AES 01192006

0 likes238 views

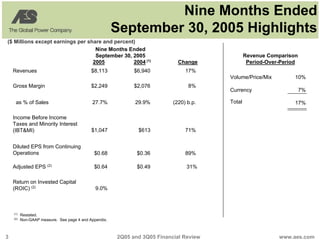

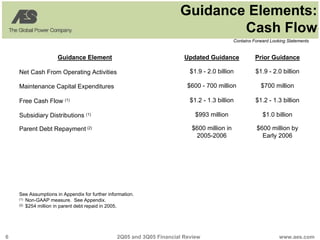

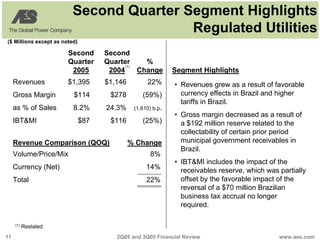

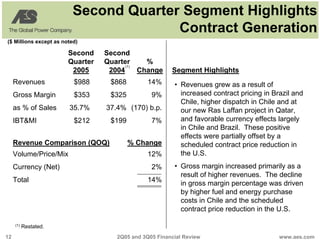

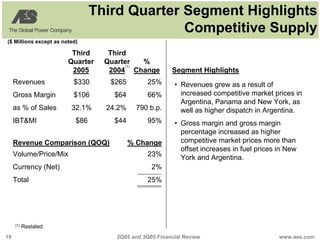

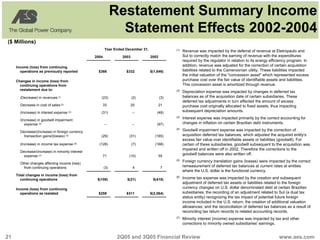

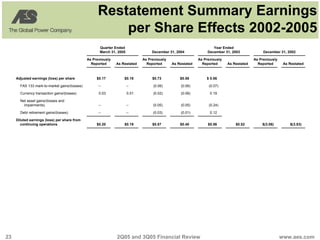

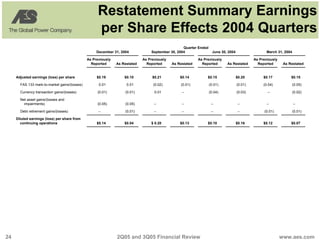

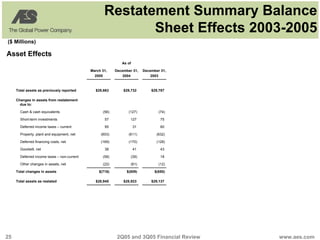

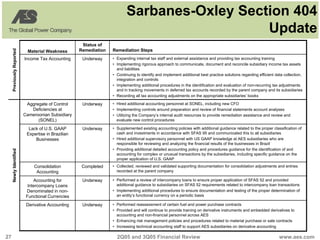

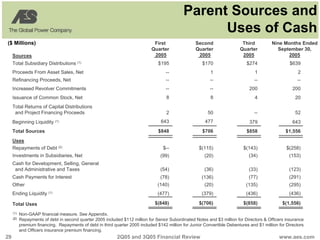

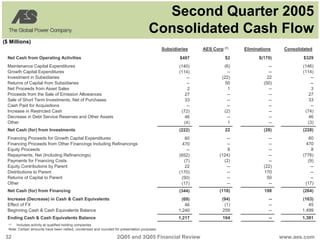

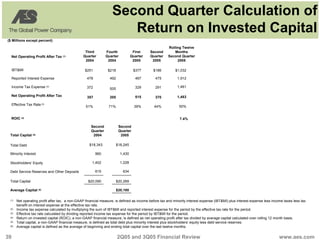

This document summarizes AES Corporation's financial performance for the second and third quarters of 2005. It reports that revenues for the first nine months of 2005 were $8.1 billion, a 17% increase over the same period in 2004, driven by higher electricity prices and currency effects. Net income was $1.047 billion for the nine months, up 71% compared to the same period in 2004. Adjusted earnings per share, which excludes certain one-time items, were $0.64 per share for the nine months, a 31% increase over the prior year. The document also provides guidance for full-year 2005 revenues to increase 16-17% over 2004 and adjusted earnings per share of $0.83-$0

1 of 40

Download to read offline

Recommended

AES 2Q 2006 AE SFinancial

AES 2Q 2006 AE SFinancialfinance19 This document provides an overview of AES Corporation's financial results for the second quarter of 2006. Some key highlights include revenues increasing 15% compared to the same period last year, driven by higher electricity prices and new projects. Gross margin improved significantly to 30.3% of sales from 19.9% last year. Income before taxes and minority interest increased 160% and diluted earnings per share from continuing operations grew 138% compared to the prior year. On an adjusted basis, earnings per share rose 142%. Return on invested capital also increased substantially.

AES 3Q 2006

AES 3Q 2006finance19 - The document provides AES Corporation's third quarter 2006 financial review, including highlights and guidance updates.

- Key highlights include a 14% increase in revenues year-over-year due to higher prices and new projects. Gross margin increased 9% while income before taxes declined 114% due to losses on asset sales related to restructuring.

- Guidance for 2006 was updated, with revenue growth expected at 9-10% and adjusted EPS estimated at $1.09, up from the prior guidance of $1.01.

fannie mae Investor Summary

fannie mae Investor Summary finance6 This document provides a summary of Fannie Mae's 2007 10-K investor report. It includes tables showing Fannie Mae's consolidated financial results for 2007 compared to 2006. Net interest income, guaranty fee income, and other revenue were down in 2007 from the prior year due to the severe housing crisis. Fannie Mae reported a net loss in 2007 driven by credit-related expenses from losses on mortgages and mortgage-backed securities. While facing significant challenges from the troubled housing market, Fannie Mae met its obligations under a consent agreement with regulators and remained focused on protecting its capital position.

viacom 20081103%20Q308%20Web%20Deck

viacom 20081103%20Q308%20Web%20Deckfinance20 This document summarizes Viacom's financial results for the third quarter of 2008. Revenues increased 4% year-over-year to $3.4 billion. Operating income decreased 15% to $689 million due to an 11% increase in expenses. Adjusted net earnings decreased 22% to $339 million, while adjusted diluted EPS decreased 15% to $0.55. Free cash flow was $564 million for the quarter compared to a significant decrease year-to-date. Total debt was $8.95 billion as of September 30, 2008, while cash on hand was $525 million.

ameriprise 4Q06_Supplement

ameriprise 4Q06_Supplementfinance43 This document provides financial information for Ameriprise Financial, Inc. for the fourth quarter of 2006. It includes consolidated income statements, adjusted consolidated income statements, financial metrics, segment information, and explanatory notes. Some key figures include total revenues of $2.16 billion for Q4 2006, a 16% increase from Q4 2005. Net income was $171 million for Q4 2006, a 54% increase from Q4 2005. Adjusted earnings per share increased 34% to $1.03 for Q4 2006 compared to $0.77 for Q4 2005.

viacom Q208%20Web%20Deck%20FINAL%207.29

viacom Q208%20Web%20Deck%20FINAL%207.29finance20 This document summarizes Viacom's financial results for the second quarter and first half of 2008. Key highlights include:

- Revenues for Q2 2008 increased 21% to $3.9 billion and increased 18% to $7 billion for the first half.

- Operating income for Q2 2008 increased 13% to $792 million and increased 19% to $1.4 billion for the first half.

- Earnings per share from continuing operations for Q2 2008 increased 2% to $0.64 and increased 15% to $1.06 for the first half.

- Media Networks revenues increased 11% in Q2 2008 and 14% for the first half, driven by increases in affiliate fees

baxter international Q207PRSchedules

baxter international Q207PRSchedulesfinance24 This document summarizes Baxter International's financial performance for the second quarter and first half of 2007 compared to the same periods in 2006. It shows that net sales increased 7% to $2.8 billion in Q2 2007 and 9% to $5.5 billion for the first half. Gross profit increased 21% in Q2 and 20% for the first half. Net income increased 39% to $431 million in Q2 and 41% to $834 million for the first half. Adjusted earnings figures exclude certain one-time charges.

goodrich 1Q05_Slides

goodrich 1Q05_Slidesfinance44 - Goodrich Corporation reported first quarter 2005 results, with sales growth of 10% and net income per share growth of 21% compared to first quarter 2004.

- The company increased its 2005 outlook with expected sales of $5.1-5.2 billion and net income per share of $1.80-$1.95.

- Segment operating income grew 28% in the first quarter due to increases in all market channels and reportable segments.

ameriprise 1Q06_Supplement

ameriprise 1Q06_Supplementfinance43 This statistical supplement from Ameriprise Financial provides key financial metrics and information for the first quarter of 2006 compared to previous periods. Some highlights include:

- Revenue increased 6% to $1.949 billion from the prior year period, while income before taxes was relatively flat.

- Adjusted earnings increased 17% to $189 million, excluding one-time items.

- Total client assets under management or administration grew 11% to $446 billion.

- The number of financial advisors was relatively unchanged at 12,339.

credit sussi Annual Report Part 1 Share performance Market capitalisation Fin...

credit sussi Annual Report Part 1 Share performance Market capitalisation Fin...QuarterlyEarningsReports2 Credit Suisse Group reported strong financial results for 1998, with net profit increasing substantially to CHF 3.1 billion. Four of the Group's five business units achieved very good results, with Credit Suisse, Credit Suisse Private Banking, Credit Suisse Asset Management, and Winterthur all posting profits. However, Credit Suisse First Boston reported a loss due to provisions related to the collapse of the Russian market. Overall, the Group saw increases in revenue, assets under management, and earnings per share for the year.

du pont Earnings Release

du pont Earnings Release finance9 This document provides annual performance ratios for E.I. DuPont de Nemours and Company for the years 2007-2003. It includes metrics such as total stockholder return, price-to-earnings ratios, dividend payout ratios, return on equity, return on invested capital, debt ratios, and interest coverage. Reconciliations are also provided to calculate ratios before significant items in order to provide adjusted figures.

progressive mreport-03/05

progressive mreport-03/05finance18 The Progressive Corporation reported financial results for March 2005. Net premiums written increased 5% to $1.127 billion compared to March 2004. Net income decreased 11% to $135.2 million compared to the prior year. Earnings per share fell 3% to $0.67. The combined ratio was 84.8, an increase of 2 percentage points from the prior year. Policies in force grew 12% year-over-year for personal lines and 14% for commercial auto.

unum group 2Q 06_Statistical_Supplement

unum group 2Q 06_Statistical_Supplementfinance26 This document provides a statistical supplement for UnumProvident Corporation for the second quarter of 2006. It includes financial highlights and consolidated statements of operations, balance sheets, and sales data. Some key details are:

- For the second quarter of 2006, total revenue was $2.67 billion and net income was $125.2 million.

- Premium income for the first six months of 2006 was $3.96 billion and net income was $198.6 million.

- Financial sales data shows growth in most product lines for the U.S. Brokerage segment compared to the second quarter and first six months of 2005.

Services - GMAC Annual and Fourth Quarter Earnings

Services - GMAC Annual and Fourth Quarter Earnings finance8 GMAC reported full year net income of $2.1 billion in 2006, down from $2.3 billion in 2005. The residential mortgage market experienced a slowdown due to declining home prices and weakness in nonprime credit. Auto finance results were stable despite one-time costs. Insurance reported record earnings through robust underwriting. ResCap results were negatively impacted by $839 million due to homebuilder equity sales and nonprime mortgage market deterioration.

GM_Earning Release_Q1_08_Chart Set

GM_Earning Release_Q1_08_Chart SetManya Mohan - GM reported a GAAP net loss of $3.3 billion for the first quarter of 2008. Adjusted net loss was $350 million, excluding special items.

- Revenue was about flat at $42.1 billion as growth in international regions offset declines in North America. Adjusted automotive earnings before tax were $392 million.

- A strike at American Axle impacted production by about 100,000 units and reduced earnings before tax by approximately $800 million for the quarter.

- While markets outside North America grew, results in GMNA declined due to lower industry volume, mix shifts away from trucks, and higher material costs partially offset by cost reductions.

unum group _Q306

unum group _Q306finance26 The document is a statistical supplement from UnumProvident for the third quarter of 2006 that includes financial highlights and statistics for the company. Some key details from the financial highlights include:

- For the third quarter of 2006, UnumProvident reported a net loss of $63.7 million compared to net income of $52.6 million for the same quarter the previous year.

- For the first nine months of 2006, UnumProvident reported net income of $134.9 million compared to $376.1 million for the same period in 2005.

- Total assets for UnumProvident as of September 30, 2006 were $52.2 billion, up slightly from $51.1 billion at

goodrich 3Q06

goodrich 3Q06finance44 Goodrich Corporation reported third quarter 2006 results with the following highlights:

- Sales grew 5% year-over-year to $1.436 billion, with growth in all segments.

- Net income per diluted share was $0.80, a 63% increase from third quarter 2005.

- The company authorized a $300 million share repurchase program to reduce dilution from equity programs.

- Segment operating margins improved in all segments compared to third quarter 2005.

Reconciliations 2008 Annual Meeting of Stockholders

Reconciliations 2008 Annual Meeting of Stockholdersfinance6 This document contains reconciliations and summaries of Safeway's financial metrics for 2006-2008, including:

1) Adjusted EPS for 2006-2007 which excludes certain tax adjustments and a tax settlement;

2) Reconciliation of net income to adjusted EBITDA and interest coverage ratios for 2007-2003;

3) Basis point changes in operating profit margin guidance excluding fuel impact;

4) Reconciliation of GAAP cash flow to free cash flow forecasts for 2008-2005.

AES 050806

AES 050806finance19 The document provides an overview of AES Corporation's financial results for the first quarter of 2006. Some key highlights include revenues increasing 13% to $3.013 billion compared to the same period in 2005, driven largely by higher prices and currency effects. Income before taxes and minority interest increased 68% to $633 million. Diluted earnings per share from continuing operations were $0.52 compared to $0.19 in the prior year. Segment results were positively impacted by higher demand and prices across most business lines.

Q3 2011 Financial Highlights Presentaion Final

Q3 2011 Financial Highlights Presentaion FinalAimia's Investor Presentations - Q3 2011 saw record gross billings, adjusted EBITDA, and strong free cash flow for Aimia. Gross billings increased 4.1% year-over-year to $541.8 million.

- Adjusted EBITDA grew significantly by 83.5% to $104.2 million compared to Q3 2010. Free cash flow before dividends paid was $124.8 million.

- For the first nine months of 2011, gross billings increased 1.1% to $1.6 billion. Adjusted EBITDA rose 25.8% to $252.7 million, driven by growth across the business.

direc tv group Annual Reports 1998

direc tv group Annual Reports 1998finance15 Satellite TV dishes on tens of millions of homes and seamless global telephone service are some developing markets driving a $70 billion satellite and wireless industry. Hughes is uniquely positioned to take advantage of opportunities in this industry due to its leadership in satellite and wireless systems, proven record of innovation, strong finances, and highly skilled workforce.

oshkosh Q308_Slides

oshkosh Q308_Slidesfinance44 This document contains the transcript from Oshkosh Corporation's earnings conference call for the third quarter of fiscal year 2008. Key highlights include a 6.6% increase in quarterly sales to $1.97 billion but a 5.9% decrease in operating income to $181.2 million. EPS for the quarter decreased 1.7% to $1.19. Oshkosh revised its estimate for full year 2008 EPS to a range of $3.15 to $3.30.

omnicom group Q1 2008 Investor Presentation

omnicom group Q1 2008 Investor Presentationfinance22 The document provides an overview of Omnicom Group's financial results for the first quarter of 2008. It includes a summary of revenue and earnings growth compared to the first quarter of 2007. The document also discusses Omnicom's cash flow, credit profile, liquidity, acquisitions, and provides brief profiles of four agencies acquired during the first quarter.

baxter international Q3/06 Schedules

baxter international Q3/06 Schedulesfinance24 - Baxter International reported financial results for Q3 2006 and year-to-date 2006 compared to the same periods in 2005.

- Net sales increased 7% to $2.56 billion in Q3 2006 and 3% to $7.62 billion for the first nine months of 2006.

- Operating income increased 29% to $504 million in Q3 2006 and 9% to $1.32 billion for the first nine months of 2006.

- Net income increased 222% to $374 million in Q3 2006 and 45% to $965 million for the first nine months of 2006, helped by lower tax expenses.

AES1Q 2005 20Earnings20Slides20_20final

AES1Q 2005 20Earnings20Slides20_20finalfinance19 - AES Corporation reported financial results for the first quarter of 2005 with revenues of $2.6 billion, a 17% increase from the first quarter of 2004. Income before taxes was $350 million, up 74% from the prior year.

- Key drivers of financial performance included revenue growth from new projects and higher prices/demand across several business segments, as well as favorable currency effects. However, gross margin declined slightly due to higher fuel costs.

- Cash flow from operations was $520 million for the quarter. The company distributed $195 million in subsidiary dividends to the parent company during the period.

Micro

MicroMateo Pérez La microadministración es parte de la Teoría X y supone que los trabajadores no harán su trabajo a menos que sean vigilados estrechamente. Un ejemplo es cuando un administrador observa cada movimiento de un profesor y luego lo critica. La Teoría X también se centra en las consecuencias del fracaso como despidos o aumento de cuotas. Un gerente podría amenazar con despidos si no se alcanzan ciertas metas. Finalmente, la Teoría X lleva al secreto en procesos de evaluación para ocultar críticas a e

Nokia

NokiaMoeedAwais Nokia Corporation is a Finnish multinational communications company headquartered in Finland. It produces mobile phones and portable IT devices. The company has over 122,000 employees worldwide and annual revenues of around €38 billion. Nokia faces competition from companies like Apple, Samsung, and Motorola in both domestic and international markets. It partners with Microsoft to use the Windows Phone operating system in an effort to compete with Google and Apple in the growing smartphone sector. Nokia has had a significant economic and social impact in Finland, historically contributing up to a quarter of the country's growth and paying 23% of all corporate tax.

Compowerpoint

CompowerpointMarlton Middle School The document discusses leadership styles and behaviors, specifically an autocratic style focused on structure, goals, and results. Leaders with this style expect compliance from followers and direct them to complete tasks and utilize data to articulate a vision. Over time, these leaders and their followers can become frustrated, worn out, and disillusioned if the mission is confused or power is surrendered, feeling they have been misled in their efforts to enact change.

Mjf 2013 competition - terms and conditions

Mjf 2013 competition - terms and conditionsDeezer-Comps The document provides the terms and conditions for a competition to win tickets to the Manchester Jazz Festival 2013 hosted by Blogmusik SAS. It outlines that the competition is open to Deezer account holders in Great Britain aged 18 or older between July 18-25, 2013. 18 winners will be selected in a random draw to receive pairs of tickets to various festival performances valued between £10-24. The terms also describe rules around eligibility, entries, winner selection and notification, prize details, and liability.

More Related Content

What's hot (17)

ameriprise 1Q06_Supplement

ameriprise 1Q06_Supplementfinance43 This statistical supplement from Ameriprise Financial provides key financial metrics and information for the first quarter of 2006 compared to previous periods. Some highlights include:

- Revenue increased 6% to $1.949 billion from the prior year period, while income before taxes was relatively flat.

- Adjusted earnings increased 17% to $189 million, excluding one-time items.

- Total client assets under management or administration grew 11% to $446 billion.

- The number of financial advisors was relatively unchanged at 12,339.

credit sussi Annual Report Part 1 Share performance Market capitalisation Fin...

credit sussi Annual Report Part 1 Share performance Market capitalisation Fin...QuarterlyEarningsReports2 Credit Suisse Group reported strong financial results for 1998, with net profit increasing substantially to CHF 3.1 billion. Four of the Group's five business units achieved very good results, with Credit Suisse, Credit Suisse Private Banking, Credit Suisse Asset Management, and Winterthur all posting profits. However, Credit Suisse First Boston reported a loss due to provisions related to the collapse of the Russian market. Overall, the Group saw increases in revenue, assets under management, and earnings per share for the year.

du pont Earnings Release

du pont Earnings Release finance9 This document provides annual performance ratios for E.I. DuPont de Nemours and Company for the years 2007-2003. It includes metrics such as total stockholder return, price-to-earnings ratios, dividend payout ratios, return on equity, return on invested capital, debt ratios, and interest coverage. Reconciliations are also provided to calculate ratios before significant items in order to provide adjusted figures.

progressive mreport-03/05

progressive mreport-03/05finance18 The Progressive Corporation reported financial results for March 2005. Net premiums written increased 5% to $1.127 billion compared to March 2004. Net income decreased 11% to $135.2 million compared to the prior year. Earnings per share fell 3% to $0.67. The combined ratio was 84.8, an increase of 2 percentage points from the prior year. Policies in force grew 12% year-over-year for personal lines and 14% for commercial auto.

unum group 2Q 06_Statistical_Supplement

unum group 2Q 06_Statistical_Supplementfinance26 This document provides a statistical supplement for UnumProvident Corporation for the second quarter of 2006. It includes financial highlights and consolidated statements of operations, balance sheets, and sales data. Some key details are:

- For the second quarter of 2006, total revenue was $2.67 billion and net income was $125.2 million.

- Premium income for the first six months of 2006 was $3.96 billion and net income was $198.6 million.

- Financial sales data shows growth in most product lines for the U.S. Brokerage segment compared to the second quarter and first six months of 2005.

Services - GMAC Annual and Fourth Quarter Earnings

Services - GMAC Annual and Fourth Quarter Earnings finance8 GMAC reported full year net income of $2.1 billion in 2006, down from $2.3 billion in 2005. The residential mortgage market experienced a slowdown due to declining home prices and weakness in nonprime credit. Auto finance results were stable despite one-time costs. Insurance reported record earnings through robust underwriting. ResCap results were negatively impacted by $839 million due to homebuilder equity sales and nonprime mortgage market deterioration.

GM_Earning Release_Q1_08_Chart Set

GM_Earning Release_Q1_08_Chart SetManya Mohan - GM reported a GAAP net loss of $3.3 billion for the first quarter of 2008. Adjusted net loss was $350 million, excluding special items.

- Revenue was about flat at $42.1 billion as growth in international regions offset declines in North America. Adjusted automotive earnings before tax were $392 million.

- A strike at American Axle impacted production by about 100,000 units and reduced earnings before tax by approximately $800 million for the quarter.

- While markets outside North America grew, results in GMNA declined due to lower industry volume, mix shifts away from trucks, and higher material costs partially offset by cost reductions.

unum group _Q306

unum group _Q306finance26 The document is a statistical supplement from UnumProvident for the third quarter of 2006 that includes financial highlights and statistics for the company. Some key details from the financial highlights include:

- For the third quarter of 2006, UnumProvident reported a net loss of $63.7 million compared to net income of $52.6 million for the same quarter the previous year.

- For the first nine months of 2006, UnumProvident reported net income of $134.9 million compared to $376.1 million for the same period in 2005.

- Total assets for UnumProvident as of September 30, 2006 were $52.2 billion, up slightly from $51.1 billion at

goodrich 3Q06

goodrich 3Q06finance44 Goodrich Corporation reported third quarter 2006 results with the following highlights:

- Sales grew 5% year-over-year to $1.436 billion, with growth in all segments.

- Net income per diluted share was $0.80, a 63% increase from third quarter 2005.

- The company authorized a $300 million share repurchase program to reduce dilution from equity programs.

- Segment operating margins improved in all segments compared to third quarter 2005.

Reconciliations 2008 Annual Meeting of Stockholders

Reconciliations 2008 Annual Meeting of Stockholdersfinance6 This document contains reconciliations and summaries of Safeway's financial metrics for 2006-2008, including:

1) Adjusted EPS for 2006-2007 which excludes certain tax adjustments and a tax settlement;

2) Reconciliation of net income to adjusted EBITDA and interest coverage ratios for 2007-2003;

3) Basis point changes in operating profit margin guidance excluding fuel impact;

4) Reconciliation of GAAP cash flow to free cash flow forecasts for 2008-2005.

AES 050806

AES 050806finance19 The document provides an overview of AES Corporation's financial results for the first quarter of 2006. Some key highlights include revenues increasing 13% to $3.013 billion compared to the same period in 2005, driven largely by higher prices and currency effects. Income before taxes and minority interest increased 68% to $633 million. Diluted earnings per share from continuing operations were $0.52 compared to $0.19 in the prior year. Segment results were positively impacted by higher demand and prices across most business lines.

Q3 2011 Financial Highlights Presentaion Final

Q3 2011 Financial Highlights Presentaion FinalAimia's Investor Presentations - Q3 2011 saw record gross billings, adjusted EBITDA, and strong free cash flow for Aimia. Gross billings increased 4.1% year-over-year to $541.8 million.

- Adjusted EBITDA grew significantly by 83.5% to $104.2 million compared to Q3 2010. Free cash flow before dividends paid was $124.8 million.

- For the first nine months of 2011, gross billings increased 1.1% to $1.6 billion. Adjusted EBITDA rose 25.8% to $252.7 million, driven by growth across the business.

direc tv group Annual Reports 1998

direc tv group Annual Reports 1998finance15 Satellite TV dishes on tens of millions of homes and seamless global telephone service are some developing markets driving a $70 billion satellite and wireless industry. Hughes is uniquely positioned to take advantage of opportunities in this industry due to its leadership in satellite and wireless systems, proven record of innovation, strong finances, and highly skilled workforce.

oshkosh Q308_Slides

oshkosh Q308_Slidesfinance44 This document contains the transcript from Oshkosh Corporation's earnings conference call for the third quarter of fiscal year 2008. Key highlights include a 6.6% increase in quarterly sales to $1.97 billion but a 5.9% decrease in operating income to $181.2 million. EPS for the quarter decreased 1.7% to $1.19. Oshkosh revised its estimate for full year 2008 EPS to a range of $3.15 to $3.30.

omnicom group Q1 2008 Investor Presentation

omnicom group Q1 2008 Investor Presentationfinance22 The document provides an overview of Omnicom Group's financial results for the first quarter of 2008. It includes a summary of revenue and earnings growth compared to the first quarter of 2007. The document also discusses Omnicom's cash flow, credit profile, liquidity, acquisitions, and provides brief profiles of four agencies acquired during the first quarter.

baxter international Q3/06 Schedules

baxter international Q3/06 Schedulesfinance24 - Baxter International reported financial results for Q3 2006 and year-to-date 2006 compared to the same periods in 2005.

- Net sales increased 7% to $2.56 billion in Q3 2006 and 3% to $7.62 billion for the first nine months of 2006.

- Operating income increased 29% to $504 million in Q3 2006 and 9% to $1.32 billion for the first nine months of 2006.

- Net income increased 222% to $374 million in Q3 2006 and 45% to $965 million for the first nine months of 2006, helped by lower tax expenses.

AES1Q 2005 20Earnings20Slides20_20final

AES1Q 2005 20Earnings20Slides20_20finalfinance19 - AES Corporation reported financial results for the first quarter of 2005 with revenues of $2.6 billion, a 17% increase from the first quarter of 2004. Income before taxes was $350 million, up 74% from the prior year.

- Key drivers of financial performance included revenue growth from new projects and higher prices/demand across several business segments, as well as favorable currency effects. However, gross margin declined slightly due to higher fuel costs.

- Cash flow from operations was $520 million for the quarter. The company distributed $195 million in subsidiary dividends to the parent company during the period.

credit sussi Annual Report Part 1 Share performance Market capitalisation Fin...

credit sussi Annual Report Part 1 Share performance Market capitalisation Fin...QuarterlyEarningsReports2

Viewers also liked (6)

Micro

MicroMateo Pérez La microadministración es parte de la Teoría X y supone que los trabajadores no harán su trabajo a menos que sean vigilados estrechamente. Un ejemplo es cuando un administrador observa cada movimiento de un profesor y luego lo critica. La Teoría X también se centra en las consecuencias del fracaso como despidos o aumento de cuotas. Un gerente podría amenazar con despidos si no se alcanzan ciertas metas. Finalmente, la Teoría X lleva al secreto en procesos de evaluación para ocultar críticas a e

Nokia

NokiaMoeedAwais Nokia Corporation is a Finnish multinational communications company headquartered in Finland. It produces mobile phones and portable IT devices. The company has over 122,000 employees worldwide and annual revenues of around €38 billion. Nokia faces competition from companies like Apple, Samsung, and Motorola in both domestic and international markets. It partners with Microsoft to use the Windows Phone operating system in an effort to compete with Google and Apple in the growing smartphone sector. Nokia has had a significant economic and social impact in Finland, historically contributing up to a quarter of the country's growth and paying 23% of all corporate tax.

Compowerpoint

CompowerpointMarlton Middle School The document discusses leadership styles and behaviors, specifically an autocratic style focused on structure, goals, and results. Leaders with this style expect compliance from followers and direct them to complete tasks and utilize data to articulate a vision. Over time, these leaders and their followers can become frustrated, worn out, and disillusioned if the mission is confused or power is surrendered, feeling they have been misled in their efforts to enact change.

Mjf 2013 competition - terms and conditions

Mjf 2013 competition - terms and conditionsDeezer-Comps The document provides the terms and conditions for a competition to win tickets to the Manchester Jazz Festival 2013 hosted by Blogmusik SAS. It outlines that the competition is open to Deezer account holders in Great Britain aged 18 or older between July 18-25, 2013. 18 winners will be selected in a random draw to receive pairs of tickets to various festival performances valued between £10-24. The terms also describe rules around eligibility, entries, winner selection and notification, prize details, and liability.

Spring Data and MongoDB

Spring Data and MongoDBOliver Gierke This document discusses Spring Data and MongoDB for Java developers. It introduces Spring Data, which provides abstractions for data access in Java including JDBC and JPA. It then focuses on MongoDB support in Spring Data, covering features like MongoTemplate, mapping support, repositories, and query support. The document concludes with questions and resources for further information.

Similar to AES 01192006 (20)

northrop grumman Slide Presentation 2008 4th

northrop grumman Slide Presentation 2008 4thfinance8 This document provides an overview of Northrop Grumman Corporation's fourth quarter and full year 2008 financial results. Key highlights include record sales, cash from operations, and free cash flow that exceeded guidance. The company also achieved record backlog of $78 billion and $48.3 billion in new business awards for 2008. However, a goodwill impairment charge was taken due to adverse equity market conditions. Guidance is provided for 2009, including sales of approximately $34.5 billion and adjusted diluted EPS from continuing operations of $4.50-$4.75.

northrop grumman Q4 and Year-end 08 Earnings Presentation

northrop grumman Q4 and Year-end 08 Earnings Presentationfinance8 This document provides an overview of Northrop Grumman Corporation's fourth quarter and full year 2008 financial results. Key highlights include record sales, cash from operations, and free cash flow that exceeded guidance. The company also achieved record backlog of $78 billion and $48.3 billion in new business awards for 2008. However, a goodwill impairment charge was taken due to adverse equity market conditions. Guidance is provided for 2009, including sales of approximately $34.5 billion and adjusted diluted EPS from continuing operations of $4.50-$4.75.

3Q05FINAL

3Q05FINALfinance44 The document provides an overview of the company's third quarter 2005 earnings conference call, including highlights such as earnings per share increasing 20% compared to the prior year, business segment results with revenue and earnings increases across all segments, and debt to equity ratios remaining below long-term targets while supporting continued growth.

3Q05FINAL

3Q05FINALfinance44 - Revenue increased 14% to $1.49 billion due to growth across all business segments.

- Earnings per diluted share were $0.98, up 20% from $0.82 in the prior year, driven by improved performance across business segments.

- Fleet Management Solutions saw the largest earnings growth of 20% due to higher used vehicle sales, improved fuel margins, and lower costs.

3Q2006OperatingStatistics

3Q2006OperatingStatisticsfinance49 The document provides operating statistics for El Paso Corporation for the third quarter of 2006. It includes consolidated statements of income, operating results, business segment results, and schedules. Specifically, it shows that for the third quarter of 2006, El Paso Corporation reported net income of $135 million on operating revenues of $1.061 billion. The Pipelines business segment reported earnings before interest and taxes of $305 million and the Exploration and Production segment reported earnings of $141 million.

Earning Presentation of General Motors: Q1 2008

Earning Presentation of General Motors: Q1 2008investorrelation Preliminary 2008 First Quarter Results for General Motors showed:

- A net loss of $3.3 billion compared to a net income of $94 million in Q1 2007.

- Adjusted earnings before tax of $0.4 billion, up $0.2 billion from Q1 2007.

- Adjusted automotive operating cash flow of negative $3.6 billion.

- Global market share declined 0.5 percentage points to 12.5% while production fell 107,000 units to 2.233 million.

- The American Axle strike cost approximately $0.8 billion in lost earnings before tax for the quarter.

3Q2006OperatingStatistics

3Q2006OperatingStatisticsfinance49 The document provides operating statistics for El Paso Corporation for the third quarter of 2006. It shows that consolidated net income was $135 million for the quarter. It also provides key financial data segmented by each of El Paso's business units, including pipelines, exploration and production, marketing and trading, power, and field services. The pipelines segment reported earnings before interest and taxes of $305 million for the quarter and throughput volumes on its major pipelines.

dominion resources GAAP Reconciliations and Footnotes

dominion resources GAAP Reconciliations and Footnotesfinance17 This document reconciles operating earnings, return on equity, and return on invested capital to reported earnings, return on equity, and return on invested capital for the years 2003-2007 for a company. It shows adjustments made to operating earnings such as gains or losses from sales of business units, impairment charges, discontinued operations, and other one-time items to derive reported earnings according to GAAP. The reconciliation also calculates the impact of these adjustments on the company's return on equity and return on invested capital.

capital one Printer Friendly Version of the Financial Supplement

capital one Printer Friendly Version of the Financial Supplementfinance13 This document provides quarterly and annual financial and statistical data for Capital One Financial Corporation for 2008 and Q4 2007. Some key highlights include:

- For Q4 2008, Capital One reported a net loss of $1.42 billion compared to net income of $226.6 million in Q4 2007. Revenue declined 38% annually and the company reported an ROA of -3.45%.

- On a managed basis, which includes securitized assets, Q4 2008 net loss was $1.42 billion, revenue declined 25% annually, and ROA was -2.70%.

- Asset quality deteriorated with the net charge-off rate rising to 4.98% in Q4 2008

Earning Presentation of General Motors: Q1 2007

Earning Presentation of General Motors: Q1 2007investorrelation - GM reported preliminary first quarter 2007 results with GAAP EPS of $0.11 and adjusted EPS of $0.17.

- Adjusted total automotive results improved $0.3 billion versus Q1 2006 driven by improved results at GMNA, GMLAAM, and GMAP.

- GMAC reported a net loss of $115 million compared to net income of $495 million in Q1 2006 due to continued weakness in its mortgage business.

RYDERFINAL R2Q05

RYDERFINAL R2Q05finance44 - The company reported second quarter earnings per share of $0.98, up from $0.97 in the second quarter of 2004. Revenue increased 10% compared to the second quarter of 2004.

- Fleet Management Solutions revenue increased 9% and earnings increased 8% compared to the second quarter of 2004, driven by improved used vehicle sales and rental results.

- The company reaffirmed its full year 2005 earnings forecast of $3.42-$3.52 per share, which includes a $0.12 state tax benefit.

RYDERFINAL R2Q05

RYDERFINAL R2Q05finance44 - Revenue for the second quarter was up 10% year-over-year, with increases across all business segments. Fleet Management Solutions revenue was up 9% and earnings up 8%.

- Earnings per diluted share were $0.98 compared to $0.97 in the prior year second quarter. Excluding special items, earnings per share were $0.86, up 13% from $0.76.

- For the year-to-date period, earnings per diluted share were $1.61 compared to $1.50 in the prior year. Excluding special items, earnings per share were $1.50, up 17% from $1.28.

Slide Presentationnorthrop grumman 2006 2nd

Slide Presentationnorthrop grumman 2006 2ndfinance8 This document provides a summary of Northrop Grumman Corporation's financial performance for the second quarter of 2006. It highlights that the company's focus on performance has increased operating margins and earnings per share. Segment operating margins for 2006 are forecasted to be around 9% and total operating margin in the mid-8% range. Cash from operations for 2006 is estimated at $2.3-2.6 billion. The company also discusses its balanced approach to cash deployment through internal investments, dividends, and share repurchases.

monsanto 11-10-05

monsanto 11-10-05finance28 This document provides forward-looking statements and non-GAAP financial information for Monsanto's investor day on November 10, 2005. It includes reconciliations of free cash flow, non-GAAP EPS, and return on capital for fiscal years 2004-2007. The document also notes that references to fiscal years refer to Monsanto's year ending August 31 and lists several of Monsanto's trademarks.

goodrich 2Q06_Slides

goodrich 2Q06_Slidesfinance44 - Goodrich Corporation reported second quarter 2006 results, with sales growing 10% year-over-year and income from continuing operations increasing 30% to $81 million.

- The company raised its 2006 sales outlook to $5.75-5.85 billion and adjusted net income per diluted share outlook to $3.40-3.55 due to improved operational performance.

- Segment operating margins improved across all segments (Engine Systems, Airframe Systems, Electronic Systems), driven by higher commercial airplane original equipment and aftermarket sales as well as cost reductions.

goodrich 2Q06_Slides

goodrich 2Q06_Slidesfinance44 - Goodrich Corporation reported second quarter 2006 results, with sales growing 10% year-over-year and income from continuing operations increasing 30% to $81 million compared to second quarter 2005.

- The company raised its 2006 sales outlook to $5.75-5.85 billion and adjusted net income per diluted share outlook to $3.40-3.55 due to improved operational performance.

- All business segments saw sales and operating income increases compared to second quarter 2005, driven by higher commercial airplane original equipment and aftermarket sales as well as cost improvements.

viacom FINAL%20Q108%20Web%20Deck

viacom FINAL%20Q108%20Web%20Deckfinance20 Viacom reported financial results for the first quarter of 2008 that showed increases in revenue, operating income, and earnings per share compared to the first quarter of 2007. Revenue grew 15% to $3.117 billion. Operating income increased 29% to $567 million. Diluted earnings per share from continuing operations rose 45% to $0.42. Media Networks and Filmed Entertainment, Viacom's two business segments, both saw revenue growth for the quarter despite lower theatrical revenues at Filmed Entertainment. Viacom also provided guidance for 2008-2010 of low double-digit annual growth in diluted earnings per share from continuing operations.

Owens_Minor3Q2008_webcast_slides

Owens_Minor3Q2008_webcast_slidesfinance33 Owens & Minor reported financial results for 3Q 2008 with year-over-year revenue growth but lower earnings per share. Revenue increased 2.4% to $1.81 billion compared to $1.75 billion in 3Q 2007. Gross margin and operating earnings as a percentage of revenue declined slightly. Earnings per share fell from $0.52 to $0.55. For 2008, the company expects organic revenue growth of 5-7% and earnings per share between $2.30-$2.40, despite expected dilution from an acquisition.

Owens_Minor_2Q2008_webcast_slides_v_final

Owens_Minor_2Q2008_webcast_slides_v_finalfinance33 Owens & Minor reported financial results for the second quarter of 2008. Revenue increased 2.3% from the second quarter of 2007 to $1.795 billion. Gross margin as a percentage of revenue was 10.67%, up slightly from the prior year. Selling, general and administrative expenses decreased as a percentage of revenue. Earnings per diluted share increased 22% to $0.59 compared to the second quarter of 2007. For 2008, the company expects revenue growth between 5-7% and earnings per diluted share between $2.30-$2.40, up from previous guidance.

AES 2006 Outlook

AES 2006 Outlookfinance19 The document provides an overview of AES Corporation's 2005 financial results and outlook for 2006. Some key points:

- 2005 was a record year for revenues, net cash from operating activities, and free cash flow. Revenues exceeded $11 billion.

- Fourth quarter and full-year 2005 earnings benefited from good operating results, favorable currencies, and a lower tax rate.

- 2008 financial targets are reaffirmed, including $1.03-$1.34 diluted EPS and $2.6-$2.9 billion in net cash from operating activities.

- 2006 guidance is consistent with 2008 targets and forecasts 4-5% revenue growth, $0.90 diluted EPS, and $0.95

More from finance19 (20)

pepsi bottling Q1 Non-Gaap

pepsi bottling Q1 Non-Gaapfinance19 The document discusses Pepsi Bottling Group's use of non-GAAP financial measures to provide additional context for investors beyond standard GAAP reporting. It defines one such measure, Operating Free Cash Flow (OFCF), as cash from operations less capital expenditures plus excess tax benefits from stock options. Management uses OFCF to evaluate business performance and liquidity. The document provides Pepsi's forecast for 2007 OFCF between $530-550 million and outlines adjustments made to certain first quarter 2007 financial results to exclude foreign currency translation impacts.

pepsi bottling 071007nong

pepsi bottling 071007nongfinance19 The document discusses Pepsi Bottling Group's (PBG) use of non-GAAP financial measures to provide additional context for investors beyond standard GAAP reporting. It provides non-GAAP adjusted figures for PBG's second quarter 2007 results which exclude the impact of foreign currency translation. It also gives adjusted guidance figures for full year 2007 diluted EPS and effective tax rate which exclude the impact of reversing tax contingencies. Finally, it defines and discusses the non-GAAP measure of operating free cash flow, and provides PBG's estimated range for full year 2007 operating free cash flow.

pepsi bottling pbg Non Gaap

pepsi bottling pbg Non Gaapfinance19 The document provides reconciliations of Pepsi Bottling Group's (PBG) reported and comparable non-GAAP financial measures for the third quarter and year-to-date 2007, including net revenue, gross profit, operating income, earnings per share (EPS), and operating free cash flow (OFCF). It also provides PBG's 2007 guidance ranges on a reported and adjusted basis, adjusting for items affecting comparability including tax matters, restructuring charges, and asset rationalization charges.

pepsi bottling Non Gaap Investor Day121307

pepsi bottling Non Gaap Investor Day121307finance19 The document provides reconciliations of non-GAAP financial measures reported by The Pepsi Bottling Group to GAAP measures for 2005-2007 and 2008 guidance. It summarizes adjustments made for items affecting comparability between years, including restructuring charges, tax law changes, and accounting rule changes. Operating profit growth, EPS, and cash flow are reconciled for these periods. Non-GAAP measures are used to evaluate underlying business performance by excluding certain non-recurring or variable items.

pepsi bottling 4Q Non Gaap

pepsi bottling 4Q Non Gaapfinance19 The document summarizes Pepsi Bottling Group's (PBG) fourth quarter 2007 earnings conference call. It provides non-GAAP financial measures to allow for meaningful year-over-year comparisons. Items affecting comparability in 2007 include a tax contingency reversal, tax law changes, and restructuring charges. The document also reconciles 2007 and Q4 2007 reported results to comparable results. Guidance for 2008 reported and comparable operating income growth and EPS is also provided.

pepsi bottling Q108_NonGAAPReconciliation

pepsi bottling Q108_NonGAAPReconciliationfinance19 The document provides a reconciliation of non-GAAP financial measures for Pepsi Bottling Group's first quarter 2008 earnings conference call. It summarizes restructuring charges and an asset disposal charge that affected comparability between periods. It provides comparable and reported operating income growth, EPS, and guidance figures. It also defines and provides guidance for operating free cash flow.

pepsi bottling 2Q 08 Non GAAP

pepsi bottling 2Q 08 Non GAAPfinance19 The document summarizes Pepsi Bottling Group's second quarter 2008 earnings conference call. It discusses non-GAAP financial measures used by the company to provide meaningful year-over-year comparisons and evaluate underlying business performance. Items affecting comparability between years are also reviewed, including restructuring charges, asset disposal charges, and tax items. Specific metrics for certain international markets and 2008 guidance figures both on a comparable and reported basis are also presented. Operating free cash flow is defined and full-year 2008 expectations provided.

pepsi bottling Non GAA P0908

pepsi bottling Non GAA P0908finance19 The document provides reconciliations of non-GAAP financial measures reported by The Pepsi Bottling Group for 2008. It identifies items affecting comparability between years, including restructuring charges, asset disposal charges, and stock-based compensation. The document summarizes the quantitative impact of these items on key financial metrics like operating income growth, earnings per share, and cash flow. It also provides guidance for 2008 operating free cash flow.

pepsi bottling library.corporate

pepsi bottling library.corporatefinance19 The document provides reconciliations of non-GAAP financial measures and items affecting comparability for The Pepsi Bottling Group's third quarter 2008 earnings conference call. It summarizes restructuring charges, asset disposal charges, a tax audit settlement, tax law changes, and stock-based compensation adjustments. It also provides comparable and reported figures for net revenue, operating income, earnings per share, and other metrics. Guidance is given for full-year 2008 measures on a comparable and reported basis.

pepsi bottling library.corporate

pepsi bottling library.corporatefinance19 The document provides financial information and reconciliation of non-GAAP measures for The Pepsi Bottling Group's fourth quarter 2008 earnings conference call. It summarizes items affecting comparability for 2008 and 2009, including impairment charges, restructuring charges, and the impact of foreign exchange rates. It also provides the company's operating free cash flow for 2008 and guidance for comparable net revenues, costs, operating income, earnings per share, and operating free cash flow for 2009.

pepsi bottling library.corporate

pepsi bottling library.corporatefinance19 The document provides reconciliation of non-GAAP financial measures for The Pepsi Bottling Group for 2008. It summarizes items affecting comparability between years such as impairment charges, restructuring charges, and accounting standard changes. Tables show the impact of these items on operating income, net revenues, operating profit, and earnings per share for 2008 compared to 2005, 2007, and 2003. The document also provides 2009 guidance forecasts for revenue growth, operating income growth, earnings per share, and operating free cash flow.

pepsi bottling ar2000

pepsi bottling ar2000finance19 The document discusses PBG's financial highlights and growth in 2000. Key points:

1) PBG had strong financial results in 2000, with net revenues of $7.982 billion and EPS of $1.53, up from 1999. Operating income and EBITDA also grew substantially.

2) Two-thirds of PBG's business comes from take-home sales. In 2000 PBG focused on growing its bottled water and flavor carbonated soft drink segments in the take-home market.

3) PBG launched Sierra Mist, a new lemon-lime flavor, to capitalize on the fast growing lemon-lime segment of the carbonated soft drink category. The launch was swift in

WorldFuel2002 Transition Annual Report

WorldFuel2002 Transition Annual Reportfinance19 World Fuel Services Corporation is a global leader in the downstream marketing and financing of aviation and marine fuel products and related services. For the nine-month period ended December 31, 2002, the company reported revenue of $1.55 billion, up 52.6% from the same period the previous year. Net income was $9.9 million, down 22.6% from the previous year. The company has a strong balance sheet with $312 million in total assets and $127.7 million in stockholders' equity.

WorldFuel 2002 Transition AnnualReport

WorldFuel 2002 Transition AnnualReportfinance19 World Fuel Services Corporation is a global leader in the downstream marketing and financing of aviation and marine fuel products and related services. For the nine-month period ended December 31, 2002, the company reported revenue of $1.55 billion, up 52.6% from the same period the previous year. Net income was $9.9 million, down 22.6% from the previous year. The company has a strong balance sheet with $312 million in total assets and $127.7 million in stockholders' equity.

Recently uploaded (20)

FY 2024 Preliminary Results and Strategic Plan update

FY 2024 Preliminary Results and Strategic Plan updateGruppo TIM FY 2024 Preliminary Results and Strategic Plan update

What would be the protection gap in Motor Insurance for future

What would be the protection gap in Motor Insurance for futureBalkir Demirkan Motor insurance, protection gap, autonomus vehicles, liability, balkir demirkan, gsr, gsr2, vehicles type approval

How to Perform a Cost-Benefit Analysis A Simple Step-by-Step Guide.pptx

How to Perform a Cost-Benefit Analysis A Simple Step-by-Step Guide.pptxTfin Career A cost-benefit analysis (CBA) is essential for anyone making business decisions, managing projects, or creating policies. It helps you evaluate how much something will cost versus the benefits you expect to gain so you can make smarter, more informed choices.

This guide will show you how to quickly conduct a cost-benefit analysis, considering an investment, a new project, or a policy change.

What is a Cost-Benefit Analysis?

A cost-benefit analysis compares a decision's costs with its benefits to determine whether the benefits are worth the costs. This process is helpful when resources are limited, and you want to make sure you are making the best decision for the future.

Example: Imagine your company is thinking about buying new software. A cost-benefit analysis would compare the price of the software to the benefits, like more productivity, lower labor costs, or better customer service. If the benefits are higher than the costs, the investment makes sense.

Step 1: Identify and List All Costs

Sometime recently, you can calculate the benefits, you are required to list all the costs included. These are coordinated or backhanded, short-term or long-term. Begin by composing down each conceivable cost.

Direct Costs: These are easy to identify because they're directly tied to the project, such as buying equipment or paying for materials.

Indirect Costs: These are secondary expenses, like administrative costs or the time needed for training.

Recurring Costs: These are ongoing costs, like maintenance or subscription fees.

Opportunity Costs: Consider what you're missing out on by choosing this option instead of another.

Example: In the software case, direct costs include the price of the software and the cost of installation and training. Indirect costs could be employees' time learning how to use the new software.

Step 2: Identify and List All Benefits

Now that you've listed all the costs, you must consider the benefits. These can be tangible (easy to measure) or intangible (more challenging but still meaningful).

Tangible Benefits: These are measurable in financial terms, like increased revenue or cost savings.

Intangible Benefits: These might be improved employee morale or customer satisfaction.

Example: The computer program might bring significant benefits, like higher productivity or diminished labor costs. Intangible benefits include ways to improve group resolve or progress client advantage.

Step 3: Quantify Costs and Benefits

Once you've identified the costs and benefits, the next step is to assign a dollar amount to each one. Some benefits, especially intangibles, may be hard to quantify, but giving them a realistic value is essential. Base your estimates on reliable data, like industry standards or expert advice.

Example: If the software costs $10,000 to purchase and $1,000 per year for maintenance, and it's expected to save $15,000 annually in labor costs, the return on investment is easily visible.

Tristar Corporate Presentation Investors page

Tristar Corporate Presentation Investors pageAdnet Communications https://tristargold.com/investors/corporate-presentation/

INDUSTRIAL ESTATES IN TAMIL NADU by Dr. S. Malini

INDUSTRIAL ESTATES IN TAMIL NADU by Dr. S. MaliniMaliniHariraj Tamil Nadu is a leading industrial hub in India, attracting foreign investment due to its strong infrastructure, logistics, and diverse manufacturing sector, including automobiles, aerospace, pharmaceuticals, textiles, electronics, and chemicals. The state has the second-highest GDP in India and houses the largest number of factory units (37,220), contributing 20% of India’s electronics production. It has a high concentration of Special Economic Zones (SEZs), accounting for one-third of the state’s exports, with key industrial estates like **Ambattur, Sriperumbudur, and Oragadam**. The **Tamil Nadu Small Industries Development Corporation (TANSIDCO)**, established in 1970, supports **MSMEs** by maintaining **41 Government Industrial Estates and 87 TANSIDCO Industrial Estates**, offering developed plots (5 cents to 1 acre) and various support services such as cluster development, technical guidance, and raw material assistance. Notable industrial estates include **Ambattur (one of Asia’s largest MSME hubs), Guindy (India’s first industrial estate), Sriperumbudur (home to Hyundai, Foxconn, and Samsung), Oragadam (major automotive hub), Irungattukottai (Renault-Nissan, BMW), and Vallam Vadagal (aerospace and defense industries).** These estates provide world-class infrastructure, including **reliable power, developed plots, common facility centers, strong connectivity (highways, ports, airports), 24/7 security, water supply, stormwater drains, sewage systems, green belts, and parks**, fostering a robust environment for industrial growth.

Yanis Varoufakis - Technofeudalism_ What Killed Capitalism - libgen.li.pdf

Yanis Varoufakis - Technofeudalism_ What Killed Capitalism - libgen.li.pdfMatiasMendoza46 Libro de Varoufakis sobre la evolución del sistema capitalista.

Darkex Monthly Crypto Market Analysis – February 2025

Darkex Monthly Crypto Market Analysis – February 2025darkexglobal Explore key insights and trends shaping the crypto market in February! From Bitcoin's price movements to ETF updates and macroeconomic impacts, this report covers it all.

Highlights:

- Market recap & key takeaways

- Bitcoin & Ethereum performance metrics

- Spot ETF & options data

- Global macroeconomic events affecting crypto

The Economic History of the United States 10

The Economic History of the United States 10Gale Pooley The Economic History of the United States 10

Paper: The World Game (s) Great Redesign.pdf

Paper: The World Game (s) Great Redesign.pdfSteven McGee Paper: The Great Redesign of The World Game (s): Equitable, Ethical, Eco Economic Epochs for programmable money, economy, big data, artificial intelligence , quantum computing.. federation, federated liquidity e.g., the "JP Morgan - Knickerbocker protocol" / global unified value unit

India’s Strategic Blueprint for Economic Growth.pdf

India’s Strategic Blueprint for Economic Growth.pdfRaj Kumble This presentation highlights the key elements of India’s Union Budget for 2025, which aims to set the country on a path of sustainable economic growth. The budget's major areas of focus include tax relief for the middle class, substantial investments in infrastructure, job creation, and significant support for research and development. The budget also introduces targeted measures to strengthen India’s maritime and MRO sectors, ensuring long-term global competitiveness. Abhay Bhutada’s endorsement underscores the transformative potential of these initiatives, particularly in promoting inclusive growth.

Smart Accounting Moves Every Small Business Must Know

Smart Accounting Moves Every Small Business Must KnowRAJ KISHAN CPA INC. Learn essential accounting strategies to keep your small business financially healthy. From bookkeeping to payroll services, this guide covers key tips for better financial management. For more information contact https://rajkishan.cpa/ now!