Adp w2 2021 Template

Adp w2 2021 Template

Uploaded by

c2pjpgjj26Copyright:

Available Formats

Adp w2 2021 Template

Adp w2 2021 Template

Uploaded by

c2pjpgjj26Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Copyright:

Available Formats

Adp w2 2021 Template

Adp w2 2021 Template

Uploaded by

c2pjpgjj26Copyright:

Available Formats

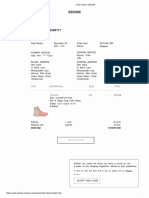

2021 W-2 and EARNINGS SUMMARY

Employee Reference Copy This summary section is included with your W-2 to help describe this

portion in more detail. The reverse side includes general information that

Wage and Tax

W-2 Statement

Copy C for employee’s records.

2021

OMB No. 1545-0008

you may also find helpful. The following reflects your final pay stub, plus

any adjustments made by your employer.

d Control number Dept. Corp. Employer use only GROSS PAY 4,959.01 SOCIAL SECURITY 307.46

0000127144 V05 TAX WITHHELD

BG95 77482

BOX 04 OF W-2

c Employer’s name, address, and ZIP code

FED. INCOME 317.90 MEDICARE TAX 71.91

AMERICAN AIRLINES INC TAX WITHHELD WITHHELD

4000 E SKY HARBOR BLVD BOX 02 OF W-2 BOX 06 OF W-2

PHX-RWE-PAY

PHOENIX, AZ 85034 STATE INCOME TAX 187.00 SUI/SDI 0.00

BOX 17 OF W-2 BOX 14 OF W-2

LOCAL INCOME TAX 11.50

BOX 19 OF W-2

e/f Employee’s name, address, and ZIP code

MICHAEL F JONES

110 WESTWOOD WAY

ERIE, CO 80516

b Employer’s FED ID number a Employee’s SSA number

13-1502798 XXX-XX-6692

1 Wages, tips, other comp. 2 Federal income tax withheld

4719.17 317.90

3 Social security wages 4 Social security tax withheld

4959.01 307.46

5 Medicare wages and tips 6 Medicare tax withheld

4959.01 71.91

7 Social security tips 8 Allocated tips To change your employee W-4 profile information

file a new W-4 with your payroll department

9 10 Dependent care benefits

11 Nonqualified plans 12a See instructions for box 12

C 1.74 Social Security Number: XXX-XX-6692

14 Other

12b D 239.84 MICHAEL F JONES

12c L 287.43

12d DD

110 WESTWOOD WAY

153.82

13 Stat emp. Ret. plan 3rd party sick pay ERIE, CO 80516

X

15 State Employer’s state ID no. 16 State wages, tips, etc.

CO 08015888 4719.17

17 State income tax 18 Local wages, tips, etc.

187.00 1953.46

19 Local income tax 20 Locality name ¤ 2021 ADP, Inc.

11.50 DENVER PAGE 01 OF 01

1 Wages, tips, other comp. 2 Federal income tax withheld 1 Wages, tips, other comp. 2 Federal income tax withheld 1 Wages, tips, other comp. 2 Federal income tax withheld

4719.17 317.90 4719.17 317.90 4719.17 317.90

3 Social security wages 4 Social security tax withheld 3 Social security wages 4 Social security tax withheld 3 Social security wages 4 Social security tax withheld

4959.01 307.46 4959.01 307.46 4959.01 307.46

5 Medicare wages and tips 6 Medicare tax withheld 5 Medicare wages and tips 6 Medicare tax withheld 5 Medicare wages and tips 6 Medicare tax withheld

4959.01 71.91 4959.01 71.91 4959.01 71.91

d Control number Dept. Corp. Employer use only d Control number Dept. Corp. Employer use only d Control number Dept. Corp. Employer use only

0000127144 V05 BG95 77482 0000127144 V05 BG95 77482 0000127144 V05 BG95 77482

c Employer’s name, address, and ZIP code c Employer’s name, address, and ZIP code c Employer’s name, address, and ZIP code

AMERICAN AIRLINES INC AMERICAN AIRLINES INC AMERICAN AIRLINES INC

4000 E SKY HARBOR BLVD 4000 E SKY HARBOR BLVD 4000 E SKY HARBOR BLVD

PHX-RWE-PAY PHX-RWE-PAY PHX-RWE-PAY

PHOENIX, AZ 85034 PHOENIX, AZ 85034 PHOENIX, AZ 85034

b Employer’s FED ID number a Employee’s SSA number b Employer’s FED ID number a Employee’s SSA number b Employer’s FED ID number a Employee’s SSA number

13-1502798 XXX-XX-6692 13-1502798 XXX-XX-6692 13-1502798 XXX-XX-6692

7 Social security tips 8 Allocated tips 7 Social security tips 8 Allocated tips 7 Social security tips 8 Allocated tips

9 10 Dependent care benefits 9 10 Dependent care benefits 9 10 Dependent care benefits

11 Nonqualified plans 12a See instructions for box 12 11 Nonqualified plans 12a

12 11 Nonqualified plans 12a

C 1.74 C 1.74 C 1.74

14 Other 12b D 239.84 14 Other 12b D 239.84 14 Other 12b D 239.84

12c L 287.43 12c L 287.43 12c L 287.43

12d DD 153.82 12d DD 153.82 12d DD 153.82

13 Stat emp. Ret. plan 3rd party sick pay 13 Stat emp. Ret. plan 3rd party sick pay 13 Stat emp. Ret. plan 3rd party sick pay

X X X

e/f Employee’s name, address and ZIP code e/f Employee’s name, address and ZIP code e/f Employee’s name, address and ZIP code

MICHAEL F JONES MICHAEL F JONES MICHAEL F JONES

110 WESTWOOD WAY 110 WESTWOOD WAY 110 WESTWOOD WAY

ERIE, CO 80516 ERIE, CO 80516 ERIE, CO 80516

15 State Employer’s state ID no. 16 State wages, tips, etc. 15 State Employer’s state ID no. 16 State wages, tips, etc. 15 State Employer’s state ID no. 16 State wages, tips, etc.

CO 08015888 4719.17 CO 08015888 4719.17 CO 08015888 4719.17

17 State income tax 18 Local wages, tips, etc. 17 State income tax 18 Local wages, tips, etc. 17 State income tax 18 Local wages, tips, etc.

187.00 1953.46 187.00 1953.46 187.00 1953.46

19 Local income tax 20 Locality name 19 Local income tax 20 Locality name 19 Local income tax 20 Locality name

11.50 DENVER 11.50 DENVER 11.50 DENVER

Federal Filing Copy CO. State Filing Copy City or Local Filing Copy

Wage and Tax Wage and Tax Wage and Tax

W-2 Statement OMB

2021

Copy B to be filed with employee’s Federal Income Tax Return.

No. 1545-0008

W-2 Statement OMB

2021

Copy 2 to be filed with employee’s State Income Tax Return.

No. 1545-0008

W-2 Statement OMB

2021 No. 1545-0008

Copy 2 to be filed with employee’s City or Local Income Tax Return.

You might also like

- Adp w2 2019 TemplateDocument1 pageAdp w2 2019 Templatetokahontas85No ratings yet

- Adp 2019 02 12 PDFDocument2 pagesAdp 2019 02 12 PDFAdam Olsen100% (2)

- Gucci Invoice TemplateDocument1 pageGucci Invoice Templatec2pjpgjj26No ratings yet

- Statement For 2021Document2 pagesStatement For 2021seguins0% (1)

- 9YWwhh55h5384810244629010109102 PDFDocument2 pages9YWwhh55h5384810244629010109102 PDFDave Yerznkyan100% (1)

- BalenciagaDocument1 pageBalenciagaLucas MullerNo ratings yet

- Sipin Sapkota 28 Kossuth PL Brooklyn Ny 11221Document2 pagesSipin Sapkota 28 Kossuth PL Brooklyn Ny 11221Suesa ThapaliyaNo ratings yet

- Hpscan 20230402093307572 2023-04-02 093355759Document1 pageHpscan 20230402093307572 2023-04-02 093355759isolaniyan2020No ratings yet

- W2 Matthew RussellDocument2 pagesW2 Matthew Russellmatthewrussell661No ratings yet

- Statement For 2022-1Document2 pagesStatement For 2022-1Hengki Yono100% (2)

- Psav Encore Global W-2Document5 pagesPsav Encore Global W-2Vincent NewsonNo ratings yet

- W2 FinalDocument1 pageW2 FinalWaqar Hussain100% (3)

- W-2 Form George PDFDocument1 pageW-2 Form George PDFGeorge Lucas100% (1)

- AutoPay Output Documents PDFDocument2 pagesAutoPay Output Documents PDFAnonymous QZuBG2IzsNo ratings yet

- Ayyappa Pasupuleti 6883 S IVY WAY APT 13 302 Engelwood, CO 80112Document3 pagesAyyappa Pasupuleti 6883 S IVY WAY APT 13 302 Engelwood, CO 80112swaroopg mphasisNo ratings yet

- MH0ihh081h6754910230616041100202 PDFDocument2 pagesMH0ihh081h6754910230616041100202 PDFLogan GoadNo ratings yet

- StubsDocument2 pagesStubsAnonymous 8C2bCutL0100% (2)

- Copy B-To Be Filed With Employee's FEDERAL Tax ReturnDocument5 pagesCopy B-To Be Filed With Employee's FEDERAL Tax ReturnKyle im taken by cailey hand Hand100% (1)

- Pro Forma Financial Statements 2014 2015 2016 Income StatementDocument4 pagesPro Forma Financial Statements 2014 2015 2016 Income Statementpriyanka khobragadeNo ratings yet

- Statement Jun 2019 PDFDocument2 pagesStatement Jun 2019 PDFal asmegaNo ratings yet

- Adp w2 2020 TemplateDocument1 pageAdp w2 2020 Templateoktawiuszstec10No ratings yet

- 7fa06e8a9c75b8817ed77fc716a6322fDocument2 pages7fa06e8a9c75b8817ed77fc716a6322f1978datsun3No ratings yet

- 2016 Adp w2 TemplateDocument1 page2016 Adp w2 Templateoktawiuszstec10No ratings yet

- Anil Gupta 2021 w2Document2 pagesAnil Gupta 2021 w2Kawljeet Singh KohliNo ratings yet

- 5 MTihh 4271 H 1914120242901191102202Document2 pages5 MTihh 4271 H 1914120242901191102202elena.69.mxNo ratings yet

- Procoleman, Tia: Tia Coleman 820 Fotis DR Unit 2 Dekalb, Il 60115Document2 pagesProcoleman, Tia: Tia Coleman 820 Fotis DR Unit 2 Dekalb, Il 60115Myt WovenNo ratings yet

- Timothy W Janssen 4812 LITTLE Fox Court Imperial MO 63052Document2 pagesTimothy W Janssen 4812 LITTLE Fox Court Imperial MO 63052TJ JanssenNo ratings yet

- J0 Pihh 184 H 254120213617160102202Document2 pagesJ0 Pihh 184 H 254120213617160102202swhb5b6pthNo ratings yet

- Ajax PDFDocument2 pagesAjax PDFGeorge AndoneNo ratings yet

- Jesus A Segovia 8803 Shoemaker LN HUDSON FL 34667-2726: Wage and Tax Employee Reference Copy StatementDocument2 pagesJesus A Segovia 8803 Shoemaker LN HUDSON FL 34667-2726: Wage and Tax Employee Reference Copy Statementcg727841No ratings yet

- Kenndal D Crawford 109 Inwood Court Spartanburg, SC 29302: Employer Use Only Corp. DeptDocument2 pagesKenndal D Crawford 109 Inwood Court Spartanburg, SC 29302: Employer Use Only Corp. Depttaylorizabella1No ratings yet

- Mona Patel 80 Marlowe CT Somerset, NJ 08873: Wage and Tax Employee Reference Copy StatementDocument3 pagesMona Patel 80 Marlowe CT Somerset, NJ 08873: Wage and Tax Employee Reference Copy StatementManubhai PatelNo ratings yet

- Z7 FWHH 44 H 4084220254315032103202Document2 pagesZ7 FWHH 44 H 4084220254315032103202spencerkoziol1997No ratings yet

- Adp w2 2018 TemplateDocument1 pageAdp w2 2018 Templatec2pjpgjj26No ratings yet

- WCEihh 05607 H 434910223005072219102Document2 pagesWCEihh 05607 H 434910223005072219102whitneydemetria007No ratings yet

- Employee Reference Copy Wage and Tax: Anyche T Artis 3030 South Grove Upper Marlbor Upper Marlboro, MD 20774Document2 pagesEmployee Reference Copy Wage and Tax: Anyche T Artis 3030 South Grove Upper Marlbor Upper Marlboro, MD 20774tayboxingNo ratings yet

- Tax ReturnDocument5 pagesTax Returnsmartmaxtv111No ratings yet

- Maria Baez 1408 Rustic Drive Apt 5 OCEAN NJ 07712Document2 pagesMaria Baez 1408 Rustic Drive Apt 5 OCEAN NJ 0771216baezmcNo ratings yet

- 779 Ihh 403 H 6754020242226102101202Document2 pages779 Ihh 403 H 6754020242226102101202elena.69.mxNo ratings yet

- Tino Altamirano 23Document1 pageTino Altamirano 23tinosaurio97No ratings yet

- Adp w2 2017 TemplateDocument1 pageAdp w2 2017 Templatec2pjpgjj26No ratings yet

- AjaxDocument2 pagesAjaxaccount.enquiry6770No ratings yet

- 9 JQihh 01201 H 064320290303092213202Document2 pages9 JQihh 01201 H 0643202903030922132022wz24b25d2No ratings yet

- W-2 Wage Reconciliation: This Form Details Your Final 2019 Payroll EarningsDocument2 pagesW-2 Wage Reconciliation: This Form Details Your Final 2019 Payroll EarningsChantale0% (1)

- Tax Return - Tyrone James w2Document3 pagesTax Return - Tyrone James w2psalmtruth960No ratings yet

- 20212Document2 pages20212carriemccabe0% (1)

- Sarah Paredes 21w2Document2 pagesSarah Paredes 21w2Sarah ParedesNo ratings yet

- Mail - GUSTAVO ANDRADE - OutlookDocument1 pageMail - GUSTAVO ANDRADE - Outlook4x8dcgqwx7No ratings yet

- Princess Sharmara Booker 7634 Fanning Drive Jacksonville FL 32244Document2 pagesPrincess Sharmara Booker 7634 Fanning Drive Jacksonville FL 32244gregorykerr388No ratings yet

- PDFDocument4 pagesPDFJesús Miguel Peña GenereNo ratings yet

- Wage and Tax Employee Reference Copy Statement: Gross Pay Other Cafe 125Document2 pagesWage and Tax Employee Reference Copy Statement: Gross Pay Other Cafe 125rachel sanchezNo ratings yet

- HEARST23PEDocument1 pageHEARST23PEperiksonNo ratings yet

- Concept Integration DocumentsDocument7 pagesConcept Integration Documentsritikpahelani257No ratings yet

- TWC LIS01 LIS - B AU20161205 P: Aqeel Haider 1 Maple Ave APT. #106 Patchogue, Ny 11772Document2 pagesTWC LIS01 LIS - B AU20161205 P: Aqeel Haider 1 Maple Ave APT. #106 Patchogue, Ny 11772sana shahidNo ratings yet

- 0940-14044252 0000009042 - NJ SEC: Copy C, For Employee's RecordsDocument2 pages0940-14044252 0000009042 - NJ SEC: Copy C, For Employee's RecordstaiNo ratings yet

- W2 ExportDocument1 pageW2 ExportenderjosNo ratings yet

- Documento PDF 8Document5 pagesDocumento PDF 8raimundotoledanoNo ratings yet

- James Melvin Anderson W2Document1 pageJames Melvin Anderson W2matheus.alcantara014No ratings yet

- Wage and Tax StatementDocument4 pagesWage and Tax StatementMark OasayNo ratings yet

- Howard W2Document2 pagesHoward W2dhhentNo ratings yet

- Wage and Tax Statement: Copy B - To Be Filed With Employee's FEDERAL Tax ReturnDocument7 pagesWage and Tax Statement: Copy B - To Be Filed With Employee's FEDERAL Tax ReturnLovely HeartNo ratings yet

- Using Economic Indicators to Improve Investment AnalysisFrom EverandUsing Economic Indicators to Improve Investment AnalysisRating: 3.5 out of 5 stars3.5/5 (1)

- Lego Shop Invoice TemplateDocument1 pageLego Shop Invoice Templatec2pjpgjj26No ratings yet

- Sense Receipt TemplateDocument1 pageSense Receipt Templatec2pjpgjj26No ratings yet

- Nikecom Shoes Receipt TemplateDocument1 pageNikecom Shoes Receipt Templatec2pjpgjj26No ratings yet

- Farfetch Invoice TemplateDocument1 pageFarfetch Invoice Templatec2pjpgjj26No ratings yet

- Curio by Hilton Hotel Invoice Guest Folio TemplateDocument1 pageCurio by Hilton Hotel Invoice Guest Folio Templatec2pjpgjj26No ratings yet

- Westin Hotel Guest Folio Receipt TemplateDocument1 pageWestin Hotel Guest Folio Receipt Templatec2pjpgjj26No ratings yet

- Ticketmaster Receipt TemplateDocument1 pageTicketmaster Receipt Templatec2pjpgjj26No ratings yet

- Home Depot Receipt TemplateDocument1 pageHome Depot Receipt Templatec2pjpgjj26No ratings yet

- Xfinity Internet Bill TemplateDocument1 pageXfinity Internet Bill Templatec2pjpgjj26No ratings yet

- Edison Bill TemplateDocument1 pageEdison Bill Templaterobertslatavia1No ratings yet

- Vistaprint Invoice TemplateDocument1 pageVistaprint Invoice Templatec2pjpgjj26No ratings yet

- Jewelry Appraisal Template EditableDocument1 pageJewelry Appraisal Template Editablec2pjpgjj26No ratings yet

- Parfüm 2Document2 pagesParfüm 2c2pjpgjj26No ratings yet

- Role of Room RatesDocument5 pagesRole of Room RatesJonathan JacquezNo ratings yet

- 5 ABN AMRO Ahmedabad Case StudyDocument3 pages5 ABN AMRO Ahmedabad Case StudyprathsNo ratings yet

- Manday Rate REV.03 .JUL.2017 ..TADocument7 pagesManday Rate REV.03 .JUL.2017 ..TAEngFaisal AlraiNo ratings yet

- International Trade and Investment: Because Learning Changes EverythingDocument42 pagesInternational Trade and Investment: Because Learning Changes EverythingzkNo ratings yet

- ENTREPRENEURSHIP SUBJECT MODULE Third WeekDocument11 pagesENTREPRENEURSHIP SUBJECT MODULE Third WeekJackNo ratings yet

- HBC Re ConditionsDocument1 pageHBC Re ConditionsJohn Christian ChangNo ratings yet

- Pricing With Market PowerDocument100 pagesPricing With Market PowerShiena NicolNo ratings yet

- SGPE Econometrics Lab 5: Returns To Scale in Electricity Supply Mark Schaffer Version of 21.10.2016Document13 pagesSGPE Econometrics Lab 5: Returns To Scale in Electricity Supply Mark Schaffer Version of 21.10.2016ZahirlianNo ratings yet

- Small Car IndiaDocument12 pagesSmall Car Indiaabid_29No ratings yet

- Administrative Order No. 248-ADocument3 pagesAdministrative Order No. 248-AmayabjajallaNo ratings yet

- Value Chain Mapping AnalysisDocument235 pagesValue Chain Mapping AnalysisBojan VojvodicNo ratings yet

- June 2007 Paper 4 Marking Scheme ECONOMICSDocument7 pagesJune 2007 Paper 4 Marking Scheme ECONOMICSÍxïфĦ EÍěctЯôŠtãЯNo ratings yet

- AptitudeDocument7 pagesAptitudeyippyme100% (1)

- Full Main Updated FORM NO 1-8Document7 pagesFull Main Updated FORM NO 1-8Solomon GnanarajNo ratings yet

- (Import Documentary Credit Application Form) : GeneralDocument3 pages(Import Documentary Credit Application Form) : GeneralFhia FussyNo ratings yet

- Geo HL Revision - Unit 4Document10 pagesGeo HL Revision - Unit 4idontliekmathsNo ratings yet

- DEC Mobile 2022Document1 pageDEC Mobile 2022Surya ChandraNo ratings yet

- Indusind Bank: Regulation OF Stock Markets ProjectDocument30 pagesIndusind Bank: Regulation OF Stock Markets ProjectDivesh ShettyNo ratings yet

- Brock Mirman JET 72Document35 pagesBrock Mirman JET 72JricardolemaNo ratings yet

- Marketing Research Proposal On Lady FingersDocument2 pagesMarketing Research Proposal On Lady FingersRuzzel Ellera0% (1)

- 2019 Ifrs GuideDocument5 pages2019 Ifrs GuideLouremie Delos Reyes MalabayabasNo ratings yet

- MAS 3104 Standard Costing and Variance Analysis MCQDocument6 pagesMAS 3104 Standard Costing and Variance Analysis MCQmonicafrancisgarcesNo ratings yet

- Asian Regionalism What Is Regionalism?Document4 pagesAsian Regionalism What Is Regionalism?Mary Grace GuarinNo ratings yet

- Inauguration: Five-Day Atal Workshop On 3D Printing and Design (16.09.2019 To 20.09.2019)Document3 pagesInauguration: Five-Day Atal Workshop On 3D Printing and Design (16.09.2019 To 20.09.2019)Pooja KrishnanNo ratings yet

- Alternative Centres of PowerDocument40 pagesAlternative Centres of PowerJigyasa Atreya0% (2)

- Irctcs E-Ticketing Service Electronic Cancellation Slip (Personal User)Document2 pagesIrctcs E-Ticketing Service Electronic Cancellation Slip (Personal User)srivastava pradeepNo ratings yet

- Julio Ramos - Resume Dec 2017Document2 pagesJulio Ramos - Resume Dec 2017api-387993621No ratings yet

- Budget Template For Recent GraduatesDocument3 pagesBudget Template For Recent GraduatesTasmim Kamal AnaNo ratings yet