Surepass PFP9sRR NSDL 6032800068411662763

Surepass PFP9sRR NSDL 6032800068411662763

Uploaded by

vgg77799Copyright:

Available Formats

Surepass PFP9sRR NSDL 6032800068411662763

Surepass PFP9sRR NSDL 6032800068411662763

Uploaded by

vgg77799Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Copyright:

Available Formats

Surepass PFP9sRR NSDL 6032800068411662763

Surepass PFP9sRR NSDL 6032800068411662763

Uploaded by

vgg77799Copyright:

Available Formats

Tycoon Credit and Portfolios Limited

G - 15, LGF, South Extension - II, New Delhi - 110049, India

CIN: U65993DL1992PLC048910 | RBI Registration No: 14.01178

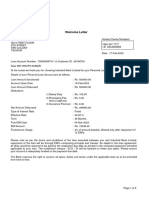

Loan Sanction Letter

Date: Thu Nov 07 2024 07:24:11 GMT+0000 (GMT) Loan No: CLN-10000000438

Dear Mr. Kamlesh Gupta,

This Loan Sanction Letter is made in reference to your Loan Application Number CLN-

10000000438 dated Thu Nov 07 2024 07:24:11 GMT+0000 (GMT). This Sanction Letter is

based on the information provided by you in your loan request/application. We are pleased to

inform you that your loan application has been approved with the following terms and

conditions:

Sr.No. Parameter Details

i Loan amount (in Rupees) 15000

ii Total interest charge during the entire tenor of the loan 3600

iii Other up-front charges 0

(a) Processing fees, if any 1500

(b) Insurance charges, if any 0

(c) Others (GST) 270

(iv) Net disbursed amount ((i) - (iii)) (in Rupees) 13230

Total amount to be paid by the borrower (sum of (i), (ii) and (iii)) (in

(v) 20370

Rupees)

Annual Percentage Rate - Effective annualized interest rate (in

(vi) 617.31

percentage)

(vii) Tenor of the Loan (in months/days) 24

(viii) Repayment frequency by the borrower Bullet

(ix) Number of instalments of repayment 1

(x) Amount of each instalment of repayment (in Rupees) 18600

(xi) Rate of annualized penal charges in case of delayed payments 0.5%

(xii) Rate of annualized other penal charges (if any) 0%

Cooling off/look-up period during which borrower shall not be charged any

(xiii) 3 Days

penalty on prepayment of loan

Growcap account

Details of LSP acting as recovery agent and authorized to approach the

(xiv) aggregation

borrower

private limited

Name, designation, address and phone number of nodal grievance

Digitally signed (xv)

by Kamlesh redressal

Gupta officer designated specifically to deal with FinTech/ digital Grievance officer

Date: 2024.11.07 13:24:07 IST

lending related complaints/ issues

Reason:

Email : info@tycooncredit.in , Contact details: 9310039776, Website : www.trycooncredit.in

Digitally signed by Kamlesh Gupta

Date: 2024.11.07 13:24:07 IST

Reason:

Tycoon Credit and Portfolios Limited

G-15, LGF, South Extension-II, New Delhi-110049, India

CIN: U65993DL1992PLC048910 : RBI Registration No: 14.01178

Other terms and Condition

Terms & Condition:

1. Loan disbursement will be made to bank account provided in the loan agreement

2. Processing fees (including GST) will be deducted from Loan Amount before disbursal

3. This sanction can be revoked and / or cancelled on the sole discretion of the Company

4. Your repayment schedule shall be depending upon the actual date of disbursement of Loan

5. Your Installment will be deducted from your bank account in which mandate will be registered

6. You can also pay the installment from any other mode provided by the lender

7. Penal Charges @0.5% per day will be charged, in case of repayment overdue on the principal due amount from the

date of default

8. You can make the pre-payment or foreclose the loan without any penalty/foreclosure charges anytime

9. You shall be required to bear and pay applicable stamp duty, charges levied by Central Registry of Securitization Asset

Reconstruction and Security Interest of India (CERSAI) and all other statutory /regulatory charges / statutory taxes that

are presently applicable and as may be made applicable from time to time. Such charges shall be non-refundable.

10. Lender offers different interest rate based on loan amount, tenor, down payment, payment history ,credit score

provided by credit information companies, borrower's age, income, type of documents provided by the applicant and

any other information as may be required for the purpose of credit evaluation.

11. You understand and acknowledge that this loan has been granted with clear understanding that you hereby waive all

rights including without limitation, immunity in respect of any repayment of loan byway of injunctionor moratorium

available to you in the capacity of borrower

12. You understand and acknowledge that the language of this Sanction letter is known to you and that you have read

and understood in vernacular language, the features of the loan product and the terms and conditions mentioned

herein and contained in any other loandocuments and shall abide by them including any amendment thereto, with

free will and volition

13. You understand and acknowledge the cost and charges associated with the loan and that once the disbursement is

made in your bank account your loan cannot be withdrawn and reversed, apart from the closing the loan as per colling

period guidelines

14. Please refer “Loan Application Terms & Conditions” and “Loan Agreement” for obtaining loans from M/s Tycoon Credit

Portfolios Limited” for terms and conditions applicable to this loan, a copy of which has been provided to you and is

also available atwebsite of Tycoon Credit, which is www.tycooncredit.in

Email : info@tycooncredit.in , Contact details: 9310039776, Website : www.trycooncredit.in

Digitally signed by Kamlesh Gupta

Date: 2024.11.07 13:24:07 IST

Reason:

Tycoon Credit and Portfolios Limited

G-15, LGF, South Extension-II, New Delhi-110049, India

CIN: U65993DL1992PLC048910 : RBI Registration No: 14.01178

TERMS AND CONDITIONS FOR OBTAINING LOANS FROM

Tycoon Credit Portfolio Limited

Tycoon Credit Portfolio Limited, a private company limited by shares incorporated under the provisions of the Companies

Act, 2013, as amended from time to time, which is duly registered NBFC with Reserve Bank of India (RBI) (hereinafter referred

as “TYCOON CREDIT”) may grant the Loan (as defined herein below) only after approval of the prescribed Loan Application

submitted by the Borrower to TYCOON CREDIT. TYCOON CREDIT reserves its right to refuse or reject any Loan Application

notwithstanding the applicants satisfying the Eligibility Criteria (as defined herein below), if any, set by TYCOON CREDIT for

the approval of the Loan. The Borrower, who intends to obtain a Loan from TYCOON CREDIT either once or multiple times,

agrees and abides by these terms and conditions as amended from time to time (hereinafter referred to as “T&C”). The

Borrower further agrees to execute such necessary documents or provide such necessary consent (either orally or in writing),

as may be deemednecessary by TYCOON CREDIT to give effect to the terms of this T&C. This T&C as agreed by the Borrower

shall be applicable and binding on the Borrower in respect of any and all kinds of Loans approved/ disbursed by TYCOON

CREDIT in favour of the Borrower as amended from time to time under this T&C.

DEFINITIONS AND INTERPRETATION

1. Unless otherwise stated under this T&C, the following definitions apply throughout –

1. “Alternate Payment Channel” means the payment mode/ channel either managed by TYCOON

CREDIT, or by a third party duly authorised by TYCOON CREDIT, to receive the Instalments and/

other dues from the Borrower in respect of the Loan.

2. “Applicable Law” shall mean any statute, regulation, notification, circular, ordinance, court

order, decree, judgment, direction, guideline, or other binding action or requirement of an

authority which has the force of law in India.

3. “APR” means effective annualized interest rate (in percentage) to be computed on net

disbursed amount using IRR approach and reducing balance method.

4. “Automated Fund Transfer” shall mean and include transfer of funds through electronic clearing

service (debit), direct debit, automated clearing house (debit) or any other permissible mode

available from time to time for the purpose of debiting the bank account of a Person on the

basis of instructions given by such Person either in writing or through any electronic media.

5. “Borrower” means the Person who applies for and/or obtains Loan from TYCOON CREDIT

(including but not limited to by using any of the Contact Options). The name and address of the

Borrower shall be mentioned in the Loan Documents issued to the Borrower for each Loan from

TYCOON CREDIT. For the purpose of this T&C, the term ‘Borrower’ shall include the heirs,

executors, administrators and legal representatives of such Person.

6. “Cooling off/ Look-up Period” means the time window mentioned in theSanction Letter which

shall be given to Borrower for exiting from Loans, in case Borrower decides not to continue with

the Loan.

7. “Documentation Fee” means the non-refundable fee, if any, charged for preparing the

Documents pertaining to the Loan of the Borrower, payment of applicable stamp duty and other

legal charges associated with Loan of the Borrower and shall be paid by the Borrower at the

time of disbursal of the Loan.

8. “Due Date” means the date on or before which the Instalment(s) of the respective Loan (s)

become due and repayable by the Borrower to TYCOON CREDIT. The Due Date for each

Instalment of the Loan shall be specified in the Loan Documents.

9. “Effective Date” in respect of each Loan obtained by the Borrower means, unless specified

otherwise, the respective date on which the Borrower consents (whether orally or in writing) to

obtain disbursement of respective Loan from TYCOON CREDIT.

10. “Eligibility Criteria” means the minimum eligibility criteria set forth by TYCOON CREDIT to judge

the credit worthiness of the Borrower, which is subject to change from time to time at the sole

and absolute discretion of TYCOON CREDIT.

11. “Interest Amount” means the amount paid/to be paid by the Borrower to TYCOON CREDIT over

and above the Loan amount excluding the amount paid as the penalty, fees, or any service

charges/ fees of whatever nature under this T&C.

12. “Loan” refers to the amount of Personal Loan approved by TYCOON CREDIT from timeto time

as stated in the Loan Documents on which interest is charged to the Borrower.

13. “Loan Application” means the application submitted by the Borrower digitally to TYCOON

CREDIT for applying for, and availing of, the Loan, together with all other information, particulars,

clarifications and declarations, if any, furnished by the Borrower in connection with the Loan.

14. “Loan Document(s)” means this T&C, Loan Application, Sanction Letter, Disbursal Letter, Loan

Agreement, Mandate and consent form (as the casemay be) executed or accepted or agreed

upon by the Borrower and all other documents, instruments, certificates, and agreements

executed and/or delivered by the Borrower or any third party in connection with the Loan,

Email : info@tycooncredit.in , Contact details: 9310039776, Website : www.trycooncredit.in

Digitally signed by Kamlesh Gupta

Date: 2024.11.07 13:24:07 IST

Reason:

Tycoon Credit and Portfolios Limited

G-15, LGF, South Extension-II, New Delhi-110049, India

CIN: U65993DL1992PLC048910 : RBI Registration No: 14.01178

including but not limited to electronic records of any and all of the aforesaid.

15. “Sanction Letter” means the terms of the Loan issued or communicated by way of any of the

Contact Options by TYCOON CREDIT to the Borrower confirming the grant of the Loan to the

Borrower subject to the terms and conditions contained inthis T&C, the Sanction Letter and

other applicable Loan Documents.

16. “Mandate” means the instructions given by the Borrower to debit his/her bank account to make

the payment to TYCOON CREDIT through Automated Fund Transfer for all the Loans availed by

the Borrower from TYCOON CREDIT from time to time.

17. “Outstanding Balance” in respect of each Loan obtained by the Borrower means the balance

of the respective Loan outstanding along with all amounts payable by the Borrower to TYCOON

CREDIT including principal amount, interest, fees, costs, charges, expenses etc.

18. “Person” shall include any individual, Hindu Undivided Family (HUF), partnership firm, company,

body corporate, association, society or any other legally recognized entity. The term “he, him

and himself in this T & C includes she, her and herself when the borrower is a woman.

19. “Personal Loan” shall mean the Loan, disbursed by TYCOON CREDIT directly to the Borrower in

the bank account of Borrower.

20. “Processing Fee” means the fees charged by TYCOON CREDIT to the Borrower as stated in the

Loan Documents for processing the Loan Application of the Borrowerthat shall be paid by the

Borrower at the time of disbursal of Loan.

2. LOAN AMOUNT

a) TYCOON CREDIT shall provide the Loan to the Borrower strictly in accordance with this

T&C and other terms & conditions mentioned in other Loan Documents executed by

and/or agreed upon by the Borrower. The amount of the Loan shall be mentioned in the

Loan Document provided to the Borrower in case of each approved Loan.

b) The Borrower hereby confirms and agrees that TYCOON CREDIT may disburse the whole

amount of the Loan or any part thereof, either in one lump sum or in such instalments as

may be decided by TYCOON CREDIT.

c) TYCOON CREDIT reserves the right to, and at its discretion shall be free to, recall the entire

Loan and all monies due and payable by the Borrower in respect of the Loan including

Interest Amount, fees, penalties etc., if any information supplied by the Borrower is found

to be incorrect or false or if the Borrower commits any default under this T&C and/ or the

other Loan Document (including the Sanction Letter) executed by and/ or agreed upon

by the Borrower.

3. RATE OF INTEREST

a) The rate of interest as applicable to each Loan obtained by the Borrower from time to

time shall be communicated to the Borrower before the approval of such Loan(s) by

TYCOON CREDIT either orally or in writing.

b) The Interest Amount on the Loan has been/ shall be calculated at reducing balance rate

basis (referred to as “Reducing Interest Rate”) and such Reducing Balance Interest Rate

shall remain fixed during the period of Loan, unless revised in accordance with this T & C.

c) The Reducing Balance Interest Rate as well as the Interest Amount applicable to each such

Loan shall be expressly stated in the Loan Documents of such Loan. The APR as applicable

shall be communicated to Borrower at the time of disbursement of Loan.

d) The Borrower confirms that he has reviewed and understood the internal guiding

principles and interest rate model of TYCOON CREDIT as available on the website of

TYCOON CREDIT (Link) for the purpose of determining and calculating rate of interest.

e) The Borrower understands that the Interest Amount is charged on the amount of the

Loan as stated in Loan Document and is likely to vary for different Borrowers and/ or for

different loans based on factors like cost of borrowed funds, cost of disbursements,

market conditions, Applicable Laws, default risk, period of loan, purpose, advance paid

by the Borrower and financial position disclosed by Borrower while submitting the Loan

Application. The Borrower undertakes that he has agreed to pay the Interest Amount on

the respective Loan(s) after considering such fact and shall not dispute the same in future.

f) Interest Amount in respect of each Loan will start accruing in favour of TYCOON CREDIT

on and from the respective Effective Date until the repayment of the Loan and all monies

due and payable by the Borrower in respect of the Loan, including Interest Amount, fees,

penalties etc., in full to the satisfaction of TYCOON CREDIT. In case the Interest Amount,

Email : info@tycooncredit.in , Contact details: 9310039776, Website : www.trycooncredit.in

Digitally signed by Kamlesh Gupta

Date: 2024.11.07 13:24:07 IST

Reason:

Tycoon Credit and Portfolios Limited

G-15, LGF, South Extension-II, New Delhi-110049, India

CIN: U65993DL1992PLC048910 : RBI Registration No: 14.01178

if charged for the period commencing from the Effective Date until the actual disbursal of

the Loan, shall be adjusted suitably by TYCOON CREDIT.

g) Interest Amount shall be computed on the basis of a year comprising of three hundred

and sixty days.

4. LOAN REPAYMENT

a) The Borrower undertakes to repay the amount of respective Loan(s) together with the

Interest Amount in specified number of instalments of the equal amount throughout the

tenure of each such Loan (hereinafter referred to as “Instalments”), if stated in the Loan

Documents not later than the respective Due Dates. The amount of EMI shall be

calculated by TYCOON CREDIT on the basis of Reducing Balance Interest Rate, the amount

of the Loan and tenure of the Loan and is rounded off to the next one rupee. The amount

of Instalment shall be expressly communicated to the Borrower and theBorrower has

agreed to the same after fully understanding the method of computation of the

Instalment and the number of Instalment payable on the Loan (including Advance

Instalment, if any, as specified in the Loan Document).

b) The Borrower may pay in advance such number of Instalments as agreed with TYCOON

CREDIT and specifically mentioned in the Sanction Letter and Loan Documents under

any particular Loan (referred as “Advance Instalments” in this T&C). TYCOON CREDIT shall

adjust the Advance Instalments, if any paid by the Borrower, towards any Outstanding

Balance in such manner and at such time as specifically described in the Loan Document.

c) The Borrower shall continue to pay the Instalments not later than on the respective Due

Dates for each such Loan regardless of whether the purpose for which the Loan is

obtained could not be achieved and/ or any other circumstance whatsoever, or any

product purchased with the Loan is defective, returned, lost, damaged, under repair or

not working or not delivered or the purchase contract with any dealer is terminated

for any reason whatsoever.

d) Where any tax or other amount, including the interest thereon, is paid by TYCOON CREDIT

on behalf of the Borrower either to any government/tax or other public authority, or to

any dealer, or to any other Person concerned, whether relating to the any product related

to Loan or the Loan granted to the Borrower or pursuant to any legal proceedings, at any

time before, or after, or during the Loan is in existence, the Borrower undertakes to

reimburse the same to TYCOON CREDIT along with interest thereon as set forth by the

applicable law, or under an arrangement with any dealer, as the case may be immediately

on demand and in the manner specified by TYCOON CREDIT.

2. The Borrower agrees to pay the Instalment, penalties, fees and other sums due and payable by

the Borrower to TYCOON CREDIT by any of the following modes as approved by TYCOON CREDIT

considering the information provided by the Borrower:

a) Payment mode available in the mobile application/Web Application/web application

used by TYCOON CREDIT.

b) Payment mode available in the mobile application/Web Application/web application

used by TYCOON CREDIT Partners.

c) Automated Fund Transfer

d) E Mandate/ Nach/UPI Mandate

e) Authorized Payment link shared my Tycoon Partner or Tycoon

f) Alternate Payment Channel as indicated on mobile application/Web Application used by

TYCOON CREDIT/ or the website of TYCOON CREDIT or mobile application/Web

Application of Tycoon Partners

g) Any other mode as may be approved by TYCOON CREDIT in writing from time to time and

informed through Contact Options.

3. TYCOON CREDIT may, at its sole discretion, change the mode of payment adopted by the

Borrower and require the Borrower to make the payment as per the changed mode:

a) upon the request received from the Borrower and/ or as agreed with the Borrower, or

b) in the event of default in repayment of the Loan or any part of the Outstanding Balance

by the Borrower, or

c) in case Mandate provided by the Borrower is found to be invalid or incomplete.

4. Where the payment by the Borrower is made through Automated Fund Transfer, the Borrower

Email : info@tycooncredit.in , Contact details: 9310039776, Website : www.trycooncredit.in

Digitally signed by Kamlesh Gupta

Date: 2024.11.07 13:24:07 IST

Reason:

Tycoon Credit and Portfolios Limited

G-15, LGF, South Extension-II, New Delhi-110049, India

CIN: U65993DL1992PLC048910 : RBI Registration No: 14.01178

assures that

a) The Borrower shall maintain sufficient balance in the bank account from which the

payment shall be made.

b) The Borrower shall neither close the bank account nor give any direction to his bank to

stop the payment to TYCOON CREDIT without prior written consent of TYCOON CREDIT.

The Borrower shall be liable to solely bear and pay bounce fee /dishonour charges and

late payment charges imposed by TYCOON CREDIT without any protest. The Borrower

shall immediately inform TYCOON CREDIT of the said bank account is freezed by any

authority and alternatively arrange for alternate bank account for making repayment on

Due Date.

c) Mandate shall not be withdrawn or cancelled by the Borrower without prior written

notice of at least 30 (thirty) days to TYCOON CREDIT. In the event the Mandate is

withdrawn or cancelled by the Borrower upon prior notice to TYCOON CREDIT and the

same is approved by TYCOON CREDIT, the Borrower unconditionally agrees to ensure the

payment through other channels and deliver to TYCOON CREDIT all documents proving

sufficiently such change or issue new Mandate with immediate effect.

d) Mandate given to TYCOON CREDIT shall remain valid until the complete repayment of the

Loan together with all Interest Amount, charges, penalties or any other amount due to

TYCOON CREDIT.

e) The Borrower shall immediately issue fresh Mandate when the Loan has been

restructured, or the Mandate is incorrect/ lost/ misplaced, or any other circumstances

have arisen that necessitate modification or change in the existing Mandate. Until then

the Borrower shall continue to make payments through Alternate Payment Channels.

f) In the event of dishonour of transaction initiated through such Mandate, the Borrower

hereby authorises TYCOON CREDIT to present the Mandate again with the bank of the

Borrower for clearance/ payment any time at the sole discretion of TYCOON CREDIT

without any prior intimation to Borrower.

g) TYCOON CREDIT is hereby authorised to debit the bank account of the Borrower one

business day before the respective Due Date(s) in the event such Due Date(s) falls on a

bank holiday.

h) Where the Borrower agrees to make the payment through Alternate Payment Channel or

any other mode approved by TYCOON CREDIT, the Borrower undertakes that:

1. Such payment shall be made only to the Person or agency duly

authorized in writing by TYCOON CREDIT.

2. Any fee/ cost charged by such Persons or agencies authorised by TYCOON

CREDIT for receiving any amount payable by the Borrower under this

T & C shall be solely borne by the Borrower.

i) TYCOON CREDIT shall not be held responsible for delay or failure in payment of

Instalments caused due to the loss or damage of the Mandate or due to any default of

thecollecting/ processing bank, or for any failure occurred in accepting and/ or crediting

such payment in favour of TYCOON CREDIT due to any discrepancy or non-functioning of

the outlets/ kiosks of such Person / agency and the Borrower shall be liable to solely bear

and pay late payment charges, as applicable, imposed by TYCOON CREDIT. The Borrower

understands and agrees that any such delay, non-performance, or default shall not affect

the liability of the Borrower to repay the Loan along with the Interest Amount, fees and

other charges. The Borrower shall be solely responsible to ensure that respective

Instalments are remitted to TYCOON CREDIT in time without any delay or default.

j) Notwithstanding anything contained under this T&C and/ or the other Loan Documents

(including the Sanction Letter) executed by and/ or agreed upon by the Borrower,

TYCOON CREDIT shall have the right to increase the number of Instalments and/ or alter

and/ or reschedule the Instalments and their amounts, resulting whether because of (i)

change in stamp duty, or any levy of any direct/indirect tax duties, cesses or other charges

by any government authority, or (ii) at the request of the Borrower received in writing.

TYCOON CREDIT shall have the absolute right to decide the manner and the extent of

such increase/ alteration/ re-scheduling with prospective effect or, if decided so by the

government authority in the respective change, with retrospective effect. The Borrower

expressly confirms to issue fresh Mandate, or make the payment through Alternate

Payment Channel or any other mode approved by TYCOON CREDIT, based upon such

increase /alteration/rescheduling and, where such Instalments have been increased/

altered/ rescheduled at the request of the Borrower, to pay any applicable charges/ fees

as communicated to the Borrower or indicated on website of TYCOON CREDIT.

k) Unless otherwise decided by TYCOON CREDIT at its sole discretion, any amount paid, or

Email : info@tycooncredit.in , Contact details: 9310039776, Website : www.trycooncredit.in

Digitally signed by Kamlesh Gupta

Date: 2024.11.07 13:24:07 IST

Reason:

Tycoon Credit and Portfolios Limited

G-15, LGF, South Extension-II, New Delhi-110049, India

CIN: U65993DL1992PLC048910 : RBI Registration No: 14.01178

prepaid, by the Borrower, either as Instalment or otherwise, shall be adjusted first

towards the penalties and charges, if any due and payable by the Borrower, then towards

the overdue Instalment(s) and then towards balance of the Interest Amount and the

Loan principal amount respectively

l) The Borrower represents and undertakes to TYCOON CREDIT that the Borrower shall be

solely and absolutely liable for the repayment of the Outstanding Balance in respect of

each Loan from time to time and he would repay/ pay the same without any requirement

of any notice, demand or intimation by TYCOON CREDIT and the Borrower further

undertakes and confirms that he/she shall not withhold or be entitled to withhold the

payments demanded by TYCOON CREDIT and/or payment of any Instalment and/or any

other amount payable under the present T&C by the Borrower to TYCOON CREDIT, on any

ground/dispute whatsoever, including but not limited to the existence of any dispute

including any dispute relating to computation of Interest and/or Instalment.

5. FEES, CHARGES AND OTHER PAYMENTS

a) The Borrower confirms and undertakes that Processing Fee, Documentation Fee, if any,

or any other charges as applicable to each such Loan applied and/ or obtained as

requested by the Borrower from time to time shall be borne and paid by the Borrower

duly on time as per the terms and conditions of the Loan Document.

b) The Borrower confirms and undertakes that late payment charges/ default interest, direct

debit bounce fee and other charges/ penalties, as applicable to each Loan obtained by

the Borrower from time to time, shall be borne and paid by the Borrower duly on time as

per the terms and conditions of the Loan Document. Further, the Borrower understands

and agrees that TYCOON CREDIT has the right to revise any such charges/ fees and

penalties from time to time, the notice of which may be given to the Borrower by posting

the same on the website of TYCOON CREDIT or through such Contract Options as decided

by TYCOON CREDIT at its sole discretion.

6. PRE-PAYMENT OF THE LOAN

a) Upon disbursement of Loan, the Borrower shall have Cooling off/ Look-up Period of

number of days as specified in Sanction Letter and other Loan Documents during which

Borrower shall have option to cancel/exit from Loan by pre-paying the outstanding

principal amount of loan, along with proportionate APR (if applicable), without any

penalty. TYCOON CREDIT shall at its sole discretion may levy / or waive levy of

proportionate APR during Cooling off/Look-up Period. The terms and conditions for such

prepayment during Cooling off/ Look- up period may be communicated by TYCOON

CREDIT separately to Borrower and Borrower hereby undertakes to comply with such

terms and conditions.

b) In case the Borrower intends to prepay all or any of the Loan(s)or any of their part before

the expiry of respective loan period, the Borrower has to give a prior notice to TYCOON

CREDIT in writing of his intention to prepay the Loan.

c) Except for Clause 6.1 above, for the purpose of pre-payment of the Loan, the Borrower

shall pay to TYCOON CREDIT the stipulated Instalments along with any applicable/due

penalties and charges due to be paid by the Borrower up to the date of such prepayment

as stated in the Loan Document or charged under this T&C and the Loan principal

outstanding calculated as per Clause 3.1 above. Further, any pre-payment of any of the

Loan(s) by the Borrower shall be subject to expiry of the minimum moratorium period

(i.e. period during which the loan cannot be terminated by Borrower) as stated in the

Loan Document, if any and the payment of prepayment penalty as applicable to such

Loan(s).

d) Notwithstanding the repayment schedule or conditions of this T&C, the Loan is repayable

on demand made by TYCOON CREDIT and TYCOON CREDIT shall have the right to be paid

immediately by the Borrower on demand, the entire Outstanding Balance in the event

the instruction or order to recall the Loan is issued by the concerned regulatory authority

or the court of law for any reason whatsoever. The Borrower shall make payment of the

entire Outstanding Balance immediately on such demand being received from TYCOON

CREDIT. In such an event, TYCOON CREDIT shall also be entitled to adjust any amount of

the Borrower lying in any other form with TYCOON CREDIT or any of its associates or

branches towards the dues of the Borrower under the Loan.

7. DEMAND PROMISSORY NOTE

Email : info@tycooncredit.in , Contact details: 9310039776, Website : www.trycooncredit.in

Digitally signed by Kamlesh Gupta

Date: 2024.11.07 13:24:07 IST

Reason:

Tycoon Credit and Portfolios Limited

G-15, LGF, South Extension-II, New Delhi-110049, India

CIN: U65993DL1992PLC048910 : RBI Registration No: 14.01178

a) In case the Borrower has executed Demand Promissory Note, in the form as approved by

TYCOON CREDIT in favour of TYCOON CREDIT, for the aggregate of the Loan amount and

Interest Amount, the Borrower undertakes that TYCOON CREDIT shall be entitled to

negotiate the Demand Promissory Note. The Borrower waives presentment and notice of

dishonour of the Demand Promissory Note.

8. USE OF TELEPHONE/MOBILE, ONLINE, SMS, MOBILE APPLICATION/WEB APPLICATIONS AND

OTHER CONTACT OPTIONS FOR LOAN(S) AND OTHER SERVICES

a) This T&C also governs the use of any telephone (either through human interface or AVR),

fax, e-mail, short messaging service (sms), mobile application/Web Applications, online

customer portal and/ or other options as made available by TYCOON CREDIT to its

Borrowers from time to time for availing Loans(s)/ services from TYCOON CREDIT

(hereinafter all such options are referred as “Contact Options”) and any consent provided,

or agreement entered into, by the Borrower (including but not limited to the consent to

the Sanction Letter and this T&C) by the use of any such Contact Options shall be valid

and binding on the Borrower. TYCOON CREDIT may, at its sole discretion, allow the

Borrower to apply for and/ or obtain Loan(s) or avail various other services/ facilities from

TYCOON CREDIT from time to time over any of the aforesaid Contact Options. All such

applications, or requests of the Borrower (including applications for Loan, acceptance of

terms & conditions for Loan(s) and order for services) to TYCOON CREDIT through any of

the aforesaid Contact Options shall be valid and binding upon the Borrower and shall

constitute a valid and binding contract between TYCOON CREDIT and the Borrower if the

same is also approved by TYCOON CREDIT. The Borrower authorizes TYCOON CREDIT to

accept all the instructions/ applications/ requests made by Borrower through any of such

Contact Options opted by the Borrower for the purposes of considering, granting,

approving, or disbursing the Loan(s) by TYCOON CREDIT, as the case may be, as per the

terms and conditions of this T&C. Further, the Borrower agrees and confirms that all Loan

Documents (including but not limited to the Sanction Letter, the loan agreement with the

enclosures in respect of the Loan) sent by TYCOON CREDIT to the Borrower over any of

the Contact Options shall be valid and binding on the Borrower.

b) By referring to or using any of the Contact Options, the Borrower confirms that the

Borrower is doing such act for using the service for the purpose it is meant and no other

malicious intent. The Borrower agrees that the phone number, e-mail address and other

details provided by the Borrower, either in the Loan Application or otherwise, for availing

Contact Options or for any call-back is owned by and belong to the Borrower only. The

Borrower further confirms that the Sanction Letter, or other Loan Document, or any

information pertaining to the Loan of the Borrower, shall be deemed to be received by

the Borrower if sent by TYCOON CREDIT to the address of the Borrower in physical form

(through courier, post, or by hand) or if sent at the e- mail address, mobile number, online

customer portal, fax number or other contacts as provided by the Borrower to TYCOON

CREDIT.

c) The Borrower understands and agrees that accepting instructions, or approving the Loan,

through any of the Contact Options shall at all times be subject to the sole discretion of

TYCOON CREDIT and that TYCOON CREDIT may, at its sole discretion, refuse to act based

on such instructions. The Borrower acknowledges that the range of services/ Loan(s)

provided over the Contact Options may change from time to time. The Borrower agrees

that TYCOON CREDIT may add or discontinue anytime all or any of the Contact Options

for granting Loan(s) and other related services by sending notice/ communication to the

Borrower through e-mail/ sms/ phone call/ online customer portal or communicate it

through its website. The Borrower confirms that TYCOON CREDIT has the absolute right

to make changes in the terms and conditions for availing all or any of the Contact Options.

Borrower’s use of these Contact Options or related services after the effective date of the

change/ amendment of the terms and conditions of the Contact Options will constitute

Borrower’s acceptance of and agreement to such change(s).

d) The Borrower agrees that, in the case of telephone communications (including AVR, sms,

mobile application/Web Applications etc.) or online customer portal, as the case may be,

TYCOON CREDIT may require the Borrower to use/ enter a password allotted by TYCOON

CREDIT to such Borrower or may ask the Borrower questions about himself/herself and

about particulars of the Borrower’s account(s) including a personal identification number

in order to verify the Borrower’s identity and/ or may require a call-back procedure, all

as deemed appropriate by TYCOON CREDIT. The Borrower is obliged to keep any password

and any identification number designated by or provided to him/her hereunder as

Email : info@tycooncredit.in , Contact details: 9310039776, Website : www.trycooncredit.in

Digitally signed by Kamlesh Gupta

Date: 2024.11.07 13:24:07 IST

Reason:

Tycoon Credit and Portfolios Limited

G-15, LGF, South Extension-II, New Delhi-110049, India

CIN: U65993DL1992PLC048910 : RBI Registration No: 14.01178

confidential, and he/she shall be responsible for any consequence that may arise from

the use of such password by any other Person. TYCOON CREDIT shall not be liable in any

manner for access to the account of the Borrower by use of the user password by any

Person whomsoever. The Borrower irrevocably and unconditionally consents to TYCOON

CREDIT recording of all the Borrower’s electronic communication (e.g. telephone calls,

electronic mail, sms, mobile application/Web Application or other) and storage of

electronic media by TYCOON CREDIT and accepts such recordings and electronic media

as evidence with regard to acceptance of all the terms of the Loan(s) including, but not

limited to, the grant of the Loan, levy of any fee/ charges, Interest Amount over each such

Loan (s), rate of Interest applicable on each such Loan, period for each such Loan

borrowed by Borrower and the number/ amount of Monthly Instalment Borrower has to

pay to TYCOON CREDIT for each such Loan). The Borrower further accepts that such

record may be used by TYCOON CREDIT as evidence in a court of law or any legal

proceeding.

e) The Borrower understands and agrees that for the purposes of on-boarding/or Know Your

Customer (KYC) process, TYCOON CREDIT shall require access for camera, microphone,

location or any other facility of Borrower’s mobile phone used for applying for Loan, as

necessary for the purpose of on-boarding/ KYC process. The Borrower shall provide such

access to TYCOON CREDIT or its service provider/ agents so to complete such on-

boarding/ KYC process.

f) The Borrower understands and agrees that for the purpose of capturing economic profile

for evaluating credit worthiness of the Borrower or for any other process for credit

appraisal for Loan, TYCOON CREDIT shall require information of Borrower through

Contact Options and the Borrower shall provide access of same as per Applicable Law.

g) It is also understood and agreed to by the Borrower that only the Borrower shall

communicate instructions over the Contact Options. TYCOON CREDIT does not have to

accept telephone/ mobile/ sms/e- mail instructions by a nominee of the Borrower, and

the Borrower will not allow anyone other than the Borrower to make telephone/ mobile/

sms/e-mail/ online customer portal instructions on his/her behalf.

h) The Borrower confirms that he/she is fully aware of and consents to the risks associated

with transmitting instructions/data for obtaining Loan(s)/ funds transfer via Contact

Options, or any other mobile facility. The Borrowers agrees that confirmation of the

Borrower’s identity, by the Borrower’s submission of the personal details required by

TYCOON CREDIT, will be sufficient evidence for TYCOON CREDIT to identify the Borrower

and to act upon the Borrower’s instructions. The Borrower authorizes TYCOON CREDIT

and directs TYCOON CREDIT to act upon instructions for funds transfer given via such

Contact Options purportedly issued by, believed by TYCOON CREDIT to be issued by or

originated from the Borrower as identified in the Loan Application or related Documents.

i) The Borrower agrees that TYCOON CREDIT’s records (be they electronic, written or

otherwise) pertaining to each of the Loan obtained from TYCOON CREDIT will be final and

binding and that the Borrower shall not deny the validity of the transactions made in

relation to the Loan(s).

j) Before using any of the Contact Options, the Borrower is required to read and

electronically agree to (“sign”) related terms and conditions and/or disclosures.

k) TYCOON CREDIT may allot a user password for the Borrower and the Borrower agrees as

follows:

l) The user password may be communicated to the Borrower in such manner as may be

deemed fit by TYCOON CREDIT at the risk of the Borrower.

m) The Borrower shall not disclose the user password to any Person and shall further prevent

discovery of the same by any Person.

n) TYCOON CREDIT, may at its discretion allow the Borrower at any time to access the details

of the Loan and verify the statements and position based on the user password issued.

o) In case of loss, theft and disclosure of the user password, the Borrower shall communicate

the same to TYCOON CREDIT and in any event not later than 48 hours.

9. ASSIGNMENT AND SUB-CONTRACTING

a) TYCOON CREDIT shall be entitled to sell, transfer, assign, or securitize any of its right and

obligations hereunder to any Person without the consent of the Borrower. Any such sale,

assignment, securitization or transfer shall conclusively bind the Borrower. The Borrower

shall be bound to fulfil and perform all his/her obligations to such transferee/ assignee,

including the payment of Outstanding Balance. The Borrower confirms and agrees that

transferee/assignee shall be entitled to collect the due amounts in respect of a Loan from

Email : info@tycooncredit.in , Contact details: 9310039776, Website : www.trycooncredit.in

Digitally signed by Kamlesh Gupta

Date: 2024.11.07 13:24:07 IST

Reason:

Tycoon Credit and Portfolios Limited

G-15, LGF, South Extension-II, New Delhi-110049, India

CIN: U65993DL1992PLC048910 : RBI Registration No: 14.01178

the Borrower.

b) TYCOON CREDIT shall also have the right to share all information and documents relating

to the Borrower and/or the Loan amount availed by the Borrower and/ or the default

committed by the Borrower with the Person to whom TYCOON CREDIT has sold, assigned,

securitised or transferred in any other manner, all or any of the rights/ obligations of

TYCOON CREDIT as per this T&C and the Borrower confirms he/she has no objection if

such details, information and documents relating to the Borrower are so shared.

c) The Borrower expressly recognises and consents to the right of TYCOON CREDIT to

appoint and authorise one or more Persons, who may or may not be the employee or

officer of TYCOON CREDIT, to exercise any or all the rights/ powers of TYCOON CREDIT

provided under this T&C, whether relating to the administration, processing, collection,

recovery of the Outstanding Balance on behalf of TYCOON CREDIT, and to provide such

Persons all or part of the information/ data relating to the Borrower and/or the Loan

availed by the Borrower and/ or the default committed by the Borrower.

d) The Borrower shall not assign or sub-contract its rights and obligations under this T&C to

any other Person without the prior consent in writing of TYCOON CREDIT.

10. EVENTS OF DEFAULT

a) The Borrower shall be deemed to have committed default if the Borrower fails to comply

with this T&C or any other Loan Document. The events of default shall include, but not

limited to, following circumstances:

1. Any misrepresentation made, or wrong information provided, by the

Borrower to TYCOON CREDIT either orally or in writing in any of the Loan

Documents provided to TYCOON CREDIT or Borrower fails to furnish any

information required by TYCOON CREDIT under the Loan Documents; or

2. If the Loan is, directly or indirectly utilized for any illegal, anti-social or

speculative purpose, or for any purpose not permitted by the concerned

government authority; or

3. If the Borrower fails to comply with any of the covenants mentioned in

this T&C or any other Loan Document or as may be agreed upon with

TYCOON CREDIT from time to time, or any representation and/or

warranty of the Borrower proves to be illegal, invalid, misleading or

untrue, or

4. If the Borrower takes any steps, or any steps are taken with a view to the

appointment of a receiver, trustee or similar officer of any of his/her

assets; or the Borrower commits an act of insolvency or makes an

application for declaring himself/herself an insolvent or an insolvency

notice is served on the Borrower, or an order is passed against the

Borrower declaring him/her an insolvent/ insane; or

5. If the Borrower is prosecuted in respect of any offence; or

6. If the Borrower fails to pay the Instalment, Interest Amount, penal

charges, or any other amount or any part thereof due to TYCOON CREDIT

on the respective Due Dates as required under this T&C or under any

other agreement/ arrangement for Loan taken from TYCOON CREDIT; or

7. If any security created for the Loan becomes infructuous or is

challenged by the Borrower or any other Person, or

8. If any other event has occurred which in the opinion of TYCOON CREDIT

jeopardizes its interest and would make it difficult for TYCOON CREDIT to

recover the Outstanding Balance.

11. REMEDIES IN CASE OF DEFAULT

1. The Borrower acknowledges following rights of TYCOON CREDIT, arising either under this T&C

or provided under the Applicable Law, against one or more defaults made by the Borrower,

whereas these rights of TYCOON CREDIT shall become enforceable immediately on the

occurrence of any default–

a) Where the complete Instalment or any other Borrower’s dues are not paid to TYCOON

CREDIT on or before the respective Due Dates, TYCOON CREDIT may demand and collect

the penal charges and other charges on such delayed payment computed from the

respective Due Dates as stated in the Loan Document, for each of the default.

b) To recall the entire Outstanding Balance and recover immediately the Outstanding

Email : info@tycooncredit.in , Contact details: 9310039776, Website : www.trycooncredit.in

Tycoon Credit and Portfolios Limited

G-15, LGF, South Extension-II, New Delhi-110049, India

CIN: U65993DL1992PLC048910 : RBI Registration No: 14.01178

Balance in respect of each of the default.

c) Not to release the charge/ hypothecation created over the security, if any, in case the

Borrower has defaulted in repayment of any Loan of whatever nature obtained from

TYCOON CREDIT, until the repayment of entire Outstanding Balanceand to enforce

such charge/ hypothecation so created for the purpose of recovery of the Outstanding

Balance.

d) TYCOON CREDIT shall have a paramount lien and right of set off on/ against (a) all

insurance proceeds whatsoever from the Security as and when created, (b) any money to

be paid/ refunded by TYCOON CREDIT to the Borrower arising out of any other

agreement/ arrangement as well as (c) all other monies, securities, deposits of any kind

and nature and all other assets and properties belonging to the Borrower or standing to

the Borrower’s credit (whether held singly or jointly with any other Person), which are

deposited with/under the control of TYCOON CREDIT whether by way of security or

otherwise pursuant to any contract entered/to be entered into by the Borrower in any

capacity and TYCOON CREDIT shall be entitled and authorized to exercise such right of

lien & set off against all such amounts and assets for settlement of the Borrower's dues

with or without any further notice to the Borrower.

e) To initiate appropriate legal proceedings before the arbitrator appointed under clause 16

of this Agreement or before Court of Law, as case may be, for taking recourse to the legal

remedies provided in Applicable Law in force from time to time. The Borrower shall be

liable to immediately reimburse the entire cost to TYCOON CREDIT in respect of all legal/

arbitration proceedings, including but not limited to, the fees of lawyers, court fees, legal

notices, reminder notices, letters, legal summons etc. without any dispute/ protest.

f) TYCOON CREDIT shall be entitled to exercise such other rights as may be available to it

under this T&C and/ or the other Loan Documents (including the Sanction Letter)

executed by and/ or agreed upon by the Borrower and/ or under Applicable Law.

2. TYCOON CREDIT may, apart from exercising all or any of the aforesaid rights in case of default(s)

caused by the Borrower, enforce following rights with respect to any security/ hypothecation, if

any, created in favour of TYCOON CREDIT –

a) To send the notice in writing to the Borrower informing about such default and/ or calling

upon the Borrower to make payments of all the dues in respect of the Loan and, if the

Borrower fails to comply with such notice, TYCOON CREDIT shall have right to take

possession of the security if the dues remain unpaid within seven days from the date of

such notice.

b) If Borrower fails to comply with the demand of TYCOON CREDIT to hand over the security

to the representative of TYCOON CREDIT, TYCOON CREDIT shall have right as per the

Applicable Law to enter into any place or premises where such security is situated or kept

or stored, and for the purpose of such entry, to do all acts, deeds or things as are deemed

necessary by TYCOON CREDIT or its representatives and to take charge and/or to seize,

recover, receive and/or take possession of all or any of the security.

c) Upon taking possession of the security, TYCOON CREDIT may call upon the Borrower to

repay and close the entire Loan amount with Interest Amount and all applicable charges,

fees, costs and penalties as per the Loan Document, including expenses incurred for

taking and/ or storing the possession of the security (i.e. yard charges) before the

sale/auction of the security within the time specified by TYCOON CREDIT in such notice

and if the Borrower honours and makes the payment of the entire Loan amount with

Interest Amount, fees, penalties, costs and other applicable charges in accordance with

such notice, TYCOON CREDIT shall handover the subject of the Security to the Borrower

provided this does not bar TYCOON CREDIT rights to take such similar action for any future

defaults made by the Borrower.

d) In case the Borrower fails to comply with such requisitions and demand made by TYCOON

CREDIT as mentioned in this Clause 11, TYCOON CREDIT shall be at liberty to forthwith or

at any time, either by public auction or tender or private contract, to sell and dispose off

all or any part of the Security to any third party in such manner as TYCOON CREDIT shall

think fit without any further notice or intimation to the Borrower. After selling/ disposing

off the said security, if the sale proceeds thereof is less than the total Outstanding Balance

as on the date of such sale/ disposal, the Borrower shall be liable to pay such shortfall to

TYCOON CREDIT within the time period specified by TYCOON CREDIT. If Borrower fails to

pay the Outstanding Balance amount within the given time period, TYCOON CREDIT

would be duly entitled to recover the Outstanding Balance amount along with Interest

Amount and other charges from the Borrower as per law. It is hereby clarified that

Email : info@tycooncredit.in , Contact details: 9310039776, Website : www.trycooncredit.in

Tycoon Credit and Portfolios Limited

G-15, LGF, South Extension-II, New Delhi-110049, India

CIN: U65993DL1992PLC048910 : RBI Registration No: 14.01178

TYCOON CREDIT would also be duly entitled to initiate proceedings for recovery of the

Outstanding Balance on the Loan even without first repossessing the security . The

Borrower undertakes and confirms that security repossessed by TYCOON CREDIT shall be

sold by TYCOON CREDIT on behalf of the Borrower and the transfer of ownership in the

security would be directly from the Borrower to the new buyer. Any liability on account

of value added tax, GST, sales tax, or any other tax/ duty levied or imposed on such sale

and paid by TYCOON CREDIT shall be recovered by TYCOON CREDIT from Borrower either

from the sale proceeds of the security or in any other manner whatsoever.

3. In case the Borrower commits default in the repayment of any sum owing under any such Loan

(including the payment of interest thereon) on the Due Date(s), TYCOON CREDIT and/or the

Reserve Bank of India will have an unqualified right to disclose or publish the information and

data relating to the Borrower and/or the Loan availed by the Borrower and/ or the default

committed by the Borrower to other banks, financial institutions, the Credit Information

Companies or any other authorised agency insuch manner and through such medium as

TYCOON CREDIT or Reserve Bank of India in their absolute discretion may think fit in accordance

with the Applicable Law and the Borrower agrees and gives consent for the disclosure,

processing, or use of such information/ data by TYCOON CREDIT/ Reserve Bank of India/ Credit

Information Companies.

4. TYCOON CREDIT or its officers, agents or nominees shall not be in any way responsible for

any loss, damage, limitation, or depreciation that the Borrower and/ or Security (if created) may

suffer or sustain on any account whatsoever in respect of Loan or whilst the Security is in the

possession of TYCOON CREDIT, its officers, agents or nominees or because of exercise or non-

exercise of the rights, powers, or remedies available to the TYCOON CREDIT or its officers, agents

or nominees and all such loss, damage or depreciation shall be debited to the account of the

Borrower howsoever the same may have been caused. Neither TYCOON CREDIT nor its agents,

officers or nominees shall be in any way responsible and liable and the Borrower hereby agrees

not to make TYCOON CREDIT or its officers, agents or any nominees liable for any loss, damage,

limitation or otherwise for any belongings and articles that may be kept or lying in the Security

at the time of taking charge and/or possession, or seizure of the Security.

12. NOTICE

a) The Borrower agrees and confirms that where any document, notice, intimation,

information, communication and/ or demand is required to be provided/ made by

TYCOON CREDIT to the Borrower under this T&C and/ or the other Documents and/ or

Applicable Law, such document, notice, intimation, information, communication and/

or demand shall be deemed to have been provided/ made and shall be binding of the

Borrower if the same is rendered or made available by TYCOON CREDIT by using any of

the Contact Options.

b) Any such notice by TYCOON CREDIT will be deemed to be effective if sent by personal

delivery, when delivered, if sent by post, two days after being deposited in the post

and if sent by courier, two days after being deposited with the courier and if sent by e-

mail/ sms/ fax or posted on online customer portal, immediately upon the same being

sent by TYCOON CREDIT.

c) Without prejudice, TYCOON CREDIT may also send any notice to the Borrower on any

additional address (s), which come to its knowledge. In case TYCOON CREDIT intimates

its change of address to the Borrower, the Borrower shall also send the notice to that

address also. Any notice by Borrower shall be sent either by personal delivery, or by

registered post, and shall be deemed to be delivered only when it is actually received by

TYCOON CREDIT.

13. UTILISATION OF LOAN

a) The Borrower ensures that no part of the Loan shall be utilized for any illegal purposes

and/or immoral activities, categorically prohibited activities, gambling, lottery, races and

activities speculative in nature and/or such other activities of similar nature or under

influence, voracity or coercive action from TYCOON CREDIT. The Borrower further

confirms that TYCOON CREDIT has neither represented the Borrower that it is the dealer/

manufacturer of any product nor has given any assurance on the quality of any product.

b) The Borrower shall not utilize Loan for any activity which is hazardous for the

environment and safety of general public or for any project which is illegal or against any

Applicable Law.

Email : info@tycooncredit.in , Contact details: 9310039776, Website : www.trycooncredit.in

Tycoon Credit and Portfolios Limited

G-15, LGF, South Extension-II, New Delhi-110049, India

CIN: U65993DL1992PLC048910 : RBI Registration No: 14.01178

c) The Borrower shall not utilize Loan for any for any child, or forced labour. The Borrower

will not employ children in any manner that is economically exploitative, or is likely to be

hazardous or to interfere with the child’s education, or to be harmful to the child’s health

or physical, mental, spiritual, moral, or social development. The Borrower will identify the

presence of all persons under the age of 18. Where national laws have provisions for the

employment of minors, the Borrower will follow those laws applicable to the Borrower.

Children under the age of 18 will not be employed by Borrower in hazardous work. All

work of persons under the age of 18 will be subject to an appropriate risk assessment

and regular monitoring of health, working conditions, and hours of work.

d) The Borrower shall not use the proceeds of the Loan in a manner or for a purpose that

would violate applicable anti-corruption laws.

14. DECLARATIONS BY THE BORROWER- The Borrower makes the following representations and

warranties to TYCOON CREDIT as of the date of this T&C and such representations and

warranties shall be repeated on each day until the repayment of the entire Outstanding Balance

in full to the satisfaction of TYCOON CREDIT:

a) That this T&C and all Documents, hereunder as required, will be valid and binding

obligations of the Borrower and enforceable in accordance with their respective terms

until TYCOON CREDIT has issued a certificate in writing to the Borrower stating that

Borrower has discharged all his/ her liabilities towards TYCOON CREDIT under all the

Loans to the satisfaction of TYCOON CREDIT.

b) That the Borrower does not violate any covenants, conditions and stipulations under any

existing agreement entered into by the Borrower with any third party by availing the Loan

from TYCOON CREDIT.

c) The Borrower hereby declares that all the information provided by the Borrower, either

verbally or in writing or by way of any of the Contact Options, and documents submitted

before or at the time of submitting Loan Application, or before or at the time of execution

of this T&C are true, genuine and correct and the Borrower further assures that any

information demanded by TYCOON CREDIT in the future shall be immediately provided

by the Borrower with complete accuracy.

d) The Borrower hereby confirms that the Borrower shall not have any right to terminate

this T&C until the whole of the Outstanding Balance is repaid in the manner directed by

TYCOON CREDIT.

e) The Borrower hereby consents that TYCOON CREDIT and/ or his/her authorised

representative may communicate with the Borrower either by phone calls, sms,

electronic mails or through any other mode of communication available for the purpose

of discussing the current status of his

f) /her Loan(s) or reminder/ collection of any dues in respect of any Loan or for any matter

related to the Loan(s) and such phone calls, sms, etc., shall not be covered under the

purview of “Do Not Disturb” policy of the Telecom Regulatory Authority of India (TRAI).

For this purpose, Borrower hereby grants permission to TYCOON CREDIT to contact

him/her any time between 0800 hours to 1900 hours from Monday to Sunday. The

Borrower may inform TYCOON CREDIT if some other time is convenient for the Borrower

by calling the customer care department/ recovery department/ or any other authorized

representatives of TYCOON CREDIT.

g) The Borrower agrees, consents and permits TYCOON CREDIT to disclose to the Borrower’s

family members (i.e. parents, spouse, children, sisters and brothers) or other Persons

whose details have been provided by the Borrower either in Loan Application or

otherwise from time to time, all necessary or relevant particulars/information relating to

the Borrower and the Loan for any legal purpose required by TYCOON CREDIT.

h) The Borrower confirms that neither Borrower nor Borrowers’ family members is citizen

or reside in any country which is not Financial Action Task Force (FATF) compliant or from

any country which is enemy country of India.

i) The Borrower undertakes to pay each of the Monthly Instalments on or before the

respective Due Dates without any default.

j) The Borrower undertakes to inform TYCOON CREDIT within 07 days of any change in

his/her residential address, employment, telephone numbers, or change in any of the

details provided to TYCOON CREDIT in writing or by using any Contact Options as made

available by TYCOON CREDIT.

k) The Borrower confirms that there is no action, suit, proceedings or investigation pending

or, to the knowledge of the Borrower, is threatened, by or against the Borrower before

any Court of Law or any government authority which might have a material adverse effect

Email : info@tycooncredit.in , Contact details: 9310039776, Website : www.trycooncredit.in

Tycoon Credit and Portfolios Limited

G-15, LGF, South Extension-II, New Delhi-110049, India

CIN: U65993DL1992PLC048910 : RBI Registration No: 14.01178

on the financial and other affairs of the Borrower or which might put into question the

validity or performance of this T&C.

l) The Borrower shall intimate TYCOON CREDIT promptly of any dispute which might arise

between the Borrower and any Person or any government authority thereby affecting the

ability of the Borrower to repay the Loan in the manner stipulated hereunder.

m) The Borrower shall at all times abide by the laws in India, and in particular, provisions of

the Prevention of Money Laundering Act, 2002.

n) The Borrower by availing the Loan shall have deemed to have warranted and undertaken

to the TYCOON CREDIT as follows: (a) Due Payment of public and other demands

o) i.e. the Borrower has/have paid all public demands such as Income Tax and all the other

taxes and revenues payable to the Government of India or to the Government of any

State or to any local authority and that at present there are no arrears of such taxes and

revenues due and outstanding. (b) It shall be the Borrower’s obligation to keep being

acquainted with the rules of TYCOON CREDIT, in force from time to time. (c) To make

regular payments to the TYCOON CREDIT.

p) The Borrower is of sound mind and has not hidden any material fact from TYCOON CREDIT

which may hamper /adversely affect the performance of obligation by Borrower under

Loan Documents.

q) The Borrower hereby warrants shall not do any act/omission in order to avoid payment

of Loan on Due Dates including giving threatening communications through any Contact

option or misbehave with representative , customer management of Tycoon Credit .

r) The Borrower hereby warrants that the Borrower shall not make any wrong statement

publicly against TYCOON CREDIT (including posting false/ abusive messages in social

media platforms) with motive to avoid repayment of Loan.

15. OTHER CONDITIONS

a) Where any part or provision of this T&C or any Document becomes illegal, invalid or

unenforceable under the law, the remaining part or provisions of the T&C or such

Document shall remain valid and enforceable so far as they are not affected by the part

or provision that become illegal, invalid or unenforceable.

b) TYCOON CREDIT shall be entitled to amend any of this T&C or any other Document at any

time at its sole discretion. Any such amendment shall have prospective effect. The

Borrower shall be informed about any such amendment by posting such amendment on

the website of TYCOON CREDIT or through any Contact Options as decided by TYCOON

CREDIT at its sole discretion. Any such amendment made to the T&C by TYCOON CREDIT

shall be binding upon and enforceable against the Borrower. The Borrower shall have the

option to repay the Outstanding Balance to TYCOON CREDIT within the time period

specified by TYCOON CREDIT on the website or as agreed with TYCOON CREDIT in case

the Borrower does not agree to the amendment of any of the terms & conditions of this

T&C or any other Document.

c) TYCOON CREDIT shall have the absolute discretion to opt and exercise all or any of the

aforesaid rights available to TYCOON CREDIT, however, where TYCOON CREDIT chooses

to exercise one right over the other, TYCOON CREDIT shall not be deemed to have waived

off the option of exercising that other right in future.

d) The Borrower agrees to comply with all Applicable Laws from time to time in force

including any amendments, modification or change thereof which may be attracted and

the Borrower shall indemnify TYCOON CREDIT in respect of any loss, claim or expense to

TYCOON CREDIT as a result of non- compliance of any such Applicable Laws.

e) In case of discrepancies, if any, between T&C and the Sanction Letter and Loan

Documents , the terms and conditions mentioned in the Loan Documents shall prevail.

f) Where the T&C or any other Document has been executed or referred in any language

along with or other than English Language, the copy of T&C or such other Document

executed or referred in English language shall be considered correct and final in case of

any dispute arising due to interpretation of any word, sentence or any clause in other

languages.

16. DISPUTE RESOLUTION AND JURISDICTION

a) Every dispute, difference, or question which may at any time arise between TYCOON

CREDIT and the Borrower in respect of the Loan or any Person claiming under them,

touching or arising out of or in respect of this T&C or any other Document or the subject

matter thereof and/ or any Loan shall be referred to a Sole Arbitrator to be appointed by

Email : info@tycooncredit.in , Contact details: 9310039776, Website : www.trycooncredit.in

Tycoon Credit and Portfolios Limited

G-15, LGF, South Extension-II, New Delhi-110049, India

CIN: U65993DL1992PLC048910 : RBI Registration No: 14.01178

TYCOON CREDIT for Arbitration. The arbitration proceedings shall be governed by the

provisions of the Arbitration and Conciliation Act, 1996 with such modification and

amendments as may be time being in force and the decision of the arbitrator shall be

final and binding on the parties. The Borrower hereby agrees and confirms that the

arbitration agreement contained in this T&C would constitute a valid and binding

arbitration agreement between the Borrower and TYCOON CREDIT even if this T&C is

accepted and agreed upon by the Borrower through any of the Contact Options provided

by TYCOON CREDIT. The place for holding such arbitration proceedings shall be Gurugram,

Haryana (India) and the language for such proceedings shall be English only.

b) This Agreement governed by and construed in all respects with the Indian Laws and the

Parties hereto agree that any matter or issues arising hereunder or any dispute hereunder

shall, at the option/discretion of TYCOON CREDIT, be subject to the exclusive jurisdiction

of the courts of Gurugram, Haryana, India.

17. DISCLAIMER

a) TYCOON CREDIT is having a valid Certificate of Registration dated 29th May 2003 issued

by the Reserve Bank of India (RBI) under section 45-IA of the Reserve Bank of India Act,

1934. However, the Reserve Bank of India does not accept any responsibility or guarantee

about the present position as to the financial soundness of the company or for the

correctness of any of the statements or representations made or opinions expressed by

the company and for repayment of deposits/discharge of the liabilitiesby the company.

18. CONFIDENTIALITY AND CONSENT FOR DISCLOSURE:

a) TYCOON CREDIT shall exercise care while handling any confidential information. However,

the Borrower acknowledges and accepts that the TYCOON CREDIT shall, in accordance

with Applicable Law, be entitled to disclose information (i) to the TYCOON CREDIT’s

affiliates, sub-contractors, agents, service providers, partners, lenders, investors, research

agencies (ii) to prospective transferees or purchasers of any interest in the Loan, (iii) as

required by law or any government order or direction including disclosure as maybe

necessary to perform or fulfill any requirement specified by the RBI, (iv) as deemed

necessary by the TYCOON CREDIT while exercising its remedies under the Loan

Documents. the TYCOON CREDIT shall also be entitled to disclosure without any notice to

the Borrower/s all or any information/documents or the data including but not limited

(a) information and data relating to the Borrower; (b) the information or data relating to

any credit facility availed of/to be availed by the Borrower; (c) default, if any, committed

by the Borrower, for protecting its interests to income tax authorities, credit rating

agencies or any other Government or any other Regulatory Authorities

b) /Bodies/ Departments/authorities as and when so demanded.

c) The Borrower understand that as a pre-condition relating to grant of Loan to the

Borrower, TYCOON CREDIT requires the consent of the Borrower for disclosure by

TYCOON CREDIT of information and data relating to Borrower, of the Loan availed/be

availed of by Borrower/s, obligations assumed/to be assumed by Borrower in relation

thereto and

d) /or default if any, committed by Borrower, in discharge thereof.

e) Accordingly, the Borrower has/have no objection to the disclosure by TYCOON CREDIT of

all or any such, (a) information and data relating to Borrower; (b) information or data

relating to Loan, or any credit facility availed/to be availed by Borrower; (c) information

and data relating to obligations assumed by Borrower in relation to the Loan/credit

facility(ies) granted/to be granted by TYCOON CREDIT ; and (d) information and data

relating to default, if any committed by Borrower in the discharge of such obligation, as

the TYCOON CREDIT may deem appropriate and necessary to disclose and furnish to any

agency as the TYCOON CREDIT feels appropriate and proper or as authorized by RBI.

f) The Borrower declare/s that the information and data furnished by him/her to the

TYCOON CREDIT is true and correct.

19. ACCEPTANCE

a) THE BORROWER CONFIRMS HAVING PERUSED, UNDERSTOOD AND AGREED TO THIS

ENTIRE T&C CONSTITUTING OF ABOVE CLAUSES INCLUDING THE LOAN AND OTHER

PRODUCT DETAILS, TYCOON CREDIT’S METHOD OF CALCULATING INSTALMENT AND

APPLICABLE CHARGES. THE AFOREMENTIONED T&C AND OTHER DOCUMENTS HAVE

BEEN EXPLAINED TO THE BORROWER IN THE LANGUAGE UNDERSTOOD BY THE

BORROWER AND THE BORROWER HAS UNDERSTOOD THE ENTIRE MEANING OF THE

Email : info@tycooncredit.in , Contact details: 9310039776, Website : www.trycooncredit.in

Tycoon Credit and Portfolios Limited

G-15, LGF, South Extension-II, New Delhi-110049, India

CIN: U65993DL1992PLC048910 : RBI Registration No: 14.01178

VARIOUS CLAUSES STATED IN THIS T&C.THE BORROWER IS AWARE THAT TYCOON CREDIT

HAS AGREED TO GRANT LOAN TO BORROWER ONLY ON THE BASIS OF THE

REPRESENTATIONS AND WARRANTIES/ DECLARATIONS MADE BY THE BORROWER AND

THE UNDERTAKING PROVIDED BY THE BORROWER TO ABIDE BY THE TERMS OF THIS T&C.

Email : info@tycooncredit.in , Contact details: 9310039776, Website : www.trycooncredit.in

You might also like

- Sanction LetterDocument3 pagesSanction LetterPraveen KumarNo ratings yet

- keyFactStatement PDFDocument8 pageskeyFactStatement PDFINAM JUNG GUJJARNo ratings yet

- ALTUM CREDO Annexures With IndexingDocument40 pagesALTUM CREDO Annexures With IndexingSwarna SinghNo ratings yet

- Signed DocumentDocument17 pagesSigned Documentgamersingh098123No ratings yet

- 20241104064530amLYRyRAUlinKU1SVLUFb3zUCwbKXxn2yk95NQ1Z0jiC80xiumXBYRFOTByUKRbgTzDocument17 pages20241104064530amLYRyRAUlinKU1SVLUFb3zUCwbKXxn2yk95NQ1Z0jiC80xiumXBYRFOTByUKRbgTzkkamble40204No ratings yet

- DownloaddigitalsignDocument23 pagesDownloaddigitalsignSubhajeet Dutta RoyNo ratings yet

- TermsAndConditions 1438 14082024101830Document3 pagesTermsAndConditions 1438 14082024101830Sridhar ChitturuNo ratings yet

- TermsAndConditions 4074 08062024074217Document3 pagesTermsAndConditions 4074 08062024074217hemantk015No ratings yet

- TermsAndConditions_0406_02082024125455Document3 pagesTermsAndConditions_0406_02082024125455Mandar MarulkarNo ratings yet

- DownloaddigitalsignDocument24 pagesDownloaddigitalsigndipankardutta200No ratings yet

- TermsAndConditions 9687 04112023153427Document3 pagesTermsAndConditions 9687 04112023153427Jeetu WadhwaniNo ratings yet

- TermsAndConditions_3706_17072023101643Document3 pagesTermsAndConditions_3706_17072023101643prabhasini1948No ratings yet

- TermsAndConditions 8943 26012024180733Document3 pagesTermsAndConditions 8943 26012024180733madhavimucherla1980No ratings yet

- TermsAndConditions 2418 20092024224715Document3 pagesTermsAndConditions 2418 20092024224715kumar kNo ratings yet

- Loan Sanction-Letter With KfsDocument4 pagesLoan Sanction-Letter With KfsibtfaizabadNo ratings yet

- DID231031172059040ZSMI2IHLDNJXVLDocument15 pagesDID231031172059040ZSMI2IHLDNJXVLgaganNo ratings yet

- Loan Sanction-Letter With KfsDocument4 pagesLoan Sanction-Letter With Kfspoojameher644No ratings yet

- State Bank of India Overdraft Against Fixed Deposit Terms & Conditions Governing Overdraft Against Fixed DepositDocument3 pagesState Bank of India Overdraft Against Fixed Deposit Terms & Conditions Governing Overdraft Against Fixed Depositsolankinayan8No ratings yet

- TermsAndConditions - 8082 - 05042024122441 HiDocument3 pagesTermsAndConditions - 8082 - 05042024122441 Hilalo1290847No ratings yet

- TermsAndConditions 8667 31032024153855Document3 pagesTermsAndConditions 8667 31032024153855siwax63285No ratings yet

- Customer Digital JourneyDocument4 pagesCustomer Digital Journeysurajhake99No ratings yet

- ead6d090-188e-449c-9342-361884f70c7a-e1a57ac5-94b6-4d9a-9149-fca0d47cbc2a-SignedKFSDMI.pdfDocument8 pagesead6d090-188e-449c-9342-361884f70c7a-e1a57ac5-94b6-4d9a-9149-fca0d47cbc2a-SignedKFSDMI.pdfnkagarwalpublicationNo ratings yet

- TermsAndConditions 0163 04072024145203Document3 pagesTermsAndConditions 0163 04072024145203Pradhish V.NNo ratings yet

- Terms and Conditions IHL 1710832175850Document9 pagesTerms and Conditions IHL 1710832175850Nageswara Rao YerramreddyNo ratings yet

- E Signed DocumentDocument22 pagesE Signed Documentcrystallqueen25No ratings yet

- Loan Sanction-Letter With kfs3323231543124847618Document4 pagesLoan Sanction-Letter With kfs3323231543124847618ajay PrajapatNo ratings yet

- keyFactStatement 1Document8 pageskeyFactStatement 1naga srinuNo ratings yet

- Loan Sanction-Letter With kfs345937221866371454Document4 pagesLoan Sanction-Letter With kfs345937221866371454Palaka PrasanthNo ratings yet

- Key Fact SDocument3 pagesKey Fact SAjay KrishnanNo ratings yet

- Loan Sanction Letter SC301K9T4U7DE216TDocument6 pagesLoan Sanction Letter SC301K9T4U7DE216Tskjadhav099No ratings yet

- Sanction Letter UNITY BANKDocument5 pagesSanction Letter UNITY BANKDasharath Sriram GoudNo ratings yet

- PL Application FormDocument10 pagesPL Application FormsujitNo ratings yet

- App 282750 Borrower 437135Document25 pagesApp 282750 Borrower 437135BISMAYA PARIDANo ratings yet

- KFS - Tawfique HussainDocument4 pagesKFS - Tawfique Hussainswapnilmaher43No ratings yet

- Key Fact StatementDocument6 pagesKey Fact StatementAnkit KumarNo ratings yet