Denbury 3rd Quarter 2016 Earnings Presentation

- 1. NYSE:DNR NYSE:DNR 3rd Quarter 2016 Earnings Presentation November 3, 2016

- 2. NYSE:DNR 2 Agenda » Introduction • John Mayer, Investor Relations » Overall review and outlook • Phil Rykhoek, Chief Executive Officer » Financial review • Mark Allen, Chief Financial Officer » Operational review • Chris Kendall, President and Chief Operating Officer

- 3. NYSE:DNR 3 Cautionary Statements Forward Looking Statements: The data and/or statements contained in this presentation that are not historical facts are forward-looking statements that involve a number of risks and uncertainties. Such forward-looking statements may be or may concern, among other things, financial forecasts, future hydrocarbon prices and timing and degree of any price recovery versus the length or severity of the current commodity price downturn, current or future liquidity sources or their adequacy to support our anticipated future activities, our ability to reduce our debt levels, possible future write-downs of oil and natural gas reserves, together with assumptions based on current and projected oil and gas prices and oilfield costs, current or future expectations or estimations of our cash flows, availability of capital, borrowing capacity, future interest rates, availability of advantageous commodity derivative contracts or the predicted cash flow benefits therefrom, forecasted capital expenditures, drilling activity or methods, including the timing and location thereof, estimated timing of commencement of CO2 flooding of particular fields or areas, or the timing of pipeline or plant construction or completion or the cost thereof, dates of completion of to-be-constructed industrial plants and the initial date of capture of CO2 from such plants, timing of CO2 injections and initial production responses in tertiary flooding projects, acquisition plans and proposals and dispositions, development activities, finding costs, anticipated future cost savings, capital budgets, interpretation or prediction of formation details, production rates and volumes or forecasts thereof, hydrocarbon reserve quantities and values, CO2 reserves and supply and their availability, helium reserves, potential reserves, barrels or percentages of recoverable original oil in place, the impact of regulatory rulings or changes, anticipated outcomes of pending litigation, prospective legislation affecting the oil and gas industry, mark-to-market values, competition, long-term forecasts of production, rates of return, estimated costs, estimates of the range of potential insurance recoveries, changes in costs, future capital expenditures and overall economics, worldwide economic conditions and other variables surrounding our operations and future plans. Such forward-looking statements generally are accompanied by words such as “plan,” “estimate,” “expect,” “predict,” “forecast,” “to our knowledge,” “anticipate,” “projected,” “preliminary,” “should,” “assume,” “believe,” “may” or other words that convey, or are intended to convey, the uncertainty of future events or outcomes. Such forward-looking information is based upon management’s current plans, expectations, estimates, and assumptions and is subject to a number of risks and uncertainties that could significantly and adversely affect current plans, anticipated actions, the timing of such actions and our financial condition and results of operations. As a consequence, actual results may differ materially from expectations, estimates or assumptions expressed in or implied by any forward-looking statements made by us or on our behalf. Among the factors that could cause actual results to differ materially are fluctuations in worldwide oil prices or in U.S. oil prices and consequently in the prices received or demand for our oil and natural gas; decisions as to production levels and/or pricing by OPEC in future periods; levels of future capital expenditures; effects of our indebtedness; success of our risk management techniques; inaccurate cost estimates; availability of and fluctuations in the prices of goods and services; the uncertainty of drilling results and reserve estimates; operating hazards and remediation costs; disruption of operations and damages from well incidents, hurricanes, tropical storms, or forest fires; acquisition risks; requirements for capital or its availability; conditions in the worldwide financial and credit markets; general economic conditions; competition; government regulations, including tax and environmental; and unexpected delays, as well as the risks and uncertainties inherent in oil and gas drilling and production activities or that are otherwise discussed in this quarterly report, including, without limitation, the portions referenced above, and the uncertainties set forth from time to time in our other public reports, filings and public statements including, without limitation, the Company’s most recent Form 10-K. Statement Regarding Non-GAAP Financial Measures: This presentation also contains certain non-GAAP financial measures. Any non-GAAP measure included herein is accompanied by a reconciliation to the most directly comparable U.S. GAAP measure along with a statement on why the Company believes the measure is beneficial to investors, which statements are included at the end of this presentation. Note to U.S. Investors: Current SEC rules regarding oil and gas reserves information allow oil and gas companies to disclose in filings with the SEC not only proved reserves, but also probable and possible reserves that meet the SEC’s definitions of such terms. We disclose only proved reserves in our filings with the SEC. Denbury’s proved reserves as of December 31, 2014 and December 31, 2015 were estimated by DeGolyer and MacNaughton, an independent petroleum engineering firm. In this presentation, we may make reference to probable and possible reserves, some of which have been estimated by our independent engineers and some of which have been estimated by Denbury’s internal staff of engineers. In this presentation, we also may refer to estimates of original oil in place, resource or reserves “potential”, barrels recoverable, or other descriptions of volumes potentially recoverable, which in addition to reserves generally classifiable as probable and possible (2P and 3P reserves), include estimates of resources that do not rise to the standards for possible reserves, and which SEC guidelines strictly prohibit us from including in filings with the SEC. These estimates, as well as the estimates of probable and possible reserves, are by their nature more speculative than estimates of proved reserves and are subject to greater uncertainties, and accordingly the likelihood of recovering those reserves is subject to substantially greater risk.

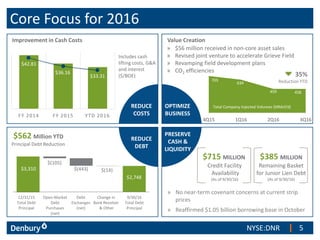

- 5. NYSE:DNR 5 705 634 459 458 4Q15 1Q16 2Q16 3Q16 35% Reduction YTD $385 MILLION Remaining Basket for Junior Lien Debt (As of 9/30/16)$2,748 $3,310 $(443) Core Focus for 2016 12/31/15 Total Debt Principal 9/30/16 Total Debt Principal Change in Bank Revolver & Other Open-Market Debt Purchases (net) Debt Exchanges (net) $(105) $(14) » No near-term covenant concerns at current strip prices » Reaffirmed $1.05 billion borrowing base in October $42.81 $36.16 $33.31 FY 2014 FY 2015 YTD 2016 $562 Million YTD Principal Debt Reduction Improvement in Cash Costs $715 MILLION Credit Facility Availability (As of 9/30/16) » $56 million received in non-core asset sales » Revised joint venture to accelerate Grieve Field » Revamping field development plans » CO2 efficiencies Includes cash lifting costs, G&A and interest ($/BOE) REDUCE COSTS OPTIMIZE BUSINESS REDUCE DEBT PRESERVE CASH & LIQUIDITY Total Company Injected Volumes (MMcf/d) Value Creation

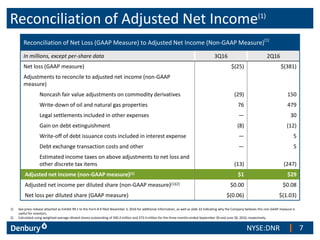

- 7. NYSE:DNR 7 Reconciliation of Adjusted Net Income(1) f Reconciliation of Net Loss (GAAP Measure) to Adjusted Net Income (Non-GAAP Measure)(1) In millions, except per-share data 3Q16 2Q16 Net loss (GAAP measure) $(25) $(381) Adjustments to reconcile to adjusted net income (non-GAAP measure) Noncash fair value adjustments on commodity derivatives (29) 150 Write-down of oil and natural gas properties 76 479 Legal settlements included in other expenses — 30 Gain on debt extinguishment (8) (12) Write-off of debt issuance costs included in interest expense — 5 Debt exchange transaction costs and other — 5 Estimated income taxes on above adjustments to net loss and other discrete tax items (13) (247) Adjusted net income (non-GAAP measure)(1) $1 $29 Adjusted net income per diluted share (non-GAAP measure)(1)(2) $0.00 $0.08 Net loss per diluted share (GAAP measure) $(0.06) $(1.03) 1) See press release attached as Exhibit 99.1 to the Form 8-K filed November 3, 2016 for additional information, as well as slide 22 indicating why the Company believes this non-GAAP measure is useful for investors. 2) Calculated using weighted-average diluted shares outstanding of 390.2 million and 372.4 million for the three months ended September 30 and June 30, 2016, respectively.

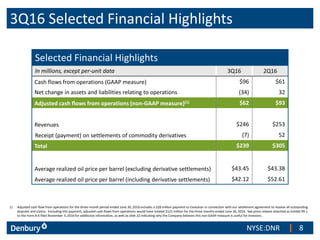

- 8. NYSE:DNR 8 3Q16 Selected Financial Highlights Selected Financial Highlights In millions, except per-unit data 3Q16 2Q16 Cash flows from operations (GAAP measure) $96 $61 Net change in assets and liabilities relating to operations (34) 32 Adjusted cash flows from operations (non-GAAP measure)(1) $62 $93 Revenues $246 $253 Receipt (payment) on settlements of commodity derivatives (7) 52 Total $239 $305 Average realized oil price per barrel (excluding derivative settlements) $43.45 $43.38 Average realized oil price per barrel (including derivative settlements) $42.12 $52.61 1) Adjusted cash flow from operations for the three-month period ended June 30, 2016 includes a $28 million payment to Evolution in connection with our settlement agreement to resolve all outstanding disputes and claims. Excluding this payment, adjusted cash flows from operations would have totaled $121 million for the three months ended June 30, 2016. See press release attached as Exhibit 99.1 to the Form 8-K filed November 3, 2016 for additional information, as well as slide 22 indicating why the Company believes this non-GAAP measure is useful for investors.

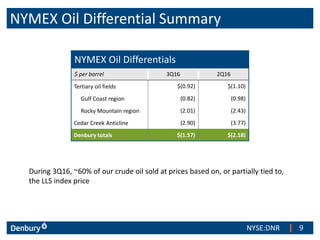

- 9. NYSE:DNR 9 NYMEX Oil Differential Summary NYMEX Oil Differentials $ per barrel 3Q16 2Q16 Tertiary oil fields $(0.92) $(1.10) Gulf Coast region (0.82) (0.98) Rocky Mountain region (2.01) (2.43) Cedar Creek Anticline (2.90) (3.77) Denbury totals $(1.57) $(2.18) During 3Q16, ~60% of our crude oil sold at prices based on, or partially tied to, the LLS index price

- 10. NYSE:DNR 10 Selected Expense Line Items Expenses 3Q16 2Q16 ($MM) ($/BOE) ($MM) ($/BOE) Lease operating expenses(1) $107 $18.82 $100 $17.04 General and administrative expenses 25 4.35 23 3.84 Interest expense (net of amounts capitalized)(2) 25 4.38 36 6.14 Depletion, depreciation, and amortization 55 9.72 67 11.34 Effective income tax rate, in percentages 37.2% 36.9% 1) See slide 16 for additional detail on lease operating expenses. 2) Interest expense during 2Q16 includes $5 million, or $0.77 per BOE, related to a write-off of debt issuance costs associated with our senior secured bank credit facility following the May 2016 redetermination which reduced our borrowing base and lender commitments. 3) Cash interest is presented on an accrual basis, and includes interest on the Company’s new 2021 Senior Secured Notes (interest on which is to be paid semiannually May 15 and November 15 of each year, beginning November 15, 2016), which are accounted for as debt and not reflected as interest for financial reporting purposes. Reconciliation of Interest Expense 3Q16 2Q16 ($MM) ($MM) Cash interest(3) $43 $43 Less: interest on 9% 2021 Sr. Secured Notes(3) (13) (7) Noncash interest expense 2 6 Less: capitalized interest (7) (6) Interest expense (net of amounts capitalized)(2) $25 $36

- 11. NYSE:DNR 11 Swaps Oil Hedge Protection 3Q16 4Q16 1Q17 2Q17 3Q17 4Q17 WTI NYMEX Fixed-Price Swaps Volumes Hedged (Bbls/d) 18,500 26,000 22,000 22,000 — — Swap Price(1) $38.96 $38.70 $42.67 $43.99 — — Argus LLS Fixed-Price Swaps Volumes Hedged (Bbls/d) 7,000 7,000 10,000 7,000 — — Swap Price(1) $39.61 $39.16 $43.77 $45.35 — — WTI NYMEX Collars Volumes Hedged (Bbls/d) 4,500 — — — — — Ceiling Price/Floor(1) $71.22/$55 — — — — — Volumes Hedged (Bbls/d)(3) 4,000 4,000 4,000 — — — Ceiling Price/Floor(1)(3) $51.40/$40 $53.48/$40 $54.80/$40 — — — WTI NYMEX 3-Way Collars Volumes Hedged (Bbls/d) — — — — 13,500 7,000 Ceiling Price/Floor/Sold Put Price(1)(2) — — — — $69.13/$40/$30 $69.45/$40/$30 Argus LLS Collars Volumes Hedged (Bbls/d) 3,000 — — — — — Ceiling Price/Floor(1) $73.85/$58 — — — — — Volumes Hedged (Bbls/d)(3) 5,000 4,000 3,000 — — — Ceiling Price/Floor(1),(3) $53.74/$40 $55.79/$40 $57.23/$40 — — — Argus LLS 3-Way Collars Volumes Hedged (Bbls/d) — — — — 2,000 1,000 Ceiling Price/Floor/Sold Put Price(1)(2) — — — — $69.25/$41/$31 $70.25/$41/$31 Total Volumes Hedged 42,000 41,000 39,000 29,000 15,500 8,000 1) Averages are volume weighted. 2) If oil prices were to average less than the sold put price, receipts on settlement would be limited to the difference between the floor price and sold put price. 3) Collars added during 2Q16. Collars Detail as of November 2, 2016

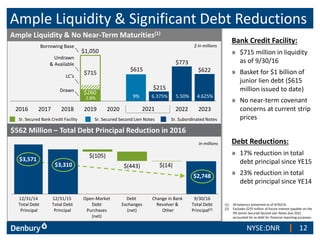

- 12. NYSE:DNR 12 Bank Credit Facility: » $715 million in liquidity as of 9/30/16 » Basket for $1 billion of junior lien debt ($615 million issued to date) » No near-term covenant concerns at current strip prices Debt Reductions: » 17% reduction in total debt principal since YE15 » 23% reduction in total debt principal since YE14 $562 Million – Total Debt Principal Reduction in 2016 Ample Liquidity & No Near-Term Maturities(1) $260 $215 $715 $615 $773 $622 2016 2017 2018 2019 2020 2021 2022 2023 $2,748 $3,310 $(443) 12/31/15 Total Debt Principal 9/30/16 Total Debt Principal(2) Open-Market Debt Purchases (net) Change in Bank Revolver & Other Debt Exchanges (net) $(105) $(14) 2021 $1,050 Undrawn & Available Drawn Sr. Subordinated NotesSr. Secured Bank Credit Facility Sr. Secured Second Lien Notes 2.8% 6.375% 5.50% 4.625%9% LC’s Ample Liquidity & Significant Debt Reductions Borrowing Base 12/31/14 Total Debt Principal $3,571 $ In millions In millions (1) All balances presented as of 9/30/16. (2) Excludes $255 million of future interest payable on the 9% Senior Secured Second Lien Notes due 2021 accounted for as debt for financial reporting purposes.

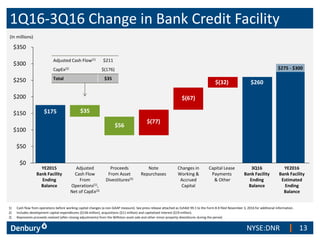

- 13. NYSE:DNR 13 $0 $50 $100 $150 $200 $250 $300 $350 YE2015 Bank Facility Ending Balance Changes in Working & Accrued Capital Note Repurchases 3Q16 Bank Facility Ending Balance $175 $260 $56 $(77) Capital Lease Payments & Other Adjusted Cash Flow From Operations(1), Net of CapEx(2) $(67) (In millions) YE2016 Bank Facility Estimated Ending Balance $275 - $300 1) Cash flow from operations before working capital changes (a non-GAAP measure). See press release attached as Exhibit 99.1 to the Form 8-K filed November 3, 2016 for additional information. 2) Includes development capital expenditures ($146 million), acquisitions ($11 million) and capitalized interest ($19 million). 3) Represents proceeds realized (after closing adjustments) from the Williston asset sale and other minor property divestitures during the period. 1Q16-3Q16 Change in Bank Credit Facility $(32) Proceeds From Asset Divestitures(3) $35 Adjusted Cash Flow(1) $211 CapEx(2) $(176) Total $35

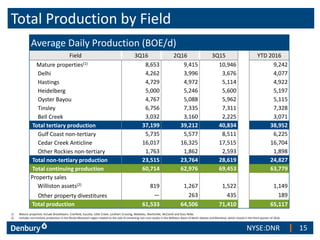

- 15. NYSE:DNR 15 Total Production by Field Average Daily Production (BOE/d) Field 3Q16 2Q16 3Q15 YTD 2016 Mature properties(1) 8,653 9,415 10,946 9,242 Delhi 4,262 3,996 3,676 4,077 Hastings 4,729 4,972 5,114 4,922 Heidelberg 5,000 5,246 5,600 5,197 Oyster Bayou 4,767 5,088 5,962 5,115 Tinsley 6,756 7,335 7,311 7,328 Bell Creek 3,032 3,160 2,225 3,071 Total tertiary production 37,199 39,212 40,834 38,952 Gulf Coast non-tertiary 5,735 5,577 8,511 6,225 Cedar Creek Anticline 16,017 16,325 17,515 16,704 Other Rockies non-tertiary 1,763 1,862 2,593 1,898 Total non-tertiary production 23,515 23,764 28,619 24,827 Total continuing production 60,714 62,976 69,453 63,779 Property sales Williston assets(2) 819 1,267 1,522 1,149 Other property divestitures — 263 435 189 Total production 61,533 64,506 71,410 65,117 1) Mature properties include Brookhaven, Cranfield, Eucutta, Little Creek, Lockhart Crossing, Mallalieu, Martinville, McComb and Soso fields. 2) Includes non-tertiary production in the Rocky Mountain region related to the sale of remaining non-core assets in the Williston Basin of North Dakota and Montana, which closed in the third quarter of 2016.

- 16. NYSE:DNR 16 Breakdown of Total Operating Costs Total Operating Costs 3Q16 2Q16 3Q15 YTD 2016 YTD 2015 ($MM) ($/BOE) ($MM) ($/BOE) ($MM) ($/BOE) ($MM) ($/BOE) ($MM) ($/BOE) CO2 Costs $12 $2.17 $13 $2.13 $14 $2.17 $37 $2.09 $53 $2.64 Power & Fuel 31 5.39 29 5.02 38 5.77 93 5.22 113 5.64 Labor & Overhead 31 5.44 31 5.22 35 5.24 94 5.23 107 5.34 Repairs & Maintenance 6 0.98 4 0.73 8 1.26 15 0.84 26 1.31 Chemicals 7 1.18 5 0.90 7 1.11 18 1.01 23 1.16 Workovers 11 2.02 12 1.99 15 2.31 31 1.72 50 2.48 Other 5 1.05 6 1.05 9 1.35 17 1.01 27 1.40 Total Normalized LOE(1) $103 $18.23 $100 $17.04 $126 $19.21 $305 $17.12 $399 $19.97 Special or Unusual Items(2) — — — — (14) (2.09) — — (14) (0.69) Thompson Field Repair Costs(3) 4 0.59 — — 1 0.22 4 0.20 2 0.11 Total LOE $107 $18.82 $100 $17.04 $114 $17.34 $309 $17.32 $387 $19.39 1) Total normalized LOE excludes special or unusual items and Thompson Field repair costs, each of which is discussed in further detail below. 2) Special or unusual items consist of a reimbursement for a retroactive utility rate adjustment ($10 MM) and an insurance reimbursement for previous well control costs ($4 MM) during 3Q15. 3) Thompson Field repair costs includes repair work at Thompson Field following the weather-related events of 2Q16 and 2Q15.

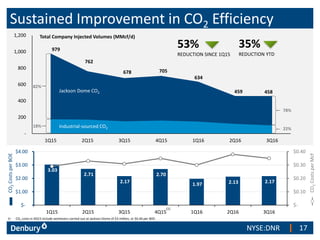

- 17. NYSE:DNR 17 3.03 2.71 2.17 2.70 1.97 2.13 2.17 $- $0.10 $0.20 $0.30 $0.40 $- $1.00 $2.00 $3.00 $4.00 1Q15 2Q15 3Q15 4Q15 1Q16 2Q16 3Q16 - 200 400 600 800 1,000 1,200 1Q15 2Q15 3Q15 4Q15 1Q16 2Q16 3Q16 53% REDUCTION SINCE 1Q15 979 Total Company Injected Volumes (MMcf/d) CO2CostsperMcf 1) CO2 costs in 4Q15 include workovers carried out at Jackson Dome of $3 million, or $0.46 per BOE. (1) Sustained Improvement in CO2 Efficiency Industrial-sourced CO2 Jackson Dome CO2 762 678 705 634 459 CO2CostsperBOE 78% 22% 82% 18% 458 35% REDUCTION YTD

- 18. NYSE:DNR 18 Delhi NGL Plant Nearing Completion » Will extract NGLs from our gas stream to be sold separately » Will improve the Delhi flood with a purer CO2 recycle stream » Will self-generate power using extracted methane Plant startup expected by the end of 2016 Delhi Field Delhi Field 2016 CapEx: $55 million Jackson Dome CO2 Source

- 19. Q&A

- 20. Appendix

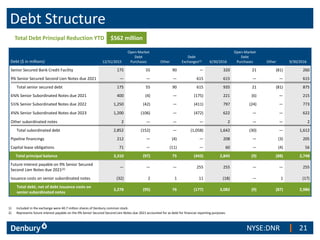

- 21. NYSE:DNR 21 Debt Structure Debt ($ in millions) 12/31/2015 Open-Market Debt Purchases Other Debt Exchanges(1) 6/30/2016 Open-Market Debt Purchases Other 9/30/2016 Senior Secured Bank Credit Facility 175 55 90 — 320 21 (81) 260 9% Senior Secured Second Lien Notes due 2021 — — — 615 615 — — 615 Total senior secured debt 175 55 90 615 935 21 (81) 875 6⅜% Senior Subordinated Notes due 2021 400 (4) — (175) 221 (6) — 215 5½% Senior Subordinated Notes due 2022 1,250 (42) — (411) 797 (24) — 773 4⅝% Senior Subordinated Notes due 2023 1,200 (106) — (472) 622 — — 622 Other subordinated notes 2 — — — 2 — — 2 Total subordinated debt 2,852 (152) — (1,058) 1,642 (30) — 1,612 Pipeline financings 212 — (4) — 208 — (3) 205 Capital lease obligations 71 — (11) — 60 — (4) 56 Total principal balance 3,310 (97) 75 (443) 2,845 (9) (88) 2,748 Future interest payable on 9% Senior Secured Second Lien Notes due 2021(2) — — — 255 255 — — 255 Issuance costs on senior subordinated notes (32) 2 1 11 (18) — 1 (17) Total debt, net of debt issuance costs on senior subordinated notes 3,278 (95) 76 (177) 3,082 (9) (87) 2,986 1) Included in the exchange were 40.7 million shares of Denbury common stock. 2) Represents future interest payable on the 9% Senior Secured Second Lien Notes due 2021 accounted for as debt for financial reporting purposes. Total Debt Principal Reduction YTD $562 million

- 22. NYSE:DNR 22 Non-GAAP Measures Adjusted Net Income Adjusted net income is a non-GAAP measure provided as a supplement to present an alternative net income measure which excludes expense and income items (and their related tax effects) not directly related to the Company’s ongoing operations. Management believes that adjusted net income may be helpful to investors by eliminating the impact of noncash and/or special or unusual items not indicative of our performance from period to period, and is widely used by the investment community, while also being used by management, in evaluating the comparability of the Company’s ongoing operational results and trends. Adjusted net income should not be considered in isolation, as a substitute for, or more meaningful than, net loss or any other measure reported in accordance with GAAP, but rather to provide additional information useful in evaluating the Company’s operational trends and performance. Adjusted Cash Flows From Operations Adjusted cash flows from operations is a non-GAAP measure that represents cash flows provided by operations before changes in assets and liabilities, as summarized from the Company’s Unaudited Condensed Consolidated Statements of Cash Flows. Adjusted cash flows from operations measures the cash flows earned or incurred from operating activities without regard to the collection or payment of associated receivables or payables. Management believes that it is important to consider this additional measure, along with cash flows from operations, as it believes the non- GAAP measure can often be a better way to discuss changes in operating trends in its business caused by changes in production, prices, operating costs and related factors, without regard to whether the earned or incurred item was collected or paid during that period.