HSL PCG "Currency Daily": 15 December, 2016

HSL PCG "Currency Daily": 15 December, 2016

Uploaded by

shobhaCopyright:

Available Formats

HSL PCG "Currency Daily": 15 December, 2016

HSL PCG "Currency Daily": 15 December, 2016

Uploaded by

shobhaOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Copyright:

Available Formats

HSL PCG "Currency Daily": 15 December, 2016

HSL PCG "Currency Daily": 15 December, 2016

Uploaded by

shobhaCopyright:

Available Formats

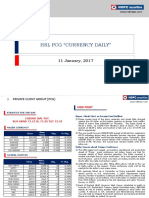

HSL PCG CURRENCY DAILY

15 December, 2016

PRIVATE CLIENT GROUP [PCG]

MAJOR CURRENCY VIEW POINT

Prev.

Close Chg. % Chg. Rupee Depreciation on Card on Feds Rate Hike

Close

USDINR 67.445 67.540 -0.095 -0.14% The Indian rupee closed stronger against the US dollar on cool down

DXY INDX 102.220 100.94 1.280 1.27% in inflation. The rupee closed at 67.45 per US dollar--up 0.14% from

EURUSD 1.052 1.065 -0.013 -1.21% its previous close of 67.54. The home currency opened at 67.55

GBPUSD 1.255 1.265 -0.010 -0.76% against the US dollar. So far this year, it has fallen 1.9%.

USDJPY 117.240 114.92 2.320 2.02% The benchmark 10-year government bond yield closed at 6.406%,

DG USDINR 67.760 67.536 0.224 0.33% compared to Tuesdays close of 6.419%.

Wholesale inflation eased for the third straight month as it fell to

3.15% in November after subdued demand due to demonetisation

GLOBAL INDICES

led to softening of prices of vegetables and other kitchen staples.

The one month forward USDINR NDF quoted at 68.00 from

Prev. yesterdays 67.66 5pm(IST) indicating strong opening at domestic

Close Chg. % Chg.

Close bourses. The USDINR will move higher on stronger overseas dollar.

SGX NIFTY 8116.5 8184.5 -68 -0.83% Technically, the Spot USDINR is having support around 67.30 marks

NIFTY 8182.5 8221.8 -39 -0.48% while continue to resist at 67.75 and 68.21

SENSEX 26602.8 26697.8 -95 -0.36%

Dollar Rises To 14 Year High After Feds Hawkish Stance

HANG-SENG 22102.0 22456.6 -355 -1.58%

After a years long time, the fed has raised interest rates by 25bps.

NIKKEI 19225.2 19253.6 -28 -0.15% This was 100% discounted. The FOMC raised rate range by 25 bps

SHANGHAI 3132.1 3140.5 -8 -0.27% to 0.50 to 0.75%. Additionally, the appropriated fed funds rate for

S&P INDEX 2253.3 2271.7 -18 -0.81% the end 2017 has shifted upwards to imply 3 rate increases rather

DOW JONES 19792.5 19911.2 -119 -0.60% than expectation of two on view of rise in growth. Verbally, Yellen

NASDAQ 5436.7 5463.8 -27 -0.50% emphasised the change in forecasts as only a modest adjustment

and continued the stance that the evolution of economy warranted

FTSE 6949.2 6968.6 -19 -0.28%

only gradual increases.

CAC 4769.2 4803.9 -35 -0.72% The dollar spiked higher on the announcement. A stronger dollar is

DAX 11244.8 11284.7 -40 -0.35% todays theme with crowded trade which will be a favourable trades

of the day as the demand for the dollar likely to rise.

INSTITUTIONAL ACTIVITY (Provisional Rs. In Cr) The dollar hovered near a 14-year peak against a basket of major

currencies today, receiving a major boost after the Federal Reserve

Segment 14-Dec-16 13-Dec-16 increased the number of projected interest rate hikes for 2017. The

dollar index stood at 102.22 after rising to 102.350 overnight, its

Equity -731.86 334.03 highest since January 2003.

Debt -411.44 -245.64 Market is re-pricing additional Fed hikes in 2017 though financial

markets are not under stress and fiscal policy is set to turn

expansionary. The bias for the buck remains bullish with higher side

109.24 and support at 99.43.

PRIVATE CLIENT GROUP [PCG]

TECHNICAL OUTLOOK

SPOT USDINR DAILY CHART

Technical Observations

USDINR drifted lower after day before yesterdays gain. The pair closed at 67.45 with loss of 0.14%.

The pair has the support around 67.11, the 200 Days simple moving average.

Momentum oscillators entered in oversold territory indicating short covering.

In near term, the pair likely to move higher on positive breakout in dollar index. The USDINR could move towards 68.21 with

support of 67.30.

PRIVATE CLIENT GROUP [PCG]

TECHNICAL LEVELS

Near Month Fut. Last Pivot S3 S2 S1 R1 R2 R3 View For The Day

USDINR 67.51 67.54 67.27 67.37 67.44 67.61 67.71 67.78 Short Covering

EURINR 71.91 71.95 71.41 71.61 71.76 72.10 72.30 72.45 Bearish

GBPINR 85.44 85.50 84.93 85.14 85.29 85.65 85.86 86.01 Bearish

JPYINR 58.84 58.81 58.43 58.54 58.69 58.96 59.07 59.22 Bearish

Wkly Wkly 1-Mth. 1-Mth. 52 Wk 52 Wk

Spot 5 DMA 20 DMA 50 DMA 100 DMA 200 DMA

High Low High Low High Low

USDINR 68.27 67.33 68.86 66.34 68.86 66.07 67.48 68.10 67.30 67.11 67.12

EURINR 73.35 71.42 75.64 71.42 77.49 71.42 72.01 72.56 73.22 74.00 74.64

GBPINR 86.88 84.83 86.88 82.20 100.77 80.89 85.29 85.41 83.61 85.62 90.05

JPYINR 60.14 58.78 66.11 58.08 68.11 53.86 58.73 60.25 62.45 64.09 63.07

CURRENCY MOVEMENT

Open Chg. In

Currency Open High Low Close Chg. Chg. in OI Volume

Interest Volume

SPOT USDINR 67.55 67.59 67.43 67.45 -0.10 -- -- -- --

USDINR DEC. FUT. 67.57 67.64 67.47 67.51 -0.08 1716971 128575 1081737 -447511

SPOT EURINR 71.83 72.02 71.65 71.76 0.10 -- -- -- --

EURINR DEC. FUT. 71.92 72.15 71.80 71.91 0.10 34153 -2347 37863 7458

SPOT GBPINR 85.48 85.62 85.23 85.32 -0.43 -- -- -- --

GBPINR DEC. FUT. 85.67 85.72 85.36 85.44 -0.39 27953 4068 35334 -6343

SPOT JPYINR 58.61 58.78 58.53 58.69 0.15 -- -- -- --

JPYINR DEC. FUT. 58.66 58.92 58.66 58.84 0.21 38178 41 19876 -2188

PRIVATE CLIENT GROUP [PCG]

ECONOMIC EVENTS RELEASED

Date Time Country Event Period Survey Actual Prior

12/14/2016 10:00 JN Industrial Production YoY Oct F -- -1.40% -1.30%

12/14/2016 12:00 IN Wholesale Prices YoY Nov 3.10% 3.15% 3.39%

12/14/2016 15:30 EC Industrial Production WDA YoY Oct 0.90% 0.60% 1.20%

12/14/2016 17:30 US MBA Mortgage Applications 9-Dec -- -4.00% -0.70%

12/14/2016 19:00 US PPI Final Demand YoY Nov 0.90% 1.30% 0.80%

12/14/2016 19:45 US Industrial Production MoM Nov -0.20% -0.40% 0.00%

12/14/2016 19:45 US Manufacturing (SIC) Production Nov -0.40% -0.10% 0.20%

12/15/2016 00:30 US FOMC Rate Decision (Upper Bound) 14-Dec 0.50%-0.75% 0.50%-0.75% 0.25%-0.50%

ECONOMIC EVENTS RELEASED

Date Time Country Event Period Survey Prior

12/15/2016 14:30 EC Markit Eurozone Manufacturing PMI Dec P 53.7 53.7

12/15/2016 14:30 EC Markit Eurozone Services PMI Dec P 53.7 53.8

12/15/2016 17:30 UK Bank of England Bank Rate 15-Dec 0.25% 0.25%

12/15/2016 17:30 UK BOE Asset Purchase Target Dec 435b 435b

12/15/2016 17:30 UK BOE Corporate Bond Target Dec 10b 10b

12/15/2016 19:00 US Current Account Balance 3Q -$111.0b -$119.9b

12/15/2016 19:00 US Empire Manufacturing Dec 2.6 1.5

12/15/2016 19:00 US CPI YoY Nov 1.70% 1.60%

12/15/2016 19:00 US Initial Jobless Claims 10-Dec -- 258k

12/15/2016 19:00 US Continuing Claims 3-Dec -- 2005k

12/15/2016 20:15 US Markit US Manufacturing PMI Dec P -- 54.1

PRIVATE CLIENT GROUP [PCG]

Technical Analyst: Vinay Rajani (vinay.rajani@hdfcsec.com)

Currency Analyst: Dilip Parmar(dilip.parmar@hdfcsec.com)

HDFC securities Limited, I Think Techno Campus, Building - B, "Alpha", Office Floor 8, Near Kanjurmarg Station, Opp. Crompton Greaves, Kanjurmarg (East), Mumbai 400 042

HDFC securities Limited, 4th Floor, Astral Tower, Above HDFC Bank Ltd, Nr.Mithakhali Six Roads, Navrangpura, Ahmedabad 380009.

Phone: (079)66070168, Website: www.hdfcsec.com Email: pcg.advisory@hdfcsec.com

Disclosure:

I/We, Dilip Parmar and Vinay Rajani, MBA, hereby certify that all of the views expressed in this research report accurately reflect my views about the subject issuer (s) or securities. I also certify that no part of our

compensation was, is, or will be directly or indirectly related to the specific recommendation(s) or view(s) in his report.

Research Analyst or his/her relative does not have any financial interest in the subject company. Also HDFC Securities Ltd. or its Associate may have beneficial ownership of 1% or more in the subject instrument at the end of

the month immediately preceding the date of publication of the Research Report.

Further Research Analyst or his relative or HDFC Securities Ltd. or its associate does not have any material conflict of interest.

Any position in Instruments NO

Disclaimer:

This report has been prepared by HDFC Securities Ltd and is meant for sole use by the recipient and not for circulation. The information and opinions contained herein have been compiled or arrived at, based upon information

obtained in good faith from sources believed to be reliable. Such information has not been independently verified and no guaranty, representation of warranty, express or implied, is made as to its accuracy, completeness or

correctness. All such information and opinions are subject to change without notice. This document is for information purposes only. Descriptions of any company or companies or their securities mentioned herein are not

intended to be complete and this document is not, and should not be construed as an offer or solicitation of an offer, to buy or sell any securities or other financial instruments.

This report is not directed to, or intended for display, downloading, printing, reproducing or for distribution to or use by, any person or entity who is a citizen or resident or located in any locality, state, country or other

jurisdiction where such distribution, publication, reproduction, availability or use would be contrary to law or regulation or what would subject HDFC Securities Ltd or its affiliates to any registration or licensing requirement

within such jurisdiction.

If this report is inadvertently send or has reached any individual in such country, especially, USA, the same may be ignored and brought to the attention of the sender. This document may not be reproduced, distributed or

published for any purposes without prior written approval of HDFC Securities Ltd.

Foreign currencies denominated securities, wherever mentioned, are subject to exchange rate fluctuations, which could have an adverse effect on their value or price, or the income derived from them. In addition, investors in

securities such as ADRs, the values of which are influenced by foreign currencies effectively assume currency risk.

It should not be considered to be taken as an offer to sell or a solicitation to buy any security. HDFC Securities Ltd may from time to time solicit from, or perform broking, or other services for, any company mentioned in this

mail and/or its attachments.

HDFC Securities and its affiliated company(ies), their directors and employees may; (a) from time to time, have a long or short position in, and buy or sell the securities of the company(ies) mentioned herein or (b) be

engaged in any other transaction involving such securities and earn brokerage or other compensation or act as a market maker in the financial instruments of the company(ies) discussed herein or act as an advisor or

lender/borrower to such company(ies) or may have any other potential conflict of interests with respect to any recommendation and other related information and opinions.

HDFC Securities Ltd, its directors, analysts or employees do not take any responsibility, financial or otherwise, of the losses or the damages sustained due to the investments made or any action taken on basis of this report,

including but not restricted to, fluctuation in the prices of shares and bonds, changes in the currency rates, diminution in the NAVs, reduction in the dividend or income, etc.

HDFC Securities Ltd and other group companies, its directors, associates, employees may have various positions in any of the stocks, securities and financial instruments dealt in the report, or may make sell or purchase or

other deals in these securities from time to time or may deal in other securities of the companies / organizations described in this report.

HDFC Securities or its associates might have managed or co-managed public offering of securities for the subject company or might have been mandated by the subject company for any other assignment in the past twelve

months.

HDFC Securities or its associates might have received any compensation from the companies mentioned in the report during the period preceding twelve months from the date of this report for services in respect of managing

or co-managing public offerings, corporate finance, investment banking or merchant banking, brokerage services or other advisory service in a merger or specific transaction in the normal course of business.

HDFC Securities or its analysts did not receive any compensation or other benefits from the companies mentioned in the report or third party in connection with preparation of the research report. Accordingly, neither HDFC

Securities nor Research Analysts have any material conflict of interest at the time of publication of this report. Compensation of our Research Analysts is not based on any specific merchant banking, investment banking or

brokerage service transactions. HDFC Securities may have issued other reports that are inconsistent with and reach different conclusion from the information presented in this report.

Research entity has not been engaged in market making activity for the subject company. Research analyst has not served as an officer, director or employee of the subject company. We have not received any

compensation/benefits from the Subject Company or third party in connection with the Research Report.

This report has been prepared by the PCG team of HDFC Securities Ltd. The views, opinions, estimates, ratings, target price, entry prices and/or other parameters mentioned in this document may or may not match or may

be contrary with those of the other Research teams (Institutional, Retail) of HDFC Securities Ltd.

"HDFC Securities Ltd. is a SEBI Registered Research Analyst having registration no. INH000002475.

PRIVATE CLIENT GROUP [PCG]

You might also like

- Presentation On Analysis of Mutual Fund As AnNo ratings yetPresentation On Analysis of Mutual Fund As An19 pages

- HSL PCG "Currency Daily": 03 November, 2016No ratings yetHSL PCG "Currency Daily": 03 November, 20166 pages

- HSL PCG "Currency Daily": 16 December, 2016No ratings yetHSL PCG "Currency Daily": 16 December, 20166 pages

- HSL PCG "Currency Daily": 14 February, 2017No ratings yetHSL PCG "Currency Daily": 14 February, 20176 pages

- HSL PCG "Currency Daily": 17 February, 2017No ratings yetHSL PCG "Currency Daily": 17 February, 20176 pages

- HSL PCG "Currency Daily": 08 December, 2016No ratings yetHSL PCG "Currency Daily": 08 December, 20166 pages

- HSL PCG "Currency Daily": 18 November, 2016No ratings yetHSL PCG "Currency Daily": 18 November, 20166 pages

- HSL PCG "Currency Daily": 23 December, 2016No ratings yetHSL PCG "Currency Daily": 23 December, 20166 pages

- HSL PCG "Currency Daily": 26 October, 2016No ratings yetHSL PCG "Currency Daily": 26 October, 20166 pages

- HSL PCG "Currency Daily": 14 December, 2016No ratings yetHSL PCG "Currency Daily": 14 December, 20166 pages

- HSL PCG "Currency Daily": 17 November, 2016No ratings yetHSL PCG "Currency Daily": 17 November, 20166 pages

- HSL PCG "Currency Daily": 18 October, 2016No ratings yetHSL PCG "Currency Daily": 18 October, 20166 pages

- HSL PCG "Currency Daily": 03 March, 2017No ratings yetHSL PCG "Currency Daily": 03 March, 20176 pages

- HSL PCG "Currency Daily": 27 December, 2016No ratings yetHSL PCG "Currency Daily": 27 December, 20166 pages

- HSL PCG "Currency Daily": 01 March, 2017No ratings yetHSL PCG "Currency Daily": 01 March, 20176 pages

- HSL PCG "Currency Daily": 25 November, 2016No ratings yetHSL PCG "Currency Daily": 25 November, 20166 pages

- HSL PCG "Currency Daily": 02 March, 2017No ratings yetHSL PCG "Currency Daily": 02 March, 20176 pages

- HSL PCG "Currency Daily": 21 October, 2016No ratings yetHSL PCG "Currency Daily": 21 October, 20166 pages

- HSL PCG "Currency Daily": 09 February, 2017No ratings yetHSL PCG "Currency Daily": 09 February, 20176 pages

- HSL PCG "Currency Daily": 19 October, 2016No ratings yetHSL PCG "Currency Daily": 19 October, 20166 pages

- HSL PCG "Currency Daily": 16 February, 2017No ratings yetHSL PCG "Currency Daily": 16 February, 20176 pages

- HSL PCG "Currency Daily": 19 January, 2017No ratings yetHSL PCG "Currency Daily": 19 January, 20176 pages

- HSL PCG "Currency Daily": 01 December, 2016No ratings yetHSL PCG "Currency Daily": 01 December, 20166 pages

- HSL PCG "Currency Daily": 03 February, 2017No ratings yetHSL PCG "Currency Daily": 03 February, 20176 pages

- HSL PCG "Currency Daily": 06 December, 2016No ratings yetHSL PCG "Currency Daily": 06 December, 20166 pages

- HSL PCG "Currency Daily": 08 February, 2017No ratings yetHSL PCG "Currency Daily": 08 February, 20176 pages

- HSL PCG "Currency Daily": 02 December, 2016No ratings yetHSL PCG "Currency Daily": 02 December, 20166 pages

- HSL PCG "Currency Daily": 29 November, 2016No ratings yetHSL PCG "Currency Daily": 29 November, 20166 pages

- HSL PCG "Currency Daily": 06 January, 2017No ratings yetHSL PCG "Currency Daily": 06 January, 20176 pages

- HSL PCG "Currency Daily": 20 December, 2016No ratings yetHSL PCG "Currency Daily": 20 December, 20166 pages

- HSL PCG "Currency Daily": 30 November, 2016No ratings yetHSL PCG "Currency Daily": 30 November, 20166 pages

- HSL PCG "Currency Daily": 28 December, 2016No ratings yetHSL PCG "Currency Daily": 28 December, 20166 pages

- HSL PCG "Currency Daily": 23 February, 2017No ratings yetHSL PCG "Currency Daily": 23 February, 20176 pages

- HSL PCG "Currency Daily": 02 February, 2017No ratings yetHSL PCG "Currency Daily": 02 February, 20176 pages

- HSL PCG "Currency Daily": 10 January, 2017No ratings yetHSL PCG "Currency Daily": 10 January, 20176 pages

- HSL PCG "Currency Daily": 28 February, 2017No ratings yetHSL PCG "Currency Daily": 28 February, 20176 pages

- HSL PCG "Currency Daily": 23 November, 2016No ratings yetHSL PCG "Currency Daily": 23 November, 20166 pages

- HSL PCG "Currency Daily": 31 January, 2017No ratings yetHSL PCG "Currency Daily": 31 January, 20176 pages

- HSL PCG "Currency Daily": 05 January, 2017No ratings yetHSL PCG "Currency Daily": 05 January, 20176 pages

- HSL PCG "Currency Daily": 22 February, 2017No ratings yetHSL PCG "Currency Daily": 22 February, 20176 pages

- HSL PCG "Currency Daily": 29 December, 2016No ratings yetHSL PCG "Currency Daily": 29 December, 20166 pages

- HSL PCG "Currency Daily": 24 January, 2017No ratings yetHSL PCG "Currency Daily": 24 January, 20176 pages

- HSL PCG "Currency Daily": 20 January, 2017No ratings yetHSL PCG "Currency Daily": 20 January, 20176 pages

- HSL PCG "Currency Daily": 08 November, 2016No ratings yetHSL PCG "Currency Daily": 08 November, 20166 pages

- HSL PCG "Currency Daily": 12 January, 2017No ratings yetHSL PCG "Currency Daily": 12 January, 20176 pages

- HSL PCG "Currency Daily": 18 January, 2017No ratings yetHSL PCG "Currency Daily": 18 January, 20176 pages

- HSL PCG "Currency Daily": 11 January, 2017No ratings yetHSL PCG "Currency Daily": 11 January, 20176 pages

- HSL PCG "Currency Insight"-Weekly: 13 February, 2017No ratings yetHSL PCG "Currency Insight"-Weekly: 13 February, 201716 pages

- HSL PCG "Currency Daily": 17 January, 2017No ratings yetHSL PCG "Currency Daily": 17 January, 20176 pages

- HSL PCG "Currency Daily": 25 January, 2017No ratings yetHSL PCG "Currency Daily": 25 January, 20176 pages

- HSL PCG "Currency Insight"-Weekly: 07 January, 2017No ratings yetHSL PCG "Currency Insight"-Weekly: 07 January, 201716 pages

- HSL PCG "Currency Insight"-Weekly: 04 February, 2017No ratings yetHSL PCG "Currency Insight"-Weekly: 04 February, 201716 pages

- HSL PCG "Currency Insight"-Weekly: 26 December, 2016No ratings yetHSL PCG "Currency Insight"-Weekly: 26 December, 201616 pages

- HSL PCG "Currency Insight"-Weekly: 18 February, 2017No ratings yetHSL PCG "Currency Insight"-Weekly: 18 February, 201716 pages

- HSL PCG "Currency Insight"-Weekly: 24 October, 2016No ratings yetHSL PCG "Currency Insight"-Weekly: 24 October, 201616 pages

- Stock Market Reports For The Week (21st - 25th March - 2011)No ratings yetStock Market Reports For The Week (21st - 25th March - 2011)6 pages

- Currency Street: The Greenback Up Amidst Disappointing June DataNo ratings yetCurrency Street: The Greenback Up Amidst Disappointing June Data5 pages

- The Increasing Importance of Migrant Remittances from the Russian Federation to Central AsiaFrom EverandThe Increasing Importance of Migrant Remittances from the Russian Federation to Central AsiaNo ratings yet

- Asia Small and Medium-Sized Enterprise Monitor 2022: Volume I: Country and Regional ReviewsFrom EverandAsia Small and Medium-Sized Enterprise Monitor 2022: Volume I: Country and Regional ReviewsNo ratings yet

- HSL PCG "Currency Insight"-Weekly: 03 December, 2016No ratings yetHSL PCG "Currency Insight"-Weekly: 03 December, 201616 pages

- Corporate Event Tracker: Tracker of Forthcoming Corporate Action From February 16, 2017 To March 01, 2017No ratings yetCorporate Event Tracker: Tracker of Forthcoming Corporate Action From February 16, 2017 To March 01, 20172 pages

- HSL PCG "Currency Daily": 14 September, 2016No ratings yetHSL PCG "Currency Daily": 14 September, 20165 pages

- Mahindra Holidays & Resorts India (MHRIL) : PCG ResearchNo ratings yetMahindra Holidays & Resorts India (MHRIL) : PCG Research15 pages

- HSL PCG "Currency Daily": 09 September, 2016No ratings yetHSL PCG "Currency Daily": 09 September, 20166 pages

- HSL PCG "Currency Daily": 30 August, 2016No ratings yetHSL PCG "Currency Daily": 30 August, 20166 pages

- HSL PCG "Currency Daily": 08 September, 2016No ratings yetHSL PCG "Currency Daily": 08 September, 20166 pages

- HSL PCG "Currency Daily": 01 September, 2016No ratings yetHSL PCG "Currency Daily": 01 September, 20166 pages

- HSL PCG "Currency Daily": 26 August, 2016No ratings yetHSL PCG "Currency Daily": 26 August, 20166 pages

- BSP Manual For Agents - Local Procedures: Vietnam 2013 EnglishNo ratings yetBSP Manual For Agents - Local Procedures: Vietnam 2013 English20 pages

- National Testing Service: Muslim Commercial Bank-McbNo ratings yetNational Testing Service: Muslim Commercial Bank-Mcb1 page

- ACTBAS1 - Lesson 2 (Statement of Financial Position)No ratings yetACTBAS1 - Lesson 2 (Statement of Financial Position)47 pages

- Indian Banking Industry by Ravi Ranjan SirNo ratings yetIndian Banking Industry by Ravi Ranjan Sir20 pages

- Instant Download The Unbanking of America How The New Middle Class Survives Lisa Servon PDF All Chapters100% (4)Instant Download The Unbanking of America How The New Middle Class Survives Lisa Servon PDF All Chapters62 pages

- Tanzania Mortgage Market Update 30 June 2016 FinalNo ratings yetTanzania Mortgage Market Update 30 June 2016 Final10 pages

- Case Study 3 - Westminster Company - ICO Bobby Norton0% (1)Case Study 3 - Westminster Company - ICO Bobby Norton10 pages

- HSL PCG "Currency Insight"-Weekly: 13 February, 2017HSL PCG "Currency Insight"-Weekly: 13 February, 2017

- HSL PCG "Currency Insight"-Weekly: 07 January, 2017HSL PCG "Currency Insight"-Weekly: 07 January, 2017

- HSL PCG "Currency Insight"-Weekly: 04 February, 2017HSL PCG "Currency Insight"-Weekly: 04 February, 2017

- HSL PCG "Currency Insight"-Weekly: 26 December, 2016HSL PCG "Currency Insight"-Weekly: 26 December, 2016

- HSL PCG "Currency Insight"-Weekly: 18 February, 2017HSL PCG "Currency Insight"-Weekly: 18 February, 2017

- HSL PCG "Currency Insight"-Weekly: 24 October, 2016HSL PCG "Currency Insight"-Weekly: 24 October, 2016

- Stock Market Reports For The Week (21st - 25th March - 2011)Stock Market Reports For The Week (21st - 25th March - 2011)

- Currency Street: The Greenback Up Amidst Disappointing June DataCurrency Street: The Greenback Up Amidst Disappointing June Data

- The Increasing Importance of Migrant Remittances from the Russian Federation to Central AsiaFrom EverandThe Increasing Importance of Migrant Remittances from the Russian Federation to Central Asia

- Asia Small and Medium-Sized Enterprise Monitor 2022: Volume I: Country and Regional ReviewsFrom EverandAsia Small and Medium-Sized Enterprise Monitor 2022: Volume I: Country and Regional Reviews

- You Too Can Be Rich In Stock Market InvestmentFrom EverandYou Too Can Be Rich In Stock Market Investment

- HSL PCG "Currency Insight"-Weekly: 03 December, 2016HSL PCG "Currency Insight"-Weekly: 03 December, 2016

- Corporate Event Tracker: Tracker of Forthcoming Corporate Action From February 16, 2017 To March 01, 2017Corporate Event Tracker: Tracker of Forthcoming Corporate Action From February 16, 2017 To March 01, 2017

- Mahindra Holidays & Resorts India (MHRIL) : PCG ResearchMahindra Holidays & Resorts India (MHRIL) : PCG Research

- BSP Manual For Agents - Local Procedures: Vietnam 2013 EnglishBSP Manual For Agents - Local Procedures: Vietnam 2013 English

- National Testing Service: Muslim Commercial Bank-McbNational Testing Service: Muslim Commercial Bank-Mcb

- ACTBAS1 - Lesson 2 (Statement of Financial Position)ACTBAS1 - Lesson 2 (Statement of Financial Position)

- Instant Download The Unbanking of America How The New Middle Class Survives Lisa Servon PDF All ChaptersInstant Download The Unbanking of America How The New Middle Class Survives Lisa Servon PDF All Chapters

- Tanzania Mortgage Market Update 30 June 2016 FinalTanzania Mortgage Market Update 30 June 2016 Final

- Case Study 3 - Westminster Company - ICO Bobby NortonCase Study 3 - Westminster Company - ICO Bobby Norton