0 ratings0% found this document useful (0 votes)

470 viewsTransnationality Index

Transnationality Index

Uploaded by

varunThe Transnationality Index (TNI) is used to rank multinational corporations based on three ratios: the ratio of foreign assets to total assets, the ratio of foreign sales to total sales, and the ratio of foreign employment to total employment. The TNI is calculated as the average of these three ratios. A TNI close to 100% indicates a highly transnational corporation. The top TNI companies according to recent data are Rio Tinto PLC, John Swire & Sons Limited, and Altice NV. The TNI was developed by the United Nations Conference on Trade and Development to measure corporations' foreign involvement.

Copyright:

© All Rights Reserved

Available Formats

Download as PPT, PDF, TXT or read online from Scribd

Transnationality Index

Transnationality Index

Uploaded by

varun0 ratings0% found this document useful (0 votes)

470 views9 pagesThe Transnationality Index (TNI) is used to rank multinational corporations based on three ratios: the ratio of foreign assets to total assets, the ratio of foreign sales to total sales, and the ratio of foreign employment to total employment. The TNI is calculated as the average of these three ratios. A TNI close to 100% indicates a highly transnational corporation. The top TNI companies according to recent data are Rio Tinto PLC, John Swire & Sons Limited, and Altice NV. The TNI was developed by the United Nations Conference on Trade and Development to measure corporations' foreign involvement.

Original Description:

ewee

Copyright

© © All Rights Reserved

Available Formats

PPT, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

The Transnationality Index (TNI) is used to rank multinational corporations based on three ratios: the ratio of foreign assets to total assets, the ratio of foreign sales to total sales, and the ratio of foreign employment to total employment. The TNI is calculated as the average of these three ratios. A TNI close to 100% indicates a highly transnational corporation. The top TNI companies according to recent data are Rio Tinto PLC, John Swire & Sons Limited, and Altice NV. The TNI was developed by the United Nations Conference on Trade and Development to measure corporations' foreign involvement.

Copyright:

© All Rights Reserved

Available Formats

Download as PPT, PDF, TXT or read online from Scribd

Download as ppt, pdf, or txt

0 ratings0% found this document useful (0 votes)

470 views9 pagesTransnationality Index

Transnationality Index

Uploaded by

varunThe Transnationality Index (TNI) is used to rank multinational corporations based on three ratios: the ratio of foreign assets to total assets, the ratio of foreign sales to total sales, and the ratio of foreign employment to total employment. The TNI is calculated as the average of these three ratios. A TNI close to 100% indicates a highly transnational corporation. The top TNI companies according to recent data are Rio Tinto PLC, John Swire & Sons Limited, and Altice NV. The TNI was developed by the United Nations Conference on Trade and Development to measure corporations' foreign involvement.

Copyright:

© All Rights Reserved

Available Formats

Download as PPT, PDF, TXT or read online from Scribd

Download as ppt, pdf, or txt

You are on page 1of 9

TRANSNATIONALITY INDEX

TRANSNATIONALITY INDEX (TNI)

The Transnationality Index (TNI) is a means of ranking multinational corporations

that is employed by economists and politicians.

• It is calculated as the arithmetic mean of the following three ratios (where "foreign"

means outside of the corporation's home country): the ratio of foreign assets to total

assets.

1. the ratio of foreign assets to total assets

2. the ratio of foreign sales to total sales

3. the ratio of foreign employment to total employment

• The Transnationality Index was developed by the United Nations Conference on

Trade and Development.

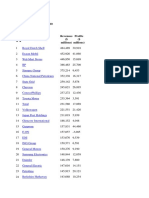

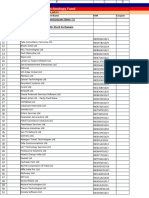

TOP 10 TNI COMPANY

Foreign Asset TNI TNI

Corporation Home Economy Industry

Rank (Per cent)

30 1 Mining, quarrying 99.3

Rio Tinto PLC United Kingdom and petroleum

66 2 John Swire & Sons Transport and 98.8

Limited e United Kingdom storage

36 3 97

Altice NV Netherlands Telecommunications

70 4 Electronic 96.4

Broadcom Limited Singapore components

71 5 Anglo American Mining, quarrying 96

plc United Kingdom and petroleum

78 6 Communications 94.4

Nokia OYJ Finland equipment

82 7 Computer and Data 92.5

SAP SE Germany Processing

24 8 Nestlé SA Switzerland Food & beverages 92.5

45 9 Shire plc Ireland Pharmaceuticals 91.9

60 10 91.6

Liberty Global plc United Kingdom Telecommunications

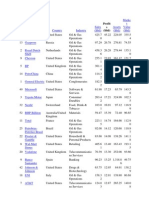

THE RATIO OF FOREIGN ASSETS TO TOTAL

ASSETS

Corporation Foreign Assets Total Assets Percentage

Rio Tinto PLC 89 177 89 263 99.9

John Swire & Sons 99.8

50 491 50 562

Limited e

Altice NV 81 640 84 761 96.3

Broadcom Limited 48 413 49 966 96.9

Anglo American plc 48 216 50 149 96.1

Nokia OYJ 44 674 47 329 94.3

SAP SE 42 635 46 671 91.3

Nestlé SA 106 319 129 467 82.1

Shire plc 66 615 67 035 99.3

Liberty Global plc 54 358 54 518 99.7

THE RATIO OF FOREIGN SALES TO TOTAL SALES

Corporation Foreign Sales Total Sales Percentage

Rio Tinto PLC 33 429 33 781 98.9

John Swire & Sons 96.6

10 241 10 599

Limited e

Altice NV 22 575 22 962 98.3

Broadcom Limited 12 990 13 240 98.1

Anglo American plc 20 139 21 378 94.2

Nokia OYJ 24 866 26 125 95.1

SAP SE 21 051 24 408 86.2

Nestlé SA 89 307 90 804 98.35

Shire plc 11 355 11 397 99.6

Liberty Global plc 17 285 17 285 100

THE RATIO OF FOREIGN EMPLOYMENT TO

TOTAL EMPLOYMENT

Foreign Total Employment Percentage

Corporation

Employment

Rio Tinto PLC 50 531 51 018 99

John Swire & Sons 99.8

121 330 121 500

Limited e

Altice NV 47 901 49 732 96.3

Broadcom Limited 14 800 15 700 94.2

Anglo American plc 78 000 80 000 97.5

Nokia OYJ 96 123 102 687 93.6

SAP SE 317 954 328 000 96.9

Nestlé SA 84 183 84 183 100

Shire plc 18 358 23 906 76.7

Liberty Global plc 30 750 41 000 75

DIFFERENCE BETWEEN MULTINATIONAL AND

TRANSNATIONAL

BIBLIOGRAPHY

https://en.wikipedia.org/wiki/Transnationality_Index

http://unctad.org/en/Docs/iteiia20072_en.pdf

http://topforeignstocks.com/2017/06/12/the-worlds-top-100-non-

financial-mnes-by-foreign-assets-2016/

unctad.org/Sections/dite_dir/docs/WIR2017/WIR17_tab24.xlsx

THANK YOU

You might also like

- GMS 200 Midterm Practice QuestionsDocument3 pagesGMS 200 Midterm Practice QuestionsqertyNo ratings yet

- The Worlds Top 100 Non Financial MNEs Ranked by Foreign Assets 2018Document8 pagesThe Worlds Top 100 Non Financial MNEs Ranked by Foreign Assets 2018Penguin_MaestroNo ratings yet

- Marketing - Marketing Strategies of Toyota FinalDocument66 pagesMarketing - Marketing Strategies of Toyota Finalvarun100% (1)

- Letter of Intent Business AcquisitionDocument3 pagesLetter of Intent Business Acquisitionee sNo ratings yet

- Peach State Federal Credit Union StatementsDocument6 pagesPeach State Federal Credit Union StatementsPeter MichaelsonNo ratings yet

- AcdDocument47 pagesAcdrandz8No ratings yet

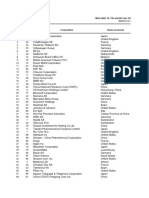

- Web Table 29. The World'S Top 100 Non-Financial TNCS, Ranked by Foreign Assets, 2010Document3 pagesWeb Table 29. The World'S Top 100 Non-Financial TNCS, Ranked by Foreign Assets, 2010Ramona Palaghianu0% (1)

- Investment Strategy For 2017Document170 pagesInvestment Strategy For 2017Nyamo SuendroNo ratings yet

- Top 200 Growing Companies in USADocument14 pagesTop 200 Growing Companies in USAKishor WaghmareNo ratings yet

- WIR16 - Tab24 2015 BunDocument1 pageWIR16 - Tab24 2015 BunpolitoNo ratings yet

- ECON254 Lecture11 MNEsDocument40 pagesECON254 Lecture11 MNEsKhalid JassimNo ratings yet

- The World'S Top 100 Non-Financial TNCS, Ranked by Foreign Assets, 2006 ADocument3 pagesThe World'S Top 100 Non-Financial TNCS, Ranked by Foreign Assets, 2006 AОльга ЧуфаровскаяNo ratings yet

- Annex Table 24. The World'S Top 100 Non-Financial Mnes, Ranked by Foreign Assets, 2016Document3 pagesAnnex Table 24. The World'S Top 100 Non-Financial Mnes, Ranked by Foreign Assets, 2016Ramona PalaghianuNo ratings yet

- Annex Table 26. The World'S Top 100 Non-Financial TNCS, Ranked by Foreign Assets, 2008Document3 pagesAnnex Table 26. The World'S Top 100 Non-Financial TNCS, Ranked by Foreign Assets, 2008Ramona PalaghianuNo ratings yet

- Table Iv. 1. The World'S 100 Non-Financial TNCS, Ranked by Foreign Assets, 2000Document3 pagesTable Iv. 1. The World'S 100 Non-Financial TNCS, Ranked by Foreign Assets, 2000Ramona PalaghianuNo ratings yet

- Annex Table A.I.11. The World'S Top 100 Non-Financial TNCS, Ranked by Foreign Assets, 2004Document3 pagesAnnex Table A.I.11. The World'S Top 100 Non-Financial TNCS, Ranked by Foreign Assets, 2004Ramona PalaghianuNo ratings yet

- Annex Table A.I.1. The World'S Top 100 Non-Financial TNCS, Ranked by Foreign Assets, 2001Document2 pagesAnnex Table A.I.1. The World'S Top 100 Non-Financial TNCS, Ranked by Foreign Assets, 2001Ramona PalaghianuNo ratings yet

- Annex Table A.I.3. The World'S Top 100 Non-Financial TNCS, Ranked by Foreign Assets, 2002Document3 pagesAnnex Table A.I.3. The World'S Top 100 Non-Financial TNCS, Ranked by Foreign Assets, 2002Ramona PalaghianuNo ratings yet

- Annex Table A.I.9. The World'S Top 100 Non-Financial TNCS, Ranked by Foreign Assets, 2003Document3 pagesAnnex Table A.I.9. The World'S Top 100 Non-Financial TNCS, Ranked by Foreign Assets, 2003Ramona PalaghianuNo ratings yet

- 2010 List: Fortune Global 500Document28 pages2010 List: Fortune Global 500Tushar SawhneyNo ratings yet

- Web Table 28. The World'S Top 100 Non-Financial TNCS, Ranked by Foreign Assets, 2013Document1 pageWeb Table 28. The World'S Top 100 Non-Financial TNCS, Ranked by Foreign Assets, 2013politoNo ratings yet

- CH01-Introduction To International UsinessDocument38 pagesCH01-Introduction To International Usinessjemalyn turinganNo ratings yet

- Web Table 28. The World'S Top 100 Non-Financial TNCS, Ranked by Foreign Assets, 2011Document3 pagesWeb Table 28. The World'S Top 100 Non-Financial TNCS, Ranked by Foreign Assets, 2011Ramona Palaghianu100% (1)

- Global 1200 2005Document12 pagesGlobal 1200 2005moogwaiNo ratings yet

- TOP500frtune PDFDocument19 pagesTOP500frtune PDFVikas RNo ratings yet

- Global 500:T.Prabhaharan, Mba-Rscm in Anna University CoimbatoreDocument4 pagesGlobal 500:T.Prabhaharan, Mba-Rscm in Anna University CoimbatorerwerrwfrNo ratings yet

- Profit S ($bil)Document5 pagesProfit S ($bil)AbhiShek YadavNo ratings yet

- Web Table 19. The World'S Top 100 Non-Financial Mnes, Ranked by Foreign Assets, 2017Document8 pagesWeb Table 19. The World'S Top 100 Non-Financial Mnes, Ranked by Foreign Assets, 2017Ramona PalaghianuNo ratings yet

- FT Global 500 December 2008 Market Values and Prices at 31 December 2008Document15 pagesFT Global 500 December 2008 Market Values and Prices at 31 December 2008Páginica CaralibroNo ratings yet

- The World'S Top 100 Tncs Ranked by Foreign Assets, 1995: (Billions of Dollars and Number of Employees)Document3 pagesThe World'S Top 100 Tncs Ranked by Foreign Assets, 1995: (Billions of Dollars and Number of Employees)Ramona PalaghianuNo ratings yet

- Chapter 2 - Operations Strategy in Global EnvironmentDocument41 pagesChapter 2 - Operations Strategy in Global Environmenttranduygiahan316No ratings yet

- Detail of Placement 2020Document7 pagesDetail of Placement 2020Nishant MishraNo ratings yet

- FT Global 500 December 2011Document13 pagesFT Global 500 December 2011Deepak DixitNo ratings yet

- Indice de Internationalizare in 2013Document8 pagesIndice de Internationalizare in 2013politoNo ratings yet

- Chap002 Inter environment+Trade+FDI+institutionDocument107 pagesChap002 Inter environment+Trade+FDI+institutionHải myNo ratings yet

- Eaton KortumDocument39 pagesEaton KortumBlanca MecinaNo ratings yet

- Managerial Accounting and The Business Environment: Garrison, Noreen, Brewer, Cheng & YuenDocument47 pagesManagerial Accounting and The Business Environment: Garrison, Noreen, Brewer, Cheng & YuenYasmine MagdiNo ratings yet

- New Ceo'sDocument8 pagesNew Ceo'sGill RaghuvarmaNo ratings yet

- Gobal 100 Full ResultsDocument45 pagesGobal 100 Full ResultsElinore AskNo ratings yet

- Sundaram Global Brand FundDocument8 pagesSundaram Global Brand FundArmstrong CapitalNo ratings yet

- Wir2023 Tab19Document8 pagesWir2023 Tab19anthoniaojima2022No ratings yet

- Slidex - Tips - 2014 2015 European Software Vendors Guide PDFDocument155 pagesSlidex - Tips - 2014 2015 European Software Vendors Guide PDFkaushikNo ratings yet

- 2024 Global 100 Full DatasetDocument30 pages2024 Global 100 Full DatasetSandeep ChatterjeeNo ratings yet

- FT500 ListDocument14 pagesFT500 Listgago_spam5196No ratings yet

- Icici Prudential Technology FundDocument10 pagesIcici Prudential Technology Fundsrushtirakhade10No ratings yet

- Rasco 1Document10 pagesRasco 1ado.arriazaNo ratings yet

- 0808 DigitalEnergy HoustonDocument18 pages0808 DigitalEnergy HoustonTedyNo ratings yet

- Bharti Airtel Limted & Indian TelecomDocument18 pagesBharti Airtel Limted & Indian TelecomAvinash KumarNo ratings yet

- 2020 Global 100 Results PDFDocument3 pages2020 Global 100 Results PDFKatherine ArangoNo ratings yet

- Forbes Top 100 CompaniesDocument6 pagesForbes Top 100 Companiessam_love471No ratings yet

- TOP 100 Multinational CompaniesDocument7 pagesTOP 100 Multinational CompaniesMy FakeNo ratings yet

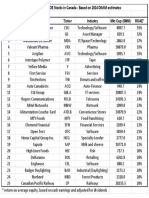

- 25 High ROE Stocks - CanadaDocument1 page25 High ROE Stocks - CanadaPattyPattersonNo ratings yet

- 128 34 2 en ArcelormittalReportsThirdQuarter2010ResultsDocument21 pages128 34 2 en ArcelormittalReportsThirdQuarter2010ResultsmithunsarangalNo ratings yet

- Company Name Ticker PBV ROE GrowthDocument4 pagesCompany Name Ticker PBV ROE Growthminhthuc203No ratings yet

- Top 100 Largest Software Companies in The USDocument4 pagesTop 100 Largest Software Companies in The USArun TalluriNo ratings yet

- Samsung Electronics Co., LTD.: Open House June 3, 2003Document11 pagesSamsung Electronics Co., LTD.: Open House June 3, 2003Shaikh Alcaraz OsamaNo ratings yet

- Hum Network LimitedDocument7 pagesHum Network LimitedAmmara Nawaz0% (1)

- Portfolio As On Jun 30,2022Document8 pagesPortfolio As On Jun 30,2022rocko Akash ThakurNo ratings yet

- Business Expectations: Are You Using Technology to its Fullest?From EverandBusiness Expectations: Are You Using Technology to its Fullest?No ratings yet

- Making Scorecards Actionable: Balancing Strategy and ControlFrom EverandMaking Scorecards Actionable: Balancing Strategy and ControlNo ratings yet

- Power BIDocument47 pagesPower BIvarunNo ratings yet

- Idea create store the way someone similar to what we just had presented scientific bio information or data products multiple different systems right now the limit is still a work in progress so all this is manually collected scientific it outDocument3 pagesIdea create store the way someone similar to what we just had presented scientific bio information or data products multiple different systems right now the limit is still a work in progress so all this is manually collected scientific it outvarunNo ratings yet

- We Are Hiring!: Intellectual Property (Ip) Valuation TraineeDocument1 pageWe Are Hiring!: Intellectual Property (Ip) Valuation TraineevarunNo ratings yet

- Spiti Short ExpeditionDocument13 pagesSpiti Short ExpeditionvarunNo ratings yet

- Ncert Physics Part - 2 11thDocument160 pagesNcert Physics Part - 2 11thvarunNo ratings yet

- Comparative Study of Public and Private Sector Banks in India: An Empirical AnalysisDocument7 pagesComparative Study of Public and Private Sector Banks in India: An Empirical AnalysisvarunNo ratings yet

- Operations Executive - Job DescriptionDocument1 pageOperations Executive - Job DescriptionvarunNo ratings yet

- 51624bos41275inter QDocument5 pages51624bos41275inter QvarunNo ratings yet

- NotesDocument13 pagesNotesvarunNo ratings yet

- Cross Cultural Management: Unit IIIDocument87 pagesCross Cultural Management: Unit IIIvarunNo ratings yet

- WAP To Check Whether The String Entered Is Palindrome or NotDocument11 pagesWAP To Check Whether The String Entered Is Palindrome or NotvarunNo ratings yet

- Role of A Parent: Managing A Muti Domestic FirmDocument9 pagesRole of A Parent: Managing A Muti Domestic FirmvarunNo ratings yet

- Customer Portfolio ManagementDocument38 pagesCustomer Portfolio ManagementvarunNo ratings yet

- Summer Internship Project Report OnDocument67 pagesSummer Internship Project Report OnvarunNo ratings yet

- SM 3 PDFDocument202 pagesSM 3 PDFvarunNo ratings yet

- Ethicsinsocialscienceandipr in Agriculture.: Vijaylaxmi - B Somanatti M.SC in Agril. Extension Uas, Dharwad - 05Document56 pagesEthicsinsocialscienceandipr in Agriculture.: Vijaylaxmi - B Somanatti M.SC in Agril. Extension Uas, Dharwad - 05varunNo ratings yet

- 10 Science Notes 03 Metals and Non Metals 1Document9 pages10 Science Notes 03 Metals and Non Metals 1varunNo ratings yet

- Case Study ICICIDocument51 pagesCase Study ICICIvarunNo ratings yet

- AKKUDocument2 pagesAKKUvarunNo ratings yet

- Study of Portfolio AnalysisDocument54 pagesStudy of Portfolio AnalysisvarunNo ratings yet

- Who Owns PakistanDocument183 pagesWho Owns PakistanSani Panhwar83% (6)

- OLA, UBER & MERU Service Marketing Case StudyDocument9 pagesOLA, UBER & MERU Service Marketing Case StudySujal PatelNo ratings yet

- Deloitte Cio 2 0 EngDocument32 pagesDeloitte Cio 2 0 EngLuis Armando Vázquez100% (1)

- Sample Cover LettersDocument8 pagesSample Cover Letterskop86328288No ratings yet

- BalcoDocument4 pagesBalcoJeevananth ThangavelNo ratings yet

- Defining Procurement and Supply Chain ManagementDocument12 pagesDefining Procurement and Supply Chain ManagementAsif Abdullah Chowdhury100% (3)

- Enlistment 2022Document69 pagesEnlistment 2022vipul anandNo ratings yet

- SN751178NDocument16 pagesSN751178Nuser1ilaNo ratings yet

- Customer Satisfaction Coca ColaDocument46 pagesCustomer Satisfaction Coca Colavishnu0751No ratings yet

- The 8 Wastes of Lean Management Aid Memoir A4Document1 pageThe 8 Wastes of Lean Management Aid Memoir A4Hajar RajabNo ratings yet

- Assignment No 1 (Sequence Problem)Document6 pagesAssignment No 1 (Sequence Problem)yadu nairNo ratings yet

- Coca-Cola Taleo RecruitmentDocument16 pagesCoca-Cola Taleo RecruitmentNitinMaheshwariNo ratings yet

- Yamappa Legal Notice For Specific PerformanceDocument4 pagesYamappa Legal Notice For Specific PerformanceShivanand BorkarNo ratings yet

- CS6005 Advanced Database System UNIT IIDocument95 pagesCS6005 Advanced Database System UNIT IIvenkatarangan rajuluNo ratings yet

- RFUMSV50Document4 pagesRFUMSV50Pepitovochoo PiscinasNo ratings yet

- Chartering & Chartering PracticeDocument8 pagesChartering & Chartering PracticegggggNo ratings yet

- ISTA Procedure 1A 01-07Document8 pagesISTA Procedure 1A 01-07Ulysses CarrascoNo ratings yet

- NewTenderCondition11 01 22Document61 pagesNewTenderCondition11 01 22Abhishek kumarNo ratings yet

- Company Profile Poslog (Short)Document18 pagesCompany Profile Poslog (Short)pwjemiNo ratings yet

- Examinations: Subject 102 - Financial MathematicsDocument11 pagesExaminations: Subject 102 - Financial MathematicsClerry SamuelNo ratings yet

- API v. SEC (Section 1504 Complaint)Document39 pagesAPI v. SEC (Section 1504 Complaint)Mike KoehlerNo ratings yet

- Employee Value PropositionDocument5 pagesEmployee Value Propositionsandeep k krishnan100% (1)

- Ca 24Document20 pagesCa 24sleepybrownzzzNo ratings yet

- Use of Lifting and Handling AidsDocument12 pagesUse of Lifting and Handling AidsHealthSafety100% (4)

- Quali Review Interim Reporting Complete SolutionDocument7 pagesQuali Review Interim Reporting Complete SolutionPaul Ivan CabanatanNo ratings yet

- Ian Rogers - CV PDFDocument2 pagesIan Rogers - CV PDFian vvNo ratings yet