BBA 6th

BBA 6th

Uploaded by

Fazal WahabCopyright:

Available Formats

BBA 6th

BBA 6th

Uploaded by

Fazal WahabOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Copyright:

Available Formats

BBA 6th

BBA 6th

Uploaded by

Fazal WahabCopyright:

Available Formats

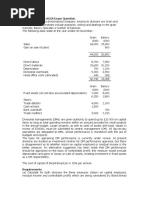

Chapter 5

JOB ORDER COSTING

Question: 2

Frog machine works collects its cost data by the job order cost accumulations procedure.

For job 642 the following data are available:

Direct Materials: DIRECT LABOUR

9/14 issued……………..$1,200 Week of sept 20--- 180hrs@ $6.20/hrs.

9/20 issued…………….. 662 week of sept 26 ---140 hrs. @7.30/hrs.

9/22 issued…………….. 480

Factory overhead is applied at the rate of 3.5 per direct labor hour

Required:

(1) The appropriate information entered on a job order cost sheet.

(2) The sale price of the job, assuming that it was contracted with a markup of 40%of cost

Answer:

Requirement: 1 FORGE MACHINE WORKS

Job order cost sheet –job 642

Direct Materials:

9/14 issued 1200

9/20 issued 662

9/22 issued 480 2342

DIRECT LABOUR :

sept 20 180*6.20 1116

sept 26 140*7.30 1022 2138

Factory overhead Cost:

sept 20 180*3.50 630

sept 26 140*3.50 490 1120

Total manufacturing 5600

Requirement: 2

Here markup means profit so the sale price will be 5600+40%of 5600

Calculation:

Cost = 6500

(+) Markup 5600*40/100 = 2240

Sale price = 7840

Problem no: 5-1

Tedyuscung Company produce special machines made customer specification. The following data

pertain to job 1106:

Customer: Markem machine shop Date of started: 11/4/19---

Customer’s order no: C696 Date of finished: 11/18/19----

Date: October 27 Total cost to manufacture?

Description: 18 drilling machine Sale price: $20,425

WEEK ENDING 11/11(1 st week) WEEK ENDING 11/18(2 nd week)

Material used, Dep1…………………………. $2,400 $1300

Direct Labor rate, Dep1……………………. $8.20 per hour $8.20 per hour

Labor hours used Dep1……………………..300 200

Direct labor rate, Dep2……………………..$8.00per hour $8.00per hour

Labor hours used, Dep2……………………..150 70

Machines hours, Dep2………………………..200 120

Applied factory overhead, Dep1…………. $4.00 per labor hour $4.00 per labor hour

Applied factory overhead, Dep2…………$1.80 per Machine hour $1.80 per Machine hour

Marketing and Administrative cost are charged to each order at a rate of 25% of the cost to

manufacturing.

Required:

A suitable cost sheet showing the above data. Did the company make an adequate profit margin on

this order?

SALOUTION:

JOB ORDER COST SHEET

Customer: Markem machine shop: JOB 1106

Customer’s order no: C696: Description: 18 drilling machine

Direct Material Cost (dep-1):

1st week cost 2400

2nd week cost 1300 3700

Direct Labor Cost (dep-1):

1st week cost ( 300*8.20) 2460

2nd week cost (200*8.20) 1640 4100

Direct Labor Cost (dep-2):

1st week cost (150*8) 1200

2nd week cost (70*8) 560 1760

F O H COST (DEP-1):

1st week cost (300*4) 1200

2nd week cost (200*4) 800 2000

F O H COST (DEP-1):

1st week cost (200*1.80) 360

2nd week cost (120*1.80) 216 576

Total Manufacturing cost 12136

Requirement 2:

Tedyuscung Company

Income statement

For the year ended…….

Sale 20425

(-) Cost (12136)

Gross profit 8289

(-)Marketing &administrative Exp 25%of total cost

(12136*25/100) 3034

Profit Margin 5255

You might also like

- DDI Competency Library 3 0 Interview Guide QuestionsDocument415 pagesDDI Competency Library 3 0 Interview Guide Questionsmiguel aldana100% (5)

- Sep 27 - Practice Problems On ValuationDocument2 pagesSep 27 - Practice Problems On ValuationMost. Amina Khatun100% (1)

- 1.a. Divisional Performance Revision Questions ROI V RIDocument3 pages1.a. Divisional Performance Revision Questions ROI V RIK Lam Lam100% (1)

- PMP Deck PMBOK6 V2.2 Edited PDFDocument360 pagesPMP Deck PMBOK6 V2.2 Edited PDFshrimanikandanNo ratings yet

- Chapter 12 Factory Overhead Planned, Actual and Applied Variance Analysis (Book 1 & Book 2)Document37 pagesChapter 12 Factory Overhead Planned, Actual and Applied Variance Analysis (Book 1 & Book 2)Ehsan Umer Farooqi100% (1)

- Chapter 12 Factory Over Head Planned Actual and Applied Variance AnalysisDocument29 pagesChapter 12 Factory Over Head Planned Actual and Applied Variance AnalysisAthar ComsatsNo ratings yet

- Discussion - Example Problem of Keep or Drop DecisionsDocument2 pagesDiscussion - Example Problem of Keep or Drop DecisionsGiselle Martinez0% (1)

- Chapter 3 AnswersDocument47 pagesChapter 3 AnswersPattranite100% (1)

- Solution Manual of Chapter 4 Managerial Accounting 15th Edition Ray H Garrison Eric W Noreen and Peter C BrewerDocument51 pagesSolution Manual of Chapter 4 Managerial Accounting 15th Edition Ray H Garrison Eric W Noreen and Peter C BrewerCoco Zaide100% (2)

- Financial Management Chapter 2Document28 pagesFinancial Management Chapter 2beyonce0% (1)

- Cost Accounting 7 8 - Solution Manual Cost Accounting 7 8 - Solution ManualDocument27 pagesCost Accounting 7 8 - Solution Manual Cost Accounting 7 8 - Solution ManualMARIA100% (1)

- Performance Magazine Issue 16 CompressedDocument79 pagesPerformance Magazine Issue 16 CompressedMNo ratings yet

- Final Accounts FR1Document62 pagesFinal Accounts FR1MUHAMMAD HASSANNo ratings yet

- CH 5 - 1Document25 pagesCH 5 - 1api-251535767No ratings yet

- 2 Pay Off TableDocument2 pages2 Pay Off TableIanNo ratings yet

- Problems On Pricing DecisionsDocument15 pagesProblems On Pricing DecisionsMae-shane SagayoNo ratings yet

- Cash Flow ProblemsDocument6 pagesCash Flow Problemsvkbm42No ratings yet

- Ch.12 FOH Carter.14thDocument40 pagesCh.12 FOH Carter.14thMuhammad Aijaz KhanNo ratings yet

- Exercises On Introduction To Cost AccountingDocument4 pagesExercises On Introduction To Cost AccountingAsi Cas Jav100% (1)

- Project On Factory Overhead Variances AnalysisDocument30 pagesProject On Factory Overhead Variances AnalysisAmby Roja100% (1)

- Registered ICAG Tuition Centers As at 1st January 2023Document6 pagesRegistered ICAG Tuition Centers As at 1st January 2023Mark Derrick CharwayNo ratings yet

- Managerial Accounting Chapter 8 & 9 SolutionsDocument8 pagesManagerial Accounting Chapter 8 & 9 SolutionsJotham NyanjeNo ratings yet

- Cost Accounting QuestionsDocument5 pagesCost Accounting QuestionsAdilHayatNo ratings yet

- 0462Document277 pages0462Tahseen Raza100% (1)

- Basic Characteristics of Process CostingDocument1 pageBasic Characteristics of Process CostingMeghan Kaye LiwenNo ratings yet

- Economic Order Quantity (EOQ) - Practical Problems and SolutionsDocument18 pagesEconomic Order Quantity (EOQ) - Practical Problems and SolutionsahmedNo ratings yet

- Chapter 21Document4 pagesChapter 21Rahila RafiqNo ratings yet

- Manufacturing AccountsDocument21 pagesManufacturing AccountsVainess S Zulu100% (1)

- Unit 8: Accounting For Spoilage, Reworked Units and Scrap ContentDocument26 pagesUnit 8: Accounting For Spoilage, Reworked Units and Scrap Contentዝምታ ተሻለ0% (1)

- Kaplan Short Term Decision MakingDocument22 pagesKaplan Short Term Decision Makingalc4css25No ratings yet

- Exam Questions and AnswersDocument18 pagesExam Questions and AnswersAna Aliyah Angin100% (1)

- CH # 8 (By Product)Document10 pagesCH # 8 (By Product)Rooh Ullah KhanNo ratings yet

- Oneil QuizDocument3 pagesOneil QuizShanthan AkkeraNo ratings yet

- Preparation of Published Financial StatementsDocument46 pagesPreparation of Published Financial StatementsBenard Bett100% (2)

- ACC00152 Business Finance Topic 6 Tutorial AnswersDocument2 pagesACC00152 Business Finance Topic 6 Tutorial AnswersPaul TianNo ratings yet

- Weller Company Cash FlowDocument3 pagesWeller Company Cash FlowMd. Omar Sakib HossainNo ratings yet

- Cost-Volume-Profit Relationships: Solutions To QuestionsDocument106 pagesCost-Volume-Profit Relationships: Solutions To QuestionsAbene Man Wt BreNo ratings yet

- Budget AnswersDocument6 pagesBudget AnswersSushant MaskeyNo ratings yet

- Cost Accounting and Cost Management 1 Accounting For Factory OverheadDocument19 pagesCost Accounting and Cost Management 1 Accounting For Factory OverheadJamaica David100% (1)

- Add or Drop Product DecisionsDocument6 pagesAdd or Drop Product DecisionsksnsatishNo ratings yet

- Fixed Assets and Intangible Assets Test BankDocument24 pagesFixed Assets and Intangible Assets Test BankTra. Sm100% (5)

- Quiz Quiz QwedadasdDocument4 pagesQuiz Quiz QwedadasdDexter TubalNo ratings yet

- Activity Based Costing Review QuestionsDocument3 pagesActivity Based Costing Review Questionshome labNo ratings yet

- Chapter: Non-Current Assets and Depreciation Answers For Model QuestionDocument4 pagesChapter: Non-Current Assets and Depreciation Answers For Model QuestionRAJIB HOSSAINNo ratings yet

- 20 Standard Costing FormulaeDocument3 pages20 Standard Costing FormulaeAnupam Bali50% (4)

- Silo - Tips Standard Costing With SolutionsDocument65 pagesSilo - Tips Standard Costing With SolutionsAlbert Muziti100% (1)

- Job Batch ContractDocument14 pagesJob Batch ContractJoydip DasguptaNo ratings yet

- Variance Analyis - ProblemsDocument9 pagesVariance Analyis - ProblemsstillwinmsNo ratings yet

- Khurasan University Faculty of Economics (BBA) : Cost AccountingDocument47 pagesKhurasan University Faculty of Economics (BBA) : Cost AccountingTalaqa Sam Sha100% (2)

- Nanyang Business School AB1201 Financial Management Tutorial 7: The Cost of Capital (Common Questions)Document3 pagesNanyang Business School AB1201 Financial Management Tutorial 7: The Cost of Capital (Common Questions)asdsadsaNo ratings yet

- Practice of Profitability RatiosDocument11 pagesPractice of Profitability RatiosZarish AzharNo ratings yet

- 3 Cost Volume Profit AnalysisDocument9 pages3 Cost Volume Profit AnalysisNancy MendozaNo ratings yet

- Activity Based Costing Test QuestionsDocument5 pagesActivity Based Costing Test QuestionsMehul Gupta100% (1)

- ScheduleofCost PractiseQuestionDocument3 pagesScheduleofCost PractiseQuestionbharteshdas100% (2)

- Hca16ge Ch06 SMDocument76 pagesHca16ge Ch06 SMAmanda GuanNo ratings yet

- Ch24 Management Accounting TB - WarrenDocument42 pagesCh24 Management Accounting TB - Warrenkevin echiverriNo ratings yet

- Cagayan State University - AndrewsDocument4 pagesCagayan State University - AndrewsWynie AreolaNo ratings yet

- AC 203 Final Exam Review WorksheetDocument6 pagesAC 203 Final Exam Review WorksheetLương Thế CườngNo ratings yet

- Some Basic Theory For Cost AccountingDocument16 pagesSome Basic Theory For Cost AccountingNaeem KhanNo ratings yet

- Job Order CostingDocument81 pagesJob Order CostingmohsinNo ratings yet

- Practice Questions - Financial Statement AnalysisDocument6 pagesPractice Questions - Financial Statement Analysisluliga.loulouNo ratings yet

- Absorption Costing QuestionsDocument10 pagesAbsorption Costing QuestionsJean LeongNo ratings yet

- Overheads - IBADocument6 pagesOverheads - IBAZehra HussainNo ratings yet

- Verification FormDocument1 pageVerification FormFazal WahabNo ratings yet

- Factor # 1. Nature of MessageDocument2 pagesFactor # 1. Nature of MessageFazal WahabNo ratings yet

- Lecture 4 & 5 - Estimate Costs: SchemeDocument22 pagesLecture 4 & 5 - Estimate Costs: SchemeFazal WahabNo ratings yet

- Lecture 1 - Introduction: Project Cost & Financial Management Ms (PM)Document20 pagesLecture 1 - Introduction: Project Cost & Financial Management Ms (PM)Fazal WahabNo ratings yet

- Flow of InformationDocument2 pagesFlow of InformationFazal WahabNo ratings yet

- AssignmentDocument1 pageAssignmentFazal WahabNo ratings yet

- Sarhad University, Peshawar: Department: Technology Program: B.Sc. Civil Engineering TechnologyDocument15 pagesSarhad University, Peshawar: Department: Technology Program: B.Sc. Civil Engineering TechnologyFazal WahabNo ratings yet

- Chap 006Document24 pagesChap 006Fazal WahabNo ratings yet

- Hedge RatioDocument12 pagesHedge RatioFazal Wahab100% (1)

- Islamic Financial Instruments: Dr. Shakir Ullah Islamic Bonds (Sukkuk)Document6 pagesIslamic Financial Instruments: Dr. Shakir Ullah Islamic Bonds (Sukkuk)Fazal WahabNo ratings yet

- Mutual Fund DataDocument9 pagesMutual Fund DataFazal WahabNo ratings yet

- Critical Success FactorsDocument4 pagesCritical Success FactorsFazal WahabNo ratings yet

- Foundations of Group BehaviorDocument50 pagesFoundations of Group BehaviorFazal WahabNo ratings yet

- Journalizing Merchandising TransactionsDocument3 pagesJournalizing Merchandising TransactionsMarian Augelio PolancoNo ratings yet

- Managing Human Resources Productivity Quality of Work Life Profits 9th Edition Cascio Solutions Manual download pdfDocument55 pagesManaging Human Resources Productivity Quality of Work Life Profits 9th Edition Cascio Solutions Manual download pdfisaqovputul100% (6)

- RAMUSSTATEMENTDocument3 pagesRAMUSSTATEMENTnocknock127No ratings yet

- Eip DisclosureDocument6 pagesEip Disclosurecute babyNo ratings yet

- Spisak Lokala Po ZonamaDocument8 pagesSpisak Lokala Po ZonamaAndreja TomaševićNo ratings yet

- Formal Letter Format Requesting InformationDocument8 pagesFormal Letter Format Requesting Informationafmsfierolcmvk100% (1)

- Form PDF 169967860090424Document11 pagesForm PDF 169967860090424akallinonesolutionNo ratings yet

- 2019 Aviation Environmental ReportDocument112 pages2019 Aviation Environmental ReportsmhNo ratings yet

- Chapter 1 - Tutorial - W.R. Economy - Management (2017-2018) 7988382273984790691Document3 pagesChapter 1 - Tutorial - W.R. Economy - Management (2017-2018) 7988382273984790691Ahmed AmediNo ratings yet

- Ucsp W7Document7 pagesUcsp W7prancineNo ratings yet

- 7 P'S of Telecom IndustryDocument23 pages7 P'S of Telecom IndustryYogesh Jain0% (1)

- Building Demolition Versova TextDocument6 pagesBuilding Demolition Versova TextpremkumalenNo ratings yet

- CUAC 408 Advanced Taxation Practical Assignments PresentationsDocument5 pagesCUAC 408 Advanced Taxation Practical Assignments PresentationsnsnhemachenaNo ratings yet

- Activity Sheet In: Business FinanceDocument7 pagesActivity Sheet In: Business FinanceCatherine LarceNo ratings yet

- Comm3201 Individual Case Study (June 2020)Document3 pagesComm3201 Individual Case Study (June 2020)Scarlett WangNo ratings yet

- Principles of Marketing Module 1 Weeks 1 To 5Document23 pagesPrinciples of Marketing Module 1 Weeks 1 To 5Jessa Mae Perfiñan100% (1)

- JinElSaawy PortfolioManagementusingReinforcementLearning ReportDocument6 pagesJinElSaawy PortfolioManagementusingReinforcementLearning Reportsojogil742No ratings yet

- BUSINESS-PLANDocument25 pagesBUSINESS-PLANdandrepatungan0109No ratings yet

- .. STDocs Tender TND 095158 181865Document287 pages.. STDocs Tender TND 095158 181865Abhijor KoliNo ratings yet

- MFO 2024Document7 pagesMFO 2024General Nakar EngineeringNo ratings yet

- (One Sheeter) Multiply Your Results Using The Latest Features in Performance Max (External, 2023)Document1 page(One Sheeter) Multiply Your Results Using The Latest Features in Performance Max (External, 2023)MarkNo ratings yet

- Leading Change and The Challenges of Managing A Learning Organisation in Hong KongDocument18 pagesLeading Change and The Challenges of Managing A Learning Organisation in Hong KongNaufal Surya MahardikaNo ratings yet

- Chapter 30-Money Growth and Inflation-PDocument43 pagesChapter 30-Money Growth and Inflation-PHuy TranNo ratings yet

- Skills Summary: Project Management: IT Project Lifecycle: Value-Added LeadershipDocument3 pagesSkills Summary: Project Management: IT Project Lifecycle: Value-Added LeadershipRodrigo JardimNo ratings yet

- Presentation: Management of Personal Claims of Army OfficersDocument60 pagesPresentation: Management of Personal Claims of Army OfficersNisha RakeshNo ratings yet

- 1305 Disposal of Impaired InventoryDocument2 pages1305 Disposal of Impaired InventoryAlejandroNo ratings yet

- Motivation LetterDocument4 pagesMotivation LetterAneeta JogiNo ratings yet