0 ratings0% found this document useful (0 votes)

21 viewsAcc124 Week 1 Ulo D

Acc124 Week 1 Ulo D

Uploaded by

Baby Leonor Razonable1. The key elements reported in financial statements are assets, liabilities, equity, income, and expenses. Assets and liabilities must be probable and reliably measurable to be recognized.

2. Revenue is recognized when earned, such as at the point of sale when risks and rewards of ownership transfer. Expenses are recognized when incurred.

3. Income and expenses must be probable and reliably measurable to be recognized. Revenue arises from ordinary business activities like sales, while gains come from non-ordinary sources.

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

Acc124 Week 1 Ulo D

Acc124 Week 1 Ulo D

Uploaded by

Baby Leonor Razonable0 ratings0% found this document useful (0 votes)

21 views3 pages1. The key elements reported in financial statements are assets, liabilities, equity, income, and expenses. Assets and liabilities must be probable and reliably measurable to be recognized.

2. Revenue is recognized when earned, such as at the point of sale when risks and rewards of ownership transfer. Expenses are recognized when incurred.

3. Income and expenses must be probable and reliably measurable to be recognized. Revenue arises from ordinary business activities like sales, while gains come from non-ordinary sources.

Original Title

ACC124 WEEK 1 ULO D

Copyright

© © All Rights Reserved

Available Formats

DOCX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

1. The key elements reported in financial statements are assets, liabilities, equity, income, and expenses. Assets and liabilities must be probable and reliably measurable to be recognized.

2. Revenue is recognized when earned, such as at the point of sale when risks and rewards of ownership transfer. Expenses are recognized when incurred.

3. Income and expenses must be probable and reliably measurable to be recognized. Revenue arises from ordinary business activities like sales, while gains come from non-ordinary sources.

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

Download as docx, pdf, or txt

0 ratings0% found this document useful (0 votes)

21 views3 pagesAcc124 Week 1 Ulo D

Acc124 Week 1 Ulo D

Uploaded by

Baby Leonor Razonable1. The key elements reported in financial statements are assets, liabilities, equity, income, and expenses. Assets and liabilities must be probable and reliably measurable to be recognized.

2. Revenue is recognized when earned, such as at the point of sale when risks and rewards of ownership transfer. Expenses are recognized when incurred.

3. Income and expenses must be probable and reliably measurable to be recognized. Revenue arises from ordinary business activities like sales, while gains come from non-ordinary sources.

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

Download as docx, pdf, or txt

You are on page 1of 3

ACC124 WEEK 1-3 ULO D equal to the fair value of the asset given or fair

value of the asset received, whichever is clearly

• Elements of financial statements. This refers

evident. In the absence of fair value, the cost is

to the quantitative information reported in the

equal to the carrying amount of the asset given.

statement of financial position and income

statement. B. LIABILITY RECOGNITION PRINCIPLE

The ELEMENTS directly related to the LIABILITY – a present obligation arising from

measurement of FINANCIAL POSITION in the past events the settlement of which is expected

statement of financial position are: to result in an outflow from the entity of resources

embodying economic benefits.

a. ASSET

2 conditions that must be present for the

b. LIABILITY

recognition of a liability

c. EQUITY

1. It is probable that an outflow of economic

The ELEMENTS directly related to the benefits will be required for the settlement of a

measurement of FINANCIAL PERFORMANCE

present obligation.

in the income statement are:

2. The amount of obligation can be measured

a. INCOME

reliably.

b. EXPENSE

Obligations may be legally enforceable as

EQUITY is the residual interest in the a consequence of a binding contract or statutory

assets of the entity after deducting all of the requirement.

liabilities. Constructive obligations arise from

normal business practice, custom and a desire to

RECOGNITION OF ELEMENTS maintain good business relations or act in an

Recognition means the reporting of an equitable manner.

asset, liability, Income or expense in the face Ways to settle present obligations

of the financial statements of an entity.

A. payment of cash

A. ASSET RECOGNITION PRINCIPLE

B. transfer of noncash assets

ASSET – a resource controlled by the entity

as a result of past events and from which future C. provision of services

economic benefits are expected to flow to the

D. replacement of the obligation with another

entity.

obligation

2 conditions that must be present for the

E. conversion of the obligation into equity

recognition of an asset

C. INCOME RECOGNITION PRINCIPLE -

1. It is probable that future economic benefits will

Income shall be recognized when earned.

flow to the entity.

INCOME – increase in economic benefit

2. The cost or value of the asset can be

during the accounting period in the form of

measured reliably.

inflow or increase in asset or decrease in liability

Future economic benefit that results in increase in equity, other than

contribution from equity participants.

The future economic benefit embodied in

an asset is the potential to contribute directly or REVENUE – arises in the course of ordinary

indirectly to the flow of cash and noncash regular activities and is referred to by a variety

equivalents to the entity. of different names including sales, fees, interest,

dividends, royalties and rent.

Cost principle

GAINS – represent other items that meet the

Asset should be recorded initially at definition of income and do not arise in the

original acquisition cost. In a cash transaction, course of the ordinary regular activities.

cost is equivalent to the cash payment. In a

noncash or an exchange transaction, the cost is

2 conditions that must be present for the construction contract shall be recognized as

recognition of income revenue and expenses, respectively, by

reference to the stage of completion of the

1. It is probable that future economic benefits will

contract activity.

flow to the entity as a result of an increase in an

asset or a decrease I a liability. 5. Production method

2. The economic benefits can be measured Revenue is recognized at the point of

reliably. production

Point of sale Other income recognition

The two conditions for income recognition Interest revenue- Recognized on a time

are present at the point of sale. Point of sale is proportion basis that takes into account

the point of income recognition. the effective yield of the asset

Royalties- Recognized in an accrual

Revenue from sale of goods

basis in accordance with the substance of

The following conditions should be the relevant agreement.

present for the revenue from sale of goods Dividends- Recognized when the

shareholder’s right to receive payment is

A. The entity has transferred to the buyer the

established, when dividends are declared.

significant risks and rewards of ownership of the

Installation fees- Recognized over the

goods.

period of installation by reference to the

B. the entity retains neither continuing managerial stage of completion.

involvement nor effective control over the goods Subscription revenue- Recognized on a

sold. straight-line basis over the subscription

period.

C. the amount of revenue can be measured

Admission fees- Recognized when the

reliably.

event takes place.

D. it is probable that economic benefits Tuition fees- Recognized over the period

associated with the transaction will flow to the in which tuition is provided.

entity.

D. EXPENSE RECOGNITION PRINCIPLE -

E. the costs incurred or to be incurred in respect Expenses are recognized when incurred.

of the transaction can be measured reliably.

EXPENSE - Decrease in economic benefit

Exceptions to the point of sale during the accounting period in the form of an

outflow or decrease in asset or increase in

1. Installment method liability that result in decrease in equity, other

Revenue is recognized at the point of than distribution to equity participants.

collection. Expenses that arise in the course of ordinary

AMT OF REVENUE = GROSS PROFIT RTE x regular activities include cost of sales, wages

AMOUNT OF COLLECTION and depreciation.

2. Cost recovery method or sunk cost LOSSESS do not arise in the course of

method ordinary regular activities and include losses

Revenue is recognized at the point of resulting from disasters

collection. Conceptual framework: expenses are incurred

3. Cash method when it is probable that a decrease in future

economic benefits related to decrease in an asset

Revenue is recognized when received or an increase in liability has occurred and that

regardless of when earned. the decrease in economic benefits can be

measured reliably.

4. Percentage of completion method

2 conditions that must be present for the

When the outcome of a construction

recognition of income

contract can be estimated reliably, contract

revenue and contract costs associated with the

1. It is probable that a decrease in future - The amount of cash or cash equivalent that

economic benefits has occurred as a result of a could currently be obtained by selling the asset in

decrease in an asset or an increase in a liability. an orderly disposal.

2. The decrease in economic benefits can be E. Present value or future exchange price

measured reliably.

- The discounted value of the future net cash

Matching principle inflows that the asset is expected to generate in

the normal course of business.

Those costs and expenses incurred in

earning a revenue shall be reported in the same

period.

3 applications

1. Cause and effect association- Expense is

recognized when revenue is recognized.

2. Systematic and rational allocation- Some

costs are expensed by simply allocating them

over the periods benefited.

3. Immediate recognition-The cost incurred is

expensed outright because uncertainty of future

economic benefits or difficulty of reliably

associating certain costs with future revenue.

An expense is recognized immediately when:

1. When an expenditure procedure produces no

future economic benefit.

2. When cost incurred does not qualify or ceases

to qualify for recognition as an asset.

MEASUREMENT OF ELEMENTS

Measurement is the process of

determining the monetary amounts at which the

elements of the financial statements are to be

recognized and carried in the statement of

financial position and income statement.

Measurement bases

A. Historical cost or past purchase exchange

price

- The amount of cash or cash equivalent paid or

the fair value of the consideration given to acquire

an asset at the time of acquisition.

B. Current cost or current purchase exchange

price

- The amount of cash or cash equivalent that

would have to be paid if the same or equivalent

asset was acquired currently.

C. Realizable value or current sale exchange

price

You might also like

- Intermediate Accounting 1: a QuickStudy Digital Reference GuideFrom EverandIntermediate Accounting 1: a QuickStudy Digital Reference GuideNo ratings yet

- Module 1 Intermediate Accounting 2Document37 pagesModule 1 Intermediate Accounting 2Andrei GoNo ratings yet

- Conceptual FrameDocument28 pagesConceptual FrameNahian HasanNo ratings yet

- ACCA - Chapter 5-6Document7 pagesACCA - Chapter 5-6Bianca Alexa SacabonNo ratings yet

- ACTG 21B (CH4) - Lecture NotesDocument4 pagesACTG 21B (CH4) - Lecture Notesraimefaye seduconNo ratings yet

- ACCA - Chapter 5-6Document7 pagesACCA - Chapter 5-6Bianca Alexa SacabonNo ratings yet

- Cfas CompreDocument17 pagesCfas CompreLouise John BacudNo ratings yet

- Cfas Chapter 6Document3 pagesCfas Chapter 6danielisaiahasdNo ratings yet

- Chapter 1 Current LiabilitiesDocument5 pagesChapter 1 Current LiabilitiesEUNICE NATASHA CABARABAN LIMNo ratings yet

- Current LiabilitiesDocument3 pagesCurrent Liabilitiesreymonastrera07No ratings yet

- ACCA - Chapter 5-6 (A5)Document6 pagesACCA - Chapter 5-6 (A5)Bianca Alexa SacabonNo ratings yet

- Conceptual Framework (Part 2) : AssetsDocument3 pagesConceptual Framework (Part 2) : AssetsEui KimNo ratings yet

- IA2 NotesDocument7 pagesIA2 NotesAshryle SalazarNo ratings yet

- 3005 Business CombinationDocument4 pages3005 Business CombinationTatianaNo ratings yet

- Afar.3204 - Business Combination MergersDocument4 pagesAfar.3204 - Business Combination Mergersj.galagar.127531.tcNo ratings yet

- ADVACC NOTES - Business CombinationDocument5 pagesADVACC NOTES - Business CombinationAlyaNo ratings yet

- AFAR 03.2 - Revenue Recognition (PFRS FOR SMEs)Document4 pagesAFAR 03.2 - Revenue Recognition (PFRS FOR SMEs)cheoreciNo ratings yet

- Ccfas Chapter 8 15Document5 pagesCcfas Chapter 8 15Ceann RapadasNo ratings yet

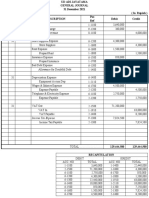

- Notes To Account Advaita Developers Pvt. Ltd.Document3 pagesNotes To Account Advaita Developers Pvt. Ltd.Prabhjot AroraNo ratings yet

- Afar.2905 Business Combination Mergers PDFDocument5 pagesAfar.2905 Business Combination Mergers PDFCyrille Keith FranciscoNo ratings yet

- Notes FAR 2Document9 pagesNotes FAR 2ALLYSA DENIELLE SAYATNo ratings yet

- Intermediate Accounting 2Document3 pagesIntermediate Accounting 2Ghie RodriguezNo ratings yet

- Declares A Share Dividend. Share Dividend Payable Is Part of EquityDocument2 pagesDeclares A Share Dividend. Share Dividend Payable Is Part of EquityAsh imoNo ratings yet

- Business Combinations Notes: Topic OutlineDocument4 pagesBusiness Combinations Notes: Topic OutlineMary Jescho Vidal AmpilNo ratings yet

- Chapter 26Document8 pagesChapter 26Mae Ciarie YangcoNo ratings yet

- Chapter 4 - Adjusting AccountsDocument4 pagesChapter 4 - Adjusting AccountsIESHA JAESAMIN TWAYE BASTIANNo ratings yet

- Accounting For Special Transactions ReviewerDocument6 pagesAccounting For Special Transactions ReviewerKaye Mariz TolentinoNo ratings yet

- PRELIMSDocument4 pagesPRELIMSJadon MejiaNo ratings yet

- CfasDocument3 pagesCfasWinnie ToribioNo ratings yet

- P 2Document4 pagesP 2Julious CaalimNo ratings yet

- The Elements Directly Related To The Measurement of Financial Position AreDocument8 pagesThe Elements Directly Related To The Measurement of Financial Position AreKim Patrice NavarraNo ratings yet

- Cfas CH5 To CH7Document7 pagesCfas CH5 To CH7James DarylNo ratings yet

- Intacc 2 NotesDocument25 pagesIntacc 2 Notescoco credoNo ratings yet

- Review 105 - Day 4 Theory of AccountsDocument14 pagesReview 105 - Day 4 Theory of AccountsAndre PulancoNo ratings yet

- FARAP 4509 Trade Payable, Provisions Other Current LiabilitiesDocument11 pagesFARAP 4509 Trade Payable, Provisions Other Current Liabilitieskyhn.beycaNo ratings yet

- KTQNNCDocument40 pagesKTQNNCcamnhu622003No ratings yet

- Definition Explained:: Liabilities A Liability Is ADocument26 pagesDefinition Explained:: Liabilities A Liability Is ACurtain SoenNo ratings yet

- FAR Self-Made ReviewerDocument2 pagesFAR Self-Made ReviewerAngelica SumatraNo ratings yet

- Intacc NotesDocument10 pagesIntacc NotesIris FenelleNo ratings yet

- 6679 Current LiabilitiesDocument3 pages6679 Current LiabilitiesSungkyu KimNo ratings yet

- Chapter 1Document18 pagesChapter 1clarizaNo ratings yet

- ACCOUNTING Reviewer Chapter 3 4Document4 pagesACCOUNTING Reviewer Chapter 3 4hoxhiiNo ratings yet

- CHAPTER 4 Mam CorvsDocument28 pagesCHAPTER 4 Mam CorvsRoniel John Franco RamilNo ratings yet

- PFRS 14 15 16Document3 pagesPFRS 14 15 16kara mNo ratings yet

- Business Combination-Date of AcquisitionDocument13 pagesBusiness Combination-Date of Acquisitionmax pNo ratings yet

- Basic Aspects of Financial AccountingDocument12 pagesBasic Aspects of Financial Accountingsiva reddyNo ratings yet

- Conceptual Framework Module 5Document3 pagesConceptual Framework Module 5Jaime LaronaNo ratings yet

- Fundamentals of Accounting I: Recognition PrinciplesDocument6 pagesFundamentals of Accounting I: Recognition PrinciplesericacadagoNo ratings yet

- D4Document13 pagesD4neo14No ratings yet

- Review 105 - Day 4 Theory of AccountsDocument13 pagesReview 105 - Day 4 Theory of Accountschristine anglaNo ratings yet

- Acc203 - Cfas - 08.19.23Document15 pagesAcc203 - Cfas - 08.19.23Hailsey WinterNo ratings yet

- Part 2 Accounting EquationDocument88 pagesPart 2 Accounting EquationDONALD GUTIERREZNo ratings yet

- Bonds Payable HandoutDocument3 pagesBonds Payable HandoutJeanieNo ratings yet

- Pfrs For Smes Full PFRS: Same Same Same SameDocument14 pagesPfrs For Smes Full PFRS: Same Same Same SameAnthon GarciaNo ratings yet

- 66705studentjournal-Oct2021a (1) - Removed MadarDocument20 pages66705studentjournal-Oct2021a (1) - Removed MadarTimepass MungfuliNo ratings yet

- Cfas ReviewerDocument7 pagesCfas ReviewerslacksheepNo ratings yet

- OMTQM - Chapter 6Document4 pagesOMTQM - Chapter 6Sailah PatakNo ratings yet

- Recognition, Derecognition, Measurement, Presentation and Disclosure of Financial InformationDocument7 pagesRecognition, Derecognition, Measurement, Presentation and Disclosure of Financial InformationMikaela LacabaNo ratings yet

- Textbook of Urgent Care Management: Chapter 46, Urgent Care Center FinancingFrom EverandTextbook of Urgent Care Management: Chapter 46, Urgent Care Center FinancingNo ratings yet

- Survey Questionnaire On Water Refilling StationDocument2 pagesSurvey Questionnaire On Water Refilling StationBaby Leonor Razonable100% (1)

- Survey QuestionnaireDocument2 pagesSurvey QuestionnaireBaby Leonor RazonableNo ratings yet

- CBM 1st Exam Rev.Document9 pagesCBM 1st Exam Rev.Baby Leonor RazonableNo ratings yet

- Financial Market 2NDDocument7 pagesFinancial Market 2NDBaby Leonor RazonableNo ratings yet

- ACC124 - First ExamDocument4 pagesACC124 - First ExamBaby Leonor RazonableNo ratings yet

- Digest Mendoza v. de Guzman 33 Off. Gazette 1505Document1 pageDigest Mendoza v. de Guzman 33 Off. Gazette 1505JureeBonifacioMudanzaNo ratings yet

- Banana Leaf Catering FSDocument2 pagesBanana Leaf Catering FSLeslie CastilloNo ratings yet

- Fabm 1 Ak 11 Q3 0401Document5 pagesFabm 1 Ak 11 Q3 0401Tin CabosNo ratings yet

- Pratical No 14 Edp HKKDocument5 pagesPratical No 14 Edp HKKHKK 169No ratings yet

- EWM SourceDocument2 pagesEWM SourceRaghavendra MJNo ratings yet

- Entrepreneurial Finance UNIT-2.NotesdocxDocument21 pagesEntrepreneurial Finance UNIT-2.Notesdocxnishantbhai8No ratings yet

- Intangible Assets Problems and Solutions2Document22 pagesIntangible Assets Problems and Solutions2Destiny LazarteNo ratings yet

- Act 5Document1 pageAct 5Unknowingly AnonymousNo ratings yet

- Chapter 5Document13 pagesChapter 5Derrick de los ReyesNo ratings yet

- Preparing Financial StatementsDocument6 pagesPreparing Financial StatementsAUDITOR97No ratings yet

- MathematicsDocument16 pagesMathematicsBapa LoloNo ratings yet

- Model Questions Fundamentals of Taxation and Auditing BBS 3rd Year PDFDocument5 pagesModel Questions Fundamentals of Taxation and Auditing BBS 3rd Year PDFShah SujitNo ratings yet

- Lesson 4 Sources of IncomeDocument9 pagesLesson 4 Sources of IncomeErick MeguisoNo ratings yet

- P5 FAC RTP June2013Document105 pagesP5 FAC RTP June2013AlankritaNo ratings yet

- Individual Assignment.123Document5 pagesIndividual Assignment.123Tsegaye BubamoNo ratings yet

- Jawaban Ajp Unit Ud Adi Jayatamaa AciiiiiiiiDocument4 pagesJawaban Ajp Unit Ud Adi Jayatamaa AciiiiiiiiASRI HANDAYANINo ratings yet

- Annual Financial Report Naturgy Energy Group SA 2021Document118 pagesAnnual Financial Report Naturgy Energy Group SA 2021Hossam El DefrawyNo ratings yet

- RoadmapDocument2 pagesRoadmaplamslamNo ratings yet

- Kunci Jawaban Siklus Akuntansi (P1)Document30 pagesKunci Jawaban Siklus Akuntansi (P1)Zulkarnain Zoel75% (4)

- 4.CIR v. General Foods, Inc.Document5 pages4.CIR v. General Foods, Inc.evelyn b t.No ratings yet

- IAS 12 Solutions PDFDocument74 pagesIAS 12 Solutions PDFrafid aliNo ratings yet

- CF Mid Term - Revision Set 3Document10 pagesCF Mid Term - Revision Set 3linhngo.31221020350No ratings yet

- ICAEW - Chapter 10 - Non-Current Assets and DepreciationDocument43 pagesICAEW - Chapter 10 - Non-Current Assets and Depreciationvothituongnhi7703No ratings yet

- Ch18.Outline ShareDocument9 pagesCh18.Outline ShareCahyo PriyatnoNo ratings yet

- United States Court of Appeals Third CircuitDocument13 pagesUnited States Court of Appeals Third CircuitScribd Government DocsNo ratings yet

- PERSONAL-FINANCE-PRELIMS-REVIEWER FinalllllDocument47 pagesPERSONAL-FINANCE-PRELIMS-REVIEWER FinalllllStephanie Andal0% (1)

- Production Budget Solutions: TopicDocument15 pagesProduction Budget Solutions: TopicTonie NascentNo ratings yet

- Mom DocumentDocument172 pagesMom DocumentvaishnaviNo ratings yet

- Gurughasidas Central University, Bilaspur: "Power and Duties of Income-Tax Authorities"Document20 pagesGurughasidas Central University, Bilaspur: "Power and Duties of Income-Tax Authorities"Kishori PatelNo ratings yet

- Parkside ApartmentsDocument25 pagesParkside ApartmentsRyan SloanNo ratings yet