $165 x 28,000)

Contribution margin .......... $6,580,000

Advertising costs .............. ?

Other fixed costs .............. 1,500,000

Before-tax profit ............... $ 1,153,846 (= $750,000 ÷ [1 − 0.35]

Taxes (35% rate) ............. 403,846

After-tax profit .................. $ 750,000

To find the maximum advertising cost to maintain after-tax profit of $750,000, solve as

follows:

Contribution Margin ($6,580,000) – Advertising Costs – Other Fixed Costs

($1,500,000)

= Before-Tax Profits ($1,153,846)

$6,580,000 – $1,500,000 – $1,153,846 = Advertising Costs

Maximum Advertising Costs = $3,926,154

©The McGraw-Hill Companies, Inc., 2017

Solutions Manual, Chapter 3 113

Downloaded by Mary Joy Banzon (mariapadillaxx@gmail.com)

lOMoARcPSD|7242917

3-56. (30 min.) Extensions of the CVP Model—Multiple Products: On-the Go, Inc.

a. Programmer + Executive

8,000 $70 + 12,000 $100 = $1,760,000 PX

8,000 $30 + 12,000 $40 = 720,000 VX

8,000 $40 + 12,000 $60 = $ 1,040,000 (P – V)X

819,000 F

$ 221,000 Profit

b.

Compute the weighted-average contribution margin.

Weights:

Programmer = 8,000 ÷ (8,000 + 12,000) = .40

Executive = 12,000 ÷ (8,000 + 12,000) = .60

Weighted-average CM = 0.4 $40 + 0.6 $60

= $16 + $36

Weighted-average CM = $52

Compute break-even:

Profit = (P – V)X – F

$0 = $52X – $819,000

$52X = $819,000

X = $819,000 ÷ $52

X = 15,750 total units

Programmer: produce 0.4 15,750 = 6,300 units

Executive: produce 0.6 15,750 = 9,450 units

Alternative approach:

Define a package containing 4 Programmer and 6 Executive models:

Price 4 $70 + 6 $100 = $880

Variable cost 4 $30 + 6 $40 = 360

Contribution margin $520

Break-even $819,000 ÷ $520 = 1,575 packages

Programmer model: 4 1,575 packages = 6,300 units

Executive model: 6 1,575 packages = 9,450 units

©The McGraw-Hill Companies, Inc., 2017

114 Fundamentals of Cost Accounting

Downloaded by Mary Joy Banzon (mariapadillaxx@gmail.com)

lOMoARcPSD|7242917

3-56. (continued).

c. New weights:

Weights:

Programmer = .90

Executive = .10

Weighted-average CM = 0.9 $40 + 0.1 $60

= $36 + $6

Weighted-average CM = $42

Compute break-even:

Profit = (P – V)X – F

$0 = $42X – $819,000

$42X = $819,000

X = $819,000 ÷ $42

X = 19,500 total units

Programmer: produce 0.9 19,500 = 17,550 units

Executive: produce 0.1 19,500 = 1,950 units

Alternative approach:

Define a package containing 9 Programmer and 1 Executive models:

Price 9 $70 + 1 $100 = $730

Variable cost 9 $30 + 1 $40 = 310

Contribution margin $420

Break-even $819,000 ÷ $420 = 1,950 packages

Programmer model: 9 1,950 packages = 17,550 units

Executive model: 1 1,950 packages = 1,950 units

©The McGraw-Hill Companies, Inc., 2017

Solutions Manual, Chapter 3 115

Downloaded by Mary Joy Banzon (mariapadillaxx@gmail.com)

lOMoARcPSD|7242917

3-57. (30 min.) Extensions of the CVP Model—Multiple Products: Sundial, Inc.

a. AU + NZ

60,000 $160 + 40,000 $160 = $16,000,000 PX

60,000 $60 + 40,000 $80 = 6,800,000 VX

60,000 $100 + 40,000 $80 = $ 9,200,000 (P – V)X

2,208,000 F

$6,992,000 Profit

b.

Compute the weighted-average contribution margin.

Weights:

AU = 60,000 ÷ (60,000 + 40,000) = .60

NZ = 40,000 ÷ (60,000 + 40,000) = .40

Weighted-average CM = 0.6 $100 + 0.4 $80

= $60 + $32

Weighted-average CM = $92

Compute break-even:

Profit = (P – V)X – F

$0 = $92X – $2,208,000

$92X = $2,208,000

X = $2,208,000 ÷ $92

X = 24,000 total units

AU: produce 0.6 24,000 = 14,400 units

NZ: produce 0.4 24,000 = 9,600 units

Alternative approach:

Define a package containing 6 AU and 4 NZ models:

Price 6 $160 + 4 $160 = $1,600

Variable cost 6 $60 + 4 $80 = 680

Contribution margin $920

Break-even $2,208,000 ÷ $920 = 2,400 packages

AU model: 6 2,400 packages = 14,400 units

NZ model: 4 2,400 packages = 9,600 units

©The McGraw-Hill Companies, Inc., 2017

116 Fundamentals of Cost Accounting

Downloaded by Mary Joy Banzon (mariapadillaxx@gmail.com)

lOMoARcPSD|7242917

3-57. (continued).

c. New weights:

Weights:

AU = .80

NZ = .20

Weighted-average CM = 0.8 $100 + 0.2 $80

= $80 + $16

Weighted-average CM = $96

Compute break-even:

Profit = (P – V)X – F

$0 = $96X – $2,208,000

$96X = $2,208,000

X = $2,208,000 ÷ $96

X = 23,000 total units

AU: produce 0.8 23,000 = 18,400 units

NZ: produce 0.2 23,000 = 4,600 units

Alternative approach:

Define a package containing 8 AU and 2 NZ models:

Price 8 $160 + 2 $160 = $1,600

Variable cost 8 $60 + 2 $80 = 640

Contribution margin $960

Break-even $2,208,000 ÷ $960 = 2,300 packages

AU model: 8 2,300 packages = 18,400 units

NZ model: 2 2,300 packages = 4,600 units

©The McGraw-Hill Companies, Inc., 2017

Solutions Manual, Chapter 3 117

Downloaded by Mary Joy Banzon (mariapadillaxx@gmail.com)

lOMoARcPSD|7242917

3-58. (30 min.) Extensions of the CVP Model—Multiple Products: Sell Block.

a. Individuals + Partnerships + Corporations

60,000 $200 + 4,000 $1,000 + 16,000 $2,000 = $48,000,000 PX

60,000 $180 + 4,000 $900 + 16,000 $1,800 = 43,200,000 VX

60,000 $20 + 4,000 $100 + 16,000 $200 = $ 4,800,000 (P – V)X

3,690,000 F

$ 1,110,000 Profit

b. Compute the weighted-average contribution margin.

Weights:

Individuals = 60,000 ÷ (60,000 + 4,000 + 16,000) = .75

Partnerships = 4,000 ÷ (60,000 + 4,000 + 16,000) = .05

Corporations = 16,000 ÷ (60,000 + 4,000 + 16,000) = .20

Weighted-average CM = 0.75 $20 + 0.05 $100 + 0.20 x $200

= $15 + $5 + $40

Weighted-average CM = $60

Compute break-even:

Profit = (P – V)X – F

$0 = $60X – $3,690,000

$60X = $3,690,000

X = $3,690,000 ÷ $60

X = 61,500 total returns

Individuals: prepare 0.75 61,500 = 46,125 returns

Partnerships: prepare 0.05 61,500 = 3,075 returns

Corporations: prepare 0.20 61,500 = 12,300 returns

©The McGraw-Hill Companies, Inc., 2017

118 Fundamentals of Cost Accounting

Downloaded by Mary Joy Banzon (mariapadillaxx@gmail.com)

lOMoARcPSD|7242917

3-58. (continued).

c. New weights:

Weights:

Individuals = .60

Partnerships = .10

Corporations = .30

Weighted-average CM = 0.6 $20 + 0.1 $100 + 0.3 x $200

= $12+ $10 + $60

Weighted-average CM = $82

Compute breakeven:

Profit = (P – V)X – F

$0 = $82X – $3,690,000

$82X = $3,690,000

X = $3,690,000 ÷ $82

X = 45,000 total units

Individuals: prepare 0.60 45,000 = 27,000 returns

Partnerships: prepare 0.10 45,000 = 4,500 returns

Corporations: prepare 0.30 45,000 = 13,500 returns

©The McGraw-Hill Companies, Inc., 2017

Solutions Manual, Chapter 3 119

Downloaded by Mary Joy Banzon (mariapadillaxx@gmail.com)

lOMoARcPSD|7242917

3-59. (20 min.) Extensions of CVP Analysis—Multiple Products: Minot Furniture.

At the break-even point of 750 total units, the total contribution margin will equal the fixed

costs. Let X = the number of basic desks sold at the break-even point. Then (750 − X) will

equal the number of adjustable desks sold at the break-even point. Therefore,

($600 − $360) X + ($900 − $450) (750 − X) = $243,000

$240 X + $450 (750 − X) = $243,000

$210 X = $94,500

X = 450 basic desks

So, (750 − X) = 300 adjustable desks

The assumed sales mix is 450/750 or 60 percent basic desks and 40 percent adjustable

desks.

©The McGraw-Hill Companies, Inc., 2017

120 Fundamentals of Cost Accounting

Downloaded by Mary Joy Banzon (mariapadillaxx@gmail.com)

lOMoARcPSD|7242917

3-60. (30 min.) Extensions of the CVP Basic Model—Multiple Products and Taxes:

Ocean King Products.

a. Compute weighted-average contribution margins for each product.

Selling Variable Contribution

Price per Cost per Margin per

Weights case Case Case

Variety 1 .40 $ 3 $ 2 $1

Variety 2 .35 5 3 2

Variety 3 .25 10 6 4

Weighted-average Revenue = .4 x $3 + .35 x $5 + .25 x $10

= $5.45

Weighted-average CM = .4 x $1 + .35 x $2 + .25 x $4

= $2.10

Weighted-average CM% = $2.10 ÷ $5.45 = 38.5321% (rounded)

Compute break-even revenue:

Break-even revenue = F ÷ Weighted-average CM%

= $46,200 ÷ 38.5321%

= $119,900 (rounded)

b.

After-tax income: = $40,950

Before-tax income = [$40,950 ÷ (1 – .35)]

= ($40,950 ÷ .65)

= $63,000

Compute required revenue:

Revenue = (F + Required profit) ÷ Weighted-average CM%

= ($46,200 + $63,000) ÷ 38.5321%

= $109,200 ÷ 38.5321%

= $283,400 (rounded)

©The McGraw-Hill Companies, Inc., 2017

Solutions Manual, Chapter 3 121

Downloaded by Mary Joy Banzon (mariapadillaxx@gmail.com)

lOMoARcPSD|7242917

3-61. (30 min.) Extensions of the CVP Model—Multiple Products and Taxes:

Limitless Labs, Inc.

a. Basic + Retest + Vital Total

Revenue 850 $500 + 100 $800 + 50 $4,000 = $705,000

Variable costs 850 $120 + 100 $400 + 50 $2,800 = 282,000

Contribution margin 850 $380 + 100 $400 + 50 $1,200 = $ 423,000

Fixed cost 390,000

Profit before taxes $ 33,000

Income tax (@ 40%) 13,200

Profit $19,800

b. Compute weighted-average contribution margin percentages for each product.

Selling Price Variable Cost Contribution

Weights per Test per Test Margin per Test

Basic .85 $ 500 $ 120 $380

Retest .10 800 400 400

Vital .05 4,000 2,800 1,200

Weighted-average Revenue = .85 x $500 + .10 x $800 + .05 x $4,000

= $705

Weighted-average CM = .85 x $380 + .10 x $400 + .05 x $1,200

= $423

Weighted-average CM% = $423 ÷ $705 = 60%

Compute break-even revenue:

Break-even revenue = F ÷ Weighted-average CM%

= $390,000 ÷ 60%

= $650,000

©The McGraw-Hill Companies, Inc., 2017

122 Fundamentals of Cost Accounting

Downloaded by Mary Joy Banzon (mariapadillaxx@gmail.com)

lOMoARcPSD|7242917

3-61. (continued).

c.

After-tax income: = $180,000

Before-tax income = [$180,000 ÷ (1 – .40)]

= ($180,000 ÷ .60)

= $300,000

Compute required revenue:

Revenue = (F + Required profit) ÷ Weighted-average CM%

= ($390,000 + $300,000) ÷ 60%

= $690,000 ÷ 60%

= $1,150,000

d. Basic + Retests + Vital Total

Revenue 100 $500 + 400 $800 + 200 $4,000 = $1,170,000

Variable costs 100 $120 + 400 $400 + 200 $2,800 = 732,000

Contribution margin 100 $380 + 400 $400 + 200 $1,200 = $ 438,000

Fixed cost 420,000

Profit before taxes $ 18,000

Income tax (@ 40%) 7,200

Profit $10,800

Based on after-tax profit, Limitless Labs should not change the product mix.

©The McGraw-Hill Companies, Inc., 2017

Solutions Manual, Chapter 3 123

Downloaded by Mary Joy Banzon (mariapadillaxx@gmail.com)

lOMoARcPSD|7242917

3-62. (30 min.) Extensions of the CVP Model—Multiple Products and Taxes:

Painless Dental Clinics, Inc.

a. Cleaning + Filling + Capping Total

Revenue 9,000 $120 + 900 $400 + 100 $1,200 = $1,560,000

Variable costs 9,000 $80 + 900 $300 + 100 $500 = 1,040,000

Contribution margin 9,000 $40 + 900 $100 + 100 $700 = $ 520,000

Fixed cost 400,000

Profit before taxes $ 120,000

Income tax (@ 30%) 36,000

Profit $84,000

b. Compute weighted-average contribution margin percentages for each product.

Selling Price Variable Cost Contribution Margin

Weights per Service per Service per Service

Cleaning .90 $ 120 $ 80 $ 40

Filling .09 400 300 100

Capping .01 1,200 500 700

Weighted-average Revenue = .90 x $120 + .09 x $400 + .01 x $1,200

= $156

Weighted-average CM = .90 x $40 + .09 x $100 + .01 x $700

= $52

Weighted-average CM% = $52 ÷ $156 = 33.33% (rounded)

Compute break-even revenue:

Break-even revenue = F ÷ Weighted-average CM%

= $400,000 ÷ 33.33%

= $1,200,000 (rounded)

c.

After tax income: = $140,000

Before tax income = [$140,000 ÷ (1 – .30)]

= ($140,000 ÷ .70)

= $200,000

Compute required revenue:

Revenue = (F + Required profit) ÷ Weighted-average CM%

= ($400,000 + $200,000) ÷ 33.33%

= $600,000 ÷ 33.33%

= $1,800,000 (rounded)

©The McGraw-Hill Companies, Inc., 2017

124 Fundamentals of Cost Accounting

Downloaded by Mary Joy Banzon (mariapadillaxx@gmail.com)

lOMoARcPSD|7242917

3-62. (continued).

d. Cleaning + Filling + Capping Total

Revenue 12,000 $120 + 1,000 $400 + 0 $1,200 = $1,840,000

Variable costs 12,000 $80 + 1,000 $300 + 0 $500 = 1,260,000

Contribution margin 12,000 $40 + 1,000 $100 + 0 $700 = $ 580,000

Fixed cost 450,000

Profit before taxes $ 130,000

Income tax (@ 30%) 39,000

Profit $91,000

Based on after-tax profit, Painless Dental Clinics should change the product mix.

3-63. (20 min.) Extensions of the CVP Model—Taxes With Graduated Rates:

Hastings & Daughters.

a.

Profit = (P – V)X – F

$0 = ($25 – $17)X – $112,000

$8X = $112,000

$112,000

X=

$8

X = 14,000 Units

©The McGraw-Hill Companies, Inc., 2017

Solutions Manual, Chapter 3 125

Downloaded by Mary Joy Banzon (mariapadillaxx@gmail.com)

lOMoARcPSD|7242917

3-63. (continued).

b.

First, determine the pre-tax income necessary to earn $90,000 after-tax. The first

$100,000 of income is taxed at 25 percent, so the after-tax income is $75,000:

= [100,000 x (1.0 – 0.25).

To earn an additional $15,000 (= $90,000 – $75,000) after tax requires pre-tax income of

$25,000 [= $15,000 ÷ (1.0 – 0.40)]. Therefore, to earn $90,000 after tax requires pre-tax

income of $125,000 (= $100,000 + $25,000).

Substitute $125,000 in the breakeven equation:

Profit = (P – V)X – F

$125,000 = ($25 – $17)X – $112,000

$8X = $112,000

$237,000

X=

$8

X = 29,625 Units

©The McGraw-Hill Companies, Inc., 2017

126 Fundamentals of Cost Accounting

Downloaded by Mary Joy Banzon (mariapadillaxx@gmail.com)

lOMoARcPSD|7242917

Solutions to Integrative Case

3-64. (60 min.) Financial Modeling: Roseville Brewing Company.

a. Potential investors and bankers were concerned about the accuracy of the income

statement projections. They wanted to know what would happen if the projections

were overly optimistic. Operating profit was heavily influenced by projected sales

dollars and product mix. The concern was over the impact changes in sales and

product mix (among other things) might have on operating profit.

b. The first income statement was in the traditional format. In the traditional format, costs

are not shown according to cost behavior. Thus, it is difficult to predict what will

happen with costs as changes are made in sales volume. For example, if sales

volume decreases by 10 percent, it is difficult to predict what will happen with cost of

sales and marketing and administrative expenses. Will they decrease by the same

percentage? (Unlikely unless all costs are variable!)

c. The best way to quickly check for reasonableness is to compare the operating profit as

a percentage of sales to other similar businesses. In addition, the dollar amount of

operating profit can be compared to other similar businesses of roughly the same size.

(In fact, the banks and investors who were approached by RBC often looked at these

two items as a starting point to ensure the projected income statement was

reasonable.)

d. The cost of a pint of beer can range from $0.15 to $1.40 depending on what is included

in the cost. Should we include only the materials? Should we include direct labor?

Indirect labor? Manufacturing overhead? The point is to understand what is included

in the cost of a product, particularly when this information is used for pricing and other

forms of decision-making.

e. (1) The break-even point in sales dollars is $1,235,154, calculated as follows:

Breakeven point = Total fixed costs ÷ contribution margin ratio

= $520,000 ÷ ($822,212 ÷ $1,953,000)

= $520,000 ÷ .421

= $1,235,154.

(2) The margin of safety is $717,846, calculated as follows:

Margin of safety = $1,953,000 – $1,235,154

= $717,846.

©The McGraw-Hill Companies, Inc., 2017

Solutions Manual, Chapter 3 127

Downloaded by Mary Joy Banzon (mariapadillaxx@gmail.com)

lOMoARcPSD|7242917

3-64 (continued).

(3) RBC is selling many different products that change daily. It is difficult if not

impossible, to measure units of product for a brew pub. This same argument holds

true for most service companies as well. Service companies do not sell ―units‖ of

service. Thus, for these types of companies, break-even points and target profit points

are calculated using sales dollars.

(4) The sales dollars required to achieve $200,000 in operating profit is $1,710,214,

calculated as follows:

Total fixed costs + Target profit

Target profit =

Contribution margin ratio

= ($520,000 + $200,000) ÷ .421

= $720,000 ÷ .421

= $1,710,214.

The sales dollars required to achieve $500,000 in operating profit is $2,422,803,

calculated as follows:

= ($520,000 + $500,000) ÷ .421

= $1,020,000 ÷ .421

= $2,422,803.

These calculations assume that the product mix is constant. The contribution margin

ratio is dependent on the product mix, and will change as the product mix changes.

©The McGraw-Hill Companies, Inc., 2017

128 Fundamentals of Cost Accounting

Downloaded by Mary Joy Banzon (mariapadillaxx@gmail.com)

You might also like

- Chapter 12 Factory Over Head Planned Actual and Applied Variance AnalysisNo ratings yetChapter 12 Factory Over Head Planned Actual and Applied Variance Analysis29 pages

- Discussion - Example Problem of Keep or Drop Decisions0% (1)Discussion - Example Problem of Keep or Drop Decisions2 pages

- Answers: Job Costing: Journal-Entry EmphasisNo ratings yetAnswers: Job Costing: Journal-Entry Emphasis7 pages

- Required: Prepare Computation Showing How Much Profit Will Increase or Decrease If SolutionNo ratings yetRequired: Prepare Computation Showing How Much Profit Will Increase or Decrease If Solution1 page

- Standard Costing and The Balance Scorecard100% (1)Standard Costing and The Balance Scorecard76 pages

- Cost Defined: Introduction To Cost Accounting, Cost Concepts, Cost Behavior Analysis and Cost Accounting CycleNo ratings yetCost Defined: Introduction To Cost Accounting, Cost Concepts, Cost Behavior Analysis and Cost Accounting Cycle4 pages

- BINUS University: Undergraduate / Master / Doctoral ) International/Regular/Smart Program/Global Class )No ratings yetBINUS University: Undergraduate / Master / Doctoral ) International/Regular/Smart Program/Global Class )3 pages

- Lanen - Fundamentals of Cost Accounting - 6e - Chapter 1 - NotesNo ratings yetLanen - Fundamentals of Cost Accounting - 6e - Chapter 1 - Notes4 pages

- Test Bank For Managerial Accounting, 17e Ray Garrison, Eric Noreen, Peter BrewerNo ratings yetTest Bank For Managerial Accounting, 17e Ray Garrison, Eric Noreen, Peter Brewer53 pages

- Module For Managerial Accounting-Job Order CostingNo ratings yetModule For Managerial Accounting-Job Order Costing17 pages

- Saint Theresa College of Tandag, Inc. Tandag City Strategic Cost Management - Summer Class Dit 1No ratings yetSaint Theresa College of Tandag, Inc. Tandag City Strategic Cost Management - Summer Class Dit 14 pages

- True/False: Chapter 10: Determining How Costs Behave100% (1)True/False: Chapter 10: Determining How Costs Behave35 pages

- Responsibility Accounting and Transfer Pricing: Illustrative Problem 13.1 Evaluation of A Cost CenterNo ratings yetResponsibility Accounting and Transfer Pricing: Illustrative Problem 13.1 Evaluation of A Cost Center4 pages

- Service Department Cost Allocation: Solutions To Exercises and ProblemsNo ratings yetService Department Cost Allocation: Solutions To Exercises and Problems27 pages

- Problem No. 1 Average Method Equivalent Production Inputs: Materials Conversion CostNo ratings yetProblem No. 1 Average Method Equivalent Production Inputs: Materials Conversion Cost4 pages

- AML-Excercise Week 3 (Reviandi Ramadhan)No ratings yetAML-Excercise Week 3 (Reviandi Ramadhan)9 pages

- Activitybased Costing May 20 GMSISUCCESSNo ratings yetActivitybased Costing May 20 GMSISUCCESS29 pages

- Objective 11.1: Chapter 11 Decision Making and Relevant InformationNo ratings yetObjective 11.1: Chapter 11 Decision Making and Relevant Information10 pages

- Intermediate Accounting Chapter 3 ProblemsNo ratings yetIntermediate Accounting Chapter 3 Problems34 pages

- Chapter 5 Assignment Regression AnalysisNo ratings yetChapter 5 Assignment Regression Analysis7 pages

- Chapter Five: Cost Estimation: Total CostsNo ratings yetChapter Five: Cost Estimation: Total Costs2 pages

- Chapter Seven - Process Selection, Design, and ImprovementNo ratings yetChapter Seven - Process Selection, Design, and Improvement3 pages

- Work It!: Stretching and Zumba ExercisesNo ratings yetWork It!: Stretching and Zumba Exercises2 pages

- CVP Analysis and Break Even Point Analysis100% (2)CVP Analysis and Break Even Point Analysis16 pages

- Realizing The Dream: Decision-Making in Action: BackgroundNo ratings yetRealizing The Dream: Decision-Making in Action: Background7 pages

- Combine Harvester: Impact On Paddy Production in Bangladesh: Journal of Bangladesh Agricultural UniversityNo ratings yetCombine Harvester: Impact On Paddy Production in Bangladesh: Journal of Bangladesh Agricultural University9 pages

- Stone Crusher: Profile No.: 262 NIC Code: 08106No ratings yetStone Crusher: Profile No.: 262 NIC Code: 0810614 pages

- Cost-Volume-Profit Analysis: Dadit Prakoso Roni Agustin Madjid Ikram Hanung Wahyu Hidayat Ressa FirmansyahNo ratings yetCost-Volume-Profit Analysis: Dadit Prakoso Roni Agustin Madjid Ikram Hanung Wahyu Hidayat Ressa Firmansyah8 pages

- Marginal Costing and Absorption CostingNo ratings yetMarginal Costing and Absorption Costing28 pages

- Cambridge International AS & A Level: Business 9609/32 October/November 2020No ratings yetCambridge International AS & A Level: Business 9609/32 October/November 202019 pages

- Group 2: Dakshayani Biscuits (: Cost Sheet)No ratings yetGroup 2: Dakshayani Biscuits (: Cost Sheet)6 pages

- Business Proposal For Navarro'S Food International, IncNo ratings yetBusiness Proposal For Navarro'S Food International, Inc53 pages

- Problem Set Chapter 3 Business Dimension: Exercise 1No ratings yetProblem Set Chapter 3 Business Dimension: Exercise 15 pages

- Chapter 12 Factory Over Head Planned Actual and Applied Variance AnalysisChapter 12 Factory Over Head Planned Actual and Applied Variance Analysis

- Discussion - Example Problem of Keep or Drop DecisionsDiscussion - Example Problem of Keep or Drop Decisions

- Required: Prepare Computation Showing How Much Profit Will Increase or Decrease If SolutionRequired: Prepare Computation Showing How Much Profit Will Increase or Decrease If Solution

- Cost Defined: Introduction To Cost Accounting, Cost Concepts, Cost Behavior Analysis and Cost Accounting CycleCost Defined: Introduction To Cost Accounting, Cost Concepts, Cost Behavior Analysis and Cost Accounting Cycle

- BINUS University: Undergraduate / Master / Doctoral ) International/Regular/Smart Program/Global Class )BINUS University: Undergraduate / Master / Doctoral ) International/Regular/Smart Program/Global Class )

- Lanen - Fundamentals of Cost Accounting - 6e - Chapter 1 - NotesLanen - Fundamentals of Cost Accounting - 6e - Chapter 1 - Notes

- Test Bank For Managerial Accounting, 17e Ray Garrison, Eric Noreen, Peter BrewerTest Bank For Managerial Accounting, 17e Ray Garrison, Eric Noreen, Peter Brewer

- Module For Managerial Accounting-Job Order CostingModule For Managerial Accounting-Job Order Costing

- Saint Theresa College of Tandag, Inc. Tandag City Strategic Cost Management - Summer Class Dit 1Saint Theresa College of Tandag, Inc. Tandag City Strategic Cost Management - Summer Class Dit 1

- True/False: Chapter 10: Determining How Costs BehaveTrue/False: Chapter 10: Determining How Costs Behave

- Responsibility Accounting and Transfer Pricing: Illustrative Problem 13.1 Evaluation of A Cost CenterResponsibility Accounting and Transfer Pricing: Illustrative Problem 13.1 Evaluation of A Cost Center

- Service Department Cost Allocation: Solutions To Exercises and ProblemsService Department Cost Allocation: Solutions To Exercises and Problems

- Problem No. 1 Average Method Equivalent Production Inputs: Materials Conversion CostProblem No. 1 Average Method Equivalent Production Inputs: Materials Conversion Cost

- Objective 11.1: Chapter 11 Decision Making and Relevant InformationObjective 11.1: Chapter 11 Decision Making and Relevant Information

- Chapter Seven - Process Selection, Design, and ImprovementChapter Seven - Process Selection, Design, and Improvement

- Realizing The Dream: Decision-Making in Action: BackgroundRealizing The Dream: Decision-Making in Action: Background

- Combine Harvester: Impact On Paddy Production in Bangladesh: Journal of Bangladesh Agricultural UniversityCombine Harvester: Impact On Paddy Production in Bangladesh: Journal of Bangladesh Agricultural University

- Cost-Volume-Profit Analysis: Dadit Prakoso Roni Agustin Madjid Ikram Hanung Wahyu Hidayat Ressa FirmansyahCost-Volume-Profit Analysis: Dadit Prakoso Roni Agustin Madjid Ikram Hanung Wahyu Hidayat Ressa Firmansyah

- Cambridge International AS & A Level: Business 9609/32 October/November 2020Cambridge International AS & A Level: Business 9609/32 October/November 2020

- Business Proposal For Navarro'S Food International, IncBusiness Proposal For Navarro'S Food International, Inc

- Problem Set Chapter 3 Business Dimension: Exercise 1Problem Set Chapter 3 Business Dimension: Exercise 1