0 ratings0% found this document useful (0 votes)

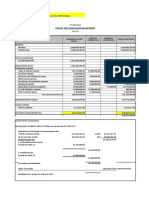

7 viewsCompute Taxable Income and Taxpayable of ABC Company For Tax Year Ending On 31st Dec 2020. (Manufactuere)

Compute Taxable Income and Taxpayable of ABC Company For Tax Year Ending On 31st Dec 2020. (Manufactuere)

Uploaded by

Abdul wahabThe document provides information to compute the taxable income and tax payable of ABC Company for the 2020 tax year. It lists the company's income and expenses and provides notes on certain line items. It then calculates the actual net profit, taxable income, taxes owed, and total tax payable.

Copyright:

© All Rights Reserved

Available Formats

Download as XLSX, PDF, TXT or read online from Scribd

Compute Taxable Income and Taxpayable of ABC Company For Tax Year Ending On 31st Dec 2020. (Manufactuere)

Compute Taxable Income and Taxpayable of ABC Company For Tax Year Ending On 31st Dec 2020. (Manufactuere)

Uploaded by

Abdul wahab0 ratings0% found this document useful (0 votes)

7 views4 pagesThe document provides information to compute the taxable income and tax payable of ABC Company for the 2020 tax year. It lists the company's income and expenses and provides notes on certain line items. It then calculates the actual net profit, taxable income, taxes owed, and total tax payable.

Original Title

2-4-21 (B)

Copyright

© © All Rights Reserved

Available Formats

XLSX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

The document provides information to compute the taxable income and tax payable of ABC Company for the 2020 tax year. It lists the company's income and expenses and provides notes on certain line items. It then calculates the actual net profit, taxable income, taxes owed, and total tax payable.

Copyright:

© All Rights Reserved

Available Formats

Download as XLSX, PDF, TXT or read online from Scribd

Download as xlsx, pdf, or txt

0 ratings0% found this document useful (0 votes)

7 views4 pagesCompute Taxable Income and Taxpayable of ABC Company For Tax Year Ending On 31st Dec 2020. (Manufactuere)

Compute Taxable Income and Taxpayable of ABC Company For Tax Year Ending On 31st Dec 2020. (Manufactuere)

Uploaded by

Abdul wahabThe document provides information to compute the taxable income and tax payable of ABC Company for the 2020 tax year. It lists the company's income and expenses and provides notes on certain line items. It then calculates the actual net profit, taxable income, taxes owed, and total tax payable.

Copyright:

© All Rights Reserved

Available Formats

Download as XLSX, PDF, TXT or read online from Scribd

Download as xlsx, pdf, or txt

You are on page 1of 4

### Compute taxable income and Taxpayable of ABC Company

for tax year ending on 31st Dec 2020. (Manufactuere)

Salaries and wages 2,000,000 Gross profit 12,500,000

Travelling Exp 100,000 Discount Received 45,000

office supplies 100,000 Miscellaneous Receipts 175,000

General exp 150,000 Bad Debts Recovered 220,000

Bad debts 1,200,000 Rental Income 680,000

Reserve for bad debts 400,000 Amount received on sale of a plot ( 1-8 10,500,000

Machinary Purchased 220,000 Income from Speculayive business 300,000

Utility bills 150,000

Advertisement 350,000

Drawings 150,000

Bank Loan 2,500,000

Loss by embazzelment 125,000

Loss of stock by theft 380,000

Sales Tax 128,000

Discount Allowed 75,000

Income tax paid in Advance 125,000

Depreciation 190,000

Net Profit 16,077,000

24,120,000 24,420,000

Notes:

1 Salary include Rs.100000 to Mr Saleem who was resposible to collect Rent.

2 20% of travevelling expenses were un vouchered, out of remaining 35% were

made by director for personal use.

3 1/3 od Bad debts were approved by CILR.

4 Plot was purchased for 40,00,000 in June 2019.

5 Machinary was retained for 8 Months and was sold for Rs.180,000.

6 1/3 Of loss by theft was insured , 2/3rd of the claim was approved by Insurance company.

7 Investigation proved Embazzelment was made after office hour.

8 Discount received was 54000 instead of 45000. Plot

9 General exp include donation of 80,000 to approved institution. Sale

10 The company has 80 Employees including 40 fresh Graduates are Having salary Profit

3000 Pm. Exempt @ 25 %

Taxable @ 75 %

Rent/ Gross RCT 680,000 50 Employeess

Allowable deductions 1 Employee

Reparing charges 136,000 80 Employee

Collection Chareges 100000 40,800 15% of Employees

Net RCT 503,200

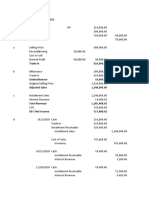

Given Net Profit 16,077,000 Machinary A/c

Add: Not Allowable deductions

Salaries 100,000.00 Initial Dep @ 25 %

un- Vouchered Travelling exp 20,000.00

Travelling exp for personal use 28,000.00 Normal Dep @ 15 %

Donation 80,000.00

Unapproved bad debts 800,000.00

Machinary Purchased 220,000.00 Profit on sale

Reserve 400,000.00

Drawings 150,000

Bank Loan 2,500,000

Loss by embazzelment 125,000

126,666.67 Insured Stock 84,444.44

Advance I.Tax 125,000.00 4,632,444.44

20,709,444.44

Less: Allowable omitted Exp

Depreciation on Machinary 55,000.00

20,654,444.44

Less: Incomes not Allowed

Rental income 680,000.00

Amount recived on sale of plot 10,500,000.00

Income from Speculayive business 300,000.00 11,480,000.00

9,174,444.44

Add: Omitted Income

Undercost Discount 9,000.00

Profit on sale of Machinary 15,000.00 24,000.00

Actual Net Profit 9,198,444.44

Computation of Tax

Step # 1 Corporate tax @ 29% 2,667,548.89

ACT 2,456,840.00 2,667,548.89

4000000 Add: Tax SBI

10,500,000.00 Plot 243,750.00

6,500,000.00 Rental income 75,480.00 319,230.00

1,625,000.00 2,986,778.89

4,875,000.00 A: Relief 23200

2,963,578.89

Tax creidit on employment generation

2 85,361.56 296,357.89 85,361.56

0.04 2,878,217.32

3.2 Tax credit on employing fresh readuates

12 A/B x C

A 2,878,217.32

B 9,198,444.44

C 459,922.22 432,000.00 135,173.93

2,743,043.39

less: Tax paid in Advance 125,000

Tax payable on Non Speculative business 2,618,043.39

plus Tax on Speculative inceme 87000

Total Tax Payable 2,705,043.39

Machinary A/c

220,000

36,666.67

183,333.33

18,333.33

165,000.00

180000

15,000.00

You might also like

- Income Tax Volume 2 - CA M.K. Gupta - StepFly (IKZD160521)Document456 pagesIncome Tax Volume 2 - CA M.K. Gupta - StepFly (IKZD160521)kalyanikamineniNo ratings yet

- Fabm2 - Statement of Comprehensive Income (Practice Problems) - Answer KeyDocument3 pagesFabm2 - Statement of Comprehensive Income (Practice Problems) - Answer KeyMounicha Ambayec100% (5)

- Growth and Development Solved Mcqs Set 2Document6 pagesGrowth and Development Solved Mcqs Set 2आशुतोष मिश्रा100% (1)

- What Is Middle Class About The Middle Class Around The WorldDocument27 pagesWhat Is Middle Class About The Middle Class Around The WorldM Fajri SiregarNo ratings yet

- AK2 13 Kheisya Buku BesarDocument2 pagesAK2 13 Kheisya Buku BesarKheisya Siva Qolbi Kiss PutriXI AKL 2No ratings yet

- Accounts List Summary PDFDocument2 pagesAccounts List Summary PDFOkie FernandaNo ratings yet

- DagohoyDocument6 pagesDagohoylinkin soyNo ratings yet

- Ilovepdf MergedDocument31 pagesIlovepdf MergedramadhandfitraNo ratings yet

- AACA2 AssignmentsDocument20 pagesAACA2 AssignmentsadieNo ratings yet

- Chapter 06 - AdjustmentsDocument26 pagesChapter 06 - AdjustmentsMkhonto Xulu100% (1)

- Itemized: Gross Income From OperationsDocument9 pagesItemized: Gross Income From OperationsLyka RoguelNo ratings yet

- TaxationDocument5 pagesTaxationPauline Jasmine Sta AnaNo ratings yet

- Acctg110 FinalsDocument21 pagesAcctg110 FinalsRoman Dominic LlanoNo ratings yet

- Trial Balance Adjustments Profit or Loss Financial Position Account Title Debit Credit Debit Credit Debit Credit Debit CreditDocument2 pagesTrial Balance Adjustments Profit or Loss Financial Position Account Title Debit Credit Debit Credit Debit Credit Debit CreditMichelle BabaNo ratings yet

- P and L and BSDocument8 pagesP and L and BSgautam48128No ratings yet

- REBYUDocument16 pagesREBYUChi EstrellaNo ratings yet

- Accounting Process ExtensionDocument24 pagesAccounting Process ExtensionVarad AngleNo ratings yet

- Investment in A/R: Current SalesDocument12 pagesInvestment in A/R: Current SalesHannaniah PabicoNo ratings yet

- Evi4 104957Document2 pagesEvi4 104957Al QadriNo ratings yet

- AccountsDocument4 pagesAccountsVencint LaranNo ratings yet

- Partnership - TemplateDocument5 pagesPartnership - TemplateMuneeb KhanNo ratings yet

- Trial Balance Adjustments Profit or Loss Financial Position Account Titles Debit Credit Debit Credit Debit Credit Debit CreditDocument2 pagesTrial Balance Adjustments Profit or Loss Financial Position Account Titles Debit Credit Debit Credit Debit Credit Debit CreditVencint LaranNo ratings yet

- ROCO - SCI Unit TestDocument9 pagesROCO - SCI Unit TestRaymond Roco100% (1)

- Karkits Corporation Excel Copy PasteDocument2 pagesKarkits Corporation Excel Copy PasteCoke Aidenry SaludoNo ratings yet

- Case Study 1Document7 pagesCase Study 1Trisha Mae Mendoza MacalinoNo ratings yet

- Hasil Abnormal ReturnDocument1 pageHasil Abnormal ReturnSurya KeceNo ratings yet

- LoadingDocument1 pageLoadingmonopolygoplusNo ratings yet

- R2.TAXML Solution CMA September 2022 Exam.Document5 pagesR2.TAXML Solution CMA September 2022 Exam.Raziur RahmanNo ratings yet

- The Institute of Finance Management: AnswersDocument6 pagesThe Institute of Finance Management: AnswersAli SalehNo ratings yet

- 5.ast - Installment & FranchisingDocument12 pages5.ast - Installment & FranchisingElaineJrV-IgotNo ratings yet

- 8447809Document11 pages8447809blackghostNo ratings yet

- FS 1 1Document4 pagesFS 1 1catzeyeNo ratings yet

- Problem & Solution - June 2019 - FDocument3 pagesProblem & Solution - June 2019 - FMohammed Shihab UddinNo ratings yet

- Allowable DeductionsDocument9 pagesAllowable DeductionsLyka RoguelNo ratings yet

- Answer KeyDocument17 pagesAnswer KeyRaymund Christian Ong AbrantesNo ratings yet

- Assignment No 1 From Book Question No 1: Detail 0 1 2 3 4 5Document1 pageAssignment No 1 From Book Question No 1: Detail 0 1 2 3 4 5TheNOOR129No ratings yet

- R2. TAX (M.L) Solution CMA May-2023 ExamDocument5 pagesR2. TAX (M.L) Solution CMA May-2023 ExamSharif MahmudNo ratings yet

- Ex Balanco Patrimonial Com RazonetesDocument3 pagesEx Balanco Patrimonial Com RazonetesNumero 1No ratings yet

- Taxation Final Pre-Board - SolutionsDocument14 pagesTaxation Final Pre-Board - SolutionsMischievous MaeNo ratings yet

- Via BIR Form 1706Document1 pageVia BIR Form 1706YnnaNo ratings yet

- Mar 2023Document1 pageMar 2023gaurav sharmaNo ratings yet

- Laba RugiDocument1 pageLaba RugiNando BernandhoNo ratings yet

- WorkDocument4 pagesWorkhassan KyendoNo ratings yet

- Solution Comp Acc Soalan 1Document4 pagesSolution Comp Acc Soalan 1maiNo ratings yet

- 5 Class Test 1 Example 2Document60 pages5 Class Test 1 Example 2Śuńįľ KûshwahaNo ratings yet

- Financial Accounting Practice QuestionsDocument3 pagesFinancial Accounting Practice Questionswilliamalexusa14No ratings yet

- Activity 3Document1 pageActivity 3John Michael Gaoiran GajotanNo ratings yet

- MIDTERMS Solution - IntAcc 3Document8 pagesMIDTERMS Solution - IntAcc 3Danica Mae CanosaNo ratings yet

- Pricilla AssignmentDocument3 pagesPricilla AssignmentjasonnumahnalkelNo ratings yet

- Taxation AssessmentDocument8 pagesTaxation AssessmentBhanumati BhunjunNo ratings yet

- Anwar Group of IndustriesDocument1 pageAnwar Group of IndustriesMoment RevealersNo ratings yet

- Debit Credit Debit: Cielo Corporation Working Trial Balance For The Fiscal Year Ended September 30, 2016Document6 pagesDebit Credit Debit: Cielo Corporation Working Trial Balance For The Fiscal Year Ended September 30, 2016Jeane Mae BooNo ratings yet

- Accounting 2Document2 pagesAccounting 2reeisha7No ratings yet

- Project Report PriyavartDocument10 pagesProject Report PriyavartmukeshjainassociatesNo ratings yet

- Fabm2 Statement of Comprehensive Income Practice Problems Answer KeyDocument3 pagesFabm2 Statement of Comprehensive Income Practice Problems Answer KeyMounicha Ambayec0% (1)

- Compe SolutionDocument10 pagesCompe SolutionRianell Andrea AsumbradoNo ratings yet

- Schedule 3Document8 pagesSchedule 3Hilary GaureaNo ratings yet

- PT Jayatama - Dhiwa - Laba Rugi (Standar)Document1 pagePT Jayatama - Dhiwa - Laba Rugi (Standar)Dhiwa RafiantoNo ratings yet

- Quiz 2 - Income Tax Concepts and ComplianceDocument3 pagesQuiz 2 - Income Tax Concepts and Compliancelc100% (1)

- Is Fishing Non Motorized BangkaDocument4 pagesIs Fishing Non Motorized BangkaAnonymous EvbW4o1U7No ratings yet

- Cash Flow Statement QuestionDocument5 pagesCash Flow Statement QuestionsatyaNo ratings yet

- Accounts Practice ProblemsDocument45 pagesAccounts Practice Problemsloveumona1970No ratings yet

- J.K. Lasser's Small Business Taxes 2021: Your Complete Guide to a Better Bottom LineFrom EverandJ.K. Lasser's Small Business Taxes 2021: Your Complete Guide to a Better Bottom LineNo ratings yet

- (Template) Untitled DocumentDocument1 page(Template) Untitled DocumentAbdul wahabNo ratings yet

- Ais MCQSDocument7 pagesAis MCQSAbdul wahabNo ratings yet

- 7 Digit Account Code String Category Main Account Sub Account Location ProductDocument10 pages7 Digit Account Code String Category Main Account Sub Account Location ProductAbdul wahabNo ratings yet

- Pakistan's Agriculture SecterDocument28 pagesPakistan's Agriculture SecterAbdul wahabNo ratings yet

- C GRP Mid Fall 2021 (28-10-2021)Document1 pageC GRP Mid Fall 2021 (28-10-2021)Abdul wahabNo ratings yet

- Diploma in Taxation: Pakistan Tax Bar AssociationDocument6 pagesDiploma in Taxation: Pakistan Tax Bar AssociationAbdul wahabNo ratings yet

- ABC Company Having 3 Partners Khalid, Bilal and Ahmad Having P & L Ratio 4:3:2 For 2020. Ending Dare 31st Dec Rs. RsDocument2 pagesABC Company Having 3 Partners Khalid, Bilal and Ahmad Having P & L Ratio 4:3:2 For 2020. Ending Dare 31st Dec Rs. RsAbdul wahabNo ratings yet

- Question#01 Year 2003 2004 2005 2006 2007 2008 2009 2010 2011 2012 SUM Expected Return Variance Standard Deviation Covariance of I, J Correlation of I, JDocument10 pagesQuestion#01 Year 2003 2004 2005 2006 2007 2008 2009 2010 2011 2012 SUM Expected Return Variance Standard Deviation Covariance of I, J Correlation of I, JAbdul wahabNo ratings yet

- Board of Directors: A Powerful Instrument in GovernanceDocument27 pagesBoard of Directors: A Powerful Instrument in GovernanceAbdul wahabNo ratings yet

- API FP - CPI.TOTL - ZG DS2 en Excel v2 2252550Document79 pagesAPI FP - CPI.TOTL - ZG DS2 en Excel v2 2252550Abdul wahabNo ratings yet

- In The Islamabad High Court, Islamabad.: Judgment SheetDocument44 pagesIn The Islamabad High Court, Islamabad.: Judgment SheetAbdul wahabNo ratings yet

- Income Statement - P&L - WPDocument9 pagesIncome Statement - P&L - WPFrancisco Del PuertoNo ratings yet

- Consumer Credits and Economic Growth in China: The Chinese EconomyDocument11 pagesConsumer Credits and Economic Growth in China: The Chinese EconomyFadel MuhammadNo ratings yet

- IT 2013-14 Details in TELUGU and EnglishDocument2 pagesIT 2013-14 Details in TELUGU and EnglishsareenckNo ratings yet

- Income and Business TaxationDocument1 pageIncome and Business TaxationTomo Euryl San JuanNo ratings yet

- ReSA B42 FAR First PB Exam Questions Answers Solutions-1Document25 pagesReSA B42 FAR First PB Exam Questions Answers Solutions-1Heart EspineliNo ratings yet

- ACCT336 Chapter23 SolutionsDocument7 pagesACCT336 Chapter23 SolutionskareemrawwadNo ratings yet

- 2022 - 25 March Indocement Public Expose - FinalDocument35 pages2022 - 25 March Indocement Public Expose - FinalDecky PrayogaNo ratings yet

- Heads of Income TaxDocument6 pagesHeads of Income Taxkanchan100% (1)

- Afar 2 Module CH 2Document22 pagesAfar 2 Module CH 2Razmen Ramirez PintoNo ratings yet

- Unit 3 KeynoteDocument12 pagesUnit 3 KeynoteTrung HiếuNo ratings yet

- Ra 9856 - Reit Law (19p)Document19 pagesRa 9856 - Reit Law (19p)Yvonne RiveraNo ratings yet

- Macro Environment Factor of Business in BangladeshDocument6 pagesMacro Environment Factor of Business in BangladeshRasel RazNo ratings yet

- Why Governments Should Invest More To Educate Girls T. Paul SchultzDocument49 pagesWhy Governments Should Invest More To Educate Girls T. Paul SchultzAhmed FayekNo ratings yet

- Feir Alexa Mae C. Final Exam Financial Analysis and ReportingDocument7 pagesFeir Alexa Mae C. Final Exam Financial Analysis and ReportingEnalyn AldeNo ratings yet

- Employment Income TaxDocument5 pagesEmployment Income TaxYehualashet MekonninNo ratings yet

- Cta Eb 2400 - Pascual Vs CirDocument19 pagesCta Eb 2400 - Pascual Vs CirEm EmNo ratings yet

- Solved Critics of Federal Banking Policy Argue That Deposit Insurance IsDocument1 pageSolved Critics of Federal Banking Policy Argue That Deposit Insurance IsM Bilal SaleemNo ratings yet

- Week 3 Course Material For Income TaxationDocument11 pagesWeek 3 Course Material For Income TaxationAshly MateoNo ratings yet

- Full - Keynesian Theory of EmploymentDocument20 pagesFull - Keynesian Theory of Employmentcottiar100% (2)

- TAX ON OTHER EntityDocument5 pagesTAX ON OTHER EntitySaneej SamsudeenNo ratings yet

- N. Gregory Mankiw: Powerpoint Slides by Ron CronovichDocument36 pagesN. Gregory Mankiw: Powerpoint Slides by Ron CronovichTook Shir LiNo ratings yet

- First Week Lesson Business Enterprise Simulation First Week Lesson 1 ObjectivesDocument7 pagesFirst Week Lesson Business Enterprise Simulation First Week Lesson 1 ObjectivesCamila EllaNo ratings yet

- Case Study-Octane-Service-StationDocument10 pagesCase Study-Octane-Service-Stationprakashscribd123No ratings yet

- Corporate Accounting AssignmentDocument5 pagesCorporate Accounting AssignmentMd.Mahmudul HasanNo ratings yet

- Module 1: Partnership Equity Accounting: Test-Your-Knowledge QuestionsDocument46 pagesModule 1: Partnership Equity Accounting: Test-Your-Knowledge QuestionsginalynNo ratings yet

- Requirement No. 1 (20A1) : Acctax1 Problem 1 - Concept of Income and When TaxableDocument338 pagesRequirement No. 1 (20A1) : Acctax1 Problem 1 - Concept of Income and When TaxableRigine MorgadezNo ratings yet

- ISWK XII Economics (030) QP & MS REHEARSAL 1 (23-24)Document15 pagesISWK XII Economics (030) QP & MS REHEARSAL 1 (23-24)hanaNo ratings yet