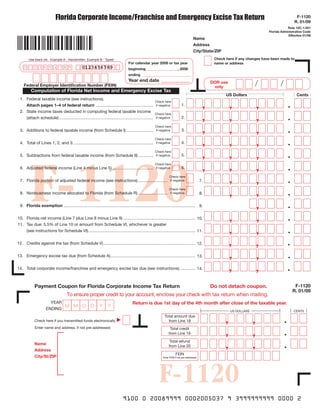

Florida Corporate Income/Franchise and Emergency Excise Tax Return for 2008 Tax Year R.01/09

- 1. Florida Corporate Income/Franchise and Emergency Excise Tax Return F-1120 R. 01/09 Rule 12C-1.051 Florida Administrative Code Effective 01/09 Name Address City/State/ZIP Check here if any changes have been made to Use black ink. Example A - Handwritten Example B - Typed For calendar year 2008 or tax year name or address 0123456789 01 23456789 beginning _________________, 2008 ending __________________________ Year end date ____________ / / DoR use Federal Employer Identification Number (FEIN) only Computation of Florida Net Income and Emergency Excise Tax US Dollars Cents , , , 1. Federal taxable income (see instructions). Check here 1. Attach pages 1–4 of federal return ................................................. if negative , , , 2. State income taxes deducted in computing federal taxable income Check here 2. (attach schedule) ................................................................................. if negative , , , Check here 3. 3. Additions to federal taxable income (from Schedule I) ....................... if negative , , , Check here 4. 4. Total of Lines 1, 2, and 3. .................................................................... if negative , , , Check here F-1120 5. 5. Subtractions from federal taxable income (from Schedule II) ............. if negative , , , Check here 6. 6. Adjusted federal income (Line 4 minus Line 5) ................................... if negative , , Check here 7. Florida portion of adjusted federal income (see instructions) ......................... 7. if negative , , Check here 8. Nonbusiness income allocated to Florida (from Schedule R) ......................... 8. if negative , 9. Florida exemption ................................................................................................................. 9. , , 10. Florida net income (Line 7 plus Line 8 minus Line 9) .............................................................. 10. , , 11. Tax due: 5.5% of Line 10 or amount from Schedule VI, whichever is greater (see instructions for Schedule VI). ........................................................................................... 11. , , 12. Credits against the tax (from Schedule V) ............................................................................... 12. , , 13. Emergency excise tax due (from Schedule A)......................................................................... 13. , , 14. Total corporate income/franchise and emergency excise tax due (see instructions). ............ 14. Payment Coupon for Florida Corporate Income Tax Return Do not detach coupon. F-1120 R. 01/09 To ensure proper credit to your account, enclose your check with tax return when mailing. YEAR Return is due 1st day of the 4th month after close of the taxable year. MMDDYY ENDING US DOLLARS CENTS , , Total amount due ▼ from Line 18 Check here if you transmitted funds electronically , , Enter name and address, if not pre-addressed: Total credit from Line 19 , , Total refund Name from Line 20 Address FEIN City/St/ZIP Enter FEIN if not pre-addressed F-1120 9100 0 20089999 0002005037 9 3999999999 0000 2

- 2. F-1120 R. 01/09 Page 2 , , 15. a) Penalty: F-2220 __________________ b) Other ___________________ c) Interest: F-2220 _________________ d) Other ___________________ Line 15 Total ➤. .15. , , 16. Total of Lines 14 and 15 ....................................................................................................... 16. , , 17. Payment credits: Estimated tax payments 17a $ Tentative tax payment 17b $ ............... 17. 18. Total amount due: Subtract Line 17 from Line 16. If positive, enter amount , , due here and on payment coupon. If the amount is negative (overpayment), enter on Line 19 and/or Line 20 ............................................................................................ 18. , , 19. Credit: Enter amount of overpayment credited to next year’s estimated tax here and on payment coupon ............................................................................................. 19. , , 20. Refund: Enter amount of overpayment to be refunded here and on payment coupon ..... 20. This return is considered incomplete unless a copy of the federal return is attached. If your return is not signed, or improperly signed and verified, it will be subject to a penalty. The statute of limitations will not start until your return is properly signed and verified. Your return must be completed in its entirety. Under penalties of perjury, I declare that I have examined this return, including accompanying schedules and statements, and to the best of my knowledge and belief, it is true, correct, and complete. Declaration of preparer (other than taxpayer) is based on all information of which preparer has any knowledge. Sign here Title Signature of officer (must be an original signature) Date Preparer’s Preparer Preparer’s PTIN check if self- Paid signature employed Date preparers only Firm’s name (or yours FEIN if self-employed) and address ZIP All Taxpayers Must Answer Questions A Through M Below — See Instructions A. State of incorporation: ______________________________________________________________ ❑ ❑ If yes, provide: Part of a federal consolidated return? YES NO H-2. B. Florida Secretary of State document number:__________________________________________ FEIN from federal consolidated return: ___________________________________ YES ❑ NO ❑ C. Florida consolidated return? Name of corporation: _______________________________________________ ❑. Initial return ❑ Final return (final federal return filed) D. ❑ ❑ The federal common parent has sales, property, or payroll in Florida? YES NO H-3. ❑ E. Taxpayer election section (s.) 220.03(5), Florida Statutes (F.S.) General Rule I. Location of corporate books: ____________________________________________________________ ❑ ❑ Election A Election B City: _________________________________________ State: _____________ ZIP: _______________ F. Principal Business Activity Code (as pertains to Florida) ❑ ❑ Taxpayer is a member of a Florida partnership or joint venture? YES NO J. K. Enter date of latest IRS audit: ______________ a) List years examined: ____________ ❑ ❑ NO G. A Florida extension of time was timely filed? YES L. Contact person concerning this return: __________________________________________________ ❑ ❑ Corporation is a member of a controlled group? YES NO H-1. If yes, attach list. a) Contact person telephone number: ( _______) ___________________________________________ ❑ 1120S or __________________ M. Type of federal return filed ❑ 1120 Where to Send Payments and Returns Remember: Make check payable to and send with return to: Make your check payable to the Florida ✔. Florida Department of Revenue Department of Revenue. 5050 W Tennessee Street Tallahassee FL 32399-0135 Write your FEIN on your check. ✔ If you are requesting a refund (Line 20), send your return to: Sign your check and return. ✔ Florida Department of Revenue PO Box 6440 Tallahassee FL 32314-6440 Attach a copy of your federal return. ✔ Attach a copy of your Florida Form F-7004 ✔ (extension of time) if applicable.

- 3. F-1120 R. 01/09 Page 3 NAME FEIN TAXABLE YEAR ENDING Schedule A — Computation of Emergency Excise Tax (for assets placed in service 1/1/81 to 12/31/86) 1. Total depreciation expense deducted on federal Form 1120 1. 2. Florida portion of adjusted federal income from F-1120, Page 1, Line 7 or Schedule VI, Line 7 (see instructions) 2. 3. Loss carry forward (Enter the loss as a positive number) 3. 4. Subtract Line 3 from Line 2 and enter result here 4. Note: If a loss carry forward shown on Line 3 exceeds a loss on Line 2, enter positive difference of the loss amounts shown 5. Depreciation deducted pursuant to Internal Revenue Code (IRC.) s. 168 for assets placed in service 1/1/81 to 12/31/86 5. 6. Straight-line depreciation deducted pursuant to IRC s. 168(b)(3) and 60% of amounts of depreciation previously taxed on Schedule VI (for 6. assets placed in service 1/1/81 to 12/31/86) 7. All depreciation deducted pursuant to IRC s. 168 directly related to any amount shown as nonbusiness income 7. 8. Subtract the sum of Lines 6 and 7 from the amount on Line 5 and enter result here 8. 9. Multiply Line 8 by .40 (40%) and enter result here 9. 10. Florida apportionment fraction shown in Schedule IIIA or IIID of F-1120 (Taxpayers that are 100% in Florida enter 1.0) 10. 11. Multiply Line 9 by Line 10 and enter result here 11. 12. Determine the amount of depreciation deducted pursuant to IRC s. 168 [except pursuant to s. 168(b)(3)] used in computing nonbusiness income 12. allocated to Florida, multiply the amount by .40 (40%), and enter result here 13. Add Lines 11 and 12 and enter result here 13. Loss shown on Line 4. Note: If Line 4 does not show a loss, enter 0 14. 14. 15. The portion of the exemption provided in s. 220.14, F.S., not used for Chapter 220, F.S. purposes, if any. If none, enter 0 15. 16. Subtract the sum of Lines 14 and 15 from the amount on Line 13 and enter result here 16. Multiply Line 16 by 2.5 (not 2.5 %) and enter result here. Note: If Line 16 shows a loss, enter 0 17. 17. 18. Total tax due (2.2% of Line 17) 18. 19. (a) Emergency excise tax credit: (b) Emergency excise tax credit carryover: (attach schedule) Total ➤ 19. 20. Balance of tax due (enter on Page 1, Line 13) 20. Column (a) Column (b) Schedule I — Additions and/or Adjustments to Federal Taxable Income For page 1 For Schedule VI, AMT 1. Interest excluded from federal taxable income (see instructions) 1. 1. 2. Undistributed net long-term capital gains (see instructions) 2. 2. 3. Net operating loss deduction (attach schedule) 3. 3. 4. Net capital loss carryover (attach schedule) 4. 4. 5. Excess charitable contribution carryover (attach schedule) 5. 5. 6. Employee benefit plan contribution carryover (attach schedule) 6. 6. 7. Enterprise zone jobs credit (Form F-1156Z) 7. 7. 8. Ad valorem taxes allowable as enterprise zone property tax credit (Form F-1158Z) 8. 8. 9. Guaranty association assessment(s) credit 9. 9. 10. Rural and/or urban high crime area job tax credits 10. 10. 11. State housing tax credit 11. 11. 12. Credit for contributions to nonprofit scholarship funding organizations 12. 12. 13. Renewable energy tax credits 13. 13. 14. Section 179 expense deduction above $25,000 14. 14. 15. Special 50% depreciation allowance 15. 15. 16. Other additions (attach statement) 16. 16. 17. Total Lines 1 through 16 in Columns (a) and (b). Enter totals for each column on Line 17. Column (a) total is 17. 17. also entered on Page 1, Line 3 (of the F-1120 return). Column (b) total is also entered on Schedule VI, Line 3.

- 4. F-1120 R. 01/09 Page 4 NAME FEIN TAXABLE YEAR ENDING Column (b) Column (a) Schedule II — Subtractions from Federal Taxable Income For Schedule VI, AMT For page 1 1. Gross foreign source income less attributable expenses (a) Enter s. 78, IRC income $ ____________________ (b) plus s. 862, IRC dividends $ ____________________________ (c) less direct and indirect expenses $ ____________ _________________________________________________ Total ➤ 1. 1. 2. Gross subpart F income less attributable expenses (a) Enter s. 951, IRC subpart F income $ _________________ (b) less direct and indirect expenses $ _______________ Total ➤. 2. 2. Note: Taxpayers doing business outside Florida enter zero on Lines 3, through 6, and complete Schedule IV. 3. Florida net operating loss carryover deduction (see instructions) 3. 3. 4. Florida net capital loss carryover deduction (see instructions) 4. 4. 5. Florida excess charitable contribution carryover (see instructions) 5. 5. 6. Florida employee benefit plan contribution carryover (see instructions) 6. 6. 7. Nonbusiness income (from Schedule R, Line 3) 7. 7. 8. Eligible net income of an international banking facility (see instructions) 8. 8. 9. Other subtractions (attach statement) 9. 9. 10. Total Lines 1 through 9 in Columns (a) and (b). Enter totals for each column on Line 10. Column (a) total is also entered on Page 1, Line 5 (of the F-1120 return). Column (b) total is also entered on Schedule VI, Line 5. 10. 10. Schedule III — Apportionment of Adjusted Federal Income III-A For use by taxpayers doing business outside Florida, except those providing insurance or transportation services. (a) (b) (c) (d) (e) Col. (a) 4 Col. (b) WITHIN FLORIDA TOTAL EVERYWHERE Weight Weighted Factors If any factor in Column (b) is zero, (Numerator) (Denominator) Rounded to Six Decimal Rounded to Six Decimal see note on Page 10 of the instructions. Places Places 1. Property (Schedule III-B below) X 25% or ______ 2. Payroll X 25% or ______ 3. Sales (Schedule III-C below) X 50% or ______ 4. Apportionment fraction [Sum of Lines 1, 2, and 3, Column (e)]. Enter here and on Schedule IV, Line 2. WITHIN FLORIDA TOTAL EVERYWHERE III-B For use in computing average value of property (use original cost). a. Beginning of year b. End of year c. Beginning of year d. End of year 1. Inventories of raw material, work in process, finished goods 2. Buildings and other depreciable assets 3. Land owned 4. Other tangible and intangible (financial org. only) assets (attach schedule) 5. Total (Lines 1 through 4) 6. Average value of property a. Add Line 5, Columns (a) and (b) and divide by 2 (for within Florida) .......... 6a. b. Add Line 5, Columns (c) and (d) and divide by 2 (for total everywhere) ......................................................................................... 6b. 7. Rented property (8 times net annual rent) a. Rented property in Florida .......................................................................... 7a. b. Rented property Everywhere ......................................................................................................................................................... 7b. 8. Total (Lines 6 and 7). Enter on Line 1, Schedule III-A, Columns (a) and (b). a. Enter Lines 6 a. plus 7 a. and also enter on Schedule III-A, Line 1, Column (a) for total average property in Florida ......................................... 8a. b. Enter Lines 6 b. plus 7 b. and also enter on Schedule III-A, Line 1, Column (b) for total average property Everywhere ......................................................................................................................... 8b. Average Florida Average Everywhere (a) (b) III-C Sales Factor TOTAL WITHIN FLORIDA TOTAL EVERYWHERE (Numerator) (Denominator) N/A 1. Sales (gross receipts) N/A 2. Sales delivered or shipped to Florida purchasers 3. Other gross receipts (rents, royalties, interest, etc. when applicable) 4. TOTAL SALES [Enter on Schedule III-A, Line 3, Columns (a) and (b)] (c) FLORIDA Fraction [(a) 4 (b)] III-D Special Apportionment Fractions (see instructions) (a) WITHIN FLORIDA (b) TOTAL EVERYWHERE Rounded to Six Decimal Places 1. Insurance companies (attach copy of Schedule T–Annual Report) 2. Transportation services

- 5. F-1120 R. 01/09 Page 5 NAME FEIN TAXABLE YEAR ENDING Schedule IV — Computation of Florida Portion of Adjusted Federal Income Column (a) Column (b) Adjusted Adjusted Federal Income AMT Income 1. Apportionable adjusted federal income from Page 1, Line 6 [or Line 6, Schedule VI for AMT in Col. (b)] 1. 1. 2. Florida apportionment fraction [Schedule III-A, Line 4 or Schedule III-D, Column (c)] 2. 2. 3. Tentative apportioned adjusted federal income (multiply Line 1 by Line 2) 3. 3. 4. Net operating loss carryover apportioned to Florida (attach schedule; see instructions) 4. 4. 5. Net capital loss carryover apportioned to Florida (attach schedule; see instructions) 5. 5. 6. Excess charitable contribution carryover apportioned to Florida (attach schedule; see instructions) 6. 6. 7. Employee benefit plan contribution carryover apportioned to Florida (attach schedule; see instructions) 7. 7. 8. Total carryovers apportioned to Florida (add Lines 4 through 7) 8. 8. 9. Adjusted federal income apportioned to Florida (Line 3 less Line 8; see instructions) 9. 9. Schedule V — Credits Against the Corporate Income/Franchise Tax 1. Florida health maintenance organization credit (attach assessment notice) 1. 2. Capital investment tax credit (attach certification letter) 2. 3. Enterprise zone jobs credit (from Form F-1156Z attached) 3. 4. Community contribution tax credit (attach certification letter) 4. 5. Enterprise zone property tax credit (from Form F-1158Z attached) 5. 6. Rural job tax credit (attach certification letter) 6. 7. Urban high crime area job tax credit (attach certification letter) 7. 8. Emergency excise tax (EET) credit (see instructions and attach schedule) 8. 9. Hazardous waste facility tax credit 9. 10. Florida alternative minimum tax (AMT) credit 10. 11. Contaminated site rehabilitation tax credit (attach tax credit certificate) 11. 12. Child care tax credits (attach certification letter) 12. 13. State housing tax credit (attach certification letter) 13. Credit for contributions to nonprofit scholarship funding organizations (attach certificate) 14. 14. 15. Florida renewable energy technologies investment tax credit 15. 16. Florida renewable energy production tax credit 16. 17. Other credits (attach schedule) 17. 18. Total credits against the tax (sum of Lines 1 through 17 not to exceed the amount on Page 1, Line 11). 18. Enter total credits on Page 1, Line 12 Schedule VI — Computation of Florida Alternative Minimum Tax (AMT) 1. Federal alternative minimum taxable income after exemption (attach federal Form 4626) 1. 2. State income taxes deducted in computing federal taxable income (attach schedule) 2. 3. Additions to federal taxable income [from Schedule I, Column (b)] 3. 4. Total of Lines 1 through 3 4. 5. Subtractions from federal taxable income [from Schedule II, Column (b)] 5. 6. Adjusted federal alternative minimum taxable income (Line 4 minus Line 5) 6. 7. Florida portion of adjusted federal income (see instructions) 7. 8. Nonbusiness income allocated to Florida (see instructions) 8. 9. Florida exemption 9. 10. Florida net income (Line 7 plus Line 8 minus Line 9) 10. 11. Florida alternative minimum tax due (3.3% of Line 10). See instructions for Page 1, Line 11 11.

- 6. F-1120 R. 01/09 Page 6 NAME FEIN TAXABLE YEAR ENDING Schedule R — Nonbusiness Income Line 1. Nonbusiness income (loss) allocated to Florida Type Amount _____________________________________ _____________________________________ _____________________________________ _____________________________________ _____________________________________ _____________________________________ Total allocated to Florida ................................................................................. 1. __________________________________ (Enter here and on Page 1, Line 8 or Schedule VI, Line 8 for AMT) Line 2. Nonbusiness income (loss) allocated elsewhere Type State/country allocated to Amount _____________________________________ ____________________________________ _____________________________________ _____________________________________ ____________________________________ _____________________________________ _____________________________________ ____________________________________ _____________________________________ Total allocated elsewhere ................................................................................ 2. __________________________________ Line 3. Total nonbusiness income Grand total. Total of Lines 1 and 2 .................................................................. 3. __________________________________ (Enter here and on Schedule II, Line 7) Estimated Tax Worksheet For Taxable Years Beginning on or After January 1, 2009 1. Florida income expected in taxable year ................................................................................................... 1. $ _______________ 2. Florida exemption $5,000 (Members of a controlled group, see instructions on Page 15 of F-1120N) ..... 2. $ _______________ 3. Estimated Florida net income (Line 1 less Line 2) ...................................................................................... 3. $ _______________ 4. Total Estimated Florida tax (5.5% of Line 3)* .................................. $ ____________________________ Less: Credits against the tax ........................................................... $ ____________________________ 4. $ _______________ * Taxpayers subject to federal alternative minimum tax must compute Florida alternative minimum tax at 3.3% and enter the greater of these two computations. 5. Estimated emergency excise tax ............................................................................................................... 5. $ _______________ 6. Total corporate and emergency excise tax (Line 4 plus Line 5) ................................................................. 6. $ _______________ If Line 6 is more than $2,500, file installment as computed on Line 7; if $2,500 or less, no declaration (Form F-1120ES) is required. 7. Computation of installments: Payment due dates and Last day of 4th month - Enter 0.25 of Line 6 ..................................... 7a. _________________ payment amounts: Last day of 6th month - Enter 0.25 of Line 6 .................................... 7b. _________________ Last day of 9th month - Enter 0.25 of Line 6 ..................................... 7c. _________________ Last day of fiscal year – Enter 0.25 of Line 6 .................................. 7d. _________________ NOTE: If your estimated tax should change during the year, you may use the amended computation below to determine the amended amounts to be entered on the declaration (Form F-1120ES). 1. Amended estimated tax ............................................................................................................................. 1. $ _______________ 2. Less: (a) Amount of overpayment from last year elected for credit to estimated tax and applied to date ............................................ 2a. — $ __________________________ (b) Payments made on estimated tax declaration (F-1120ES) .... 2b. — $ __________________________ (c) Total of Lines 2(a) and 2(b) .................................................................................................................. 2c. $ _______________ 3. Unpaid balance (Line 1 less Line 2(c)) ........................................................................................................ 3. $ _______________ 4. Amount to be paid (Line 3 divided by number of remaining installments) ................................................. 4. $ _______________

- 7. FEIN of entity Change of Address or Business Name CHANGE IN Complete this form, sign it, and mail Mail to: New Business location____________________________________________________ Location it to the Department if: Florida Department of Revenue Address City_______________________________State_______ZIP__________________ • The address below is not correct. 5050 W Tennessee St • The business location changes. Tallahassee FL 32399-0100 Business telephone (_______) ___________________County________________ • The corporation name changes. In care of__________________________________________________________ F-1120 Mailing address_____________________________________________________ New Mailing Address City_______________________________State_______ZIP__________________ Owner’s telephone (_______) ___________________County_________________ New Business DBA______________________________________________________________ Name New ______________________________________________________ Corporation _________________________________________________________________________ Signature of officer (Required) Date Name 9100 0 20089999 0002005999 8 3999999999 0000 2 Florida Department of Revenue - Corporate Income Tax F-7004 Rule 12C-1.051 R. 01/09 Florida Tentative Income / Franchise and Emergency Excise Tax Florida Administrative Code Effective 01/09 Return and Application for Extension of Time to File Return You must write within the boxes. (example) 0 1 2 3 4 5 6 7 8 9 0123456789 If typing, type through the boxes. (example) F-7004 Write your numbers as shown and enter one number per box. FEIN Name Corporation Partnership Taxable year end: FILING STATUS Address MMDDY Y (Mark “X” in one box only) City/St/ZIP US DOLLARS CENTS Tentative tax due (See reverse side) Under penalties of perjury, I declare that I have been authorized by the above-named taxpayer to make this application, and that to the best of my knowledge and belief the statements herein are true and correct: Check here if you transmitted ▼ Sign here:___________________________________________ Date:__________________ funds electronically Make checks payable and mail to: Florida Department of Revenue, 5050 W Tennessee St, Tallahassee FL 32399-0135 9100 0 20089999 0002005030 6 3999999999 0000 2 Florida Department of Revenue — Corporate Income Tax F-1120ES Rule 12C-1.051 R. 01/09 Declaration/Installment of Florida Estimated Income/Franchise and Florida Administrative Code Effective 01/09 Emergency Excise Tax for Taxable Year Beginning on or After January 1, 2009 Installment #_____ You must write within the boxes. (example) 0 1 2 3 4 5 6 7 8 9 0123456789 If typing, type through the boxes. (example) Write your numbers as shown and enter one number per box. F-1120ES FEIN Taxable MMDDY Y year end Name Estimated tax payment Address (See reverse side) City/St/ZIP US DOLLARS CENTS Check here if you transmitted Office use ▼ MMDDY Y funds electronically only Make checks payable and mail to: Florida Department of Revenue, 5050 W Tennessee St, Tallahassee FL 32399-0135 9100 0 20099999 0002005033 0 3999999999 0000 2

- 8. Closing or Sale of Business or Change of Legal Entity The legal entity changed on _____ / _____ / _____ . If you change your legal entity and are continuing to do business in Florida and the corporation is registered for Sales and Use Tax, you must complete a new Application to Collect and Report Tax in Florida (Form DR-1). The business was closed permanently on _____ / _____ / _____ . (The Department will remove your corporate income tax obligation as of this date.) Are you a corporation/partnership required to file sales and use tax returns? Yes No The business was sold on _____ / _____ / _____ . The new owner information is: Name of new owner: ___________________________________________Telephone number of new owner: ( __________) ____________________________ Mailing address of new owner: ___________________________________________________________________________________________________________ City: ___________________________________________County: _____________________________ State: __________ZIP: ____________________________ Sales and Use Tax FEIN Certificate Number ▼ Signature of officer (Required) __________________________________________ Date ___________________ Telephone number ( _______) ________________ Information for Filing Form F-7004 F-7004 R. 01/09 B. If applicable, state the reason you need the extension: ______________________ When to file — File this application on or before the original due date of the taxpayer’s corporate income tax or partnership return. Do not file before the end of ______________________________________________________________________ the tax year. ______________________________________________________________________ To file online go to www.myflorida.com/dor C. Type of federal return filed:_______________________________________________ Penalties for failure to pay tax — If you are required to pay tax with this application, Contact person for questions: ____________________________________________ failure to pay will void any extension of time and subject the taxpayer to penalties and Telephone number: (________) ___________________________________________ interest for failure to file a timely return(s) and pay all taxes due. There is also a penalty for a late-filed return when no tax is due. Signature — A person authorized by the taxpayer must sign Form F-7004. They must be (a) an officer or partner of the taxpayer, (b) a person currently enrolled to Florida Income/Franchise practice before the Internal Revenue Service (IRS), or (c) an attorney or Certified Extension of Time Request Emergency Excise Tax Due Public Accountant qualified to practice before the IRS under Public Law 89-332. 1. 1. Tentative amount of Florida tax for the taxable year A. Have you filed Form 7004 with the IRS ■ ■ Yes No for the taxable year? ................................................................ 2. 2. LESS: Estimated tax payments for the taxable year If the answer is “No,” complete Item B. 3. Balance due — You must pay 100% of the tax An extension for Florida tax purposes may be granted, even though no federal 3. tentatively determined due with this extension request. extension was granted. See Rule 12C-1.0222, F.A.C., for information on the Transfer the amount on Line 3 to Tentative tax due on reverse side. requirements that must be met for your request for an extension of time to be valid. Information for Filing Form F-1120ES F-1120ES R. 01/09 1. Who must make estimated tax payments — Every domestic or foreign corporation or other entity subject to taxation under the provisions of Chapter Contact person for questions: ____________________________________________ 220 and/or Chapter 221, Florida Statutes, must declare estimated tax for the taxable year if the amount of income tax liability and emergency excise tax Phone number: (________) ______________________________________________ liability for the year will be more than $2,500. To file online go to www.myflorida.com/dor 2. Due Date — Generally, estimated tax must be paid on or before the last day of the 4th, 6th, and 9th month of the taxable year and the last day of the taxable year; 25 percent of the estimated tax must be paid with each installment. 3. Amended Declaration — To prepare an amended declaration, write “Amended” on Florida Form F-1120ES and complete Lines 1 through 3 of the correct Combined Income/Franchise Estimated Tax Payment installment. You may file an amendment during any interval between installment and Emergency Excise Tax dates prescribed for the taxable year. You must timely pay any increase in the 1. 1. Amount of this installment estimated tax. 2. Amount of overpayment from last year for credit to 2. 4. Interest and Penalties — If you fail to comply with the law about filing a estimated tax and applied to this installment declaration or paying estimated tax, you will be assessed interest and penalties. 3. 3. Amount of this payment (Line 1 minus Line 2) Transfer the amount on Line 3 to Estimated tax payment box on front.

- 9. Florida Department of Revenue — Corporate Income Tax F-1120ES Rule 12C-1.051 R. 01/09 Declaration/Installment of Florida Estimated Income/Franchise and Florida Administrative Code Effective 01/09 Emergency Excise Tax for Taxable Year Beginning on or After January 1, 2009 Installment #_____ You must write within the boxes. (example) 0 1 2 3 4 5 6 7 8 9 0123456789 If typing, type through the boxes. (example) Write your numbers as shown and enter one number per box. F-1120ES FEIN Taxable MMDDY Y year end Name Estimated tax payment Address (See reverse side) City/St/ZIP US DOLLARS CENTS Check here if you transmitted Office use ▼ MMDDY Y funds electronically only Make checks payable and mail to: Florida Department of Revenue, 5050 W Tennessee St, Tallahassee FL 32399-0135 9100 0 20099999 0002005033 0 3999999999 0000 2 Florida Department of Revenue — Corporate Income Tax F-1120ES Rule 12C-1.051 R. 01/09 Declaration/Installment of Florida Estimated Income/Franchise and Florida Administrative Code Effective 01/09 Emergency Excise Tax for Taxable Year Beginning on or After January 1, 2009 Installment #_____ You must write within the boxes. (example) 0 1 2 3 4 5 6 7 8 9 0123456789 If typing, type through the boxes. (example) Write your numbers as shown and enter one number per box. F-1120ES FEIN Taxable MMDDY Y year end Name Estimated tax payment Address (See reverse side) City/St/ZIP US DOLLARS CENTS Check here if you transmitted Office use ▼ MMDDY Y funds electronically only Make checks payable and mail to: Florida Department of Revenue, 5050 W Tennessee St, Tallahassee FL 32399-0135 9100 0 20099999 0002005033 0 3999999999 0000 2 Florida Department of Revenue — Corporate Income Tax F-1120ES Rule 12C-1.051 R. 01/09 Declaration/Installment of Florida Estimated Income/Franchise and Florida Administrative Code Effective 01/09 Emergency Excise Tax for Taxable Year Beginning on or After January 1, 2009 Installment #_____ You must write within the boxes. (example) 0 1 2 3 4 5 6 7 8 9 0123456789 If typing, type through the boxes. (example) Write your numbers as shown and enter one number per box. F-1120ES FEIN Taxable MMDDY Y year end Name Estimated tax payment Address (See reverse side) City/St/ZIP US DOLLARS CENTS Check here if you transmitted Office use ▼ MMDDY Y funds electronically only Make checks payable and mail to: Florida Department of Revenue, 5050 W Tennessee St, Tallahassee FL 32399-0135 9100 0 20099999 0002005033 0 3999999999 0000 2

- 10. Information for Filing Form F-1120ES F-1120ES R. 01/09 1. Who must make estimated tax payments — Every domestic or foreign corporation or other entity subject to taxation under the provisions of Chapter Contact person for questions: ____________________________________________ 220 and/or Chapter 221, Florida Statutes, must declare estimated tax for the taxable year if the amount of income tax liability and emergency excise tax Phone number: (________) ______________________________________________ liability for the year will be more than $2,500. To file online go to www.myflorida.com/dor 2. Due Date — Generally, estimated tax must be paid on or before the last day of the 4th, 6th, and 9th month of the taxable year and the last day of the taxable year; 25 percent of the estimated tax must be paid with each installment. 3. Amended Declaration — To prepare an amended declaration, write “Amended” on Florida Form F-1120ES and complete Lines 1 through 3 of the correct Combined Income/Franchise Estimated Tax Payment installment. You may file an amendment during any interval between installment and Emergency Excise Tax dates prescribed for the taxable year. You must timely pay any increase in the 1. 1. Amount of this installment estimated tax. 2. Amount of overpayment from last year for credit to 2. 4. Interest and Penalties — If you fail to comply with the law about filing a estimated tax and applied to this installment declaration or paying estimated tax, you will be assessed interest and penalties. 3. 3. Amount of this payment (Line 1 minus Line 2) Transfer the amount on Line 3 to Estimated tax payment box on front. Information for Filing Form F-1120ES F-1120ES R. 01/09 1. Who must make estimated tax payments — Every domestic or foreign corporation or other entity subject to taxation under the provisions of Chapter Contact person for questions: ____________________________________________ 220 and/or Chapter 221, Florida Statutes, must declare estimated tax for the taxable year if the amount of income tax liability and emergency excise tax Phone number: (________) ______________________________________________ liability for the year will be more than $2,500. To file online go to www.myflorida.com/dor 2. Due Date — Generally, estimated tax must be paid on or before the last day of the 4th, 6th, and 9th month of the taxable year and the last day of the taxable year; 25 percent of the estimated tax must be paid with each installment. 3. Amended Declaration — To prepare an amended declaration, write “Amended” on Florida Form F-1120ES and complete Lines 1 through 3 of the correct Combined Income/Franchise Estimated Tax Payment installment. You may file an amendment during any interval between installment and Emergency Excise Tax dates prescribed for the taxable year. You must timely pay any increase in the 1. 1. Amount of this installment estimated tax. 2. Amount of overpayment from last year for credit to 2. 4. Interest and Penalties — If you fail to comply with the law about filing a estimated tax and applied to this installment declaration or paying estimated tax, you will be assessed interest and penalties. 3. 3. Amount of this payment (Line 1 minus Line 2) Transfer the amount on Line 3 to Estimated tax payment box on front. Information for Filing Form F-1120ES F-1120ES R. 01/09 1. Who must make estimated tax payments — Every domestic or foreign corporation or other entity subject to taxation under the provisions of Chapter Contact person for questions: ____________________________________________ 220 and/or Chapter 221, Florida Statutes, must declare estimated tax for the taxable year if the amount of income tax liability and emergency excise tax Phone number: (________) ______________________________________________ liability for the year will be more than $2,500. To file online go to www.myflorida.com/dor 2. Due Date — Generally, estimated tax must be paid on or before the last day of the 4th, 6th, and 9th month of the taxable year and the last day of the taxable year; 25 percent of the estimated tax must be paid with each installment. 3. Amended Declaration — To prepare an amended declaration, write “Amended” on Florida Form F-1120ES and complete Lines 1 through 3 of the correct Combined Income/Franchise Estimated Tax Payment installment. You may file an amendment during any interval between installment and Emergency Excise Tax dates prescribed for the taxable year. You must timely pay any increase in the 1. 1. Amount of this installment estimated tax. 2. Amount of overpayment from last year for credit to 2. 4. Interest and Penalties — If you fail to comply with the law about filing a estimated tax and applied to this installment declaration or paying estimated tax, you will be assessed interest and penalties. 3. 3. Amount of this payment (Line 1 minus Line 2) Transfer the amount on Line 3 to Estimated tax payment box on front.