International Studies Quarterly (2022) 0, 1–14

Capital Mobility and Taxation: State–Business Collusion in China

LING CHEN

Johns Hopkins University, USA

AND

Do more mobile firms pay lower taxes? Conventional wisdom argues that capital mobility creates downward pressure on

corporate taxes, as firms can threaten to exit. Nevertheless, empirical findings are highly mixed and hard to reconcile, partly

due to a lack of data at the microlevel. Using two comprehensive panel data sets with more than 780,000 Chinese firms

over two decades, we find that firms with higher shares of mobile capital pay higher effective tax rates. We contend that this

counterintuitive finding results from the strategic interaction between firms and governments. Knowing their vulnerability and

sunk cost, firms with more fixed assets were more active in protecting themselves by bribing and colluding with local officials.

Meanwhile, officials were more willing to seek bribes from these firms in exchange for tax cuts. In contrast, mobile firms were

disadvantaged. Although capital mobility may provide additional bargaining power, firms with fixed assets can overcome this

advantage through state–business collusion. Our quantitative and qualitative evidence show that fixed firms paid lower taxes

in cities with cozy government–business relations. However, such advantages decreased after the launch of anti-corruption

campaigns and in cities with higher fiscal transparency.

¿Las empresas más móviles pagan menos impuestos? La creencia popular sostiene que la movilidad del capital crea una presión

a la baja en los impuestos de sociedades, ya que las empresas pueden amenazar con irse. Sin embargo, los resultados empíricos

son muy variados y difíciles de conciliar, en parte debido a la falta de datos en el micronivel. Utilizando dos conjuntos de datos

de panel exhaustivos con más de 780 000 empresas chinas a lo largo de dos décadas, descubrimos que las empresas con mayor

proporción de capital móvil pagan tipos impositivos efectivos más altos. Consideramos que este hallazgo contraintuitivo se

debe a la interacción estratégica entre empresas y gobiernos. Conscientes de su vulnerabilidad y de los costos irrecuperables,

las empresas con más activos fijos fueron más dinámicas a la hora de protegerse mediante la práctica del cohecho y la colusión

con los funcionarios locales. Mientras tanto, los funcionarios estaban más dispuestos a conseguir sobornos de estas empresas

a cambio de reducciones de impuestos. Por el contrario, las empresas móviles estaban en desventaja. Aunque la movilidad

del capital puede proporcionar un poder de negociación adicional, las empresas con activos fijos pueden superar esta ventaja

mediante la colusión entre las empresas y el Estado. Nuestros datos cuantitativos y cualitativos demuestran que las empresas

fijas pagaron menos impuestos en las ciudades con relaciones estrechas entre el gobierno y las empresas. Sin embargo, estas

ventajas disminuyeron después del lanzamiento de las campañas anticorrupción y en las ciudades con mayor transparencia

fiscal.

Les entreprises plus mobiles paient-elles moins d’impôts? Les idées reçues soutiennent que la mobilité des capitaux crée

une pression à la baisse sur les impôts sur les sociétés, car les entreprises peuvent menacer de quitter un pays. Néanmoins,

les constatations empiriques sont très mitigées et difficiles à réconcilier, en partie en raison d’un manque de données au

niveau micro. Nous nous sommes appuyés sur deux jeux de données de panel complets comprenant plus de 780 000 entreprises chinoises sur deux décennies et nous avons constaté que les entreprises dont les parts de capitaux mobiles étaient

plus importantes payaient des taux d’imposition effectifs plus élevés. Nous soutenons que cette constatation contre-intuitive

résulte de l’interaction stratégique entre les entreprises et les gouvernements. Conscientes de leur vulnérabilité et de leurs

coûts irrécupérables, les entreprises disposant d’un plus grand nombre d’actifs fixes se sont protégées plus activement en

soudoyant et en s’entendant avec des fonctionnaires locaux. Dans le même temps, les fonctionnaires étaient davantage disposés à demander des pots-de-vin à ces entreprises en échange de réductions d’impôts. À l’inverse, les entreprises mobiles ont

été désavantagées. Bien que la mobilité des capitaux puisse offrir un pouvoir de négociation supplémentaire, les entreprises

disposant d’actifs fixes peuvent pallier cet avantage par le biais d’une collusion entre l’État et les entreprises. Nos preuves

quantitatives et qualitatives montrent que les entreprises fixes ont payé moins d’impôts dans les villes où les relations entre le

gouvernement et les entreprises étaient intimes. Toutefois, ces avantages ont diminué suite au lancement de campagnes de

lutte contre la corruption et dans les villes où la transparence fiscale est plus grande.

Ling Chen is an Assistant Professor in the School of Advanced International Studies at Johns Hopkins University. Her research interests lie in the political economy

and state–business relations of China, such as economic, tax, and industrial policies. She is also affiliated with the Fairbank Center at Harvard University as an Associate

in Research.

Florian M. Hollenbach is an Associate Professor in the Department of International Economics, Government, and Business at Copenhagen Business School. His

primary research interests are the political economy of taxation, state capacity, corruption, and the influence of money in politics. He is also in the steering committee

of the Anti-Corruption Data Collective, a new initiative bringing together journalists, data analysts, academics, and policy advocates to expose corruption in developed

countries.

Author’s note: The article was previously presented at the Meeting of the American Political Science Association in 2017, the Meeting of the Association for Asian

Studies in 2018, the Undemocratic Political Economy conference at the Western Political Science Association in 2018, and the Chinese Politics Mini-Conference at the

American Political Science Association meeting in 2021. We thank the editors and two anonymous reviewers, as well as Timm Betz, Iza Ding, Nate Jensen, Ding Li, Quan

Li, Weijia Li, Margaret Pearson, Amy Pond, David Steinberg, Juan Wang, Rachel Wellhausen, and Susan Whiting for very helpful comments. We also thank Kevin Acker,

Yufan Huang, Xiuyu Li, Yue Lin, Hao Zhang, and Yujin Zhang for their research assistance. All remaining errors are our own. The replication code underlying this article

is available on the ISQ Dataverse, at https://dataverse.harvard.edu/dataverse/isq. For questions concerning our data, please contact us directly.

Chen, Ling, and Florian M. Hollenbach. (2022) Capital Mobility and Taxation: State–Business Collusion in China. International Studies Quarterly,

https://doi.org/10.1093/isq/sqab096

© The Author(s) (2022). Published by Oxford University Press on behalf of the International Studies Association. This is an Open Access article distributed under the terms of the

Creative Commons Attribution License (https://creativecommons.org/licenses/by/4.0/), which permits unrestricted reuse, distribution, and reproduction in any medium,

provided the original work is properly cited.

Downloaded from https://academic.oup.com/isq/advance-article/doi/10.1093/isq/sqab096/6514648 by guest on 04 February 2022

FLORIAN M. HOLLENBACH

Government and Business, Copenhagen Business School, Denmark

�2

Capital Mobility and Taxation

Introduction

Government officials, meanwhile, also have more incentives to create connections with fixed asset firms. Officials

are more likely to offer tax cuts in exchange for bribery and

long-term economic benefits when they anticipate firms to

reside in their jurisdiction for a long time. On the other

hand, with more mobile firms, officials may become opportunistic and extract as much as they can through the already established channel of taxation. While mobile firms

may have some bargaining power, fixed asset firms can effectively overcome their own disadvantages in cozy state–

business environments. Only when state–business collusion

is substantially constrained, do mobile firms have significant

advantages over fixed asset firms.

We investigate our argument using two firm-level data sets

containing data on asset types and yearly tax payments. The

first data set is based on the China National Survey of Industrial Firms (CNSIF) and contains data on over 780,000 firms

in 477 Chinese cities between 1995 and 2007. As a second

source, we use the China Stock Market and Accounting Research

Database (CSMAR) for data on effective tax payments by

3,628 firms in 285 cities between 2009 and 2017. The two

data sets allow us to investigate the relationship between capital mobility and tax rates on two different samples of firms,

as well as two unique time periods.

Using these data, we first establish that the overall relationship between capital mobility and effective tax rates in

China is consistently positive across two different data sets

and several different empirical specifications. We then empirically explore the strategic interactions between governments and firms as a potential explanation for our findings,

drawing on quantitative and qualitative evidence.

First, we show that the relationship between capital mobility and effective tax rates differs by city-level government–

business relations. The advantage of fixed asset firms is

stronger in cities with better relations between firms and

city tax bureaus. Second, we present evidence that the

anti-corruption campaign launched by President Xi Jinping in 2013 has significantly weakened the relationship between mobility and effective tax rates, compared to the precampaign period. Xi’s campaign has substantially tightened

the control on government–business collusion and reduced

the options of government business interactions compared

to the pre-Xi period. As we show, more mobile firms paid

higher taxes before the anti-corruption campaign, but this

difference was significantly smaller after 2013, even when

accounting for firm fixed effects. Finally, we show that the

relationship between capital mobility and higher effective

tax rates only exists in cities with low fiscal transparency. In

cities with high fiscal transparency, the advantage of fixed

asset firms disappears.

Overall, our evidence suggests that when widespread

government–business collusion is allowed, fixed asset firms

have lower effective tax rates due to their commitment to

networking and building relationships with local governments. However, anti-corruption and pro-transparency reforms have constrained the choice of collusion, leveled the

playing field, and weakened the advantages of fixed asset

firms.

Our findings illustrate that when studying the relationship between capital mobility and taxation, we need to consider both the advantages and disadvantages of mobile and

fixed asset firms. The relationship is highly dependent on

firm–government interactions and the political and economic environment. The conventional wisdom about mobile firms’ advantages is not wrong in highly transparent

and clean settings, where state–business collusion through

bribery is constrained. Nevertheless, where government

Downloaded from https://academic.oup.com/isq/advance-article/doi/10.1093/isq/sqab096/6514648 by guest on 04 February 2022

Over the last half-century, political economists have grappled with the idea that capitalist countries’ power to

tax corporations is limited, with capital mobility being a

crucial constraining factor. Economic growth in capitalist

societies is dependent on the investment of private actors.

Even in closed economies, politicians have to trade off maximizing revenues and increasing taxes such that capital owners do not limit private investment. In other words, the state

is structurally dependent on capital (Przeworski and Wallerstein

1988). As capital becomes more mobile, capital owners can

threaten to move to other jurisdictions, further exerting

downward pressure on tax rates. Standard theoretical arguments, therefore, expect higher capital mobility to lead to

lower corporate tax rates.

This classic argument in political economy, however, has

both theoretical and empirical shortcomings. Theoretically,

the argument overlooks other strategic interactions between

firms and governments (Kim 2017). While capital mobility

can provide firms with more bargaining power under some

conditions, such mobility can also create disadvantages. Empirically, existing research has arrived at contradictory findings. While some studies confirm the conventional wisdom

that capital mobility and corporate taxes are inversely related, others cast doubt on such a claim and even find that

the reverse is true. The relationship between capital mobility and taxation varies considerably across contexts, with political and economic variables—ranging from regime type

to levels of economic development—playing a role. Therefore, one crucial challenge is to tease out the conditions in

which a negative relationship between capital mobility and

taxation may exist.

The difficulties in reconciling the mixed findings are

likely caused by the lack of comprehensive data at the microlevel. Much of the research investigating the relationship between capital mobility and tax rates has used countrylevel data on average or statutory tax rates, which can mask

key relationships among variables and are often weak predictors of effective tax rates. In contrast, we use comprehensive panel data sets with individual firms’ effective tax

rates across China. We test our argument at the firm level

in a single country, where local governments with high autonomy compete to attract and retain investments. This research design allows us to hold constant other potential

confounding factors, such as the political system. The finegrained data on each firm’s actual tax payments and total

profits allow us to calculate a yearly effective tax rate for each

firm instead of relying on statutory tax rates at the country

level.

In this context, we find that, contrary to conventional

expectations, firms with higher mobile capital shares pay

higher effective tax rates than firms with a higher proportion of fixed assets. We contend that this positive relationship between mobility and tax rates results from the strategic interactions between firms and governments under the

condition of state–business collusion instead of the conventional scenario of state–business bargaining. Firms with low

asset mobility are aware that they are vulnerable to predatory taxation. In exchange for tax reductions, they thus

spend extra effort in bribing and building connections with

government officials over the long run. Given the startup cost associated with fixed assets, these firms also have

stronger incentives to invest in such behavior. By contrast,

mobile firms may be more willing to pay higher taxes in the

short run and use their bargaining power instead of investing in long-term resources to build connections.

�LING CHEN

AND

FLORIAN M. HOLLENBACH

business collusion is prevalent, mobile firms may pay higher

costs, and fixed asset firms’ advantages may dominate.

Capital Mobility and Taxation

run and in areas beyond taxation. At the same time, government officials are much more likely to seek bribes and build

relations with firms with low mobility. Since fixed asset firms

are more dependent on local government officials for survival in the long run, these relationships are also more beneficial to government officials. Consequently, under certain

political and economic conditions, fixed asset firms can turn

their apparent disadvantages into advantages when competing over local fiscal policies.

Firms with higher capital mobility, in contrast, have fewer

barriers to move and have more bargaining power, according to conventional wisdom. However, when collusion is allowed, mobility also comes with disadvantages. For these

firms, it is less worthwhile to invest resources into building

relations as they are more likely to move in the future. Due

to lower relocation costs and shorter time horizons, mobile

firms are less active than fixed asset firms in terms of paying

bribes to public officials (Gauthier and Goyette 2014). Anticipating that mobile firms are less dependent on the government and less vulnerable, officials would also have fewer

incentives to seek bribes or establish new networks. Knowing that they may move, government officials would resort

to taxation, an already set-up institution of state extraction,

while firms are still in their jurisdiction.

Viewed in this light, the conventional theoretical expectation that capital mobility increases a firm’s bargaining power

over taxation is not necessarily wrong but requires essential

qualifications. One has to take firm–government interaction

and the political economic environment into full consideration, which determines the advantages and disadvantages

for mobile/fixed asset firms:

(1) In a context when state–business collusion is prevalent, as described above, the strategic interactions between firms and governments can reach an equilibrium that favors fixed asset firms rather than mobile

firms. While mobile firms can still threaten to exit,

such threat has less impact, as officials focus on colluding with fixed asset firms, which offer kickbacks and

side payments. This scenario is especially applicable

in countries where corruption and political connections are found to help reduce tax rates to the state’s

detriment, e.g., as has been noted for Brazil, Malaysia,

India, and Russia (Marjit, Mukherjee, and Mukherjee

2000; Tanzi and Davoodi 2000; Safavian, Graham, and

Gonzalez-Vega 2001; Adhikari, Derashid and Zhang

2006; Timmons and Garfias 2015; Hollenbach and

Silva 2019).

(2) By contrast, where fiscal transparency is high or

government–business collusion and corruption are significantly constrained, the conventional assumption

of state–business bargaining is more appropriate. In

this context, bribery, corruption, and government–

business relationships matter less, and fixed-asset firms

have few advantages. In the ideal scenario where corruption is impossible, mobile firms’ exit threats become salient in obtaining tax breaks. The mobile

firms’ exit would cause losses to the local economy,

pushing local officials to offer tax breaks to mobile

firms.

Placed in such a theoretical context, much of recent

Chinese history falls into the former scenario, where

government–business collusion and the guanxi network

have played crucial roles in shaping economic activities.

Given the limited channels for formal policy lobbying and

weak protection of property rights, businesses tend to bribe

public officials and resort to political connections (Pearson

Downloaded from https://academic.oup.com/isq/advance-article/doi/10.1093/isq/sqab096/6514648 by guest on 04 February 2022

Much theoretical work suggests that capital mobility constrains the extractive ability of the state and ought to lower

taxes on capital. To put simply, firms with mobile capital can

choose to exit in the face of higher tax rates. Increasing capital mobility should, therefore, exert downward pressure on

effective tax rates (Hirschman 1970) and may change distributive outcomes. All else equal, governments may attempt

to attract mobile capital by lowering taxes and providing investment incentives, which can result in a “race to the bottom” (Rodrik and van Ypersele 2001).

Even though this theoretical expectation is well known

and straightforward, the empirical results are mixed. On the

one hand, research suggests that capital mobility has indeed

shifted taxation from capital to labor, generating distributional consequences by lowering effective tax rates on capital and raising taxes on labor (Garrett 1995; Rodrik 1997;

Bretschger and Hettich 2002). Statutory corporate tax rates

have continuously fallen in Organization for Economic Cooperation and Development (OECD) countries since the

mid-1980s (Devereux, Griffith and Klemm 2002). On the

other hand, others question the supposed effect of globalization on tax competition, finding little support for a

race to the bottom for capital tax rates (Quinn 1997; Hays

2003; Basinger and Hallerberg 2004; Plümper, Troeger, and

Winner 2009).

Moreover, the relationship between capital mobility and

tax rates differs considerably across countries and regions, depending on factors such as resource endowment,

regime type, and level of economic development. Cai and

Treisman (2005) argue that countries’ resource endowments and levels of human capital determine whether the

competition to attract mobile capital constrains governments. Li (2006) and Genschel, Lierse, and Seelkopf (2016)

show that whether countries compete over mobile capital

via tax rates depends on their level of fiscal decentralization

and regime type. Jensen (2013) finds that while capital mobility may lower firms’ taxes in OECD countries, paradoxically, mobility raises tax rates in non-OECD countries with

US firms’ investments. Pond and Zafeiridou (2019) show

that when governments care about firm performance in financial markets, they prefer lower taxation for less mobile

firms to prop up their financial performance. The effect is

most prominent under democratic governance and broad

participation in the stock market.

How does one reconcile these different findings regarding the relationship between capital mobility and taxation? A growing body of work suggests that strategic interactions between governments and businesses can offer

a potential explanation. Firms with a high proportion of

fixed assets are more vulnerable to government extraction as they cannot easily move to another location (Cao

et al. 2021). Additionally, with higher start-up and thus

sunk costs, these firms face more extensive losses when

government intervention disrupts production (Johns and

Wellhausen 2020; Zhu and Deng 2021). Understanding

their disadvantages, these firms are more likely to actively

engage in bribery and corruption to protect themselves

from the extractive state. Recent studies found that fixed

assets are associated with higher levels of bribery and corruption, based on evidence in China, Vietnam, and Uganda

(Bai et al. 2019; Zhu and Deng 2021). Once firms establish

good relationships with the state, they benefit in the long

3

�4

Capital Mobility and Taxation

Research Design and Case Selection

China is now one of the world’s largest economies, where

state involvement and state–business relations play an important role. In the early 1980s, China decentralized its revenue system and increased fiscal autonomy at the local level.

The fiscal decentralization significantly incentivized local

governments to promote economic growth and generate

revenue sources (Shirk 1993; Oi 1999; Whiting 2001; Ong

2012). Although a 1994 reform reclaimed part of the revenue to the central government, most expenditures and the

responsibilities of tax collections remain at the local level

(National Bureau of Statistics 2015). Until the start of the Xi

regime, local governments had considerable discretion over

the offering of tax breaks before collecting taxes. At the

same time, the cadre evaluation systems of party and government officials create an essential institution of accountability from above, comparable to that of Vietnam (Jensen

and Malesky 2018). Higher-level officials evaluate the performance of lower-level officials based on local economic

indicators. These evaluations increase pressure on local

government officials to compete to attract investment and

to promote economic growth (Lü and Landry 2014; Jiang

2018; Chen and Zhang 2021). Since the 1990s, offering tax

breaks has become an essential tool for local governments to

draw investment and retain firms in their jurisdiction (Gao

2015; Zuo 2015; Chen 2018; Naughton 2018). While the

central government did not openly endorse this practice, it

allowed local governments to provide tax breaks based on

local conditions (yin di zhi yi). Several studies have noted the

impact of regional competition on offering tax breaks in

China (Cheng, Lin, and Simmons 2017; Xing, Cui, and Qu

2018).1

1

These policies, from 1990 to present, were later summarized in the catalog

of tax-break policies [see The State Tax Bureau of China (2015)].

In contrast, we still know little about how local government officials and businesses in China have used tax-break

policies to build mutually beneficial relationships and consolidate connections (Zheng 2006; Choi 2009; Chen 2018).

Local officials, generally underpaid, often sacrifice state revenue for personal benefits (Zhang 2021). The hundreds of

tax-break policies issued by the central government, which

generated even more policies at the local level, were hard to

monitor. The criteria for evaluating firms’ eligibility for tax

breaks were particularly flexible. A China National Audit Office investigation found that 98 percent of the investigated

counties had issued tax-break policies without central government approval, reducing tax revenues by more than 7 billion yuan.2 According to interviews, tax bureaus and other

government departments would often directly reach out to

firms (or tax companies with connections to firms) to seek

bribes and kickbacks and advertise such opportunities.3 At

the same time, firms actively seek help from local governments. While official application processes exist, it is nearly

impossible to stay on top of hundreds of policies or navigate approval through different government departments

without building networks with local tax bureaus. Nurturing and maintaining good relationships with local officials—

through cash, gifts, or banquets—are essential for firms to

“get things done” and receive approval within a realistic

time frame. As discussed above, both the officials and firms

have strong incentives to engage in this type of government–

business collusion, particularly when firms have a higher

proportion of fixed assets. In many of these firms, to facilitate the eventual implementation of tax breaks or exemption policies, specific personnel are employed to establish

and maintain good relations with the tax bureau and other

departments. For example, the representative for a company selling electric power equipment recalled being responsible for establishing connections with the government

department that issued tax-break policies (in this case, the

Development and Reform Commission). She would go to

the government office about twice a week to promise bribes

for a few months. After receiving initial approval, she had to

receive final support from the tax bureau and, therefore, repeated the procedure for another couple of months. When

the official notified her that the tax breaks were finally

“done,” the representative would go in person to deliver the

cash bribes to both the department and tax officials.4

As we show with additional examples below, long-term

government collusion is often established through repeated

interactions, making it more rational to invest in future bribing. By contrast, although mobile firms can also bribe officials, they tend to invest fewer resources and personnel

into doing so and do so less regularly. Moreover, while these

firms have in-house accountants or outsource tax issues to

external accountants, in contrast to fixed asset firms, they

often do not bother to set up special departments or allocate particular personnel in charge of government–business

relations.5 In a comparative context, the Chinese case is representative of a broader set of countries with a lack of fiscal

2

See China National Audit Office, http://www.audit.gov.cn/n5/n25/

c63597/content.html.

3

Interview with a tax bureau official, Sichuan, October 2009; interview with

an accountant in an equipment manufacturing firm, Jiangsu, March 2010. In addition, see Choi (2009).

4

Interview with a financial manager in an electric power equipment company,

Sichuan, November 2009. Earlier forms of bribing are often in cash; later ones

can often take the forms of reimbursement for business travel and entertainment

expenses (Cai, Fang, and Xu 2011).

5

Interview with a manager of a start-up information technology company,

Zhejiang, March 2010.

Downloaded from https://academic.oup.com/isq/advance-article/doi/10.1093/isq/sqab096/6514648 by guest on 04 February 2022

1997). The increased state–business connections play an essential role as an alternative way to obtain property rights

protection (Tsai 2007; Dickson 2008; Wang 2014; Truex

2016; Hou 2019; Zhu and Shi 2019). At the same time, taxation is one of the most important areas for state–business

collusion. Businesses often prepare their bribes well before

the tax season or attend various banquets with local officials. In exchange, officials offer tax breaks or turn a blind

eye toward tax evasion. As discussed above, such an environment made fixed asset firms more active in rent-seeking

than mobile firms. Therefore, we expect firms with a higher

proportion of fixed assets to be more likely to invest in

government–business collusion in China. Meanwhile, officials are more likely to offer tax cuts to those firms than to

more mobile firms.

That said, we also observe variations in government–

business interactions across different periods and localities

in China. We use this variation to investigate our argument

within the same country. We expect fixed-asset firms’ advantages to be most salient in localities with cozy government–

business relations and less salient in areas of higher fiscal

transparency. Likewise, when the state cracks down on corruption and state–business collusion, firms and officials are

deprived of the full range of options for strategic interaction. In this case, mobile firms’ advantages increase. In the

following sections, we use fine-grained firm-level data combined with city-level variables and qualitative evidence to examine the empirical relationship between capital mobility

and taxation and uncover the mechanisms underlying such

a relationship.

�LING CHEN

AND

FLORIAN M. HOLLENBACH

Empirical Analysis

Before proceeding to our primary analysis, we first present

descriptive statistics of our dependent variable of interest: effective income tax rates. Following the standard calculation

for effective income tax rates in China (Liu and MartinezVazquez 2014), we calculate each firm’s yearly effective income tax rate by dividing the firm’s paid corporate income

taxes by its profits.8 The corporate income tax is one of the

primary revenue sources the Chinese government collects

6

Although economic data in China are often subject to manipulation by local

officials (Wallace 2016), the CNSIF data used here are collected directly at the

firm level.

7

Before 2008, China’s standard corporate income tax rate was 33 percent.

Rates for domestic firms were 27 percent for those with profits between 30,000

and 100,000 and 18 percent for those below 30,000. Foreign-invested firms’ rates

were set to 15 percent. In 2008, the standard corporate income tax rate was

changed to 25 percent for domestic and foreign firms. Given the time of its implementation, we do not include the year 2008 in either analysis. In both our data

sets, we control firms’ total profits and their ownership types.

8

We drop observations for firm years with zero or negative profits. We do so

for two reasons: (1) firms with zero or negative profits are pre-determined to pay

from firms. As noted above, crucial for our research design,

local officials have the authority to grant tax breaks on corporate income taxes for a wide range of reasons (Cheng,

Lin, and Simmons 2017; Xing, Cui, and Qu 2018).9

After calculating the effective income tax rate, we end up

with 2,024,432 observations from 1995 to 2007 for 784,267

unique firms in 477 cities across 40 industries (at two-digit

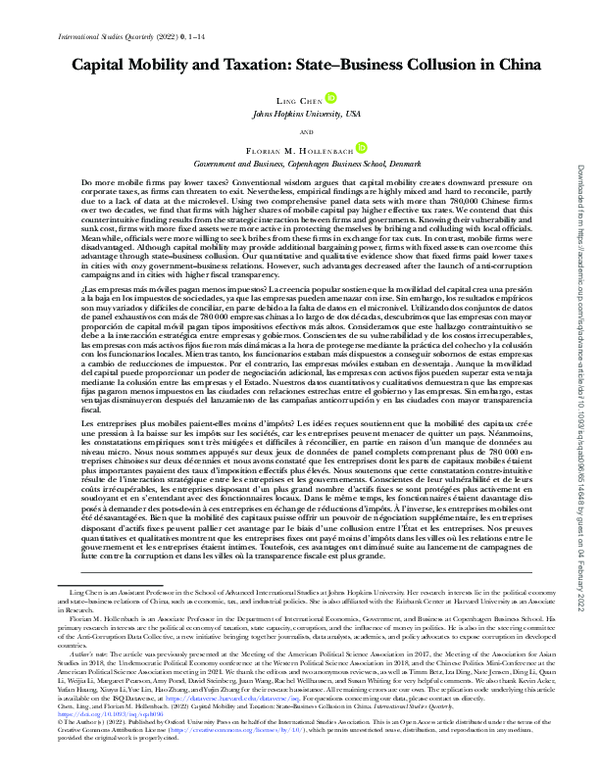

coding) in the national survey data. The left plot in figure 1

displays the density of effective income tax rates for values

between zero and one.10 We use the same method to plot

effective tax rates of firms in the stock market data in the

right plot of figure 1, which includes 22,012 total observations from 3,628 unique firms in 282 cities between 2009

and 2017.11 The two densities have peaks at different values,

which is unsurprising, given the different statutory corporate tax rates in the two time periods. Even though the National Tax Bureau set the standard statutory rates, figure 1

shows a wide range in actual income tax rates paid by firms.

Since both data sets include extremely uncommon values

on the effective income tax rate and a high number of zeros, we estimate statistical models on several transformations

of the dependent variable, including the original scale. Our

main results are based on our preferred measure: the winsorized effective income tax rate (Winsorized). Winsorizing

the dependent variables ensures that our inference is not

the result of extreme values in the dependent variable.12 In

addition, we create a binary variable that is coded zero for

firms paying no income tax and one for those firms that pay

positive income tax rates (Binary). Lastly, we estimate models on the original measure of effective tax rate (Untransformed).Tables A.1 and A.2 in the online appendix show the

summary statistics for all variables for the national firm survey and stock market data, respectively.

We measure our independent variable, capital mobility, as the ratio of mobile assets to the sum of mobile

and fixed assets owned by each firm in a given year, i.e.,

mobile assets

. We largely follow

capital mobility = fixed assets

+ mobile assets

Jensen (2013) on this measurement, which defines capital

mobility as the opposite of fixed assets. According to the

definition of the dataset, mobile capital or mobile assets are

“assets which can be cashed in or spent or consumed in an

operating cycle of one year or over one year, including cash,

all kinds of deposits, short-term investment, receivables,

advance payment, stock, etc.” In contrast, fixed assets are

defined as “the net value of fixed assets, clearance of fixed

assets, project under construction, fixed assets losses in

suspense.” The net value of fixed assets typically includes

property, plants, and any equipment and tools associated

with production and operation of the business.13

Given the observational nature of the data, we are concerned about potential omitted variables that might affect

the relationship between capital mobility and effective tax

rates. At the same time, for many of the potential conzero taxes even without tax breaks according to Chinese Corporate Income Tax

Law (see http://www.gov.cn/flfg/2007-03/19/content_554243.htm; (2) zeros or

negative values in the denominator create infinite or unreasonable effective tax

rates.

9

What we study here is different from tax evasion. A firm’s corporate income

tax is calculated by multiplying total profits with the given tax rate. Tax evasion

means firms under report profits; however, in this case, the effective tax rate remains legitimate.

10

There are 6,260 observations that fall out of this range and are not plotted

here.

11

Again, 815 observations fall out of this range and are not plotted.

12

Specifically, we set values below the 2.5th percentile and above the 97.5th

percentile to the 2.5th or 97.5th percentile value.

13

See the definition of these concepts by National Statistics Bureau at

http://www.stats.gov.cn/tjsj/ ndsj/2011/html/zb14.htm.

Downloaded from https://academic.oup.com/isq/advance-article/doi/10.1093/isq/sqab096/6514648 by guest on 04 February 2022

transparency, e.g., Brazil and India. In many of these cases,

government–business collusion is vital for tax breaks at the

local level with fiscal decentralization (Marjit, Mukherjee,

and Mukherjee 2000; Hollenbach and Silva 2019). Furthermore, even in centralized tax systems, such as Russia and

Malaysia, tax collectors often seek bribes, and the “relational

based” ties between firms and politicians have reduced effective tax rates (Safavian, Graham, and Gonzalez-Vega 2001;

Adhikari, Derashid, and Zhang 2006).

We have assembled two large firm-level panel data sets

to systematically investigate the relationship between capital mobility and taxation, including firm characteristics and

actual tax payments. The first set of data comes from the

CNSIF and cover the years 1995 to 2007. The survey was

taken by the State Economic Census Center of the National

Bureau of Statistics (NBS) and includes microlevel data of

all above-scale industrial firms (with sales above 5 million

yuan) across the entire jurisdictions of mainland China,

covering about 2 million observations.6 As a second data

set, we use firm-level data from the CSMAR, which includes

all publicly listed firms from 2009 to 2017 (about 24, 000

observations).

The two data sets allow us to investigate the relationship between capital mobility and taxation with fine-grained

firm-level data in China. The within-country research design

accounts for potential confounding factors at the country

level, such as differences due to institutional or legal environments. Additionally, both data sets allow us to calculate the effective tax rates based on taxes paid and profits

earned, taking into account any tax rebates, tax breaks, or

special rates.

We study two different periods in the two data sets to ensure policy consistency within each sample. China implemented a fiscal reform in 1994 and a corporate income tax

rate change in 2008. Based on data availability and to avoid

major policy disruption, we analyze the national survey data

from 1995 to 2007, after fiscal reform and before the corporate tax changes. In contrast, we analyze the stock market

data in the period after the corporate tax reform, i.e., from

2009 to 2017.7 The two data sets complement each other

in terms of time period covered and the sample of firms

included. In addition, as we further explain below, we also

use city-level variables as moderators in the capital mobility–

taxation relationship: (1) firms’ rating of relationships with

tax bureau officials and (2) cities’ fiscal transparency scores.

5

�6

Capital Mobility and Taxation

founders, the causal ordering is unclear, and their inclusion

could potentially induce post-treatment bias (Montgomery,

Nyhan, and Torres 2018). We, therefore, present a number

of models with different sets of covariates and fixed effects

included in the analysis.

We estimate a set of standard ordinary least squares

(OLS) models with different sets of fixed effects for both

data sets. First, we estimate a pair of bivariate models with

only our main variable of interest included: capital mobility.

In the second set of models, we add several covariates that

may influence the relationship between capital mobility and

effective tax rates. We include logged firm profits and total

assets, as companies with more mobile capital may also be

more profitable, subjecting them to different statutory tax

rates. Similarly, larger firms may be more mobile, profitable,

and may potentially have more bargaining power with city

bureaucracies. In the third set of models, we add covariates

for the share of exports in firms’ sales, logged total employment, and indicators for state-owned or foreign-invested enterprises. More export-oriented firms could profit from Chinese export promotion and exports may be related to capital

mobility. Foreign firms have a lower statutory tax rate than

domestic firms (state-owned or private), influencing their

effective tax rates. Given that firms are nested within cities,

we cluster standard errors at the city level.

We estimate a similar set of models with the same sets

of fixed effects for the models based on the stock market

data. First, we estimate bivariate models. Next, we control

only for profits (logged) and assets (logged). Lastly, we estimate models with covariates for profits (logged), total assets

(logged), research and development (R&D) expenditure as

the share of total operating costs (R&D intensity), logged

expenditure on employees, as well as ownership type. R&D

expenditure may be related to capital mobility and has been

promoted by the Chinese government through various industrial policies (Chen 2018).

We estimate the three models with different covariates

conditional on two sets of fixed effects. First, we only include

fixed effects for years and the city in which the firm is located. We include year fixed effects in case of domestic or

international events that influence firms’ behavior or local

economies. City fixed effects allow us to account for China’s

vast regional variation in implementing and adapting economic policies (Rithmire 2014). Second, we add additional

fixed effects for industry types (at the two digit-level industrial coding), as different industries are often subject to different tax policies. In total, we thus estimate six different

models for each dependent variable and its transformations.

Given that we are interested in the influence of capital

mobility and most firms’ level of capital mobility does not

significantly change over time, our main models focus on

the differences between firms within each city (and industry).14 The exception is our later model leveraging changes

before and after the anti-corruption campaign, where we include firm fixed effects similar to a difference-in-difference

design.

The Influence of Firm Mobility on Tax Rate

Table 1 shows the relationship between capital mobility and

the winsorized effective income tax rate based on data from

the national survey of industrial firms. Columns 1 and 2

present the estimates for the bivariate models with city/year

and city/year/industry fixed effects, respectively. The coefficient remains effectively unchanged if we add controls for

profits and total assets to these models (columns 3 and 4).

Similarly, adding covariates for exports, employment, and

ownership type does not change the coefficient estimate for

capital mobility (columns 5 and 6). In all six models, the

estimated coefficient on capital mobility is positive and statistically significant at the 1 percent level. Higher shares of

mobile capital are associated with higher effective tax rates.

To interpret the results substantively, consider the model

presented in column 5 in table 1. Here we include fixed effects for city and year, as well as the full set of controls. Holding all other variables constant, an increase in capital mobility from the median value for firms in Shanghai in 2000 to

the third quartile in that group (i.e., from 0.73 to 0.85) is

associated with half percentage point rise in the effective income tax rate (or a 16 percent increase in the tax rate).

The results in table 1 are based on the winsorized dependent variable. In the online appendix, we show the

14

Our main results are effectively unchanged if we include firm fixed effects.

For space reasons, we have not included these results.

Downloaded from https://academic.oup.com/isq/advance-article/doi/10.1093/isq/sqab096/6514648 by guest on 04 February 2022

Figure 1. Density of the effective income tax rates.

Note: The left plot shows the density of the effective income tax rate for the sample derived from the CNSIF for 1995–2007.

The right plot shows the density for the same variable calculated on data from the CSMAR for 2009–2017. Both data sets

contain a large number of firms who pay zero income tax, i.e., both densities spike at zero. At the same time, they display a

large variation in effective income taxes paid by firms.

�LING CHEN

AND

FLORIAN M. HOLLENBACH

7

Table 1. Effective income tax rate (national survey)

Winsorized

Capital mobility

(2)

(3)

(4)

(5)

(6)

0.039**

(0.003)

0.046**

(0.003)

0.042**

(0.003)

−0.001

(0.001)

0.007**

(0.001)

0.048**

(0.003)

−0.001

(0.001)

0.006**

(0.001)

0.046**

(0.003)

−0.001

(0.001)

0.008**

(0.001)

−0.000

(0.000)

0.005**

(0.000)

−0.098**

(0.006)

−0.007*

(0.003)

0.051**

(0.003)

−0.001

(0.001)

0.007**

(0.001)

0.000

(0.000)

0.006**

(0.000)

−0.095**

(0.006)

−0.013**

(0.003)

Yes

Yes

No

Yes

Yes

Yes

Yes

Yes

No

Yes

Yes

Yes

Yes

Yes

No

Yes

Yes

Yes

2,023,967

0.08

2,023,967

0.09

2,023,961

0.08

2,023,961

0.09

1,973,136

0.12

1,973,136

0.13

Profits (ln)

Assets (ln)

Export share

Employees (ln)

Foreign ownership

State ownership

City fixed effects

Year fixed effects

Industry fixed effects

N

Adjusted R2

Notes: Models estimated with standard errors clustered by city. * p < .05; ** p < .01.

The bold rows are emphasized as they are for main independent variables of interest.

same models for the effective tax rates on the original scale

(table A.3 in the online appendix) and the dichotomized

dependent variable (table A.4 in the online appendix).

Throughout all models and specifications of the dependent

variable, we find a positive and statistically significant association between effective income taxes and capital mobility.

With the untransformed dependent variable, the estimated

coefficient on capital mobility is slightly larger. For the

binary dependent variable, we consistently find evidence

that more mobile firms are more likely to pay a positive

effective income tax rate.

In addition to the city and year fixed effects, we estimate

models with the full set of controls for each of the three

dependent variables but with fixed effects for the interactions between city–year and city–year–industry. Table A.6 in

the online appendix shows the results when we add fixed effects for the city–year interaction, in the models presented

in Table A7 in the online appendix, we include fixed effects

for the city–year–industry interaction. Again, the coefficient

of capital mobility is effectively unchanged: Capital mobility

has a positive association with effective income tax rates.15

Table A.5 in the online appendix shows the results when we

estimate our main models (as in table 1) as random instead

of fixed effects models; results are virtually unchanged.

Next, we estimate a similar set of models using the stock

market data. Table 2 shows the estimated coefficients for

capital mobility with the winsorized effective income tax rate

from the stock market data as our dependent variable. As

with the data from the national survey, the coefficient for

capital mobility is generally positive in all six models.16 However, the estimated coefficient is quite small and rounds to

zero in the bivariate model with only city and year fixed effects (column 1).

15

Our results remain if we estimate models with the winsorized dependent

variable on yearly cross-sections and include city fixed effects. Capital mobility is

positively related to effective income tax rates for all years in the sample. Due to

space constraints, we have omitted these results.

16

Note that the stock market data is based on 2009–2017, when China erased

the different corporate tax rates between foreign and domestic firms.

Again, we also estimate these models on the untransformed and dichotomized effective income tax rate. In

models with the untransformed dependent variable, the

coefficient on capital mobility is larger but estimated with

substantially more uncertainty and not statistically significant (Table A.8 in the online appendix). This difference in

results can be traced to only about 170 of the almost 23,000

observations, with very extreme and unrealistic effective income tax rates. With the dichotomized dependent variable,

our main finding remains: firms with more mobile capital

are more likely to pay positive income tax rates (Table A.9

in the online appendix). Our main finding of a positive

relationship remains in models with fixed effects for the

interaction between city and year (Table A.11 in the online

appendix), when we include fixed effects for the city–year–

industry interaction (Table A.12 in the online appendix),

or if we estimate models with random intercepts instead of

fixed effects (Table A.10 in the online appendix). In general, results are quite consistent, with positive coefficient

estimates on capital mobility throughout.

State–Business Collusion as a Moderator

In the previous section, we examined the relationship between capital mobility and effective income tax rates using

two different samples of firm-level data from China. Contrary to conventional wisdom, we find a positive association between capital mobility and effective tax rates, which

challenges the standard assumption that mobile firms generally have advantages over fixed asset firms. Instead, our

results suggest a more complicated reality about the relationship between mobility and taxation. As discussed above,

a reason for this finding is the strategic interaction between firms and governments. Firms with more fixed capital

tend to have advantages under the conditions of constant

government–business collusion. In this section, we further

untangle the mechanisms using qualitative and quantitative

evidence.

Downloaded from https://academic.oup.com/isq/advance-article/doi/10.1093/isq/sqab096/6514648 by guest on 04 February 2022

(1)

�8

Capital Mobility and Taxation

Table 2. Effective income tax rate (stock market data)

Winsorized

Capital mobility

(2)

(3)

(4)

(5)

(6)

0.001

(0.009)

0.017

(0.009)

0.031**

(0.008)

−0.021**

(0.002)

0.035**

(0.002)

0.045**

(0.008)

−0.022**

(0.002)

0.029**

(0.002)

0.036**

(0.009)

−0.019**

(0.002)

0.034**

(0.003)

−0.136**

(0.033)

−0.005**

(0.001)

0.012

(0.013)

0.018*

(0.008)

−0.003

(0.006)

0.049**

(0.009)

−0.022**

(0.002)

0.028**

(0.003)

−0.048

(0.030)

−0.000

(0.001)

0.003

(0.011)

0.013*

(0.006)

0.002

(0.005)

Yes

Yes

No

Yes

Yes

Yes

Yes

Yes

No

Yes

Yes

Yes

Yes

Yes

No

Yes

Yes

Yes

20,945

0.04

20,945

0.15

20,945

0.09

20,945

0.18

15,570

0.10

15,570

0.18

Profits (ln)

Assets (ln)

R&D intensity

Employee benefits (ln)

Foreign ownership

State ownership

Private ownership

City fixed effects

Year fixed effects

Industry fixed effects

N

Adjusted R2

Note: Models estimated with standard errors clustered by city. * p < .05; ** p < .01

The bold rows are emphasized as they are for main independent variables of interest.

Qualitative evidence suggests that firms with a lower degree of mobility, i.e., a higher proportion of fixed assets, are

significantly more likely to invest in political connections to

acquire tax breaks. Moreover, these firms are more likely

to be the targets of public officials seeking gifts. Many of

these businesses rely on natural resource extraction, such

as coal, petroleum, power generation, and mining, where

the location of these resources is geographically constraining and where firms have to interact with government officials intensively to gain access to resources and land. For

example, a coal mining company in the Tongliang county

of Chongqing city with a fixed asset share of 85 percent

was caught bribing a local official with 147,000 yuan. Before the arrest of the official and the firm’s closure, the

company enjoyed an average income tax rate of 10 percent

since its establishment in 2005.17 Similarly, a steel company

in the Liaocheng City of Shandong Province, with a fixed

asset share of 83 percent, had been paying an effective income tax rate of about 3 percent. Nevertheless, the company was on the list of “the top 100 taxpaying companies” in

Liaocheng.18 Liaocheng has recently gained unwanted attention due to an investigation into corruption, money embezzlement, and suicide by public officials.19

Other avenues for firms to gain influence exist as well.

Since its establishment in 1997, a real estate and software

company in Chengdu, Sichuan had successfully received tax

breaks. In the mid-2000s, however, a newly appointed official denied the firm’s qualification for the tax breaks based

on the policy’s restrictions concerning industry type. After

17

Authors’ calculation based on China National Survey of Industrial Firms.

Also, see the report by China Legal Daily at http://www.legaldaily.com.cn/

index/content/2012-05/25/content_3598724. htm?node=20908.

18

Authors’ calculation; also see records at the Tax Bureau of Liaocheng at

http://liaocheng.sd-n-tax.gov.cn/art/2007/11/6/art_22992_49102.html.

19

See, for example, the announcement by Shandong Central Commission for Discipline Inspection at http://www.sdjj.gov.cn/tbbg/201607/

t20160728_11244711.htm.

denial of the tax benefit, a previous colleague of the official

was given a well-paid position in the company. The former

official soon informed his old colleague in government that

the firm’s CEO was a member of the budget committee in

the local People’s Congress, who could influence the budget allocated to the government official’s office. In the end,

the firm was once again approved for the tax break policy.20

Firms with higher capital mobility are not constrained

to particular industries. They range from garments, shoes,

metal processing to auto parts and consumer electronics.

These firms have a higher ability to relocate. In their development, mobile firms are less tied down to local resources

such as mining or land and hence less vulnerable and dependent on local governments. They, therefore, tend to

have weaker incentives to invest resources in bribing, corruption, and networking with local governments. Anticipating that they may move, such investment may not be worth

it in the long run. Similarly, given that government officials

suspect that businesses may not remain in the locality in the

long run, they put less value in relationships with more mobile firms. They tend to take fewer risks engaging in collusion where bribes are exchanged for tax breaks. Not surprisingly, officials had not heard of or were much less familiar

with more mobile firms in their jurisdiction but knew most

fixed asset firms quite well.21

The qualitative evidence brought to bear here suggests a mechanism that links the capital mobility–taxation

relationship to the dynamics of firm–government strategic

interactions. Although each set of the firm-level data does

not allow us to test the proposition directly, we can leverage

the differences across Chinese cities and between different

periods to further investigate the potential mechanism.

20

Interviews with the manager and financial staff of a real estate and software

company, Sichuan, January 2009 and May 2019.

21

Interview with officials in the Bureau of Finance and Bureau of Commerce,

Jiangsu, April 2010.

Downloaded from https://academic.oup.com/isq/advance-article/doi/10.1093/isq/sqab096/6514648 by guest on 04 February 2022

(1)

�LING CHEN

AND

FLORIAN M. HOLLENBACH

First, to examine the potential role of political connections given the estimated relationship in the CNSIF survey,

we use data from the 2005 World Bank Investment Climate Survey (Enterprise Analysis Unit—World Bank Group

2005). The survey investigated various aspects of business–

government relations and was conducted across a sample of

firms in 123 cities in China. The survey included questions

about firms’ interaction with government agencies. We use

the firms’ survey responses about their perceived relationship with tax bureaus as an indicator for political connections at the city level, i.e., better relationships are indicative

of better political connections.

Based on survey responses, we create city-level measures

of government–business relationships for the 123 cities,

which we merge to the firm survey data for 2004 based on

firm locations. While imperfect, we would prefer a firm-level

measure of corruption, this allows us to investigate differences in firm behavior based on city averages. Specifically,

we aim to proxy the city-level environment for corruption

or government–business collusion with the measure of

firm–tax bureau relationships. If our conjecture about the

link between capital mobility, corruption, and tax rates

is correct, then we should observe this relationship play

out differently depending on the city context. We expect

the positive relationship between mobility and tax rates to

be particularly pronounced in cities with more prevalent

government–business collusion.

As a first indication that this is indeed the case, we plot

the bivariate association between firm-level capital mobility

and effective tax rates for two types of cities in figure 2.

In cities where the average relationship between firms and

tax bureaus is below (i.e., worse than) the median of the

tax bureau relationship variable, the bivariate association

is plotted in grey. In contrast, for firms in cities where the

average relationship is above the median, the bivariate

relationship is plotted in black. As the figure suggests, the

relationship between tax rates and mobility is stronger

in cities where government–business relations are better

(more collusion) than the median. In cities with worse

government–business relationships, the linear relationship

between mobility and tax rates is close to zero.

To estimate this potential mechanism using regression

analysis, we regress firms’ effective income tax rates on our

independent variable of interest (capital mobility) interacted with the city-level measure of the relationship between

firms and tax bureaus. We again include the three sets of covariates. In addition, models presented in columns 2, 4, and

6 include city fixed effects, which result in the constituent

term for the tax–bureau relationship to drop out. As table 3

shows, we find evidence in line with the proposed explanation. First, the constituent terms are in the expected direction. Capital mobility has a negative association with tax

rates in cities where relations with the tax bureau are worst,

i.e., when government–business collusion is low, more mobile firms pay lower taxes. At the same time, the constituent

term of our proxy for corruption environment is negative.

Most importantly, in line with the proposed explanation, we

find that the interaction between firm-level capital mobility and city-level firm–tax bureau relationship is positive and

statistically significant. Figure 3 shows the marginal effect of

capital mobility at different levels of city-level firm–tax bureau relationships (based on column 3 in table 3). More

mobile firms pay higher effective tax rates than firms with

more fixed assets in cities with better firm–tax bureau relationships (more collusion). In other words, firms with more

fixed assets pay lower taxes but only in cities with the potential for political connections. This finding holds true across

the full set of controls and if we include city fixed effect, i.e.,

when analyzing only within city variation. In the online appendix, we present results for models with city and industry

fixed effects (Table A.14 in the online appendix), fixed effects for the city–industry interaction (Table A.15 in the online appendix), and with random intercepts (Table A.13 in

the online appendix). Overall, the results are quite similar;

the interaction is always estimated to be positive.22

Anti-Corruption Campaign as a Tipping Point

In November 2012, President Xi Jinping took power in

China and subsequently launched a major anti-corruption

campaign in 2013, which continues to this day. The campaign aims to curb rampant corruption and government–

business collusion in China (Manion 2016). Along with the

campaign, in 2014, the State Council of the central government issued a “Notice on Clearing and Regulating Taxation and Other Preferential Policies,” which started a crackdown on local governments offering tax breaks based on

government–business collusion. Any such tax break would

now have to be inspected and approved by the State Council

of the central state (The State Council of China 2014). However, the central government later provided a grace period

to fend off potential lawsuits by businesses (The State Council of China 2015). The crackdown reduced the issuance of

illegitimate tax breaks based on government–business connections or bribery (Ye 2017). As a result, many bureaucrats

started avoiding direct contact with business owners. The

frequency with which public officials would attend banquets

with business leaders, another avenue for gifts or money to

be presented to public officials, sharply declined. Overall,

the campaign significantly changed how governments and

businesses interact (Ang 2020).

22

We have run the same regression models but using time spent with tax bureaus as the proxy for corruption potential. While we find a positive interaction

effect, the estimate is not significant when standard errors are clustered at the city

level. For space reasons, we have omitted those results.

Downloaded from https://academic.oup.com/isq/advance-article/doi/10.1093/isq/sqab096/6514648 by guest on 04 February 2022

Figure 2. Relationship between mobility and income tax

rates across cities.

Note: This figure shows the relationship between city average capital mobility and effective tax rates for cities with below and above median firm–tax bureau relationships. The

positive association between mobility and tax rates is only

present in cities with above median government–business

relationships (higher collusion).

9

�10

Capital Mobility and Taxation

Table 3. Effective income tax rate—relationship with tax bureaus (national survey)

Winsorized

Capital mobility

Relationship with tax bureau

Capital mobility × tax bureau

(2)

(3)

(4)

(5)

(6)

−0.126

(0.067)

−0.093**

(0.015)

0.045*

(0.019)

−0.098**

(0.036)

−0.100**

(0.037)

−0.110

(0.058)

−0.091**

(0.015)

0.044**

(0.016)

−0.007**

(0.001)

0.004**

(0.001)

0.012*

(0.005)

0.005*

(0.002)

−0.122**

(0.008)

−0.039**

(0.007)

−0.046

(0.042)

0.036**

(0.010)

−0.127*

(0.064)

−0.089**

(0.016)

0.044*

(0.018)

−0.009**

(0.002)

−0.001

(0.002)

0.023*

(0.012)

−0.007**

(0.001)

0.004**

(0.001)

−0.003

(0.004)

0.009**

(0.001)

−0.114**

(0.009)

−0.023**

(0.004)

No

Yes

No

Yes

No

Yes

165,423

0.01

165,423

0.09

165,423

0.02

165,423

0.10

165,168

0.11

165,168

0.17

Profits (ln)

Assets (ln)

0.036**

(0.010)

−0.009**

(0.001)

0.003

(0.002)

Exports (ln)

Employees (ln)

Foreign ownership

State ownership

City FE

N

Adjusted R2

Note: Models estimated with standard errors clustered by city. * p < .05, ** p < .01.

The bold rows are emphasized as they are for main independent variables of interest.

Figure 3. Marginal effect of capital mobility.

Note: This figure shows the marginal effect of capital mobility conditional on the city average score of firm–tax bureau

relationships. As the relationship between firms and the tax

bureau becomes cozier (higher scores), the estimated effect

of capital mobility is increasingly positive.

We use this anti-corruption campaign as a potential shock

to the system of corruption. Suppose the prevalence of

state-–business collusion and bribery is crucial in the relationship between capital mobility and firm taxation. In

that case, the relationship should change with the anticorruption campaign. To test this proposition, we use the

stock market data and estimate the same models as above

but interact our independent variables with an indicator

variable that is zero for the period from 2009 to 2013 (including) and one for years starting 2014 and afterward.

Table 4 presents the results regarding the interaction of

capital mobility with the post-2013 dummy when estimated

on the winsorized dependent variable. For these models,

estimating the effect of mobility in the pre- and post-anticorruption campaign periods, we alternatively include city

and year (columns 1, 3, 5) or firm and year fixed effects

(columns 2, 4, 6). In models with firm and year fixed effects, constant firm-level differences are absorbed, and we

can estimate how firms are affected differently before and

after the start of the anti-corruption campaign (similar to a

difference-in-differences design).

The positive and significant estimate for the constituent

term of capital mobility indicates the positive association in

the period until 2013. After the anti-corruption campaign

went into full effect in 2014, the relationship between capital mobility and effective income taxation is substantially

weaker. Depending on the specific model, the estimated

relationship is halved for the period after 2013. In general,

these results hold across all three of our dependent variables.23 The positive relationship between capital mobility

and tax rates disappears after the Chinese government

cracked down on local corruption and government–

business collusion. The advantage for firms with higher

shares of fixed assets is much smaller after 2013. These

results, especially where we include firm fixed effects, are

quite strong evidence for the idea that the anti-corruption

campaign significantly weakened the mechanism by which

fixed-asset firms gained an advantage over mobile firms.24

In table A.18 in the online appendix, we present the results

23

The estimates of the post-2013 interaction effect are generally robust to using the untransformed effective rate (table A.16 in the online appendix) or the

binary coding (table A.17 in the online appendix) as the dependent variable. In

some of the models without any control variables, we do find insignificant interaction effects.

24

These results generally remain the same if we interact all covariates with the

pre-/post-2013 interaction. Due to space constraints, we have not included those

results.

Downloaded from https://academic.oup.com/isq/advance-article/doi/10.1093/isq/sqab096/6514648 by guest on 04 February 2022

(1)

�LING CHEN

AND

FLORIAN M. HOLLENBACH

11

Table 4. Effective income tax rate (stock market data)—pre-/post-2013

Winsorized

Capital mobility

Capital mobility × post 2013

Profits (ln)

Assets (ln)

Assets (ln) × post 2013

(2)

(3)

(4)

(5)

(6)

0.010

(0.010)

−0.019*

(0.009)

−0.023**

(0.002)

0.002

(0.003)

0.037**

(0.003)

−0.003

(0.003)

0.033**

(0.013)

−0.016

(0.009)

−0.022**

(0.003)

−0.000

(0.003)

0.031**

(0.004)

0.001

(0.003)

0.043**

(0.009)

−0.024**

(0.009)

−0.022**

(0.002)

0.006

(0.004)

0.037**

(0.003)

−0.005

(0.004)

−0.190**

(0.030)

0.098**

(0.036)

−0.004**

(0.001)

−0.003

(0.001)

0.007

(0.012)

0.011

(0.016)

0.015

(0.009)

0.007

(0.009)

−0.002

(0.007)

−0.003

(0.009)

0.062**

(0.012)

−0.026**

(0.009)

−0.022**

(0.003)

0.004

(0.004)

0.034**

(0.005)

−0.001

(0.004)

−0.132*

(0.061)

0.035

(0.055)

−0.003

(0.002)

−0.003*

(0.002)

0.011

(0.021)

0.008

(0.016)

−0.001

(0.013)

0.006

(0.010)

0.008

(0.012)

−0.005

(0.009)

0.046**

(0.009)

−0.028*

(0.012)

0.047**

(0.013)

−0.025*

(0.010)

Yes

No

Yes

No

Yes

Yes

Yes

No

Yes

No

Yes

Yes

Yes

No

Yes

No

Yes

Yes

20,945

0.04

20,945

0.34

20,945

0.09

20,945

0.36

15,570

0.10

15,570

0.38

R&D intensity

R&D intensity × post 2013

Employee benefits (ln)

Employee benefits (ln) × post 2013

Foreign ownership

Foreign ownership × post 2013

State ownership

State ownership × post 2013

Private ownership

Private ownership × post 2013

City fixed effects

Firm fixed effects

Year fixed effects

N

Adjusted R2

Note: Models estimated with standard errors clustered by city. * p < .05; ** p < .01

The bold rows are emphasized as they are for main independent variables of interest.

when we interact our main independent variable with the

year fixed effects, i.e., estimating year-specific effects for

capital mobility. Alternatively, we interact capital mobility

and all covariates with the year fixed effects. To better visualize the results, figure 4 presents the coefficient estimates

for capital mobility from model 4 in table A.18 in the online

appendix. As one can see, the relationship between capital

mobility and effective tax rates becomes weaker over time.

In line with the initial grace period mentioned above, the

relationship first weakens and turns negative in 2016. We

do find a significant positive effect in 2014, likely due to the

fact that a grace period was offered. Thus, firms and local

officials rushed to get tax cuts done before the end of the

grace period.

As the last test of the potential mechanism outlined

above, we use a city-level measure of fiscal transparency as

a moderator of the capital mobility–taxation relationship.

As part of Xi’s effort to establish a more efficient market

and cleaning up the bureaucracy, the Third Plenum of the

18th Party Congress implemented the decision to increase

fiscal transparency in cities nationwide (China CCP Central

Committee 2013). Tax rates should be based strictly on rules

and laws rather than personal relations in more transparent

cities. If our argument is correct, we should see less of a positive relationship between mobility and effective tax rates in

more fiscally transparent cities. Additionally, and in accordance with the findings above, we should expect the interactive relationship between fiscal capacity and mobility to

matter less in later years as the anti-corruption crackdown

takes effect. We test this argument by merging the city fiscal

transparency index from the reports published by Tsinghua

University (Yu 2018) to the stock market data from 2014 to

2018.25

As table 5 shows, in line with our expectations, we find a

positive and significant effect of capital mobility for 2014,

while the interaction with fiscal transparency is negative

25

We used the final scores of fiscal transparency for each city and rescaled

each year’s full score to 100. For more information, see http://www.sppm.

tsinghua.edu.cn/xycbw/yjbg/.

Downloaded from https://academic.oup.com/isq/advance-article/doi/10.1093/isq/sqab096/6514648 by guest on 04 February 2022

Profits (ln) × post 2013

(1)

�12

Capital Mobility and Taxation

Figure 5. Marginal effect of capital mobility by fiscal transparency in 2014.

Note: This figure shows the marginal effect of capital mobility

conditional on the city’s fiscal transparency score for 2014.

As fiscal transparency increases (higher score), the positive

relationship between capital mobility and effective tax rates

disappears.

and significant. Figure 5 shows the marginal effect of capital mobility for 2014. As one can see, the positive relationship of capital mobility with effective tax rates decreases

with higher levels of fiscal transparency. Similar results are

true for 2015, but the relationship disappears in 2016 and

2017. At this point, the anti-corruption campaign had taken

full effect, and firms and officials nationwide were increasingly less likely to collude. Tables A.19 and A.20 in the

Table 5. Interaction with fiscal transparency (stock market data)

Winsorized

Capital mobility

Fiscal transparency (ln)

Capital mobility × transparency

Profits (ln)

Assets (ln)

R&D intensity

Employee benefits (ln)

Ownership other

Foreign ownership

State ownership

Private ownership

2014

2014

2015

2015

2016

2016

2017

2017

0.310**

(0.097)

0.034*

(0.016)

−0.071**

(0.025)

−0.035**

(0.003)

0.051**

(0.004)

−0.088

(0.076)

−0.005*

(0.002)

−0.349**

(0.073)

−0.309**

(0.071)

−0.325**

(0.073)

−0.342**

(0.071)

0.362**

(0.095)

0.251*

(0.106)

−0.029

(0.034)

−0.019

(0.019)

−0.029

(0.021)

0.263

(0.248)

0.042

(0.036)

−0.076

(0.060)

−0.045**

(0.008)

0.045**

(0.008)

−0.118

(0.051)

0.001

(0.003)

−0.137

(0.163)

−0.129

(0.159)

−0.143

(0.164)

−0.143

(0.161)

0.679

(0.395)

0.002

(0.020)

−0.025

(0.019)

−0.198

(0.247)

−0.025

(0.033)

0.040

(0.059)

−0.035**

(0.008)

0.044**

(0.008)

−0.029