0 ratings0% found this document useful (0 votes)

186 viewsSecondary Market

Secondary Market

Uploaded by

Harsh ThakurThe secondary market refers to the subsequent trading of securities after their initial sale. It allows investors to buy and sell securities and provides liquidity. In India, the major stock exchanges are the Bombay Stock Exchange (BSE), established in 1875, and the National Stock Exchange (NSE), established in 1992. The NSE aims to establish a nationwide trading facility for securities and facilitate fair and transparent transactions. It uses a computerized, order-driven system connected via satellite across India. The BSE was the first stock exchange but later modernized its open-outcry system and expanded its reach through subsidiaries of regional exchanges.

Copyright:

© All Rights Reserved

Available Formats

Download as PPT, PDF, TXT or read online from Scribd

Secondary Market

Secondary Market

Uploaded by

Harsh Thakur0 ratings0% found this document useful (0 votes)

186 views22 pagesThe secondary market refers to the subsequent trading of securities after their initial sale. It allows investors to buy and sell securities and provides liquidity. In India, the major stock exchanges are the Bombay Stock Exchange (BSE), established in 1875, and the National Stock Exchange (NSE), established in 1992. The NSE aims to establish a nationwide trading facility for securities and facilitate fair and transparent transactions. It uses a computerized, order-driven system connected via satellite across India. The BSE was the first stock exchange but later modernized its open-outcry system and expanded its reach through subsidiaries of regional exchanges.

Original Title

Secondary Market (1)

Copyright

© © All Rights Reserved

Available Formats

PPT, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

The secondary market refers to the subsequent trading of securities after their initial sale. It allows investors to buy and sell securities and provides liquidity. In India, the major stock exchanges are the Bombay Stock Exchange (BSE), established in 1875, and the National Stock Exchange (NSE), established in 1992. The NSE aims to establish a nationwide trading facility for securities and facilitate fair and transparent transactions. It uses a computerized, order-driven system connected via satellite across India. The BSE was the first stock exchange but later modernized its open-outcry system and expanded its reach through subsidiaries of regional exchanges.

Copyright:

© All Rights Reserved

Available Formats

Download as PPT, PDF, TXT or read online from Scribd

Download as ppt, pdf, or txt

0 ratings0% found this document useful (0 votes)

186 views22 pagesSecondary Market

Secondary Market

Uploaded by

Harsh ThakurThe secondary market refers to the subsequent trading of securities after their initial sale. It allows investors to buy and sell securities and provides liquidity. In India, the major stock exchanges are the Bombay Stock Exchange (BSE), established in 1875, and the National Stock Exchange (NSE), established in 1992. The NSE aims to establish a nationwide trading facility for securities and facilitate fair and transparent transactions. It uses a computerized, order-driven system connected via satellite across India. The BSE was the first stock exchange but later modernized its open-outcry system and expanded its reach through subsidiaries of regional exchanges.

Copyright:

© All Rights Reserved

Available Formats

Download as PPT, PDF, TXT or read online from Scribd

Download as ppt, pdf, or txt

You are on page 1of 22

Secondary Market

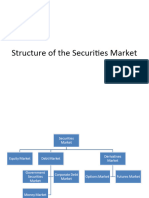

• Secondary Market refers to the network /

system for the subsequent sale and

purchase of securities.

• A security emerges or takes birth in the

primary market but its subsequent

movements take place in the secondary

market.

• The secondary market is represented by

the stock exchanges in any capital market.

History

• In India, the only stock exchanges operated in the 19th

century were those of Mumbai in 1875 and Ahmedabad

in 1894.

• Both stock exchanges were organized as voluntarily

nonprofit making associations of brokers. The main

intention and objectives is to regulate and protect their

interests.

• Bombay Securities Control Act, 1925, which was

recognized the Bombay Stock Exchange in 1937 and

Ahmedabad in 1937.

• It may be noted that out of 23 stock exchanges, only 2,

i.e., the NSE and the OTCEI, have been established by

the All India Financial Institutions while other stock

exchanges are operating as associations or limited

companies.

Functions of Stock Exchanges

• Liquidity & Marketability of Securities

• Safety of Funds

• Supply of long term funds

• Flow of Capital to profitable Ventures

• Motivation for improved performance

• Promotion of investment

• Reflection of business cycle

• Marketing of new issues

• Miscellaneous services

Liquidity & Marketability of Securities

• Stock exchanges provide buying and selling of

securities. Stock exchange provide liquidity to

securities since securities can be converted into

cash at any time according to the discretion of

investor by selling them at the listed price. This

facility is providing continuous marketability to

the investors in respect of securities they hold or

intend to hold.

Safety of Funds

• Over trading, illegitimate speculation etc.,

are prevented through carefully designed

set of rules, regulations and the byelaws

are meant to ensure safety of investible

funds. Therefore, stock exchange is

protected investors fund.

Supply of Long term Funds

• In security market, securities are

transferable from one person to another

with minimum formalities. When security is

sold, one investor is substituted by

another. However, the company is

assured availability of long term funds.

Flow of Capital to Profitable

Venture

• The profitability and popularity of companies are

reflected in terms of hike in stocks.

• According to Husband and Dockeray “ Stock

exchanges function like a traffic signal,

indicating a green light when certain fields offer

the necessary inducement to attract capital

blazing a red light when the outlook for new

investments is not attractive”.

Motivation for Improved

Performance

• The performance of a company is

reflected in terms of prices quoted in the

stock market. Stock exchange always

encourages to improve performance of

companies. Because public can expect to

invest in growth companies.

Promotion of investment

• Stock exchanges mobilizes the savings

from the public into effective production

purpose. In this way, stock exchange can

promote investment through capital

formation.

Reflection of Business Cycle

• The changing economic and business

conditions are immediately reflected on

the stock exchanges. Stock exchange

identifies the booms & depressions of the

economy. The government can take

suitable monetary and fiscal policies which

can help to investors.

Marketing of New Issues

• If the new issues are listed in stock

exchange. Stock exchanges ready to

accept and their evaluation by concerned

stock exchange authorities. Stock market

always helps in marketing of new issues.

Miscellaneous Services

• Common Platform

• Safe in price determination

• Tight regulations.

Regulatory Developments During

2009-10

1. The SEBI (Delisting of Equity Shares) Regulations

2009 notified on June 10, 2009 provide a mechanism

for voluntarily as well as compulsory delisting of equity

shares of a company and listing of delisted equity

shares.

2. The SEBI (Issue of Capital & Disclosure

Requirements) Regulations 2009 provide for, inter alia,

offer for sale by listed companies and stipulate that the

allotment / refund period in public issues should be 15

days and the issue period for all types of issuers 10

days. Under this regulations, exemption from eligibility

norms for making an IPO earlier available, to a banking

company, corresponding new bank and infrastructure

companies, and firm allotment in public issues has

been removed.

3. In order to facilitate the issuance of IDRs, SEBI

has laid down a regulatory structure by carrying

out suitable amendments to the SEBI (Custodian

of Securities) Regulations 1996 (to enable the

custodian to undertake the activity of domestic

depository for IDRs), SEBI (Depository

Participants) Regulations 1996 (to make IDRs

eligible as security for dematerialization), SEBI

(Foreign Institutional Investors Regulations 1995

(to allow FIIs also to invest in IDRs).

4. The fees payable by some of the intermediaries

and market participants, namely custodian of

securities, FIIs, Mutual Funds and Stock Brokers

and Sub brokers, have been modified.

5.The SEBI (Mutual Funds) Regulation 1996 have

been amended in April and June 2009 to make

listing of close-ended schemes mandatory and

to provide that the units under close-ended

schemes shall not be re-purchased before

maturity. Close-ended debt schemes have been

allowed to invest in securities of initial or residual

maturities not exceeding their own maturity.

Furthermore, a mutual fund scheme can invest

only up to 30% of its net assets in money market

instruments of an issuer. However, this limit is

not applicable to investments in government

Securities, T-Bills and collateralized borrowing

and lending obligation.

National Stock Exchange

• Inaugurated in 1994, the national Stock

Exchange seeks to:

1. Establish a nation-wide trading facility for

equities, debt and hybrids;

2. Facilitates equal access to investors across

the country;

3. Impart fairness, efficiency, and transparency to

transactions in securities;

4. Shorten settlement cycle;

5. Meet international securities market standards.

The Distinctive features of NSE, as its

functions currently, are as follows:

The NSE is a ringless, national, computerized exchange.

The NSE has 4 segments: The Capital Market, the

Wholesale Debt Market segment, Futures & Options

Segment and the Currency Derivatives Segment. The

Capital Market segment covers equities, convertible

debentures, and retail trade in non-convertible

debentures. The wholesale debt market segment is a

market for high values transactions in Government

Securities, PSU bonds, Commercial Papers and other

Debt instruments.

The NSE has opted for an order driven system. When an

order is placed by a trading member, the computer

automatically generates a unique order number and the

member can take a print of order confirmation slip

containing the number.

The trading members in Capital Market

segment are connected to the central computer

in Mumbai through a satellite link-up, using

VSATs (Very Small Aperture Terminals).

Incidentally, NSE is the 1st exchange in the world

to employ the satellite technology. This enabled

the NSE to achieve a nation-wide reach. The

trading member in Wholesale Debt Market

segment are linked through dedicated high

speed lines to the central computer in Mumbai.

When a trade takes place, a trade confirmation

slip is printed at the trading member’s work

station. It gives details like quantity, price, code

number of counterparty, and so on.

• The identity of trading members is not revealed

to others when he / she places an order or when

his pending orders are displayed. Hence, large

orders can be placed on NSE.

• Members are required to deliver securities and

cash by a certain day. The payout day is the

following day.

• All trades on NSE are guaranteed by the

National Clearing Corporation (NSCC). This

means that when ‘A’ buys from ‘B’, NSCC

becomes the counterparty to both legs of the

transaction. In effect, NSCC becomes the seller

to ‘A’ and buyer from ‘B’. This eliminates

counterparty risk.

Bombay Stock Exchange

• Established in 1875, the Bombay Stock Exchange

(BSE) is one of the oldest organized exchanges in the

world with a long, colorful, history. Its distinctive

features are as follows:

1. The BSE switched from the open outcry system to the

screen-based system in 1995 which is called BOLT

(BSE On Line Trading). It accelerated its

computerization programme in response to the threat

from the NSE.

2. In October 1996, SEBI permitted BSE to extend its

BOLT network outside Mumbai. In 2002, subsidiary

companies of 13 regional exchanges became members

of BSE and through them members of regional

exchanges now serve as sub-brokers of BSE. This has

expanded the reach of BSE considerably.

3. To begin with, BOLT was a ‘quote-driven’ as

well as ‘order-driven’ system, with jobbers

(specialists) feeding two-way quotes and

brokers feeding buy or sell orders. This hybrid

system reflected the historical practice of BSE

where jobbers played an important role. A

Jobber is a broker who trades on his own

account and hence offers a two-way quote or a

bid-ask quote. The bid price reflects the price at

which the jobber is willing to buy and the ask

price represents the price at which the jobber is

willing to sell. From August 13, 2001, however,

BSE, like NSE, became a completely order-

driven market.

You might also like

- Trading StrategyDocument2 pagesTrading StrategyAzizalindaNo ratings yet

- Rural Marketing - Unit 3 (Targeting, Segmenting and Positioning)Document33 pagesRural Marketing - Unit 3 (Targeting, Segmenting and Positioning)Vamshi NCNo ratings yet

- 16 Operating Costing 1 (ASIDJKHDutosaved)Document20 pages16 Operating Costing 1 (ASIDJKHDutosaved)Deepak R GoradNo ratings yet

- On Banking Sector For PresentationDocument23 pagesOn Banking Sector For Presentationvaishali haritNo ratings yet

- Session 12 CVP AnalysisDocument52 pagesSession 12 CVP Analysismuskan mittalNo ratings yet

- The Primary Market in IndiaDocument34 pagesThe Primary Market in IndiaPINAL100% (1)

- Chapter 1 Banking and OperationsDocument15 pagesChapter 1 Banking and OperationsManavAgarwal0% (1)

- Capital and Revenue TransactionsDocument23 pagesCapital and Revenue TransactionsRajib Deb100% (1)

- Merchant BankingDocument10 pagesMerchant BankingSejal ChavanNo ratings yet

- CH 2 Indian Financial SystemDocument46 pagesCH 2 Indian Financial SystemAkshay AhirNo ratings yet

- Indian Money Market and Capital MarketDocument17 pagesIndian Money Market and Capital MarketMerakizz100% (1)

- 7 TariffDocument22 pages7 TariffParvathy SureshNo ratings yet

- Business EnvironmentDocument1 pageBusiness Environmentnani66215487No ratings yet

- Overview of Financial SystemDocument50 pagesOverview of Financial SystemshahyashrNo ratings yet

- FEIA 2&5m Question With AnswerDocument5 pagesFEIA 2&5m Question With Answerprashanthuddar6No ratings yet

- TariffDocument21 pagesTariffNiranjan Taware100% (1)

- Commercial Banks in IndiaDocument29 pagesCommercial Banks in IndiaVarsha SinghNo ratings yet

- Mgnrega PPT CRM OrientationDocument77 pagesMgnrega PPT CRM Orientationmkshri_in0% (1)

- Monte Carlo My Presentation PDFDocument11 pagesMonte Carlo My Presentation PDFRASHMINo ratings yet

- Departmental Accounts: by Dr. Pranabananda Rath Consultant & Visiting FacultyDocument16 pagesDepartmental Accounts: by Dr. Pranabananda Rath Consultant & Visiting FacultyAnamika VatsaNo ratings yet

- 1 5Document14 pages1 5kunjaNo ratings yet

- Managerial Economics - A Decision Science andDocument5 pagesManagerial Economics - A Decision Science andSam NietNo ratings yet

- Stock Market I. What Are Stocks?Document9 pagesStock Market I. What Are Stocks?JehannahBaratNo ratings yet

- Mba Anna University PPT Material For MBFS 2012Document39 pagesMba Anna University PPT Material For MBFS 2012mail2nsathish67% (3)

- BCom I-Unit III - Notes On Working Capital ManagementDocument9 pagesBCom I-Unit III - Notes On Working Capital ManagementRohit Patel100% (3)

- Electricity TariffDocument34 pagesElectricity Tariffdks12No ratings yet

- Small Scale IndustryDocument14 pagesSmall Scale IndustryNandiniBharatNo ratings yet

- RBI Classification of MoneyDocument10 pagesRBI Classification of Moneyprof_akvchary60% (5)

- Balance of Payment: Meaning and ComponentsDocument6 pagesBalance of Payment: Meaning and ComponentsForum DaghaNo ratings yet

- A Study About Investment & Transition in Indian Derivative Markets.Document79 pagesA Study About Investment & Transition in Indian Derivative Markets.SurajKashidNo ratings yet

- NCDCDocument14 pagesNCDCsudadhich100% (1)

- Efficient Market TheoryDocument3 pagesEfficient Market TheoryVinay KushwahaaNo ratings yet

- Stock Market IndicesDocument15 pagesStock Market Indicesarco1234No ratings yet

- Calculation Methof of KSE-100 IndexDocument23 pagesCalculation Methof of KSE-100 Indexamina_rabia100% (2)

- Indian Financial SystemDocument16 pagesIndian Financial SystemParth UpadhyayNo ratings yet

- Chapter 1 PDFDocument20 pagesChapter 1 PDFANILNo ratings yet

- Monetary PolicyDocument32 pagesMonetary PolicyAbhi JainNo ratings yet

- Types of Market StructuresDocument25 pagesTypes of Market StructuresAngelo Mark Pacis100% (1)

- Neft and RtgsDocument15 pagesNeft and Rtgssandhya22No ratings yet

- Bagedari SectorDocument32 pagesBagedari SectorswathiNo ratings yet

- Assessment of Various EntitiesDocument31 pagesAssessment of Various Entitiesinsathi0% (1)

- A Comparative Study On BSE and NSEDocument30 pagesA Comparative Study On BSE and NSEShailja ManyaNo ratings yet

- Indian Accounting Standard 5Document12 pagesIndian Accounting Standard 5Rattan Preet SinghNo ratings yet

- Cost Function NotesDocument7 pagesCost Function Noteschandanpalai91100% (1)

- Production FunctionDocument6 pagesProduction Functionshrey100% (1)

- Airtel - 4psDocument42 pagesAirtel - 4psPraveen SangwanNo ratings yet

- Participants in OTCEI MarketDocument7 pagesParticipants in OTCEI MarketAshu158No ratings yet

- IIMMDocument24 pagesIIMMarun1974No ratings yet

- RtgsDocument13 pagesRtgsBari Rajnish100% (2)

- Share CapitalDocument76 pagesShare CapitalCollege CollegeNo ratings yet

- 1 Joint Stock Company PPT by ManasDocument10 pages1 Joint Stock Company PPT by ManaspadhnedebcNo ratings yet

- Money Market's InstrumentsDocument20 pagesMoney Market's InstrumentsManmohan Prasad RauniyarNo ratings yet

- IMT 79 Economic Environment of India M2 PDFDocument27 pagesIMT 79 Economic Environment of India M2 PDFDivyangi WaliaNo ratings yet

- Recent Dev in Stock MKT 1Document19 pagesRecent Dev in Stock MKT 1Manikandan N-17No ratings yet

- Origin of Share Markets in IndiaDocument18 pagesOrigin of Share Markets in IndiasrinivasjettyNo ratings yet

- FMO Module 3Document11 pagesFMO Module 3Sonia Dann KuruvillaNo ratings yet

- Capital Market Reforms and FfoDocument10 pagesCapital Market Reforms and FfoVishruti Shah JobanputraNo ratings yet

- Project Report On Stock Market "Working of Stock Exchange & Depositary Services"Document11 pagesProject Report On Stock Market "Working of Stock Exchange & Depositary Services"Kruti NemaNo ratings yet

- Stock Exchanges - A ProfileDocument24 pagesStock Exchanges - A Profilerohitluthra88No ratings yet

- Secondary Markets in IndiaDocument49 pagesSecondary Markets in Indiayashi225100% (1)

- Article Writing - Capital Market - Jyoti Mittal - FBD ChapterDocument5 pagesArticle Writing - Capital Market - Jyoti Mittal - FBD ChapterEsayas ArayaNo ratings yet

- Bba IV Bis Unit 4 NotesDocument12 pagesBba IV Bis Unit 4 NotesHarsh ThakurNo ratings yet

- 850Document21 pages850Harsh ThakurNo ratings yet

- Players in The MarketDocument17 pagesPlayers in The MarketHarsh ThakurNo ratings yet

- Chapter 4Document34 pagesChapter 4Harsh ThakurNo ratings yet

- Money Market Its InstrumentsDocument13 pagesMoney Market Its InstrumentsHarsh ThakurNo ratings yet

- Chapter 1Document16 pagesChapter 1Harsh ThakurNo ratings yet

- School of Managment Sciences, Varanasi (An Autonomous College)Document2 pagesSchool of Managment Sciences, Varanasi (An Autonomous College)Harsh ThakurNo ratings yet

- Fso Unit-3Document7 pagesFso Unit-3Harsh ThakurNo ratings yet

- Chapter 3Document32 pagesChapter 3Harsh ThakurNo ratings yet

- Capital Primary MarketDocument45 pagesCapital Primary MarketHarsh ThakurNo ratings yet

- Mutual Funds 1Document42 pagesMutual Funds 1Harsh ThakurNo ratings yet

- Bba IV Bis Unit 3 NotesDocument18 pagesBba IV Bis Unit 3 NotesHarsh ThakurNo ratings yet

- Significance of Diagrams and GraphsDocument2 pagesSignificance of Diagrams and GraphsHarsh ThakurNo ratings yet

- Bagi Saving AccountsDocument5 pagesBagi Saving Accountstengku nesaNo ratings yet

- 2021 Retake Exam in Corporate FInanceDocument4 pages2021 Retake Exam in Corporate FInanceNikolai PriessNo ratings yet

- Paper1 With Cover Page v2Document18 pagesPaper1 With Cover Page v2Palash WanwaniNo ratings yet

- NISM Series v-A-Mutual Fund Distributors Workbook - 2020Document341 pagesNISM Series v-A-Mutual Fund Distributors Workbook - 2020prachiNo ratings yet

- Dokumen - Pub Options Trading in Bear Mkts 0070152721 9780070152724Document303 pagesDokumen - Pub Options Trading in Bear Mkts 0070152721 9780070152724saktirajNo ratings yet

- Roth IRA Investing Starter KitDocument17 pagesRoth IRA Investing Starter KitHuliaNo ratings yet

- BS ProjectDocument15 pagesBS Projectgoplo singhNo ratings yet

- Rudra TrishatiDocument3 pagesRudra TrishatiAnkurNagpal108No ratings yet

- Comparative Analysis On Selected Public Sector and Private Sector Mutual Funds in India With Special Reference To Growth FundsDocument9 pagesComparative Analysis On Selected Public Sector and Private Sector Mutual Funds in India With Special Reference To Growth Fundsparmeen singhNo ratings yet

- 2024 l1 Topics CombinedDocument27 pages2024 l1 Topics CombinedShaitan Ladka0% (1)

- The Most Effective Stock Trading Strategy in Indonesia Equity MarketDocument8 pagesThe Most Effective Stock Trading Strategy in Indonesia Equity Marketjon doeNo ratings yet

- Fs SP 500 CadDocument7 pagesFs SP 500 Cadalt.sa-33bwuogNo ratings yet

- A Study On Customer's Preference While Investing in Systematic Investment PlanDocument11 pagesA Study On Customer's Preference While Investing in Systematic Investment PlanK C ChandanNo ratings yet

- Overview of The Financial System: QuestionsDocument15 pagesOverview of The Financial System: QuestionsAmbra KoraNo ratings yet

- Bản Sao Của 22040291 - Lê Bảo Linh Đan - English for Finance and Banking Case Study 3Document12 pagesBản Sao Của 22040291 - Lê Bảo Linh Đan - English for Finance and Banking Case Study 3qainparis77No ratings yet

- IAPM AssignmentDocument5 pagesIAPM AssignmentSushant ThombreNo ratings yet

- Factsheet NiftyMidSmallFinancialSevicesDocument2 pagesFactsheet NiftyMidSmallFinancialSevicesKrishna GoyalNo ratings yet

- Passive Equity InvestingDocument2 pagesPassive Equity InvestingkypvikasNo ratings yet

- Kantor Blog Reddit PhenomenonDocument2 pagesKantor Blog Reddit PhenomenonCaptain GurkoNo ratings yet

- IACFMAS-ASSIGN MarjDocument4 pagesIACFMAS-ASSIGN MarjMarjorie PagsinuhinNo ratings yet

- Finmar - Chapter 12 - 14Document24 pagesFinmar - Chapter 12 - 14AlexanNo ratings yet

- AQR Alternative Thinking 3Q17Document20 pagesAQR Alternative Thinking 3Q17magNo ratings yet

- MBA 223 Financial Markets InstitutionsDocument15 pagesMBA 223 Financial Markets InstitutionsDragon BankNo ratings yet

- Role of Financial Markets and InstitutionsDocument35 pagesRole of Financial Markets and InstitutionsThảo Linh TrầnNo ratings yet

- 1.3. EP13.NHLT1107 - Monetary and Financial Theories 2023 RevisedDocument24 pages1.3. EP13.NHLT1107 - Monetary and Financial Theories 2023 RevisedNgọc LươngNo ratings yet

- Discussion Problems InvestmentsDocument2 pagesDiscussion Problems InvestmentsSamantha Nicole ValdezNo ratings yet

- Second Updated Research ProposalDocument45 pagesSecond Updated Research ProposalNebiyu KebedeNo ratings yet

- HSC SP Q.6. Justify PDFDocument4 pagesHSC SP Q.6. Justify PDFTanya SinghNo ratings yet

- Question Bank Nism Equity DerivativeDocument13 pagesQuestion Bank Nism Equity Derivativedev12_lokeshNo ratings yet