revenue.ne.gov tax current f_4466n

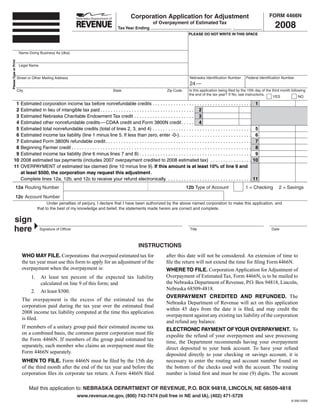

- 1. FORM 4466N Corporation Application for Adjustment 2008 of Overpayment of Estimated Tax Tax Year Ending , PLEASE DO NOT WRITE IN THIS SPACE Name Doing Business As (dba) SAVE RESET PRINT Please Type or Print Legal Name Nebraska Identification Number Federal Identification Number Street or Other Mailing Address 24 — Is this application being filed by the 15th day of the third month following City State Zip Code the end of the tax year? If No, see instructions. YES NO 1 1 Estimated corporation income tax before nonrefundable credits . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 2 Estimated in lieu of intangible tax paid . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 2 3 Estimated Nebraska Charitable Endowment Tax credit . . . . . . . . . . . . . . . . . . . . . . . 3 4 Estimated other nonrefundable credits — CDAA credit and Form 3800N credit . . . . . 4 5 5 Estimated total nonrefundable credits (total of lines 2, 3, and 4) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 6 6 Estimated income tax liability (line 1 minus line 5. If less than zero, enter -0-). . . . . . . . . . . . . . . . . . . . . . . . . . . . 7 7 Estimated Form 3800N refundable credit. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 8 8 Beginning Farmer credit . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 9 9 Estimated income tax liability (line 6 minus lines 7 and 8) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 10 10 2008 estimated tax payments (includes 2007 overpayment credited to 2008 estimated tax) . . . . . . . . . . . . . . . . 11 OVERPAYMENT of estimated tax claimed (line 10 minus line 9). If this amount is at least 10% of line 9 and at least $500, the corporation may request this adjustment . 11 Complete lines 12a, 12b, and 12c to receive your refund electronically. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 12a Routing Number 12b Type of Account 1 = Checking 2 = Savings 12c Account Number Under penalties of perjury, I declare that I have been authorized by the above named corporation to make this application, and that to the best of my knowledge and belief, the statements made herein are correct and complete. sign here Signature of Officer Title Date INSTRUCTIONS WHO MAY FILE. Corporations that overpaid estimated tax for after this date will not be considered. An extension of time to the tax year must use this form to apply for an adjustment of the file the return will not extend the time for filing Form 4466N. overpayment when the overpayment is: WHERE TO FILE. Corporation Application for Adjustment of Overpayment of Estimated Tax, Form 4466N, is to be mailed to 1. At least ten percent of the expected tax liability the Nebraska Department of Revenue, P.O. Box 94818, Lincoln, calculated on line 9 of this form; and Nebraska 68509-4818. 2. At least $500. OVERPAYMENT CREDITED AND REFUNDED. The The overpayment is the excess of the estimated tax the Nebraska Department of Revenue will act on this application corporation paid during the tax year over the estimated final within 45 days from the date it is filed, and may credit the 2008 income tax liability computed at the time this application overpayment against any existing tax liability of the corporation is filed. and refund any balance. If members of a unitary group paid their estimated income tax ELECTRONIC PAYMENT OF YOUR OVERPAYMENT. To on a combined basis, the common parent corporation must file expedite the refund of your overpayment and save processing the Form 4466N. If members of the group paid estimated tax time, the Department recommends having your overpayment separately, each member who claims an overpayment must file direct deposited to your bank account. To have your refund Form 4466N separately. deposited directly to your checking or savings account, it is WHEN TO FILE. Form 4466N must be filed by the 15th day necessary to enter the routing and account number found on of the third month after the end of the tax year and before the the bottom of the checks used with the account. The routing corporation files its corporate tax return. A Form 4466N filed number is listed first and must be nine (9) digits. The account Mail this application to: NEBRASKA DEPARTMENT OF REVENUE, P.O. BOX 94818, LINCOLN, NE 68509-4818 www.revenue.ne.gov, (800) 742-7474 (toll free in NE and IA), (402) 471-5729 8-390-2008

- 2. number is listed to the right of the routing number and can be up excessive adjustment, calculated from the date the adjustment to seventeen (17) digits. Enter these numbers in the boxes found was made until the original due date of the corporation’s on lines 12a and 12c. Also complete line 12b, Type of Account. return. If you fail to complete lines 12a through 12c, the payment of The excessive amount is the lesser of: your refund will be delayed. 1. The amount of the adjustment, or 2. The excess of: DISALLOWANCE OF APPLICATION. The Nebraska Department of Revenue may disallow, without further action a. The corporation’s income tax liability as shown on or appeal, any application containing material omissions its return over or errors that cannot be corrected within the 45-day review b. The estimated tax paid less the adjustment period. Form 4466N does not constitute a claim for credit allowed. or refund. SIGNATURE. This application must be signed by a corporate EXCESSIVE ADJUSTMENT. If any adjustment made by the officer. If the taxpayer authorizes another person to sign this Nebraska Department of Revenue is later found to be excessive, application, there must be a Power of Attorney, Form 33, on file interest at the statutory rate will be due on the amount of the with the Nebraska Department of Revenue.