TermsAndConditions 8943 26012024180733

TermsAndConditions 8943 26012024180733

Uploaded by

madhavimucherla1980Copyright:

Available Formats

TermsAndConditions 8943 26012024180733

TermsAndConditions 8943 26012024180733

Uploaded by

madhavimucherla1980Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Copyright:

Available Formats

TermsAndConditions 8943 26012024180733

TermsAndConditions 8943 26012024180733

Uploaded by

madhavimucherla1980Copyright:

Available Formats

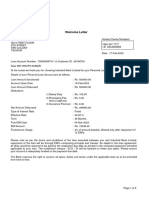

State Bank of India

Overdraft against Fixed Deposit

Terms & Conditions governing Overdraft Against Fixed Deposit

Name - Mrs. LALITHA BURUGU .

CIF No. - 86434462941

Date and time of request: 26/01/2024 | 06:07:24 PM

Overdraft Limit: Rs. 8,769

Rate of Interest – 6.45%

The OD facility is available to individuals having TDR / STDR/ eTDR/ eSTDR Account in his/her sole name and

also have an operative Savings/Current account.

The Loan limit will be 90 % of the Face value of your selected STDR/ eSTDR Account. The Loan limit will be 75

% of the Face value of your selected TDR/ eTDR Account.

The minimum amount of OD against FD is Rs 5000/- and maximum Limit of OD against FD would be Rs 5.00 crs.

The period of loan will be fixed as unexpired period of the relative Domestic STDR/eSTDR account accepted as

security or 5 years which is less.

The period of loan will be fixed as unexpired period of the relative Domestic TDR/eTDR account accepted as

security or 3 years which is less.

The OD account has to be closed on or before the end of the OD Tenor failing which the Bank will close the loan

account by premature payment of the TDR/STDR/eTDR/eSTDR held as security.

It is to be noted that the facility of premature withdrawal of NRE/FCNR (B) deposits shall not be available to the

depositor/borrower when he/she avails loans against such deposits.

Your mandate for rollover of the TDR/STDR/eTDR/eSTDR given at the time of opening the deposit account will

be treated as cancelled if the OD account is not closed on or before the loan Tenure.

In case OD is availed against TDR/e-TDR, the monthly/quarterly/half yearly/ yearly interest payout to your

Deposit a/c will be diverted to the newly opened OD account. In case the interest payout is mandated for any

existing loan account, the OD facility would not be available unless this is changed by the Home Branch to the

Deposit account.

Withdrawal/transfer of fund from this account can be made either through Cheque Book (A request for same is

required to be made by you through the YONO/INB/Branch) or through YONO using transaction rights.

Credit / Deposit in the OD a/c can be done by cash deposit from any Branch or Transfer from any deposit

Branch.

The closure of OD account on maturity or at the end of term of TDR/STDR/e-TDR/e-STDR will be done by the

Home Branch. To close the OD account please contact your home branch.

Closure of OD account before maturity: Closure of account will be done on your request by the Home Branch.

Page 1 of 3 86434462941 2405:201:c412:180 26/01/2024 | 06:07:24 PM

1:d1f4:fbfc:

Online overdraft against Fixed Deposit can be created online from 8:00 AM IST to 8:00 PM IST. Requests

initiated beyond this period will be scheduled for the next opening hours.

The loan is also subject to other terms and conditions as may be prescribed by the Bank from time to time.

In case of any default, the Bank reserves the right to use the services of resolution agents/collection agents for

recovery of loans and their service charges, if any, will be borne by the customer. The list of recovery

/resolution agents is available on the Bank’s website.

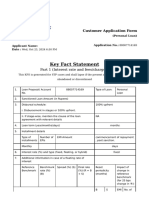

Key Fact Statement

Date : 26 Jan 2024 Name of the regulated entity: SBI Applicant Name: Mrs. LALITHA

Branch Name: JEDCHERLA Branch Code: 12715

Sr. No. Parameter Details

(i) Loan amount (amount disbursed/ to be disbursed to the 8,769

borrower) (in Rupees)

(ii) Interest Type (Floating or Fixed) / Effective interest rate Fixed @6.45% p.a.

(iii) Total interest charge during the entire tenor of the loan (in It is an overdraft account;

Rupees) interest would be charged

based on the utilisation of

limit.

(iv) Other up-front charges, if any (break-up of each component 0

to be given below) (in Rupees) (Sum of a+b+c)

Processing fees, if any (in Rupees) 0

a.

Insurance charges, if any (in Rupees) 0

b.

Others (if any) (in Rupees) (details to be provided) 0

c.

(v) Net disbursed amount ((i)-(iv)) (in Rupees) 8,769

(vi) Total amount to be paid by the borrower (sum of (i), (iii) and Loan amount plus interest

(iv)) (in Rupees) applied from time to time.

(vii) Annual Percentage Rate (APR) - Effective annualized interest Fixed @6.45% p.a.

rate (in percentage) (computed on net disbursed amount

using IRR approach and reducing balance method)

(viii) Loan Expiry date 27 JUL 2025

(ix) Repayment frequency by the borrower Principal plus interest to be

paid on expiry of the loan

limit.

(x) Number of instalments of repayment N.A.

(xi) Amount of each instalment of repayment (in Rupees) N.A.

Page 2 of 3 86434462941 2405:201:c412:180 26/01/2024 | 06:07:24 PM

1:d1f4:fbfc:

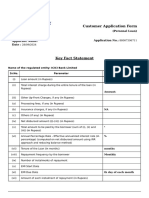

Details about Contingent Charges

(xii) Rate of annualized penal charges in case of delayed payments N.A.

(if any)

(xiii) Rate of annualized other penal charges (if any); (details to be N.A.

provided)

Other disclosures

(xiv) Cooling off/look-up period during which borrower shall not Loan can be closed any time,

be charged any penalty on prepayment of loan no penalty charges on

prepayment of loan.

(xv) Details of LSP acting as recovery agent and authorized to In case of any default, the Bank

approach the borrower reserves the right to use the

services of resolution agents /

collection agents for recovery

of loans and their service

charges, if any, will be borne

by the customer.

(xvi) Name, designation, address and phone number of nodal Published on Bank website at

grievance redressal officer designated specifically to deal with https://bank.sbi/web/customer-

FinTech/ digital lending related complaints/ issues care/addresses-and-helpline-nos-

of-grievances-redressal-cell

(xvii) Date of interest reset No Reset

(xviii) Mode of communication of changes in interest changes in As published on the Bank’s

interest rates/MCLR/APR website

(xix) Conversion charges for switching from floating to fixed Not Applicable

interest and vice-versa

(xx) Details of security/collateral obtained Lien over Fixed Deposit

Account No: 33162151825

against which Overdraft is

opted

The above digital loan is Applied, Accepted, Signed and Delivered by the borrower by authenticating

the Terms and Conditions by ticking the “I agree to the terms and conditions” checkbox and by entering

the OTP sent on borrower’s mobile number/e-mail registered with SBI and that there is no requirement

of any physical signature on any loan document.

Note: This is a system generated, digitally signed document.

Digitally signed by SBI_RLMS

Date: 2024.01.26 18:07:26 GMT+05:30

Reason: Digital Document Execution

Location: Maharashtra

Page 3 of 3 86434462941 2405:201:c412:180 26/01/2024 | 06:07:24 PM

1:d1f4:fbfc:

You might also like

- Sanction LetterDocument3 pagesSanction LetterPraveen KumarNo ratings yet

- keyFactStatement PDFDocument8 pageskeyFactStatement PDFINAM JUNG GUJJARNo ratings yet

- Three-Equation Model, IS - PC - MRDocument12 pagesThree-Equation Model, IS - PC - MRhishamsauk80% (5)

- TermsAndConditions 0163 04072024145203Document3 pagesTermsAndConditions 0163 04072024145203Pradhish V.NNo ratings yet

- TermsAndConditions - 8082 - 05042024122441 HiDocument3 pagesTermsAndConditions - 8082 - 05042024122441 Hilalo1290847No ratings yet

- State Bank of India Overdraft Against Fixed Deposit Terms & Conditions Governing Overdraft Against Fixed DepositDocument3 pagesState Bank of India Overdraft Against Fixed Deposit Terms & Conditions Governing Overdraft Against Fixed Depositsolankinayan8No ratings yet

- TermsAndConditions_0406_02082024125455Document3 pagesTermsAndConditions_0406_02082024125455Mandar MarulkarNo ratings yet

- TermsAndConditions 8667 31032024153855Document3 pagesTermsAndConditions 8667 31032024153855siwax63285No ratings yet

- TermsAndConditions 2418 20092024224715Document3 pagesTermsAndConditions 2418 20092024224715kumar kNo ratings yet

- TermsAndConditions 9687 04112023153427Document3 pagesTermsAndConditions 9687 04112023153427Jeetu WadhwaniNo ratings yet

- TermsAndConditions 1438 14082024101830Document3 pagesTermsAndConditions 1438 14082024101830Sridhar ChitturuNo ratings yet

- TermsAndConditions 4074 08062024074217Document3 pagesTermsAndConditions 4074 08062024074217hemantk015No ratings yet

- TermsAndConditions_3706_17072023101643Document3 pagesTermsAndConditions_3706_17072023101643prabhasini1948No ratings yet

- Terms and Conditions IHL 1710832175850Document9 pagesTerms and Conditions IHL 1710832175850Nageswara Rao YerramreddyNo ratings yet

- Surepass PFP9sRR NSDL 6032800068411662763Document17 pagesSurepass PFP9sRR NSDL 6032800068411662763vgg77799No ratings yet

- Key Fact Statement.pdf (25)Document7 pagesKey Fact Statement.pdf (25)pallavighosh037No ratings yet

- Key Facts Statement PDFDocument6 pagesKey Facts Statement PDFankulkumar54321ewqNo ratings yet

- Key Fact SDocument3 pagesKey Fact SAjay KrishnanNo ratings yet

- PL 88007714169Document37 pagesPL 880077141698804puruNo ratings yet

- Signed DocumentDocument17 pagesSigned Documentgamersingh098123No ratings yet

- Agreement 0001014450001319648Document4 pagesAgreement 0001014450001319648bullbear240No ratings yet

- Agreement 0001010730006569824Document3 pagesAgreement 0001010730006569824rajeshket10No ratings yet

- 20241104064530amLYRyRAUlinKU1SVLUFb3zUCwbKXxn2yk95NQ1Z0jiC80xiumXBYRFOTByUKRbgTzDocument17 pages20241104064530amLYRyRAUlinKU1SVLUFb3zUCwbKXxn2yk95NQ1Z0jiC80xiumXBYRFOTByUKRbgTzkkamble40204No ratings yet

- Kfs Agreement PDFDocument2 pagesKfs Agreement PDFkeerthi achantiNo ratings yet

- Customer Digital JourneyDocument4 pagesCustomer Digital Journeysurajhake99No ratings yet

- Loan Sanction-Letter With KfsDocument4 pagesLoan Sanction-Letter With KfsibtfaizabadNo ratings yet

- Loan Sanction-Letter With KfsDocument4 pagesLoan Sanction-Letter With Kfspoojameher644No ratings yet

- TermsAndConditions_2986_01122024214659Document6 pagesTermsAndConditions_2986_01122024214659Modicare/ RajaNo ratings yet

- DID231031172059040ZSMI2IHLDNJXVLDocument15 pagesDID231031172059040ZSMI2IHLDNJXVLgaganNo ratings yet

- Key Fact Sheet Your Loan Application Number: C02310191077218238Document2 pagesKey Fact Sheet Your Loan Application Number: C02310191077218238vkintouch1987No ratings yet

- PL 88007329873Document31 pagesPL 88007329873Sumit PatilNo ratings yet

- Sanction Letter 1Document16 pagesSanction Letter 1girishbabuv817No ratings yet

- DownloaddigitalsignDocument23 pagesDownloaddigitalsignSubhajeet Dutta RoyNo ratings yet

- Loan Sanction-Letter With kfs345937221866371454Document4 pagesLoan Sanction-Letter With kfs345937221866371454Palaka PrasanthNo ratings yet

- Loan Sanction-Letter With kfs3323231543124847618Document4 pagesLoan Sanction-Letter With kfs3323231543124847618ajay PrajapatNo ratings yet

- ManubhaiDocument6 pagesManubhaimansurishahrukh007No ratings yet

- PL 795000067411-IndusindDocument6 pagesPL 795000067411-IndusindVinoth KumarNo ratings yet

- PL88006857908Document29 pagesPL88006857908any37447No ratings yet

- PL Application FormDocument10 pagesPL Application FormsujitNo ratings yet

- ead6d090-188e-449c-9342-361884f70c7a-e1a57ac5-94b6-4d9a-9149-fca0d47cbc2a-SignedKFSDMI.pdfDocument8 pagesead6d090-188e-449c-9342-361884f70c7a-e1a57ac5-94b6-4d9a-9149-fca0d47cbc2a-SignedKFSDMI.pdfnkagarwalpublicationNo ratings yet

- Renewal JLG Loan PDD EnglishDocument12 pagesRenewal JLG Loan PDD EnglishViswa JoshNo ratings yet

- TW KFS PageDocument6 pagesTW KFS PagechandanacamzoneNo ratings yet

- HDFC Home Loan SanctionDocument18 pagesHDFC Home Loan SanctionAshish JhaNo ratings yet

- 1 UnlockedDocument9 pages1 UnlockedAshish JhaNo ratings yet

- Pl 88007396711Document30 pagesPl 88007396711bhuvneshNo ratings yet

- TermsAndConditions_5930_01122024155902Document6 pagesTermsAndConditions_5930_01122024155902TNBHARDWAJNo ratings yet

- Loan AgreementDocument18 pagesLoan AgreementArbindraNo ratings yet

- DownloaddigitalsignDocument24 pagesDownloaddigitalsigndipankardutta200No ratings yet

- KFSDocument10 pagesKFSbhowmik1967No ratings yet

- Inbound 1362226825039526581Document3 pagesInbound 1362226825039526581Yashodhara MangloreNo ratings yet

- Loan Sanction Letter SC301K9T4U7DE216TDocument6 pagesLoan Sanction Letter SC301K9T4U7DE216Tskjadhav099No ratings yet

- KFS - Tawfique HussainDocument4 pagesKFS - Tawfique Hussainswapnilmaher43No ratings yet

- Sanction LetterDocument3 pagesSanction LetterPraveen KumarNo ratings yet

- Sanction Cum Loan Agreement 6916117Document28 pagesSanction Cum Loan Agreement 6916117chutkipathanNo ratings yet

- Sanction LetterDocument16 pagesSanction LetterKiran Kumar DevajjiNo ratings yet

- LAI-122470246 - DRF - Key Fact Statement - SignedDocument4 pagesLAI-122470246 - DRF - Key Fact Statement - Signedgamersingh098123No ratings yet

- Key Fact StatementDocument5 pagesKey Fact StatementYash PorwalNo ratings yet

- Loan Agreement 010008383434Document26 pagesLoan Agreement 010008383434pd14960No ratings yet

- Mauli Krishi Seva Kendra - KFSDocument4 pagesMauli Krishi Seva Kendra - KFSswapnilmaher43No ratings yet

- E Signed DocumentDocument22 pagesE Signed Documentcrystallqueen25No ratings yet

- Financial InstrumentsDocument74 pagesFinancial InstrumentsReyzza Mae EspenesinNo ratings yet

- Paper14 SolutionDocument20 pagesPaper14 Solutionஜெயமுருகன் மருதுபாண்டியன்No ratings yet

- DS Chapter 7 (p203-213) Mortgage ModificationDocument11 pagesDS Chapter 7 (p203-213) Mortgage ModificationsandeepdevathiNo ratings yet

- TCS NQT Numerical Aptitude PYQ - 160 QuestionsDocument26 pagesTCS NQT Numerical Aptitude PYQ - 160 QuestionsAman RuhelaNo ratings yet

- Ize y Yeyati (2003) - Financial DollarizationDocument25 pagesIze y Yeyati (2003) - Financial DollarizationEduardo MartinezNo ratings yet

- Module 1 and 2 IMP Question AnswerDocument21 pagesModule 1 and 2 IMP Question AnswerAnkit JajalNo ratings yet

- GSFM7514 Assignment Master Budget QuestionsDocument3 pagesGSFM7514 Assignment Master Budget Questionsnoorfazirah9196No ratings yet

- FM 5Document3 pagesFM 5gojo satoru100% (1)

- Commercial Banking MCQsDocument8 pagesCommercial Banking MCQsaahmed459No ratings yet

- C15 Krugman 12e Accessible EdDocument48 pagesC15 Krugman 12e Accessible Ed7ARDELIA GRANDIVA CIPTAMURTINo ratings yet

- A A A A A A A A A A: Rumus Matematik Mathematical FormulaeDocument12 pagesA A A A A A A A A A: Rumus Matematik Mathematical FormulaeUMI KALSUM BINTI NGAH MoeNo ratings yet

- MSL 708 Financial Management Topic 1a: Time Value of Money: Topics (Tentative) : Pre-Readings (BM Chapters)Document15 pagesMSL 708 Financial Management Topic 1a: Time Value of Money: Topics (Tentative) : Pre-Readings (BM Chapters)sasidhar naidu SiripurapuNo ratings yet

- What Is A CRR RateDocument8 pagesWhat Is A CRR Ratesunilkumart7No ratings yet

- Chapter 4. Time Value of MoneyDocument49 pagesChapter 4. Time Value of MoneySơn Đặng TháiNo ratings yet

- Thrift Operations: Financial Markets and Institutions, 7e, Jeff MaduraDocument30 pagesThrift Operations: Financial Markets and Institutions, 7e, Jeff MaduraKevin NicoNo ratings yet

- 11 Notes Receivable and Loan Impairment For UploadDocument15 pages11 Notes Receivable and Loan Impairment For UploadNorfaidah IbrahimNo ratings yet

- Meaning:: Public Debt: Meaning, Objectives and Problems!Document5 pagesMeaning:: Public Debt: Meaning, Objectives and Problems!document singhNo ratings yet

- Assignment 4Document2 pagesAssignment 4Cheung HarveyNo ratings yet

- S2023 Assignment 3 Chs 6 7 - For ReleaseDocument3 pagesS2023 Assignment 3 Chs 6 7 - For Releasehusan aulakhNo ratings yet

- Lec57 Witheqs PDFDocument9 pagesLec57 Witheqs PDFRohit Kumar PandeyNo ratings yet

- Workbook With Solutions FDRMDocument32 pagesWorkbook With Solutions FDRMshenoyshravan77No ratings yet

- Solvencia GRIFOLSDocument3 pagesSolvencia GRIFOLSamparooo20No ratings yet

- ES032 Engineering EconDocument18 pagesES032 Engineering EconGrace Ann ConcepcionNo ratings yet

- Financial Market: 0allocating CapitalDocument5 pagesFinancial Market: 0allocating Capitalharon franciscoNo ratings yet

- Financial Managemnet 3B LAO 2020 FinalDocument11 pagesFinancial Managemnet 3B LAO 2020 Finalsabelo.j.nkosi.5No ratings yet

- CAF 5 FAR2 Autumn 2023Document7 pagesCAF 5 FAR2 Autumn 2023Hammad ShahidNo ratings yet

- Year-To-Date Tax Activity Fidelity InvestmentsDocument1 pageYear-To-Date Tax Activity Fidelity InvestmentsJack Carroll (Attorney Jack B. Carroll)No ratings yet

- Compounded Interest Word ProblemsDocument2 pagesCompounded Interest Word Problemsbaltazar.nudaloNo ratings yet

- Tugas Kelompok Manajemen KeuanganDocument9 pagesTugas Kelompok Manajemen Keuangan2j9yp89bkgNo ratings yet